Frequently Asked Questions

FAQs for Personal Banking Clients

This page will continue to be updated with additional information regarding the migration of your products and services to RBC.

- Banking

- Branches / ATMs

- Client Card

- Credit Cards

- Digital Banking

- Direct Investing

- eSavings

- GIC & Savings

- Global View & International Money Transfers (IMT)

- Group Advantage

- Insurance

- Mutual Funds

- Payments

- Personal Financing Products

- 1) Through your existing HSBC Bank Canada Online credentials. If you are already enrolled in HSBC Bank Canada Online Banking, you will have access to enroll in RBC Online Banking via https://www.rbc.com/hsbc-canada/enrol

- 2) If you are not currently enrolled in HSBC Bank Canada Online Banking and would like to access your accounts through digital channels at RBC, you can enrol once you receive your RBC Client Card, or your RBC client number.

Android

- Canada

- US

- India

- China (Mainland, not Hong Kong)

- Philippines

- Hong Kong

- Australia

- UAE

- UK

- Singapore

- Malaysia

- Canada

- US

- India

- China (Mainland, not Hong Kong)

- Philippines

- UK

- Hong Kong

- Australia

- UAE

- Singapore

- Malaysia

Existing RBC clients may see their migrated HSBC accounts greyed out with a $0 account balance until migration is complete.

Please note that even with enrolment in RBC OLB or the RBC Mobile app, your migrated products and services will not be accessible in RBC channels until migration. Where possible, your existing HSBC Bank Canada PIN will migrate to be used with your new RBC Client Card. If your PIN could not be migrated, or if you have received more than one RBC Client Card, you will receive a letter enclosing a new PIN along with instructions on how to set a PIN of your choice.

After your accounts migrate to RBC and if you want to change your PIN, you may do so at any time at an RBC branch or RBC ATM. If you have lost or do not remember your PIN after migration, you will need to speak to an RBC advisor.

Learn more about how to enrol in RBC Digital Banking today.

Please refer to your product and service notification letter for further information.

Any associated cost will depend on your account package. Please refer to your product and service notification letter for further information.

1) Prior to Migration Date:

- Accept the HSBC updated Terms and Conditions on HSBC Online Banking.

2) After Migration date (when your HSBC Canada account(s) migrate to RBC):

- Accept the RBC Terms and Conditions in the ‘External Accounts’ section on RBC Online Banking and RBC Mobile Banking.

- Transfer Money to your HSBC Global View Linked Accounts: Using RBC International Money Transfer (IMT), you will be able to transfer money from your eligible RBC CAD or USD chequing account to the globally linked HSBC Accounts (exception: CAD to CAD transfers are not available)

- Send Money to others Globally: Using RBC International Money Transfer, you can also choose to send money to anyone else globally. You will be able to transfer money from your eligible RBC CAD chequing account to third parties.

- You will NOT be able to view your non-Canadian HSBC accounts in RBC Online Banking or Mobile Banking and

- You will NOT be able to view your RBC Canada account information from other HSBC locations where you have Global View.

If you delink your accounts from RBC’s External Accounts you will NOT be able to re-establish the link.

If you provide consent, you will be the only person able to view certain account information related to your linked Global HSBC Savings and/or chequing account(s) from RBC Online Banking and Mobile Banking after migration.

RBC International Money Transfer (IMT) can be used to send money internationally. You can:

- Send money internationally to your own Global View Linked HSBC accounts around the world and/or

- Send money internationally to anyone around the world, where permitted, whether the recipient is a client of HSBC or a client of another financial institution.

HSBC’s Global Money Transfer service is currently available in Hong Kong, UK, US, UAE, Singapore, Australia, HSBC Expat (Jersey) and India (available on your HSBC mobile app). HSBC Global Money Transfer service is free in most jurisdictions with an exception of Hong Kong. Please refer to your local HSBC product pages/ guides for latest information.

Note: All other Jurisdictions that are not on this list will not be viewable in RBC Online Banking and RBC Mobile App.

RBC International Money Transfer (IMT) can be used to send money internationally. You can:

- Send money internationally to anyone around the world, where permitted, whether the recipient is a client of HSBC or a client of another financial institution

Currently, using IMT to send money to any person across the world can only be initiated from a RBC CAD account.

If you deposited a cheque(s) to your HSBC Bank Canada chequing or savings account on or after the migration date, rest assured that the funds will be reflected in your RBC account.

If you have direct deposits (e.g., payroll, tax refunds/HST credits, etc.) being made to your HSBC Canada chequing or savings accounts, these will automatically continue to be deposited to your new RBC accounts unless you provide alternative instructions.

If you have an existing RBC Online Banking profile, to avoid overwriting your current payee list, your HSBC Bank Canada payees will not be migrated. You will need to add them to RBC OLB or the RBC Mobile app after migration.

If you have scheduled post-dated bill payments through HSBC Bank Canada Online Banking, these will be migrated to your RBC account after migration, if you have digitally enrolled in RBC OLB prior to migration.

Learn more about how to enrol in RBC Digital Banking today.

- Beneficiary Transit number (Routing #)

- Beneficiary Account number (International Bank Account Numbers are called IBANs)

- Beneficiary Name

- Amount of money being sent

- Beneficiary Address (where the statement is mailed to)

Please note that any wire payees (branch or digital) and any post-dated wires you have set up at HSBC Bank Canada will not be migrating to RBC. After migration, you will need to re-establish wire instructions and will be able to add IMT payees in RBC OLB or RBC Mobile.

- Your RBC account number (this a 12-digit account number made up of the 5-digit branch transit code and your 7-digit account number).

- RBC Royal Bank institution number: 003

- RBC Royal Bank Routing/ABA number (if funds coming from U.S.): 021000021

- RBC Royal Bank SWIFT BIC (if funds coming from international location): ROYCCAT2

- Your RBC Royal Bank branch phone number, address and transit number

Wire Transfer - RBC Royal Bank (Opens link in new window).

However, if you are an existing RBC client prior to the migration date, the Interac e-transfer Auto Deposit feature will not migrate. You will need to re-create your Auto Deposit registration via RBC OLB after migration.

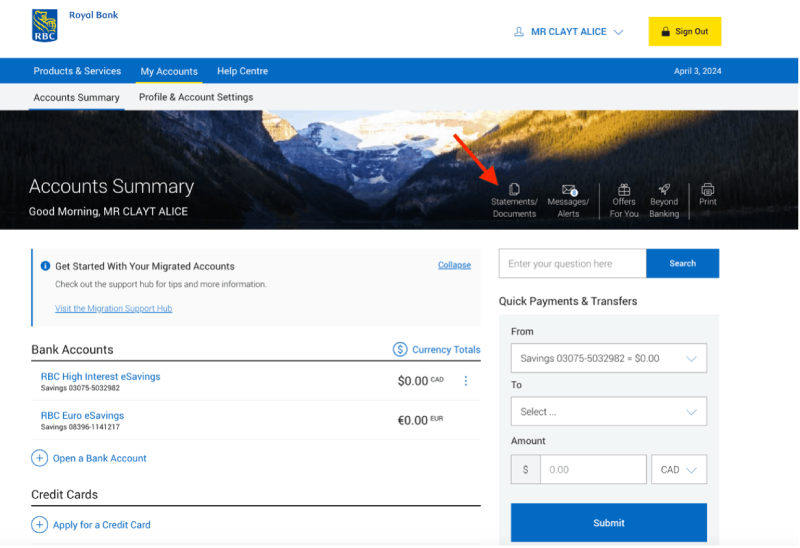

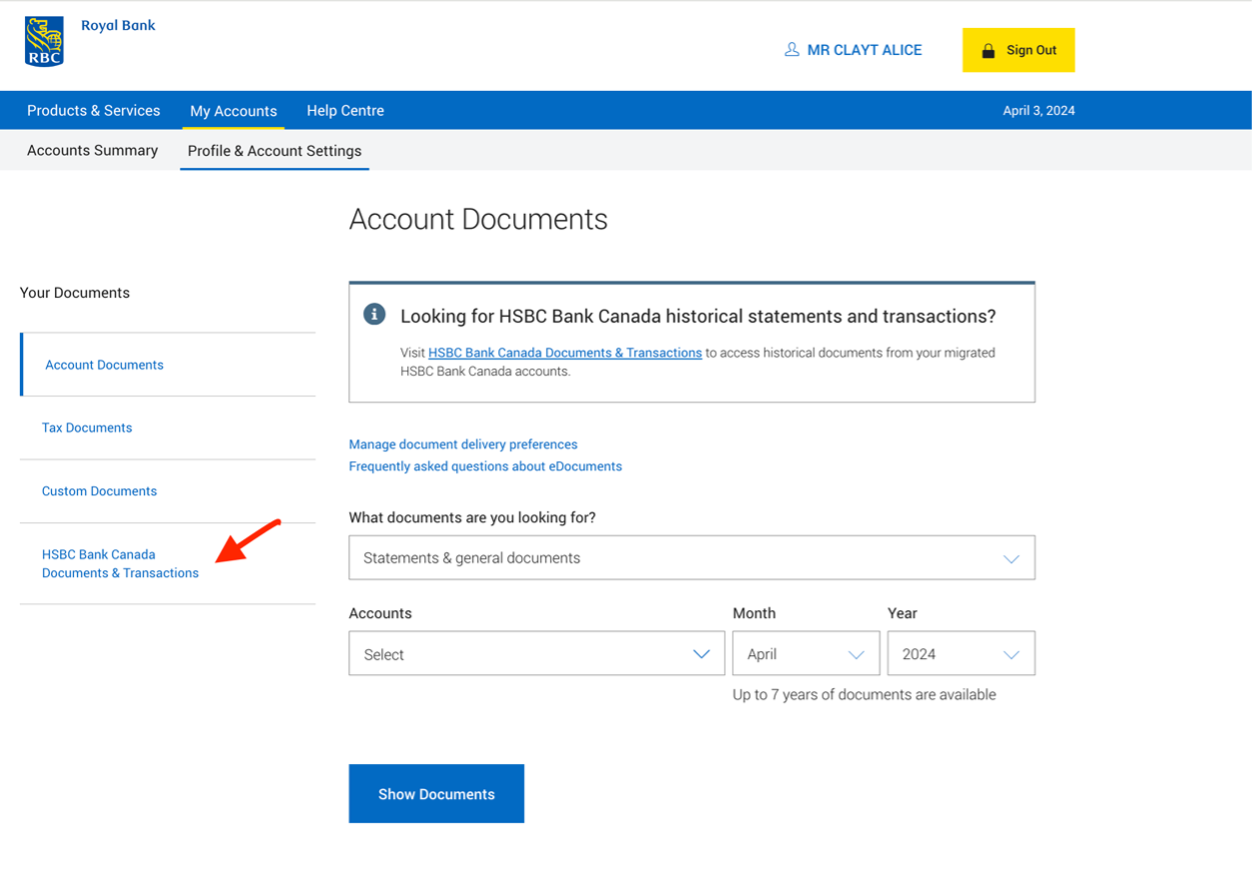

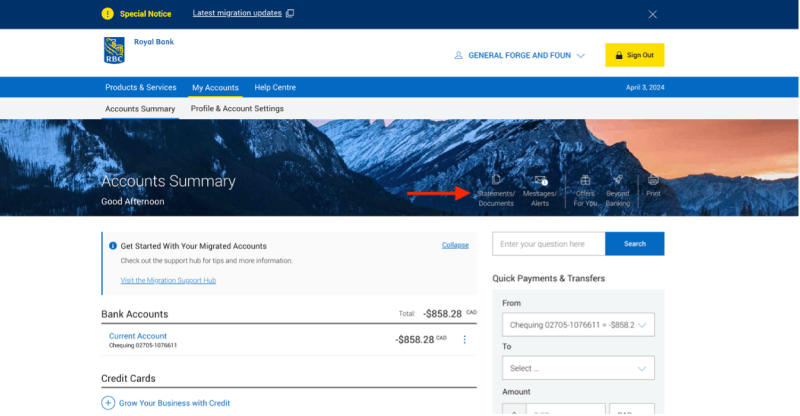

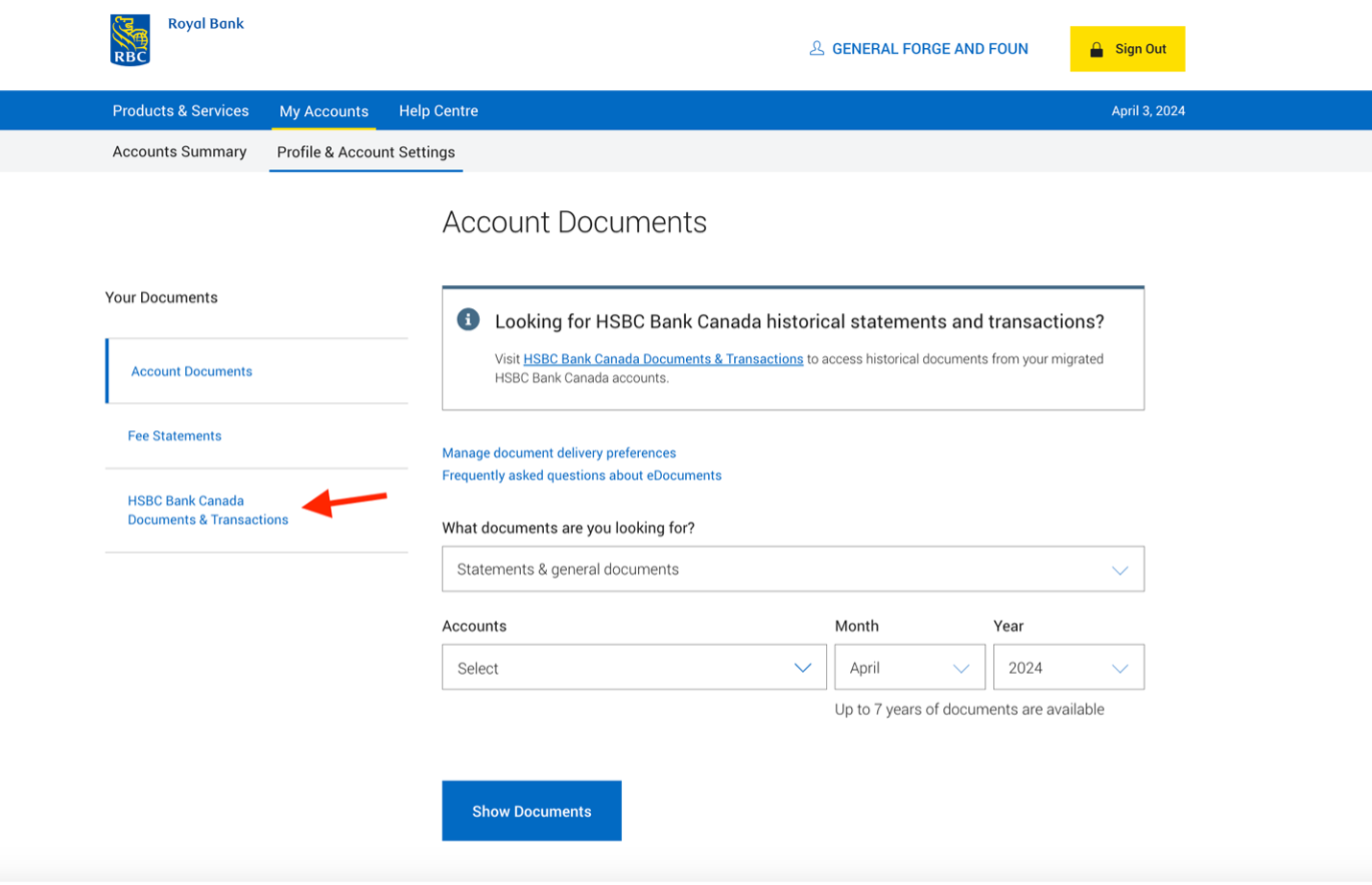

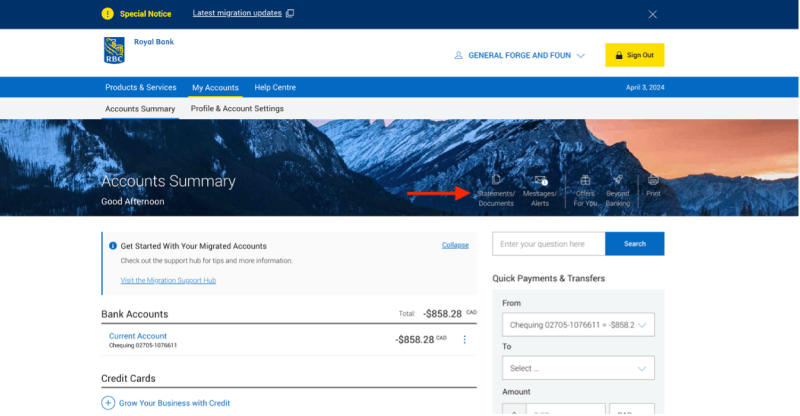

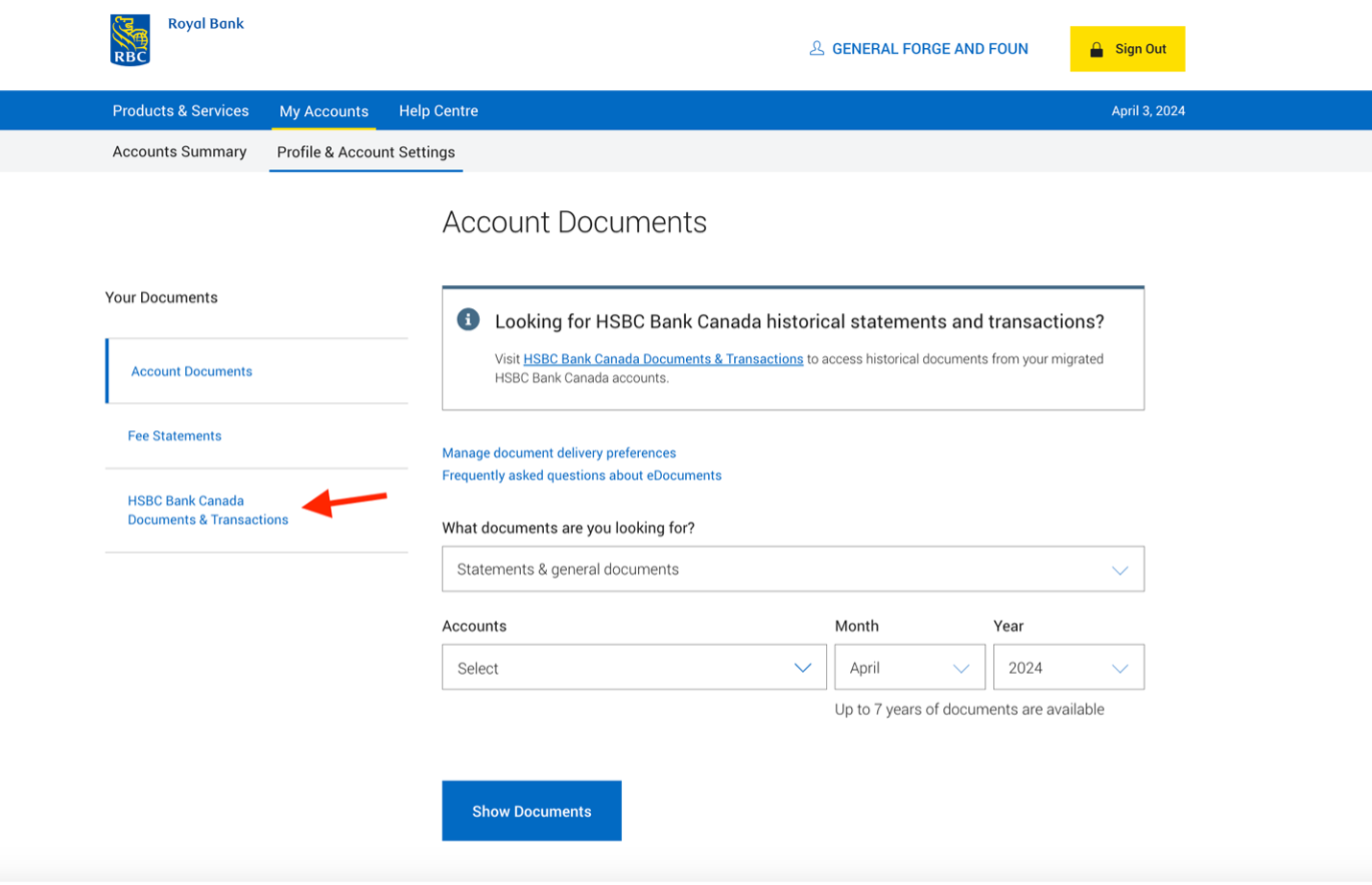

then click HSBC Bank Canada Documents & Transactions.

Historical transactions and statements are not available through the RBC Mobile app.

To learn more about deposit insurance and how to maximize coverage please visit https://www.rbc.com/hsbc-canada/cdic.html.

- Transfer funds to and from your foreign currency account to another one of your RBC CAD or U.S. dollar Personal Deposit Accounts through RBC Online Banking and the RBC Mobile App.

- Transfer funds to and from RBC Direct Investing Foreign Currently Accounts within the same currency

- Receive and send branch wires from your Foreign Currency Account.

- Visit a branch for any cash withdrawals and deposit needs.

Please note that a limited supply of currency will be available in RBC branches and an order may have to be placed for you. It will take up to 5 business days for your foreign currency to arrive.

- Deposit or withdraw at the ATM (including cheques).

- Request the issuance of drafts or personalized cheques

- Execute the following transactions: Debit Point of Sale, Cross-Border debits, bill payments, e-Transfer, Third-Party Payment, and International Money Transfers

- Request RBC Virtual Visa Debit to make online purchases

- Transfer money between two FCA accounts that differ in currency.

Note: Internal transfers, transfer to Direct Investing, branch wires and cash transactions will always generate a currency exchange charge.

Note For Fixed Rate Mortgage Clients: At RBC, your online banking will display the interest rate that aligns with the rate displayed on your Cost of Borrowing Disclosure and your annual mortgage statement. This rate does not incorporate the impact of compound interest nor the payment frequency. However, the rate displayed, on your online banking at the former HSBC Bank Canada did incorporate the impact of compound interest and payment frequency thus, it was lower than one displayed on RBC’s online banking.

Note: Monthly payments are interest only at RBC. If you wish to make a payment to principal you will need to set up the payment from your designated RBC Chequing account.

Learn more about how your migrated line of credit works.

For US dollar Line of Credit accounts migrating to a USD Revolving Demand Loan, clients will not maintain a connection between their USD Revolving Demand Loan and their USD chequing account. Please see Section 3 of the RBC Product Migration Guide for more details related to the USD Revolving Demand Loan and its functionality.

Here’s what you need to know about your HSBC Lines of Credit and how they will be migrated to RBC:

- HSBC’s LOCs are attached to a chequing account that operates in a similar way to overdraft protection.

- RBC will maintain connection between an LOC and the designated chequing account for you to make credit draws.

- Your RBC LOC will appear separately from the designated chequing account on statements and online banking and will have a different account number. The line of credit will appear as a Royal Credit Line, but you will not have that product as the terms and conditions of the HSBC Bank Canada Line of Credit agreement will continue to apply, subject to the information in the RBC Product Migration Guide.

- Your monthly payments will only be taken from the designated chequing account linked to line of credit. If you wish to make principal payments, you can make a deposit directly into your designated chequing account.

- Your RBC LOC and designated chequing account may operate differently from the one you had at HSBC and it will be important to understand those differences upon migration as outlined in the "Loans, Line of Credit" section of the RBC Product Migration Guide.

-

Depending on what product(s) you have under your EPM, you will be moved to the most similar product we offer at RBC and therefore your statements and online banking (OLB) may refer to:

- RBC Mortgage;

- RBC Royal Credit Line;

- RBC Homeline Plan (HLP)

-

HSBC’s Equity Power Mortgage (EPM) has a different product structure and operates differently than RBC’s Homeline Plan. If you have an HSBC EPM:

- You will not have the ability to adjust your product mix and reallocate funds without having to re-qualify.

- As you pay down your mortgage(s), the limit of any Line of Credit you have under your EPM does not automatically increase.

- You may see references to an RBC Homeline Plan and a Royal Credit Line on your monthly statements and online banking (OLB). This is for migration purposes, ensuring you can continue using your products after migration as you do now. You have not signed an RBC Homeline Plan Agreement or a Royal Credit Line Agreement. The terms of your HSBC Bank Canada mortgage and/or line of credit agreement will apply, subject to the information in the RBC Product Migration Guide.

Consequently, because you do not have an RBC Homeline Plan, you:

- Do not have the ability to adjust your product mix and reallocate funds without having to re-qualify with RBC.

- The credit limit of the Line of Credit does not automatically increase as you pay down your mortgage(s).

- Will receive monthly statements for an RBC Homeline Plan that disclose an RBC Homeline Credit Limit, and a Royal Credit Line and your RBC OLB will also show an RBC Homeline Plan including Royal Credit Line. You do not have either of those products and should disregard the RBC Homeline Plan Credit Limit disclosed.

You will receive monthly statements for an RBC Homeline Plan that disclose an RBC Homeline Credit Limit, and a Royal Credit Line and your RBC OLB will also show an RBC Homeline Plan including Royal Credit Line. You do not have either of those products and should disregard the RBC Homeline Plan Credit Limit disclosed.

If you would like an RBC Homeline Plan or a Royal Credit Line after migrating over, you can contact an RBC Advisor.

- Your interest rate on the outstanding balance of your RBC personal overdraft account will increase from 18.5% or 21% per year to 22% per year.

- At HSBC Bank Canada you pay a $5 fee when you go into overdraft on a given month. At RBC we charge a monthly overdraft fee of $5 unless you have a personal banking package that waives this fee. If this fee applies to you, RBC will waive it for a minimum of your first 12 months after your account migrates to RBC.

- You may have been making monthly payments of interest only, or an amount that includes both principal and interest at HSBC Bank Canada. When your personal overdraft accounts migrates to RBC your monthly payments will be interest only and you should be aware that monthly payments will come out of the chequing account attached to the overdraft.

- For more information relating to personal overdraft, refer to the RBC Product Migration Guide, Section 3.

The specific payment calculation method is confidential and not shared with others. We can only determine the cost of borrowing differences but not the specific factors causing them.

The difference in cost can vary based on the outstanding mortgage amount and other factors.

If, on the other hand, your HSBC Bank Canada mortgage or loan has a lower cost of borrowing after migration, RBC won’t ask you to return the difference.

- Making additional payments

- Paying Principal only

- Missing a matched payment

- RBC Online banking will continue to display ‘Making additional payment’ and ‘Paying principal only’ options. Clients will be permitted to pay principal and additional payments through online banking to a maximum of 10% of initial mortgage amount and monthly payment, respectively. If your HSBC Bank Canada mortgage allows you to pay a greater amount, please contact an RBC Advisor.

- RBC Online banking displays an option for RBC Skip- a- Payment. As HSBC Bank Canada terms for missing a payment are different than terms of RBC skip-a-payment, if you wish to exercise the HSBC Bank Canada option to miss a payment, you should contact an RBC Advisor. You should not use the self-serve functionality on RBC Online banking.

If your mortgage application was not approved or conditionally approved, simply contact your Advisor who will assist you in submitting a new RBC mortgage application.

Learn more about how your migrated line of credit works.

Learn more about how your migrated line of credit works.

If you are submitting a creditor insurance claim prior to migration day, please reach out to HSBC at 1-888-310-4722.

If you are submitting a creditor insurance claim on or after migration date, please contact RBC Insurance Service Centre at 1-855-379-5928.

- For Mortgage Life insurance only – a partial return of premium is going to be sent to you as an offset to this increase for the first year.

Your premium is based on a combination of several factors including:

i. If you have a mortgage, the life insurance premium will be based on the premium rate for your age,and mortgage balance, as of the migration date

ii. If you have an LOC, the life insurance premium will be based on the premium rate for your age on the date your payment is due and your average daily debit balance during the statement period. - Please refer to the RBC Product Migration Guide – Section 3 for detailed information on the calculation of insurance premiums

Creditor Insurance

If your HSBC new mortgage is approved by March 15, 2024, but your creditor insurance application is pending decision, the application will migrate with the credit facility, and you will be notified of the decision by the insurer. Please note that the terms outlined in the RBC amendment to your HSBC certificate of insurance will apply to your coverage if approved.

The insurer will send you notification of the final decision on your creditor insurance application. You can contact HSBC at 1-888-310-4722 prior to migration for any inquiries on your application. If you have questions after March 28, 2024, please contact RBC Insurance Service Center at 1-855-379-5928.

Please be aware that any coverage/applications involving a guarantor or any product with more than 2 insured parties will not be migrated to RBC.

If your application for creditor insurance is submitted on or before March 22, 2024, but your Creditor insurance application is pending decision, the application will migrate with the credit facility, and you will be notified of the decision by the insurer. Please note that the terms outlined in the RBC amendment to your HSBC certificate of insurance will apply to your coverage if approved.

The insurer will send you notification of the final decision on your creditor insurance application. You can contact HSBC at 1-888-310-4722 prior to migration for any inquiries on your application. If you have questions after March 28, 2024, please contact RBC Insurance Service Center at 1-855-379-5928.

Please be aware that any coverage/applications involving a guarantor or any product with more than 2 insured parties will not be migrated to RBC.

Optional Travel Insurance

In the event that your PAC or SWP instructions are changed or cancelled, you will receive a notification after migration with the details of the new instructions or cancelled instructions.

Note: If you have an address outside of Canada your PAC instruction will be cancelled. To find out more information please refer to the HSBC microsite or the RBC Product Migration Guide section 4.

Where instructions are modified, changes will be made to mitigate any negative impacts to frequency and/or amount.

For accounts migrating to RBC Dominion Securities Pre-authorized contributions / Systematic Withdrawal instructions will resume starting April 15, 2024.

You will be able to maintain your existing underlying holdings, however there will no longer be tactical discretionary management of your portfolio. The portfolio will continue to be strategically rebalanced to align to the investment objective (asset allocation) of the portfolio.

Please refer to the microsite for the RRIF payment schedule following the migration.

PLEASE NOTE: Only accounts that meet the following criteria will be migrated to RBC Dominion Securities. All other accounts will be migrated to RMFI in kind:

- Joint RESP (joint subscribers)

- Accounts Market Linked GIC(s)

- Registered accounts holding US Dollar Mutual Fund(s)

- Registered accounts with US Dollar cash balance(s)

- Your total account holdings are > $50,000 at any time between January 1st and June 30th, or;

- You have initiated activity on the account between January 1st and June 30th.

Important Information

If you need access to your credit card in the meantime, Apple Pay may work as a temporary option, however, it may not accepted at all merchants. This will only work on Apple (iOS) devices, enrollment into Samsung Pay or Google Pay will require your physical card on hand.

- As of April 1st, if you do not have a physical credit card on hand, you can set up Apple Pay through the Apple (iOS) version of the RBC Mobile App. Go to the credit card product page and select Manage card (top right) and under services select “Add to Apple Pay”. The credit card does not need to be activated to use the card through Apple Pay.

- You will be able to complete in-store purchases, where merchants accept Apple Pay, for transactions $250 and under. You will also make online/ecommerce purchases, if the merchant accepts Apple Pay, with no transaction limit.

Using Your RBC Credit Card

Continue to use your HSBC Bank Canada credit card until this date.

If you are concerned about Visa acceptance at Costco or another specific merchant, please note RBC offers both Visa and MasterCard credit cards. If you would like a MasterCard credit card you can apply an RBC MasterCard anytime or seek to product transfer from your replacement card to a Mastercard on or after April 2nd. Please note if you choose to switch, some of the features and benefits on the RBC card you were migrated to may differ from the card you switch to, and some may not be available to switch back to.

You can also use your Debit card (Client Card) at all Canadian merchants.

If you have not received your remaining card(s) card by March 18, please call us at 1-800-769-2511.

- After March 18th, 2024, please call RBC at 1-800-769-2511 to request a new card to be mailed to you. Please note, you will need to be at the temporary address until April 15th to receive the card.

- Consider Apple Pay as a temporary option, noting this is not accepted at all merchants, see below for details. Please note, the following example is only for Apple Pay when initiating enrollment from the RBC Mobile App. Enrollment into Samsung Pay or Google Pay will require your physical card on hand.

- As of April 1st, despite not having your credit card on hand, please go into the Apple (iOS) version of the RBC Mobile App. Go to the credit card product page and select Manage card (top right) and under services select “Add to Apple Pay”. The credit card does not need to be activated to use the card through Apple Pay.

- You will be able to make in-store purchases with Apple Pay where merchants accept Apple Pay for transactions $250 and under. You will be able to make ecommerce purchases with your card through Apple Pay if the merchant accepts Apple Pay, with no transaction limit.

Managing Your RBC Credit Card

If you choose to switch, please be aware that the features and benefits of the RBC credit card you were migrated to may differ from those of the card you switch to, and some cards may not be available to switch back to.

- To pay your credit card using funds from an RBC bank account, simply transfer the funds from your RBC bank account to your RBC credit card account. Visit rbc.com/hsbc-canada for detailed instructions and tutorials on how to enrol in RBC Online Banking.

- To pay your credit card using funds from a bank account at another financial institution, you must register the RBC credit card account as a “Bill Payment” to make a payment.

To make payments by mail, please follow the instructions on the tear-off portion of your RBC credit card statement.

Please note, transactions that were visible in HSBC digital channels prior to March 28th will not appear in your RBC transaction summary in RBC Online Banking or the RBC Mobile App. These transactions will appear under Statements / Documents, found on your Accounts Summary page in RBC Online Banking.

If you are the primary card holder, you can add authorized user(s) to your credit card(s) through Online Banking (OLB).

While logged into OLB Open the Account Details page of the credit card the authorized user is being added to. Unfortunately, co-applicants cannot be added to any migrated credit cards.

Rewards

- Market-leading travel offerings

- An innovative shopping companion, Avion Rewards ShopPlus

- Cash-back deals

- The ability to redeem Avion points for gift cards, merchandise, financial rewards, and more

- Offers from our extensive network of Avion Rewards retail partners

| Former HSBC Credit Card | Rewards Redemption Phone # |

|---|---|

|

1-888-560-4722 |

|

1-866-611-4722 |

|

1-866-688-4722 |

Once your cash back balance reaches $25 or more on your RBC cash back credit card account, you can receive the credit in one of two ways:

- It will automatically be credited to your credit card account in January of any given calendar year; or

- You can have the full amount credited to your credit card account by calling 1-800 ROYAL 1-2 any time after the migration.

Any unused points will be converted to an Avion® points balance that will have equal or higher value in the Avion Rewards flexible travel redemption category, which is similar to how you book travel today. You will receive a detailed email which includes your points balance, associated value, and details regarding redemption options. Full access to Avion Rewards will be available via avionrewards.com or the Avion Rewards™. Full access to Avion rewards will be available via avionrewards.com or the Avion Rewards™ app with your new RBC Online Banking credentials.

Additionally, if you are eligible, you can find information on how to redeem your Travel Credit on AvionRewards.com, he Avion Rewards Mobile App, and Online Banking under Offers.

- Travel tab - Go here to use your points for flights, hotels, vacation packages, car rentals and more.

- Redeem tab - Go here to use your points for anything other than travel, including: Merchandise and gift cards in the Avion Rewards catalogue, Donations to charity, RBC Financial Rewards, Convert points to partner loyalty programs, Pay with points

Note: You can access Visa Airport Companion the later of i) April 1, 2024 or ii) the date you activate your RBC credit card.

Insurance

However, you may have coverage through your RBC credit card if your RBC credit card includes Emergency Travel Medical Insurance and your travel departure date is on or after March 29, 2024.

Please familiarize yourself with your RBC credit card coverage details as coverage may vary from your HSBC credit card. Details are included with your RBC Welcome kit and also available online rbc.com/carddocs

Your RBC credit card insurance coverage(s) will come into effect on March 29, 2024. For information on how to submit a claim, please visit rbc.com/hsbc-canada (Opens link in new window).

A copy of the Certificate of Insurance for your specific credit card is also available at rbc.com/carddocs (Opens link in new window).

The above statement applies to the following coverages if included with your HSBC credit card:

- Trip Cancellation

- Trip Interruption / Delay

- Baggage Delay or Loss

- Hotel/Motel Burglary

- Flight Delay

- Car Rental Insurance

- Common Carrier Accidental Death and Dismemberment

- Purchase Assurance

- Extended Warranty

- Mobile Device

However, you may have coverage through your RBC credit card if your RBC credit card includes Emergency Travel Medical Insurance and your travel departure date is on or after March 29, 2024.

Please familiarize yourself with your RBC credit card coverage details as coverage may vary from your HSBC credit card. Details are included with your RBC Welcome kit and also available online rbc.com/carddocs

However, you may have coverage through your RBC credit card if your RBC credit card includes Emergency Travel Medical Insurance and your travel departure date is on or after March 29, 2024.

Please familiarize yourself with your RBC credit card coverage details as coverage may vary from your HSBC credit card. Details are included with your RBC Welcome kit and also available online rbc.com/carddocs

If your RBC credit card does not include Emergency Travel Medical Insurance, as of March 29, 2024, you can visit rbc.com/cardtravelcoverage or call 1-866-292-5233 to obtain a quote.

If you have margin and/or option accounts, forms must be completed and submitted no later than November 27, 2024. Forms for other account types can be submitted before March 31, 2026.

Log in to your RBC Direct Investing account to learn more about accessing and completing your RBC Direct Investing account forms. From the Explore menu, select “About your HSBC accounts.”

At RBC Direct Investing, all commissions and fees are charged to the RBC Direct Investing account(s). You will not have the ability to charge them to a bank account (either an account at RBC or from another financial institution). To learn how to transfer funds to your RBC Direct Investing account, check out the videos on this page.

FR

https://www.rbcplacementsendirect.com/cercle-royal.html (Opens link in new window)

If you hold an Active Trader status at the time of migration (that is, you trade 150+ times during the trading period):

You will receive Active Trader status at RBC Direct Investing and the pricing you currently receive at HSBC InvestDirect will be honoured. Learn more about the benefits associated with the Active Trader program including access to exclusive research. Learn more

https://www.rbcdirectinvesting.com/active-trader.html (Opens link in new window)

A ‘Support page’ is available to you with frequently asked questions. To access it, log on to rbcdirectinvesting.com and click on the ‘Explore’ tab.

Your Pre-Authorized Contribution instructions (PAC) from your HSBC Bank Canada account(s) to your HSBC InvestDirect account(s) will migrate to RBC Direct Investing but may be subject to change after migration due to differences in RBC Direct Investing’s frequency and/or payment date options.

The following will be amended upon transition:

- Weekly PAC instructions on your registered account, your payment date will automatically be changed to be paid out every Friday.

- Bi-weekly and semi-monthly PAC instructions on your registered account, payment date will be on the 15th and end of the month following the migration date.

- Monthly PAC instructions on your registered account, payment date will be on the 15th day of the month following the migration date

- For all non-registered PAC instructions, all payment amount and frequency will remain the same.

- If you have an Automatic Funds Transfer (AFT) on your Sweep Account, upon migration your weekly AFT payment will revert to the first business day of the week.

Split Currency Payment Instructions (applies to RRIF and related accounts)

- If you receive your regular scheduled payment in either 100% Canadian or 100% U.S. dollar, there will be no change.

- If you receive a regularly scheduled payment in a combination of Canadian and U.S. dollars, this will change to Canadian dollars only upon migration. You may call RBC Direct Investing after migration to change your scheduled payment to all U.S. dollars if that is your preference.

Non Registered: At InvestDirect, your non-registered cash accounts are separated by currency. For example, you may have separate CAD, USD, and/or other foreign currency non-registered cash accounts. Upon migration to RBC Direct Investing, your non-registered cash accounts will be consolidated into one account that can hold multiple currencies (CAD, USD and foreign currencies).

Registered: At InvestDirect, your registered account type (RRSP, TFSA,RRIF) are separated by currency. For example, you may have separate CAD and USD currency registered accounts. Upon migration to RBC Direct Investing, your registered account type (RRSP, TFSA, RRIF) will be consolidated into one account type that can hold both CAD and USD currency.

Margin: At InvestDirect, your margin accounts are separated by currency. For example, you may have separate CAD and USD currency margin accounts. Upon migration to RBC Direct Investing, your margin accounts will be consolidated into one account that can hold both CAD and USD currency.

RESP: Your RESP account in CAD at InvestDirect will migrate to an RBC Direct Investing RESP account in CAD.

You can also fund your RBC Direct Investing account(s) from a non-RBC chequing or savings account by adding “RBC Direct Investing” as a bill payee in your RBC OLB or the RBC Mobile app. Please be aware that transfers from a non-RBC account can take 2-4 business days.

You can also transfer HKD, GBP and EUR from your RBC Foreign Currency bank account to an RBC Direct Investing non-registered cash account. Trades at RBC Direct Investing settle within the account. You will not have the ability to settle trades directly from a bank account (either an account at RBC or from another financial institution) after your HSBC InvestDirect account(s) migrate to RBC Direct Investing.

You will be able to hold eight foreign currencies in non-registered cash accounts at RBC Direct Investing, including: Hong Kong Dollar; Great Britain Pound; Euro; Swiss Franc; Singapore Dollar; Australian Dollar; New Zealand Dollar; Japanese Yen.

You will have the ability to carry out Foreign Exchange transactions between foreign currencies and CAD & USD. You will also be able to place a trade in a foreign market in the local currency, or you can place a trade in the foreign market from a CAD or USD account.

Once your accounts have migrated to RBC Direct Investing, you will have access to trade on the Hong Kong Stock Exchange in real time through the online investing site and mobile app, and by phone.

Trading by phone will be available for:

Swiss Exchange (Switzerland); Euronext Brussels (Belgium); Borsa Italia (Italy); Euronext Amsterdam (Netherlands); Euronext Lisbon (Portugal); Vienna Stock Exchange (Austria); Bolsa de Madrid (Spain); Nasdaq Helsinki (Finland); Athens Stock Exchange (Greece); Australian Securities Exchange; Singapore Exchange; Tokyo Stock Exchange (Japan); Nagoya Stock Exchange (Japan); Osaka Securities Exchange (Japan)

Online trading capability for London Stock Exchange, Euronext Paris, Frankfurt Stock Exchange is coming later in 2024.

Some restrictions apply to other markets. For more details, please refer to the RBC Product Migration Guide section 4.

Please note that for a temporary period, you will not have the ability to make modifications to your trade orders on international markets. To make a change you will need to cancel the order and place a new one. The ability to modify orders will be available later in 2024.

- Download your previous HSBC InvestDirect account statements, tax documents or transactions history as you will not have immediate access to these documents upon migration.

- Export or screenshot your watchlist and alerts as these won’t be migrated to RBC Direct Investing. You can re-create them after migration.

English, French, Cantonese and Mandarin speaking investment representatives are available by phone. Online and RBC mobile app are available in English and French only. Chat functionality is not available.

Investment Services Representatives are available Monday to Friday from 7 am to 8 pm ET for North American trades. For International trading, Investment Services Representatives will be available by phone when the markets are open.

Frequency and payment date options from RBC Direct Investing differ from what you experienced at HSBC InvestDirect. Please refer to your RBC Product Migration Guide section 4 page 92 of the Product and Service Guide for details.

For a list of all RBC ISA products, please visit: https://www.rbcroyalbank.com/products/isa/index.html

(Opens link in new window). Note: RBC Direct Investing offers Series A.

(Opens link in new window). Note: RBC Direct Investing offers Series A.

You will still have the ability to trade over the phone with an Investment Services Representative but for the best experience we recommend enrolling in RBC Online Banking or the RBC Mobile app.

If you reside outside of Canada, your ability to view your accounts will remain the same immediately after your transition to RBC Direct Investing. Following migration, RBC Direct Investing will review your account and notify you if your account(s) will be subject to access or trading limitations.

If you reside in the United States of America, your ability to access and view your accounts will remain the same, with the exception of residents of the state of New York, who will not have access to the online or mobile platform. For all US residents, upon migration trading will be available by phone only and product restrictions as determined by the state of residence will apply. Please contact us at the telephone number below to reach a U.S. licensed representatives.

- U.S. Licensed - Trading Line Toll-free (North America): 1-800-769-2514

The list of impacted jurisdictions is reviewed periodically and subject to change.

- Afghanistan

- Belarus

- Cameroon

- Central African Republic (the)

- Congo (the Democratic Republic of the)

- Egypt

- Eritrea

- Guinea-Bissau

- Iran (Islamic Republic of)

- Iraq

- Jamaica

- Kazakhstan

- Korea (the Democratic People's Republic of) [North Korea]

- Lebanon

- Libya

- Myanmar

- Nicaragua

- Pakistan

- Russian Federation (the)

- Somalia

- South Sudan

- Sudan (the)

- Sri Lanka

- Syrian Arab Republic

- Ukraine

- Venezuela (Bolivarian Republic of)

- Yemen

- Zimbabwe

You will also experience:

- The benefit of the RBC trading desk, where expert traders and smart technology come together.

- The power of the extensive investor resources including free real-time streaming and level 2 quotes for North American exchanges plus expert research and analysis for Canadian, U.S. and International markets.

- The convenience of connecting with RBC Direct Investing representatives who can support your trading needs either in person at Investor Centres or via the phone through the Contact Centre.

Legal disclosure:

Level 2 quotes are available on stocks and ETFs that trade on the TSX and TSX-Venture exchanges for all clients. Level 2 quotes are also available on stocks and ETFs that trade on the Canadian Securities Exchange and Nasdaq for Active Trader clients upon accepting the terms and conditions of all exchange agreements on the RBC Direct Investing online investing site.

Once migration has been completed, you will be able to see your actual account balances, and be able to use these migrated accounts.

Free online transfers of HKD, GBP and EUR from your RBC Foreign Currency account to an RBC Direct Investing non-registered cash account are available through RBC Online Banking (OLB) or the RBC Mobile app in real time between 4:30 am and 3 PM ET Monday to Friday, excluding holidays. Outside these hours, funds are available the next business day. Daily limits by account apply and wire transfers are available for instances where you require an amount above the daily limit.

| Transfer from your RBC Royal Bank Canada Account to your RBC Direct Investing Account | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Online |

|

- Hong Kong Dollars, British Pounds and Euros over the daily limit noted above. There is no charge for these transfers.

- Please visit your local RBC Branch to initiate a wire.

From RBC Direct Investing to RBC bank account:

Free transfers of Canadian and US dollars from your RBC Direct Investing account to an RBC Royal Bank account are processed in real-time between 9:00 a.m. and 4:00 p.m. ET, Monday to Friday (excluding holidays). Transfers out of your RBC Direct Investing account made outside of these hours will be processed the next business day. Locked-in, Registered Retirement Income Fund, and Registered Education Savings Plan (transfer out only) accounts excluded. Other conditions apply.

Free transfers of HKD, GBP and EUR from your RBC Direct Investing non-registered cash account to your RBC Foreign Currency bank account are available in real time between 9:00 am and 3 PM ET Monday to Friday (excluding holidays). Outside these hours, funds are available the next business day. Daily limits by account apply and wire transfers are available for instances where you require an amount above the daily limit.

| Transfer from your RBC Direct Investing Account to your RBC Royal Bank of Canada Account | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Online |

|

- Hong Kong Dollars, British Pounds and Euros over the daily limit noted above. There is no charge for these transfers.

- To place a wire, call us at 1-800-769-2560 between 7:00 AM and 8:00 PM ET Monday-Friday (excluding holidays).

If you had payroll contributions connected to a Group World Selection Portfolio account, you will need to open a new Group RRSP account at RBC post migration to continue to receive payroll contributions. Further information on next steps will be shared through your employer post migration.

You will be able to transfer funds between accounts, but your payroll contributions will be deposited into your new RBC Group RRSP account.

FAQs for Private Banking and Wealth Management Clients

This page will continue to be updated with additional information regarding the migration of your products and services to RBC.

- Branches / ATMs

- Credit Cards

- Digital Banking

- Direct Investing

- Global View & International Money Transfers (IMT)

- Investments

- Private Banking

If you have margin and/or option accounts, forms must be completed and submitted no later than November 27, 2024. Forms for other account types can be submitted before March 31, 2026.

Log in to your RBC Direct Investing account to learn more about accessing and completing your RBC Direct Investing account forms. From the Explore menu, select “About your HSBC accounts.”

At RBC Direct Investing, all commissions and fees are charged to the RBC Direct Investing account(s). You will not have the ability to charge them to a bank account (either an account at RBC or from another financial institution). To learn how to transfer funds to your RBC Direct Investing account, check out the videos on this page.

FR

https://www.rbcplacementsendirect.com/cercle-royal.html (Opens link in new window)

If you hold an Active Trader status at the time of migration (that is, you trade 150+ times during the trading period):

You will receive Active Trader status at RBC Direct Investing and the pricing you currently receive at HSBC InvestDirect will be honoured. Learn more about the benefits associated with the Active Trader program including access to exclusive research. Learn more

https://www.rbcdirectinvesting.com/active-trader.html (Opens link in new window)

A ‘Support page’ is available to you with frequently asked questions. To access it, log on to rbcdirectinvesting.com and click on the ‘Explore’ tab.

Your Pre-Authorized Contribution instructions (PAC) from your HSBC Bank Canada account(s) to your HSBC InvestDirect account(s) will migrate to RBC Direct Investing but may be subject to change after migration due to differences in RBC Direct Investing’s frequency and/or payment date options.

The following will be amended upon transition:

- Weekly PAC instructions on your registered account, your payment date will automatically be changed to be paid out every Friday.

- Bi-weekly and semi-monthly PAC instructions on your registered account, payment date will be on the 15th and end of the month following the migration date.

- Monthly PAC instructions on your registered account, payment date will be on the 15th day of the month following the migration date

- For all non-registered PAC instructions, all payment amount and frequency will remain the same.

- If you have an Automatic Funds Transfer (AFT) on your Sweep Account, upon migration your weekly AFT payment will revert to the first business day of the week.

Split Currency Payment Instructions (applies to RRIF and related accounts)

- If you receive your regular scheduled payment in either 100% Canadian or 100% U.S. dollar, there will be no change.

- If you receive a regularly scheduled payment in a combination of Canadian and U.S. dollars, this will change to Canadian dollars only upon migration. You may call RBC Direct Investing after migration to change your scheduled payment to all U.S. dollars if that is your preference.

Non Registered: At InvestDirect, your non-registered cash accounts are separated by currency. For example, you may have separate CAD, USD, and/or other foreign currency non-registered cash accounts. Upon migration to RBC Direct Investing, your non-registered cash accounts will be consolidated into one account that can hold multiple currencies (CAD, USD and foreign currencies).

Registered: At InvestDirect, your registered account type (RRSP, TFSA,RRIF) are separated by currency. For example, you may have separate CAD and USD currency registered accounts. Upon migration to RBC Direct Investing, your registered account type (RRSP, TFSA, RRIF) will be consolidated into one account type that can hold both CAD and USD currency.

Margin: At InvestDirect, your margin accounts are separated by currency. For example, you may have separate CAD and USD currency margin accounts. Upon migration to RBC Direct Investing, your margin accounts will be consolidated into one account that can hold both CAD and USD currency.

RESP: Your RESP account in CAD at InvestDirect will migrate to an RBC Direct Investing RESP account in CAD.

You can also fund your RBC Direct Investing account(s) from a non-RBC chequing or savings account by adding “RBC Direct Investing” as a bill payee in your RBC OLB or the RBC Mobile app. Please be aware that transfers from a non-RBC account can take 2-4 business days.

You can also transfer HKD, GBP and EUR from your RBC Foreign Currency bank account to an RBC Direct Investing non-registered cash account. Trades at RBC Direct Investing settle within the account. You will not have the ability to settle trades directly from a bank account (either an account at RBC or from another financial institution) after your HSBC InvestDirect account(s) migrate to RBC Direct Investing.

You will be able to hold eight foreign currencies in non-registered cash accounts at RBC Direct Investing, including: Hong Kong Dollar; Great Britain Pound; Euro; Swiss Franc; Singapore Dollar; Australian Dollar; New Zealand Dollar; Japanese Yen.

You will have the ability to carry out Foreign Exchange transactions between foreign currencies and CAD & USD. You will also be able to place a trade in a foreign market in the local currency, or you can place a trade in the foreign market from a CAD or USD account.

Once your accounts have migrated to RBC Direct Investing, you will have access to trade on the Hong Kong Stock Exchange in real time through the online investing site and mobile app, and by phone.

Trading by phone will be available for:

Swiss Exchange (Switzerland); Euronext Brussels (Belgium); Borsa Italia (Italy); Euronext Amsterdam (Netherlands); Euronext Lisbon (Portugal); Vienna Stock Exchange (Austria); Bolsa de Madrid (Spain); Nasdaq Helsinki (Finland); Athens Stock Exchange (Greece); Australian Securities Exchange; Singapore Exchange; Tokyo Stock Exchange (Japan); Nagoya Stock Exchange (Japan); Osaka Securities Exchange (Japan)

Online trading capability for London Stock Exchange, Euronext Paris, Frankfurt Stock Exchange is coming later in 2024.

Some restrictions apply to other markets. For more details, please refer to the RBC Product Migration Guide section 4.

Please note that for a temporary period, you will not have the ability to make modifications to your trade orders on international markets. To make a change you will need to cancel the order and place a new one. The ability to modify orders will be available later in 2024.

- Download your previous HSBC InvestDirect account statements, tax documents or transactions history as you will not have immediate access to these documents upon migration.

- Export or screenshot your watchlist and alerts as these won’t be migrated to RBC Direct Investing. You can re-create them after migration.

English, French, Cantonese and Mandarin speaking investment representatives are available by phone. Online and RBC mobile app are available in English and French only. Chat functionality is not available.

Investment Services Representatives are available Monday to Friday from 7 am to 8 pm ET for North American trades. For International trading, Investment Services Representatives will be available by phone when the markets are open.

Frequency and payment date options from RBC Direct Investing differ from what you experienced at HSBC InvestDirect. Please refer to your RBC Product Migration Guide section 4 page 92 of the Product and Service Guide for details.

For a list of all RBC ISA products, please visit: https://www.rbcroyalbank.com/products/isa/index.html

(Opens link in new window). Note: RBC Direct Investing offers Series A.

(Opens link in new window). Note: RBC Direct Investing offers Series A.

You will still have the ability to trade over the phone with an Investment Services Representative but for the best experience we recommend enrolling in RBC Online Banking or the RBC Mobile app.

If you reside outside of Canada, your ability to view your accounts will remain the same immediately after your transition to RBC Direct Investing. Following migration, RBC Direct Investing will review your account and notify you if your account(s) will be subject to access or trading limitations.

If you reside in the United States of America, your ability to access and view your accounts will remain the same, with the exception of residents of the state of New York, who will not have access to the online or mobile platform. For all US residents, upon migration trading will be available by phone only and product restrictions as determined by the state of residence will apply. Please contact us at the telephone number below to reach a U.S. licensed representatives.

- U.S. Licensed - Trading Line Toll-free (North America): 1-800-769-2514

The list of impacted jurisdictions is reviewed periodically and subject to change.

- Afghanistan

- Belarus

- Cameroon

- Central African Republic (the)

- Congo (the Democratic Republic of the)

- Egypt

- Eritrea

- Guinea-Bissau

- Iran (Islamic Republic of)

- Iraq

- Jamaica

- Kazakhstan

- Korea (the Democratic People's Republic of) [North Korea]

- Lebanon

- Libya

- Myanmar

- Nicaragua

- Pakistan

- Russian Federation (the)

- Somalia

- South Sudan

- Sudan (the)

- Sri Lanka

- Syrian Arab Republic

- Ukraine

- Venezuela (Bolivarian Republic of)

- Yemen

- Zimbabwe

You will also experience:

- The benefit of the RBC trading desk, where expert traders and smart technology come together.

- The power of the extensive investor resources including free real-time streaming and level 2 quotes for North American exchanges plus expert research and analysis for Canadian, U.S. and International markets.

- The convenience of connecting with RBC Direct Investing representatives who can support your trading needs either in person at Investor Centres or via the phone through the Contact Centre.

Legal disclosure:

Level 2 quotes are available on stocks and ETFs that trade on the TSX and TSX-Venture exchanges for all clients. Level 2 quotes are also available on stocks and ETFs that trade on the Canadian Securities Exchange and Nasdaq for Active Trader clients upon accepting the terms and conditions of all exchange agreements on the RBC Direct Investing online investing site.

Once migration has been completed, you will be able to see your actual account balances, and be able to use these migrated accounts.

Free online transfers of HKD, GBP and EUR from your RBC Foreign Currency account to an RBC Direct Investing non-registered cash account are available through RBC Online Banking (OLB) or the RBC Mobile app in real time between 4:30 am and 3 PM ET Monday to Friday, excluding holidays. Outside these hours, funds are available the next business day. Daily limits by account apply and wire transfers are available for instances where you require an amount above the daily limit.

| Transfer from your RBC Royal Bank Canada Account to your RBC Direct Investing Account | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Online |

|

- Hong Kong Dollars, British Pounds and Euros over the daily limit noted above. There is no charge for these transfers.

- Please visit your local RBC Branch to initiate a wire.

From RBC Direct Investing to RBC bank account:

Free transfers of Canadian and US dollars from your RBC Direct Investing account to an RBC Royal Bank account are processed in real-time between 9:00 a.m. and 4:00 p.m. ET, Monday to Friday (excluding holidays). Transfers out of your RBC Direct Investing account made outside of these hours will be processed the next business day. Locked-in, Registered Retirement Income Fund, and Registered Education Savings Plan (transfer out only) accounts excluded. Other conditions apply.

Free transfers of HKD, GBP and EUR from your RBC Direct Investing non-registered cash account to your RBC Foreign Currency bank account are available in real time between 9:00 am and 3 PM ET Monday to Friday (excluding holidays). Outside these hours, funds are available the next business day. Daily limits by account apply and wire transfers are available for instances where you require an amount above the daily limit.

| Transfer from your RBC Direct Investing Account to your RBC Royal Bank of Canada Account | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Online |

|

- Hong Kong Dollars, British Pounds and Euros over the daily limit noted above. There is no charge for these transfers.

- To place a wire, call us at 1-800-769-2560 between 7:00 AM and 8:00 PM ET Monday-Friday (excluding holidays).

Please note that RBC Concierge provided by Ten Lifestyle Management Group Limited is available to RBC Private Banking clients with the RBC Avion Visa Infinite Privilege for Private Banking credit card. Please contact your Relationship Manager for more details. (Offer subject to adherence with RBC credit granting policies.)

- Keep all important HSBC Private Investment Counsel account information for your records as you transition to RBC PH&N Investment Counsel. Save your HSBC Private Investment Counsel statements and tax documents before migration.

- It is recommended you enrol in RBC Online Banking once you’ve received your RBC Client Card to ensure you have continued online access to view your account information.

- Your portfolio(s) historical transaction, performance information and annual reports will not be available online to you after migration. Please retain your HSBC Private Investment Counsel account statements and annual reports for this information. New performance calculations will be provided going forward after migration.

- Review the RBC PH&N Investment Counsel Client Account Agreement which will govern your portfolio(s) after migration. You can obtain a physical copy at a PH&N IC office or by contacting your Investment Counsellor.

To learn more about deposit insurance and how to maximize coverage please visit https://www.rbc.com/hsbc-canada/cdic.html.

If you are the primary card holder, you can add authorized user(s) to your credit card(s) through Online Banking (OLB).

While logged into OLB Open the Account Details page of the credit card the authorized user is being added to. Unfortunately, co-applicants cannot be added to any migrated credit cards.

You can expect similar high-quality service and value that you received at HSBC Canada.

Our investment counsellors and portfolio managers have access to expertise and guidance on security selection and portfolio construction at RBC Global Asset Management, Canada’s largest asset manager , as well as third-party money managers worldwide. RBC Wealth Management’s broad range of investing solutions including the global diversification you’ve come to enjoy at HSBC and provides access to many managers and mandates, including alternative investments.

Outgoing payments set up for April 1 will be processed on April 2 after the systems have been updated.

For subsequent months, 1st of the month payments will be set up for clients.

Please speak with your Investment Counsellor or refer to your Product and Service Notification letter for details.

Fees for your HSBC account for first quarter will appear on your April 30, 2024, custody statement.

The custodian’s role is to provide basic record keeping and administrative services such as tax reporting. In addition, the custodian confirms that your holdings and transactions are consistent with your investment management reporting from RBC PHN Investment Counsel. RBC Royal Trust is obligated to provide this reporting at least once per year.

Valuations in the custody statement are reflected as of settlement date, but in the investment management statement as of trade date. Custody statements do not provide any historical performance data. This is consistent with industry practice as custodians only report on settled amounts.

Please refer to the product and service notification letter for additional details.

1) Prior to Migration Date:

- Accept the HSBC updated Terms and Conditions on HSBC Online Banking.

2) After Migration date (when your HSBC Canada account(s) migrate to RBC):

- Accept the RBC Terms and Conditions in the ‘External Accounts’ section on RBC Online Banking and RBC Mobile Banking.

- Transfer Money to your HSBC Global View Linked Accounts: Using RBC International Money Transfer (IMT), you will be able to transfer money from your eligible RBC CAD or USD chequing account to the globally linked HSBC Accounts (exception: CAD to CAD transfers are not available)

- Send Money to others Globally: Using RBC International Money Transfer, you can also choose to send money to anyone else globally. You will be able to transfer money from your eligible RBC CAD chequing account to third parties.

- You will NOT be able to view your non-Canadian HSBC accounts in RBC Online Banking or Mobile Banking and

- You will NOT be able to view your RBC Canada account information from other HSBC locations where you have Global View.

If you delink your accounts from RBC’s External Accounts you will NOT be able to re-establish the link.

If you provide consent, you will be the only person able to view certain account information related to your linked Global HSBC Savings and/or chequing account(s) from RBC Online Banking and Mobile Banking after migration.

RBC International Money Transfer (IMT) can be used to send money internationally. You can:

- Send money internationally to your own Global View Linked HSBC accounts around the world and/or

- Send money internationally to anyone around the world, where permitted, whether the recipient is a client of HSBC or a client of another financial institution.

HSBC’s Global Money Transfer service is currently available in Hong Kong, UK, US, UAE, Singapore, Australia, HSBC Expat (Jersey) and India (available on your HSBC mobile app). HSBC Global Money Transfer service is free in most jurisdictions with an exception of Hong Kong. Please refer to your local HSBC product pages/ guides for latest information.

Note: All other Jurisdictions that are not on this list will not be viewable in RBC Online Banking and RBC Mobile App.

RBC International Money Transfer (IMT) can be used to send money internationally. You can:

- Send money internationally to anyone around the world, where permitted, whether the recipient is a client of HSBC or a client of another financial institution

Currently, using IMT to send money to any person across the world can only be initiated from a RBC CAD account.

FAQs for Small Business Clients

This page will continue to be updated with additional information regarding the migration of your products and services to RBC.

- Banking

- Business Accounts

- Business Banking APIs

- Branches / ATMs

- Bulk Payment Files

- Client (Debit) Cards

- Credit & Lending

- Credit Cards

- Deposit Interest Arrangements

- Digital Channels

- Direct Investing

- Foreign Currency Accounts

- GICs & US Term Deposits

- Group Banking Program

- Group RRSP

- Insurance

- Investments

- Interac receive/ auto registration

- International Payments

- Mutual Funds

- Online Tax Filing

- Payments

- Power of Attorney

- Receivables

- Rewards Program

- Statements

- Trade Finance

- Wires

Contact Customer Support for further help:

- Canada & USA: 1-800-769-2535

- International: 1-416-974-3334

For all other locations, please contact your HSBC Bank Canada Relationship Manager.

SFTP: SSH Key or Password

FTPS: Password

Swift FileAct: PKI certificates

AS2: SSL certificate

Once they’ve registered their RBC Express Credentials, system administrators can access the RBC Express BSU by logging into www6.rbc.com. Additionally, system administrators can order hard tokens anytime from the User Administration section on RBC Express, accessible via the Business Banking Portal.

Note: If you have set up a soft token, you do not require a hard token.

Note: Any import duties and taxes are payable by the client and handled directly by the shipping courier.

- Cuba

- Iran

- North Korea

- Sudan

- Syria

- Crimea region

- Russia

- Venezuela

- Palestinian Territories

- Belarus

If you are the sole administrator for your business and have lost access to the RSA Authenticator (SecurID) app, then please call 1-800-769-2535 (Canada and USA) or 1-416-974-3334 (International). If you reside outside of these countries, please contact your Relationship Manager.

Click here for more information on how to set up your RBC Express English and French banking profiles and/or change a user's language setting on other RBC digital banking platforms.

You can view up to 7 years of your transaction history from your former HSBC Bank Canada account(s) on the RBC Business Banking Portal. Use the main menu to navigate to the 'Additional Services' page and select the option for "HSBC Bank Canada: Transaction History". Alternatively, on the 'Accounts Overview' page, navigate to the 'Quick Links' section to select the "HSBC Bank Canada: Transaction History" option.

If you are in RBC Express, select the 'Back to RBC Business Banking Portal' link at the top of the page and then follow the above instructions.

To view and download former HSBC Bank Canada statements, please speak with your Relationship Manager.

For both English and French support on RBC Global Trade, you can call the RBC CLO Team (Client Liaison Officers) at 1-800-757-4525, Option 5.

- Please download your trade transaction history from HSBC Bank Canada Digital platform prior to March 28th.

- We recommend you download your outstanding reports as of your financial year-end for financial statement and tax purposes.

- We recommend you download your current saved and available HSBC Bank Digital Platforms transaction templates (application details, applicant/beneficiary information, clauses, or texts) for later reference, as these will not be automatically migrated.

However, some changes may will be made respecting trade instruments issued after migration, including charging of interest, charges and fees in CAD or USD, rather than in the currency of your trade products. RBC product processes may be slightly different from HSBC Bank Canada; however, we intend to provide a similar client experience. Your HSBC Bank Canada Client Service Manager (CSM) and Business Development Manager (BDM) can address any questions you may have throughout this migration.

- If you are submitting a claim prior to migration day, please reach out to HSBC Bank Canada at 1-877-955-4722 or your HSBC Bank Canada Relationship Manager.

- If you are submitting the claim on or after migration date, please contact RBC Insurance Service Center at 1-855-379-5928

- Your insurance premium is changing as a result of the migration of HSBC Bank Canada creditor insurance products to RBC.

- For Mortgage Life insurance only –as some clients may experience a higher premium, a partial return of premium is going to be credited to you during the first year.

- Please refer to the Product and Service Notification Guide – Section 7 for detailed information on the calculation of insurance premiums.

If you’d like to use Interac Contactless Payment, complete a transaction using your PIN after the activation date. Once you have done that, you will be able to use Interac Contactless Payment with your RBC Business Client Card anytime.

Primary Business Client Card

The Primary Business Client Card gives you access to all your business accounts and full-function access on RBC digital business banking. Each business can have one Primary Business Client Card.

The Primary Business Client Card allows individuals with full signing authority within the business to utilize the card as a form of authentication in RBC branches, at ATMs (RBC and other financial institutions), and during Point of Sale (POS) transactions.

Cards are printed with a 16-digit card number and business legal name.

Additional Business Client Card (ABCC)

The Additional Business Client Card allows individuals with full signing authority within the business to utilize the card as a form of authentication in RBC branches, at ATMs (RBC and other financial institutions) to select business deposit accounts and during Point of Sale (POS) transactions.

Additional Business Client Cards do not provide access to RBC digital business banking.

Cards are printed with the same 16-digit card number and business legal name as the Primary Business Client Card. As well, each ABCC includes an individual cardholder name and a unique 3-digit cardholder ID.

Deposit-Only Agent Cards

Deposit-Only Agent Cards are for individuals who only make deposits to the primary account attached to the Primary Business Client Card on behalf of the business. Deposits can be accepted through any RBC ATM with no withdrawals or access to account information.

Cards are printed with the same 16-digit card number and business legal name as the Primary Business Client Card. As well, each Deposit-Only Agent Card includes a unique 3-digit cardholder ID. Deposit-Only Agent Cards do not require a PIN.

Each Agent Card has a unique 3-digit identifier that can be used to distinguish transactions that enables easy reconciliation.

If you would like to change the primary chequing account, please call 1-800-769-2520, reach out to your Relationship Manager or visit a RBC branch, on or after April 1st, 2024.

Note: Agent Cards offer no withdrawal capabilities or access to balance information and can only be used at a RBC ATM.

If you would like to change the primary chequing account, please call 1-800-769-2520, reach out to your Relationship Manager or visit a branch, on or after April 1st, 2024.

*Note: Primary chequing account refers to the account that is the default account for withdrawals and deposits at ATMs and Point of Sale transactions made using your RBC debit card. If you had more than one chequing account, only one account can be in the Primary Position.

Using your RBC Business Credit Card

Managing your RBC Business Credit card

For successful validation, the business cardholder must have a valid contact number on file in Client 360 that can receive a one-time passcode (OTP) via text message. If the number on file cannot receive an OTP, then a “fail with feedback” will be triggered, in which the business client will be told to call an agent to be manually authenticated. Anyone who is listed as an authorized contact for the business can call in to be authenticated.

Please ensure your client’s information is up to date and accurate in Client 360. Changing or updating client information can take up to 7 days to take effect.

Should you decide to switch to a different RBC business credit card, please be aware that the features and benefits of the RBC business credit card you were migrated to may differ from those of the card you switch to, and some cards may not be available to switch back to.

- To pay your business credit card using funds from an RBC bank account, simply transfer the funds from your RBC bank account to your RBC business credit card account. Visit rbc.com/hsbc-canada (Opens link in new window) for detailed instructions and tutorials on how to enrol in RBC Online Banking for Business.

- To pay your business credit card using funds from a bank account at another financial institution, you must register the RBC business credit card account as a “Bill Payment” to make a payment.

To make payments by mail, please follow the instructions on the tear-off portion of your RBC business credit card statement.

If you choose to switch or upgrade, please be aware that the features and benefits of the RBC business credit card you were migrated to may differ from the card that you switch to, and some cards may not be available to switch back to.

Statements

However, it is recommended you download your past statements prior to migration for your records.

Rewards

Once your cash back balance reaches $25 or more on your RBC business credit card account, you can receive the credit in one of two ways:

- it will automatically be credited to your RBC business credit card account in January of any given calendar year; or

- an owner can have the full amount credited to the RBC business credit card account by calling 1-800-ROYAL® 1-2 (1-800-769-2512) any time after migration.

Your points balance will be available for redemption one week after March 29, 2024, via avionrewards.com or the Avion Rewards app.

- Market-leading travel offerings

- An innovative shopping companion, Avion Rewards ShopPlus

- Cash-back deals

- The ability to redeem Avion points for gift cards, merchandise, financial rewards and more

- Offers from our extensive network of Avion Rewards retail partners

Insurance

However, eligible purchases made with your HSBC Bank Canada credit card on or before March 28, 2024, as well as eligible medical emergencies for trips with departure dates on or before March 28, 2024, will continue to be covered on or after March 29, 2024.

Your RBC credit card insurance coverage(s) will come into effect on March 29, 2024. For information on how to submit a claim, please visit rbc.com/hsbc-canada.

A copy of the Certificate of Insurance for your specific business credit card is also available at rbc.com/hsbc-canada-legal (Opens link in new window).

There is no further action you need to take. You will continue to receive ACH payments after your account has been migrated to RBC and funds will be deposited into your migrated RBC account.

- Interac API: Movement of money up to $25,000 within Canada

- RBC Pay API: Movement of money between any two RBC deposit accounts up to CAD $100,000

- Balances & Transactions API: Ability to retrieve balances and transactions of RBC deposit accounts in near real time.

Thus, if your Term Deposits, GICs, or 31 Day Notice Term Deposits mature, or you have an upcoming interest payment, and the maturity or interest disbursement instruction is to credit your account, the funds will be deposited into your RBC Business Deposit Account(s).

If you need to transfer funds from your RBC Business Deposit Account(s) to an operating account on the HSBC system, you may choose to wire those funds.

Note: Wire fees will be temporarily waived between your RBC and HSBC Canadian domiciled accounts until your products have completely migrated to RBC. However, wires sent to HSBC accounts domiciled in other jurisdictions will still incur a fee.

In the event that your PAC or SWP instructions are changed and/or cancelled, you will receive a notification after migration with the details of the new instructions or cancelled instructions.

Please refer to Section 5 of the Products & Services notification guide.

If you have margin and/or option accounts, forms must be completed and submitted no later than November 27, 2024. Forms for other account types can be submitted before March 31, 2026.

Log in to your RBC Direct Investing account to learn more about accessing and completing your RBC Direct Investing account forms. From the Explore menu, select “About your HSBC accounts.”

If you hold an Active Trader status at the time of migration (that is, you trade 150+ times during the trading period):

You will receive Active Trader status at RBC Direct Investing and the pricing you currently receive at HSBC InvestDirect will be honoured. Learn more about the benefits associated with the Active Trader program including access to exclusive research. Learn more:

https://www.rbcdirectinvesting.com/active-trader.html (Opens link in new window)

Changes to how you view and/or manage these accounts can be completed after migration by calling us.

A ‘Support page’ is available to you with frequently asked questions. To access it, log on to rbcdirectinvesting.com and click on the ‘Explore’ tab.

Your Pre-Authorized Contribution instructions (PAC) from your HSBC Bank Canada account(s) to your HSBC InvestDirect account(s) will migrate to RBC Direct Investing but may be subject to change after migration due to differences in RBC Direct Investing’s frequency and/or payment date options.

The following will be amended upon transition:

- For all non-registered PAC instructions, all payment amount and frequency will remain the same.

- If you have an Automatic Funds Transfer (AFT) on your Sweep Account, upon migration your weekly AFT payment will revert to the first business day of the week.

- At RBC Direct Investing, all commissions and fees are charged to the RBC Direct Investing account(s). You will not have the ability to charge them to a bank account (either an account at RBC or from another financial institution). To learn how to transfer funds to your RBC Direct Investing account, check out the videos on this page.

You can also fund your RBC Direct Investing account(s) from a non-RBC chequing or savings account by adding “RBC Direct Investing” as a bill payee in your RBC OLB or the RBC Mobile app. Please be aware that transfers from a non-RBC account can take 2-4 business days.

You can also transfer HKD, GBP and EUR from your RBC Foreign Currency bank account to an RBC Direct Investing non-registered cash account. Trades at RBC Direct Investing settle within the account. You will not have the ability to settle trades directly from a bank account (either an account at RBC or from another financial institution) after your HSBC InvestDirect account(s) migrate to RBC Direct Investing.

You will be able to hold eight foreign currencies in non-registered cash accounts at RBC Direct Investing, including: Hong Kong Dollar; Great Britain Pound; Euro; Swiss Franc; Singapore Dollar; Australian Dollar; New Zealand Dollar; Japanese Yen.

You will have the ability to carry out Foreign Exchange transactions between foreign currencies and CAD & USD. You will also be able to place a trade in a foreign market in the local currency, or you can place a trade in the foreign market from a CAD or USD account.

Trading by phone will be available for:

Swiss Exchange (Switzerland); Euronext Brussels (Belgium); Borsa Italia (Italy); Euronext Amsterdam (Netherlands); Euronext Lisbon (Portugal); Vienna Stock Exchange (Austria); Bolsa de Madrid (Spain); Nasdaq Helsinki (Finland); Athens Stock Exchange (Greece); Australian Securities Exchange; Stock Exchange of Singapore; Tokyo Stock Exchange (Japan); Nagoya Stock Exchange (Japan); Osaka Securities Exchange (Japan)

Online trading capability for London Stock Exchange, Euronext Paris, Frankfurt Stock Exchange is coming later in 2024.

Some restrictions apply to other markets. For more details, please refer to the RBC Product Migration Guide section 4.

Please note that for a temporary period, you will not have the ability to make modifications to your trade orders on international markets. To make a change you will need to cancel the order and place a new one. The ability to modify orders will be available later in 2024.

- Download your previous HSBC InvestDirect account statements, tax documents or transactions history as you will not have immediate access to these documents upon migration.

- Export or screenshot your watchlist and alerts as these won’t be migrated to RBC Direct Investing. You can re-create them after migration.

English, French, Cantonese and Mandarin speaking investment representatives are available by phone. Online and RBC mobile app are available in English and French only. Chat functionality is not available.

Investment Services Representatives are available Monday to Friday from 7 am to 8 pm ET for North American trades. For International trading, Investment Services Representatives will be available by phone when the markets are open.

You will also experience:

- The benefit of the RBC trading desk, where expert traders and smart technology come together.