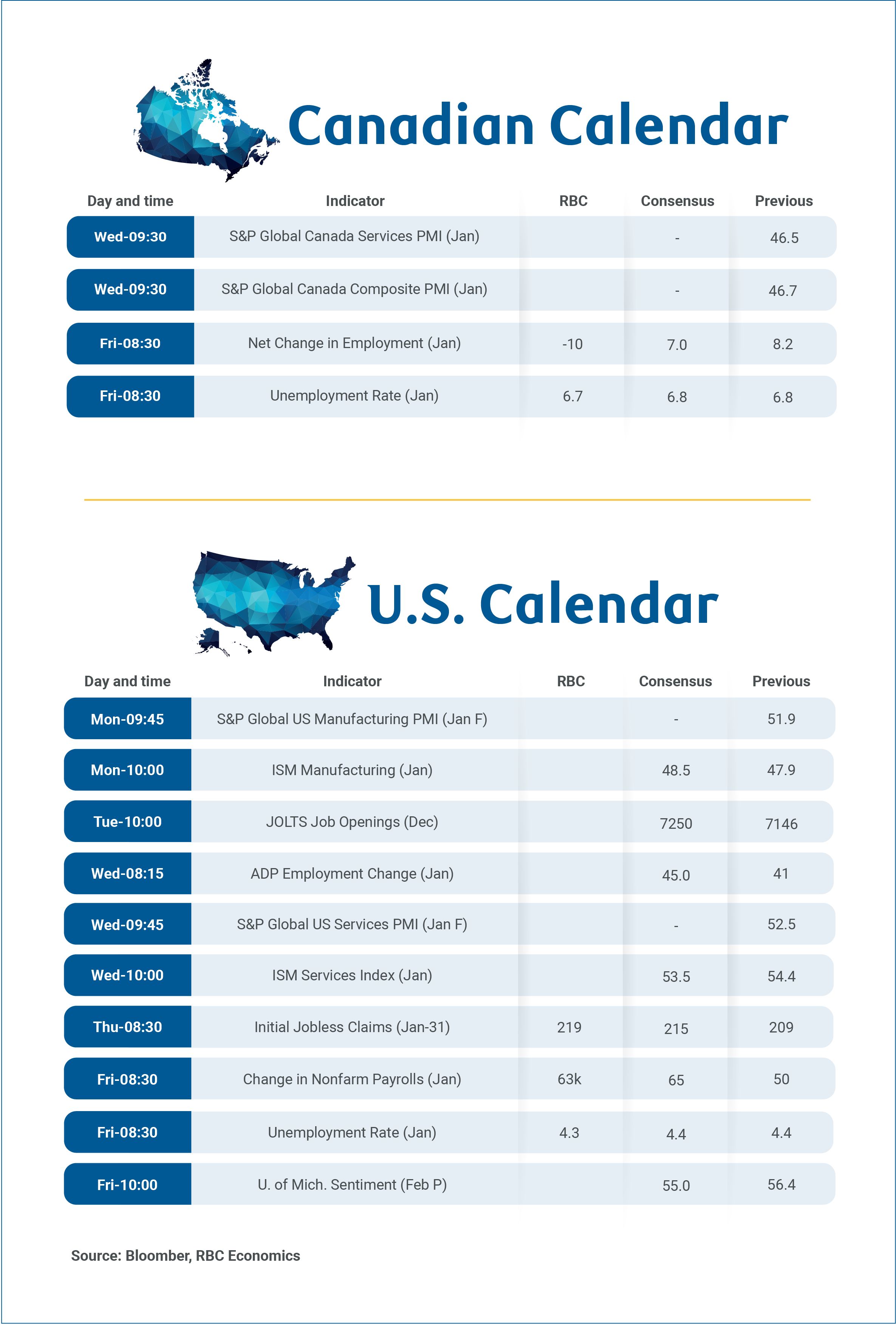

For week of Feb. 2

Next Friday, we expect Canada’s January employment report to show a tick-down in the unemployment rate to 6.7%, after an increase to 6.8% in December that partially reversed an unusually large 0.5 percentage point decline over the prior two months. Employment is expected to have declined by 10,000 in January – after the outsized 189,000 increase between September and December 2025.

Canadian labour market data is notoriously volatile month-to-month, but slower population growth is also sharply reducing the amount of job growth needed to absorb new workers into the workforce. A 9,900 increase in population in December was the smallest gain since the pandemic (December 2020) and the second smallest rise dating back to 1976. We also think a partial reversal of a jump in the December participation rate will result in a pull-back in available labour in January.

We expect these underlying structural trends to persist (on average) this year. Slower population growth, and an aging population means even small declines in job counts in 2026 would be consistent with a steady to declining unemployment rate.

Looking ahead, Canadian firms hiring intentions remained subdued, according to the latest Bank of Canada Business Outlook Survey—and most business survey data is suggesting wage growth will edge lower. Job postings from Indeed.com, however, paint a more optimistic picture with hiring demand rising since September 2025 to levels close to the pre-tariff peak in January 2025.

Sectors heavily exposed to international trade disruptions, like manufacturing, continue to underperform, but we continue to expect a stabilizing trade backdrop and strength in domestic demand will support a rebound in hiring overall. We look for the unemployment rate to edge gradually lower to 6.3% by the end of this year.

U.S. jobs market to show more signs of stabilizing after cooling

We also expect the U.S. labour market to show more signs of stabilization with the unemployment rate potentially ticking lower in January after falling to 4.4% in December.

Leading indicators are starting to point to improvement in the labour market after a year of gradual cooling best characterized as a “low hire, low fire” environment. Similar to Canada, job postings from Indeed.com started to rise in late 2025, although to levels still significantly below where they were at the start of the year. In the meantime, initial and continued jobless claims started to trend lower over the end of 2025 heading into 2026.

A pick-up in the labour market is more in line with GDP data that has surprised consecutively to the upside in the second half of 2025. But, it’s been driven by higher productivity to-date rather than improvement in the labour market. Employment and hours worked were both little changed since April as of December.

Lingering trade uncertainty means the outlook remains cloudy, but we look for the unemployment rate to end 2026 close to its current level at 4.4%.

This report was authored by Assistant Chief Economist Nathan Janzen and Senior Economist Claire Fan.

Explore the latest from RBC Economics:

Podcast: The 10-Minute Take. Breaking the trade trap: Can Canada diversify fast enough?

Canadian Analysis. Another clear hold from the BoC

U.S. Analysis. FOMC Recap: One thing is clear – the Fed is still facing a foggy outlook

Canadian Analysis. Auto and gold exports drag on Canadian trade in November

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.