Attention: Please note that HSBC Bank Canada and RBC will never proactively call you regarding enrolment for RBC Online and Mobile Banking, and never automatically enrol you for RBC Online and Mobile Banking.

Enrol Now to Access Your Products and Services at RBC

To get started, please answer a couple questions…

Aside from your migrated products and services, do you already hold any personal products at RBC?

Benefits of Digital Banking at RBC

RBC Online Banking1

- Check balances, view transactions and access statements

- Quickly and easily move money between your RBC accounts

- Pay one or more bills at once and set up payments for ongoing bills

- Make payments to your RBC credit card and loans

- Send money to others through Interac‡ e-Transfer transactions3 and International Money Transfer4

- Order foreign currency to be picked up at your local RBC branch

- Link your RBC U.S., Business or Investment accounts and access them all with a single sign-in

- View and access your RBC investment accounts (including your RBC Direct Investing account(s))

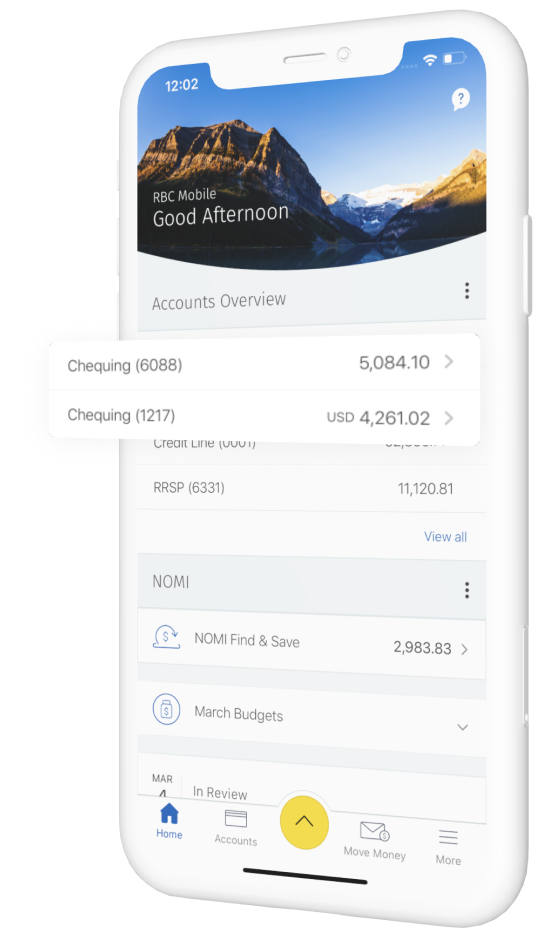

RBC Mobile1 app

- Quickly and easily move money between your RBC accounts

- Snap a photo to add payees and pay your bills

- Instantly lock a lost or stolen RBC debit or credit card right in the app

- Use Split with Friends to share the costs of group gifts, bills and more2

- Receive alerts, reminders and insights based on your banking with NOMI

- Save money with personalized offers through Avion Rewards

- View and access your RBC investment accounts (including your RBC Direct Investing account(s))

Frequently Asked Questions

Yes, RBC has a chat platform. This capability will be available to you through RBC Online Banking and the RBC Mobile app after your HSBC Bank Canada accounts have migrated to RBC.

Please call 1-800-769-2511 or visit your closest RBC branch (opens in new window).

Efforts will be made by RBC Direct Investing to migrate all information in respect of any HSBC Bank Canada trading authority and beneficiaries connected to your account(s). If you have been appointed as a Trading Authority on an HSBC InvestDirect account, you will be able to access the account(s) at RBC Direct Investing with a separate client card or number you will receive in advance of the migration date. If required, you may be contacted by RBC Direct Investing to update any information necessary.

In some cases, you may receive more than one RBC Client Card and an additional PIN, depending on the geographic location of your accounts.

If you received more than one RBC Client Card with different card numbers:

You will need to use each of the RBC Client Card numbers to create a different log-in to enrol in RBC Online Banking to view and transact with your accounts online. Each RBC Client Card enrolment will enable you to view the accounts related to the particular RBC Client Card.

If you received more than one RBC Client Card with the same card number:

Use the card with the higher issue number (located on either the front or back of the card) to create a log-in to enrol in RBC Online Banking.

To enrol in RBC Online and Mobile Banking, you will need:

- Your mobile phone

- Your RBC Client Card, account number* or credit card

- Your Government ID

Depending on your migrated product(s), your client card will either be an actual debit card or a paper card printed with your client number. If you received more than one RBC Client Card, you will need to enrol both cards.

*If your only migrated product is a foreign currency account, you will need to use your RBC Client Card to enrol.

RBC Online Banking and RBC Mobile Banking are available in English and French.

RBC's multi-factor authentication is safe and secure. We use a different, often layered approach, to protect your accounts.

Efforts will be made by RBC Direct Investing to migrate all information in respect of any HSBC Bank Canada power of attorney that has been set up. If you have been granted Power of Attorney over an HSBC InvestDirect account, you will be able to access the account(s) at RBC Direct Investing with the client card or number you will receive in advance of the migration date. You or your acting attorney may be contacted by RBC Direct Investing to update any information necessary.

Android

- Canada

- US

- India

- China (Mainland, not Hong Kong)

- Philippines

- Hong Kong

- Australia

- UAE

- Canada

- US

- India

- China (Mainland, not Hong Kong)

- Philippines

- UK

- Hong Kong

- Australia

- UAE

If you hold a foreign currency account, please use the number on the RBC Client Card you received for that account to enrol in RBC Online and Mobile Banking. You will not be able to enrol using the account number of your foreign currency account.

Your Privacy and Safety

Please note that HSBC Bank Canada and RBC will:

If you have been enrolled and did not complete this yourself, or if you have questions, please call 1-800-769-25111-800-769-2511

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc.

To get started, please answer a couple questions…

To enrol in RBC Online and Mobile Banking, you will need:

- Your mobile phone

- Your RBC Client Card, account number* or credit card

- Your Government ID

If you received more than one RBC Client Card, you will need to enrol both cards.

Enrol in RBC Online Banking*If your only migrated product is a foreign currency account, you will need to use your RBC Client Card to enrol.

You need your RBC Client Card number, account number* or credit card to enrol in RBC Online Banking.

If you have not received any of these, please call 1-800-769-2511 or visit your closest RBC branch (opens in new window).

*If your only migrated product is a foreign currency account, you will need to use your RBC Client Card to enrol.

Good news! You may not* need to enrol in RBC Online and Mobile Banking.

Now that your products and services have migrated to RBC, you will be able to view them in RBC Online Banking and the RBC Mobile app.

*If you received more than one RBC Client Card with DIFFERENT card numbers:

You will need to use each of the RBC Client Card numbers to create a different log-in to enrol in RBC Online Banking to view and transact with your accounts online. Each RBC Client Card enrolment will enable you to view the accounts related to that particular RBC Client Card.

Enrol in RBC Online BankingSince you already have products at RBC, but are not enrolled in RBC Online or Mobile Banking, you will need to complete our standard enrolment.

After enrolling, you will be able to view your migrated products and services in RBC Online Banking and the RBC Mobile app.

Enrol in RBC Online Banking