Fake RBC Investment Advisors

Bad actors are impersonating legitimate RBC investment advisors to steal funds, personal information, or login credentials.

1. Details of the scam:

Scammers create fake social media profiles or websites using real advisors’ names, photos, and credentials – these pages typically link to official regulatory pages as validation. They initiate contact through unsolicited messages on social media, email, or online ads, urging you to communicate via non-RBC channels. Often, they promote high-risk, high-reward investment opportunities, such as stocks or cryptocurrencies, through exclusive groups. Victims are then pressured to send funds via cryptocurrency transfers or wire payments to individual accounts, circumventing secure banking channels.

2. What you should know:

RBC will never ask you to:

- Provide one-time codes sent through SMS, email, or voicemail to identify yourself.

- Initiate any type of transaction on RBC’s behalf.

- Download a remote access application.

- Disclose your PIN.

- e-Transfer money for any reason.

- Create a new online banking password with an Advisor or share your password with anyone.

- Pay fees to “release” funds.

3. Red flags to look out for:

- Unsolicited offers: Messages claiming "guaranteed returns" or "insider opportunities" from unknown contacts.

- Pressure tactics: Urgency to act immediately or demands for personal/financial details.

- Unsecured payment methods: Requests for crypto, wire transfers, or payments to individual accounts.

- Unofficial channels: Insistence on communicating via non-RBC channels.

- Forged credentials: Fake profiles using real advisors’ names, photos, or links to legitimate regulatory pages.

4. What should you do?

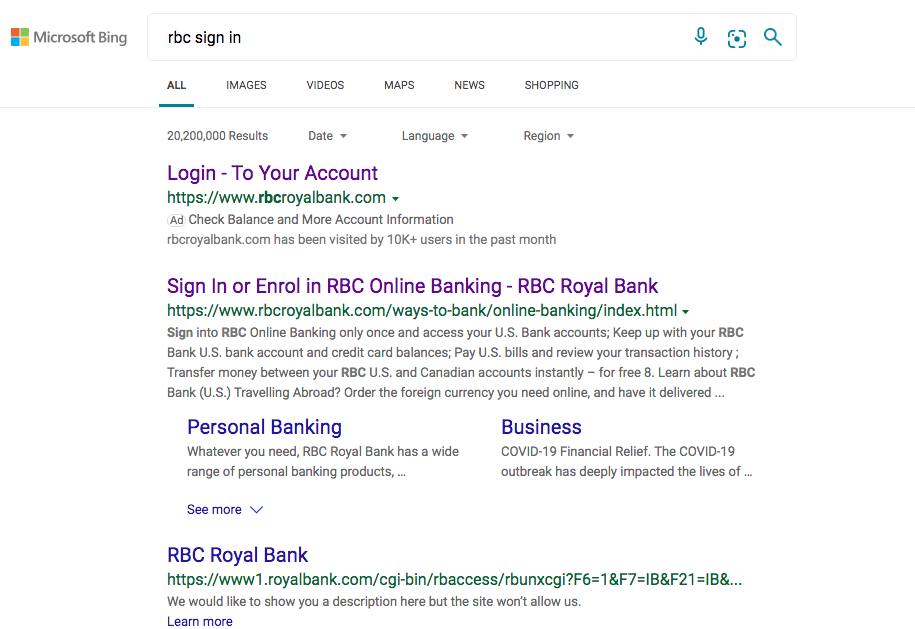

- Verify advisors: Confirm an advisor’s identity via RBC’s official website.

- Avoid unsolicited contacts: Never engage with unexpected investment offers via social media or email.

- Use official channels: Only communicate through RBC’s secure portals or verified phone numbers.

- Report scams: Forward suspicious messages to Phishing@rbc.com and report to local authorities.

- Protect your accounts: Enable multi-factor authentication (MFA) on all accounts.

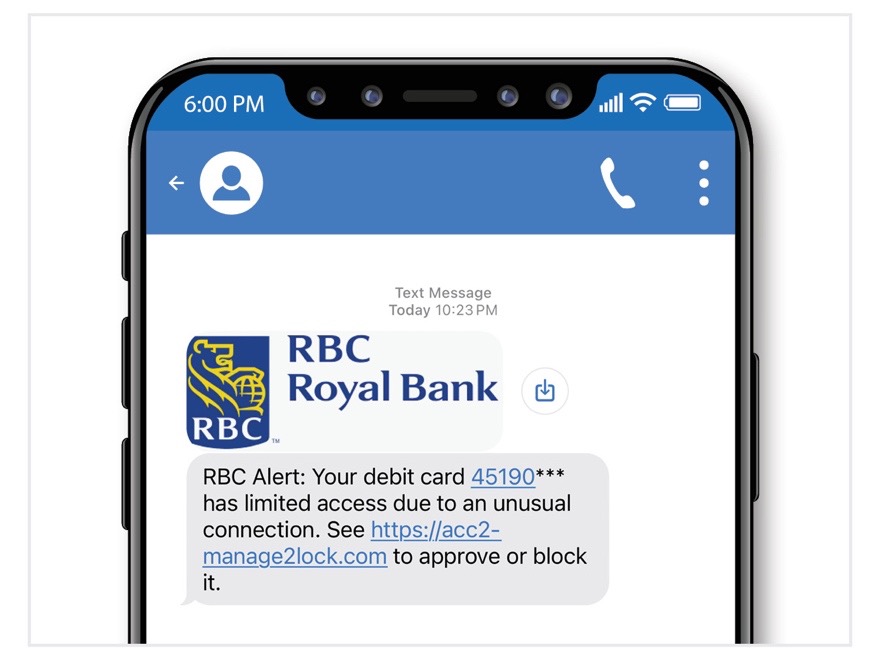

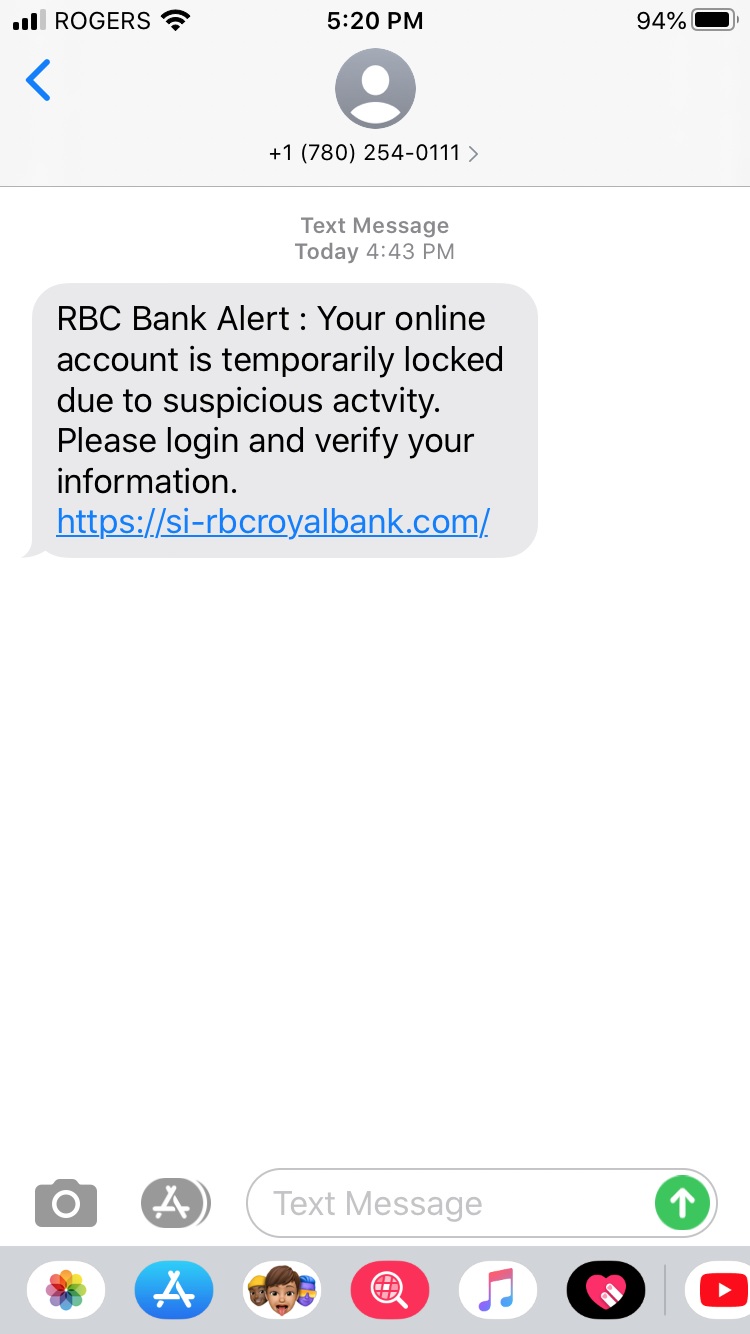

Bank Impersonation via Short Code Smishing

Scammers are using legitimate short codes to carry out smishing campaigns, impersonating banks and other businesses. Their objective is to gain your trust by posing as a trusted entity and ultimately steal your financial information.

1. Details of the scam:

You receive an unsolicited text message (SMS) from an RBC-specific short code. The message creates a sense of urgency, for instance, claiming your account is at risk and immediate action is required. You may be asked for sensitive information upfront, or be prompted to click on a link, which will redirect you to a phony login portal or another malicious website. Either approach is designed to gain access to your bank account or credit card.

2. What you should know:

- Smishing is a type of scam where fraudsters send SMS posing as a trusted entity to trick victims into revealing personal/financial information, clicking malicious links, or downloading harmful software.

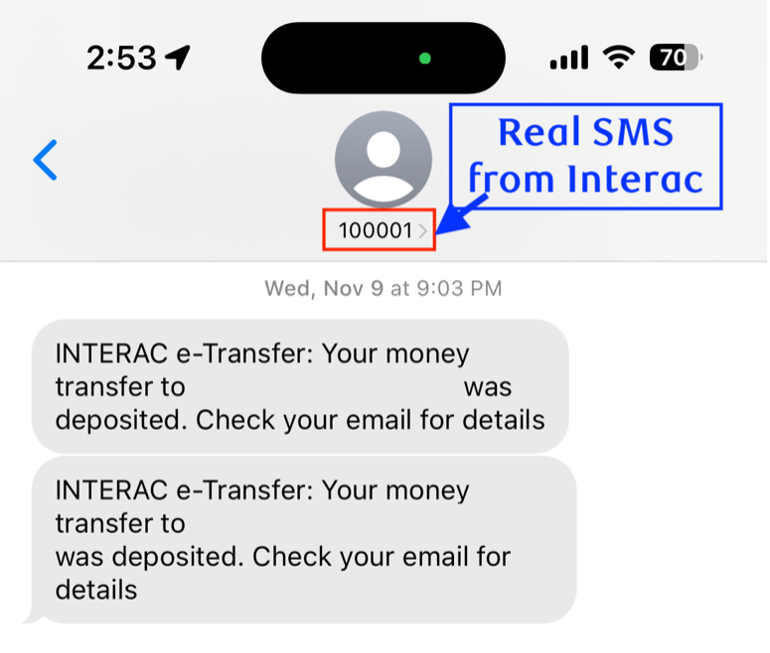

- Short codes are 5- or 6-digit phone numbers used by businesses and organizations, such as RBC, to communicate via SMS at scale. Scammers can send an SMS from RBC-specific short codes, making it more difficult to decipher the message’s validity.

-

RBC will never ask you to:

- Provide one-time codes sent through SMS, email, or voicemail to identify yourself.

- Initiate any type of transaction on RBC’s behalf.

- Download a remote access application.

- Disclose your PIN.

- e-Transfer money for any reason.

- Create a new online banking password with an Advisor or share your password with anyone.

3. Red flags to look out for:

- Contact is unsolicited.

- You receive an SMS asking for your card information, password(s), one-time passcode, e-Transfer reference number, or other sensitive information.

-

You are asked to complete actions to “secure your profile,” such as:

- Send a transfer to “RBC.”

- Send yourself funds.

- Initiate any other type of transaction.

- Spelling or grammatical errors, or a sense of urgency within the initial SMS or follow-up exchanges.

- You are offered free products, money, or services with little to no effort required.

4. What should you do?

- Don’t reply to or click on links from an unsolicited SMS. Even if the sender’s short code appears legitimate, remain cautious.

-

If you receive a message you suspect to be a scam:

- Contact RBC using the phone number on the back of your bank card to confirm the validity of the SMS.

- Report suspicious texts to your telecommunications company by forwarding the message to 7726 on your mobile device.

- You can help us by sending a screenshot of the fraudulent SMS to phishing@rbc.com.

- Delete the message.

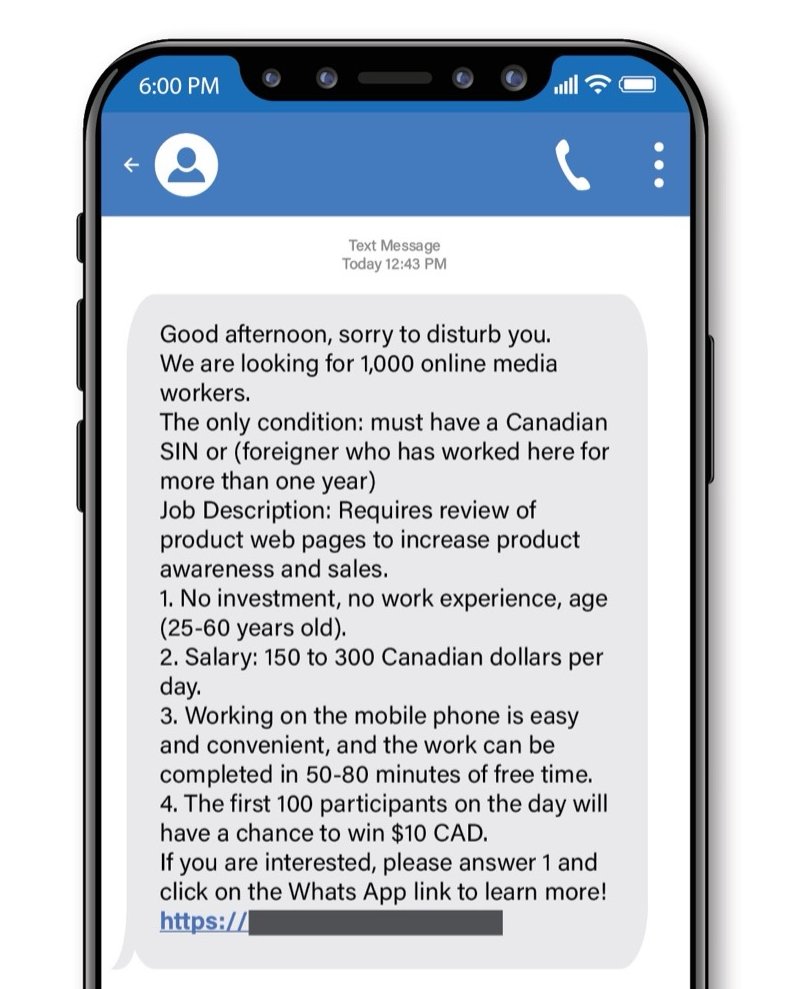

Fake Job Opportunities via SMS

Scammers are sending text messages (SMS) promising attractive, yet illegitimate, job opportunities to lure victims into clicking harmful links or sharing sensitive information, ultimately aiming to steal personal and/or financial information, or gain device access.

1. Details of the scam:

You receive an unsolicited SMS from someone claiming to be a recruiter from a company, or employment agency, despite not having applied for a job. The sender promotes flexible positions with minimal work and/or guaranteed salary. The message may prompt you to click a link or reply “YES,” further engaging you to provide confidential information or download malware* onto your device.

2. Red flags to look out for:

- Contact is unsolicited.

- Job opportunity is too good to be true (ie. a salary that is above average, unusual benefits, extremely flexible work schedule).

- Job description or requirements are vague and lack context.

- Spelling or grammatical errors, or a sense of urgency within the initial SMS or follow-up exchanges.

-

You are asked to:

- Click a link or provide personal and/or financial information before being offered a position.

- Make a payment. Legitimate employers will not require payment for a chance to work.

- Accept an e-Transfer or deposit a cheque, then prompted to send them a portion of the amount back.

3. What should you do?

- Don’t click on links from unknown senders. Even if the sender’s phone number appears legitimate, remain cautious.

-

Don’t reply to the message. If you receive a message you suspect to be a scam:

- Report the message.

- Block unwanted phone numbers.

- Delete the message.

-

Verify the legitimacy of the job opportunity by:

- Searching for the posting on the company/employment agency’s official website.

- Contacting the company/employment agency through their verified phone number, email, or website.

- Researching the name of the company/employment agency in a search engine with words like “scam” or “complaint.”

*Malware is any malicious software designed to harm or gain unauthorized access to computer systems, networks, or data. It is used by cyber criminals to steal information, disrupt operations, or extort money.

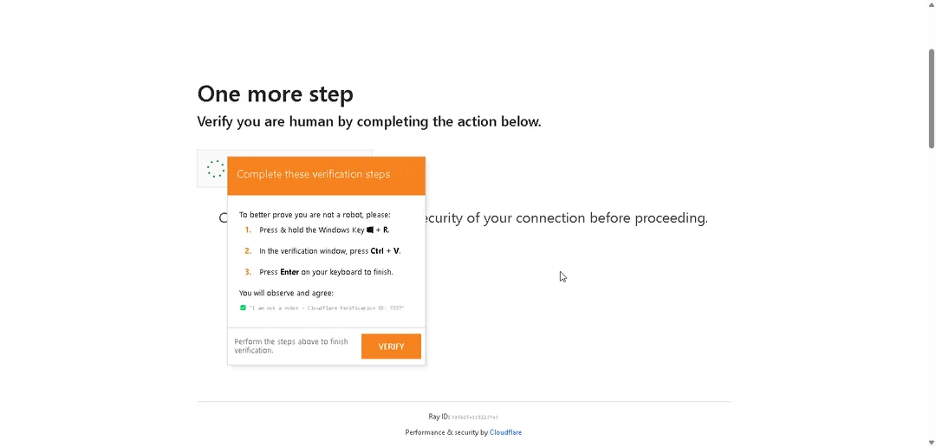

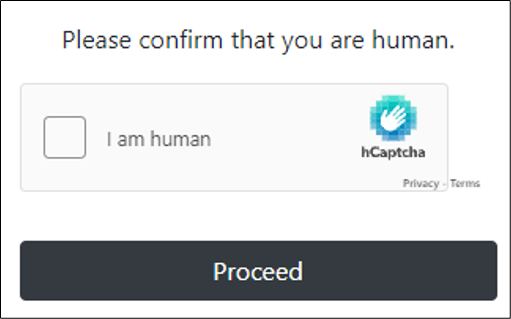

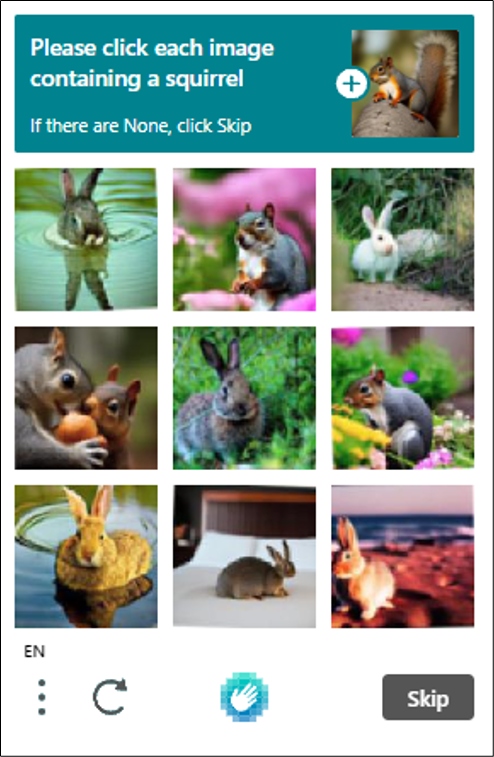

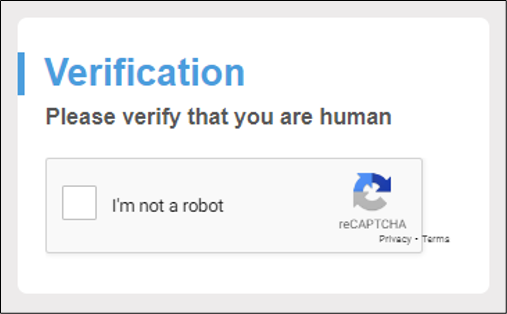

Fake Website Human Verification

Scammers are using fake human verification prompts to install malware* onto people’s computers when visiting compromised websites. This deceptive technique is known as a ClickFix attack.

1. Details of the scam:

You are directed to a compromised website where a fake security pop-up (called a CAPTCHA) prompts you to verify they’re human. When you interact with the fake CAPTCHA (ie. clicks on the “I’m not a robot” checkbox) a harmful command is silently copied to your clipboard. The pop-up then provides step-by-step instructions for “verification” that prompts you to paste and execute the dangerous command, which can lead to malware infections and/or stolen information.

2. Red flags to look out for:

- Websites with URLs that look slightly off, such as misspellings, extra characters, or unfamiliar domain extensions (ie. .xyz or .top).

- Websites that redirect you to unexpected pages or display content that doesn’t match your search query.

- Pop-ups prompting you to paste text into a black command window on your computer (ie. PowerShell).

- Pop-ups asking you to perform a set of unusual actions. Genuine human verification checks just ask you to click on images or solve simple puzzles.

- Pop-ups that appear overly urgent, warning you of immediate consequences if you don’t comply.

3. What should you do?

- Always double-check the URL of a website before interacting with it, especially if it appears under the “Sponsored Results” section.

- Be cautious of pop-ups or prompts that ask for personal information, payment details, or unusual actions.

- Never copy and paste commands or text from untrusted sources into your computer or browser.

- Close the website right away.

*Malware is any malicious software designed to harm or gain unauthorized access to computer systems, networks, or data. It is used by cyber criminals to steal information, disrupt operations, or extort money.

Expired Website Address Hijacking

Website addresses (URL) can expire unbeknownst to the owner/organization and then registered by someone else to redirect online traffic to high-risk content. This exposes visitors to cyber threats and causes reputational damage to the organization being impersonated.

1. Details of the scam:

Scammers took over an expired URL belonging to an annual Toronto Christmas Market, redirecting online traffic to gambling advertisements. The scammers were able to manipulate search engine results, ensuring their fake website appeared before that of the legitimate organization, encouraging market goers to visit their site.

2. What you should know:

- URLs have renewal/expiry dates which must be maintained, or else websites can be taken over by cyber criminals who wish to impersonate the site owner/organization.

- Content of hijacked websites can be repurposed for malicious activities, such as malware* delivery, collecting users’ personal and financial information, and reputational damage; all of which are typically driven by monetary gain.

- URL takeovers can facilitate supply chain attacks that propagate malware to downstream users.

3. Red flags to look out for:

- Websites that appear legitimate, yet feature invasive pop-ups that are unrelated to the organization, such as gambling promotions in this case.

- Hijacked URLs often redirect you several times to other websites.

- Unexpected requests for login credentials, payments, cryptocurrency, or personal information that the legitimate website would not ask for.

4. What should you do?

- When visiting a website, question if the content is in line with what you had expected to see.

- If you believe the website has been tampered with, close it immediately.

- If you clicked on a link or downloaded a file from the fake website, perform a malware scan on your device.

- If you entered financial information on the fake website, contact your bank and/or credit card provider.

- Report the hijacked URL to the search engine and the organization being impersonated.

Malware is any malicious software designed to harm or gain unauthorized access to computer systems, networks, or data. It is used by cyber criminals to steal information, disrupt operations, or extort money.

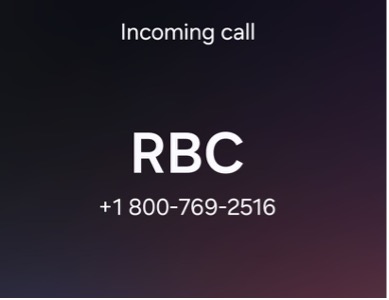

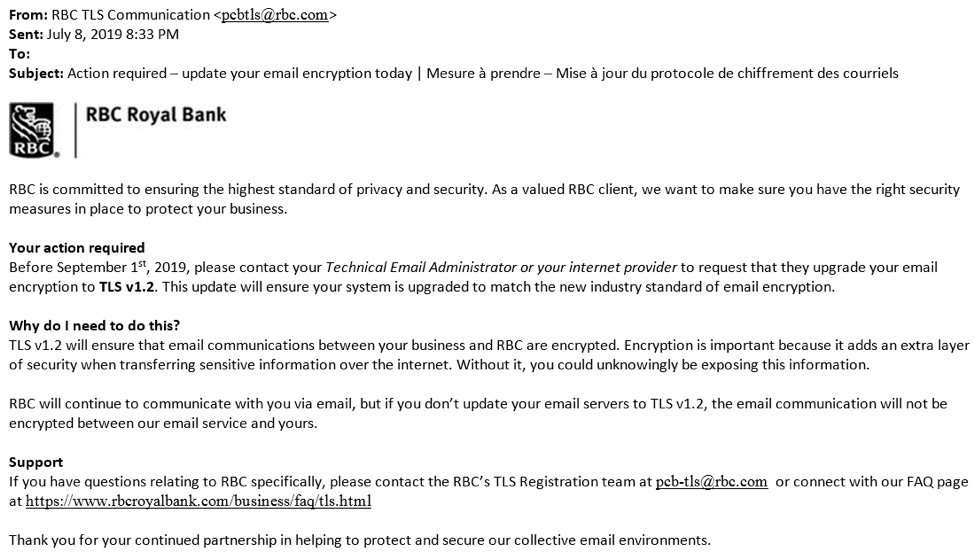

RBC Caller ID Spoofing

Caller ID spoofing is when a scammer falsifies the phone number on the caller ID to appear as if the call is coming from a legitimate source, such as a bank or government agency. There have been reports of suspicious calls falsely claiming to be from RBC.

1. Details of the scam:

Scammers are using caller ID spoofing to make their phone number appear as if it’s coming from RBC. They often create a sense of urgency, claiming your account is at risk or immediate action is required. With AI voice replication tools, these calls can be highly convincing and may reference recent transactions or personal details. The scammer’s objective is to gain your trust by impersonating a trusted entity and ultimately steal your financial and personal information.

2. What you should know:

- The caller ID that appears when receiving a phone call can be easily falsified, so a familiar caller ID does not guarantee the call is legitimate.

- RBC will never ask for your password, PIN, or one-time codes over the phone.

3. Red flags to look out for:

- Unexpected calls from RBC requesting sensitive information.

- Requests for your password, PIN, or one-time passcodes over the phone or email.

- Urgent or threatening language pressuring you to act quickly.

- Caller refuses to let you hang up and call the bank back using the official number.

4. What should you do?

- If you receive a suspicious call from someone claiming to be from RBC, don’t provide any information. Hang up and call the bank directly using the official phone number from the website or your bankcard.

- Never share sensitive information over the phone unless you initiated the call.

- Report suspicious calls to RBC and relevant authorities.

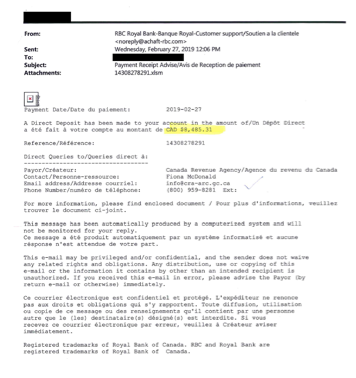

Screenshot of an RBC caller ID from a non-RBC phone number. This number has been reported online as a scam.

Gold Scam

Beware of the risks associated to the impersonation of bank employees, law enforcement or government resulting in gold scams

What to look out for:

Scammers are contacting Canadians impersonating bank employees, law enforcement or government representatives.

The scam may begin with an unexpected call from someone impersonating a bank employee, law enforcement or government representative where the caller explains that their account and/or identity has been compromised.

Alternatively, it may also begin by encountering a pop-up on a computer advising of a detected virus or an error requiring resolution. The individual is asked to call a number and speak to someone posing as a bank representative, a federal agent or law enforcement. In a returned phone call, the individual will be advised that their accounts and assets will be frozen if they don’t cooperate.

Regardless of the initial contact, the caller will insist that the individual must urgently withdraw their funds – either once or over a period of several withdrawals – to purchase gold in order to secure their funds. Once the individual purchases the gold, the caller will then proceed to make courier arrangements to have the gold picked up advising them that it will be sent to a ‘‘secure location’’ – this includes pick up at home or meeting up at a public location such as a shopping center or parking lot.

These calls may involve but are not limited to the following:

- Caller ID showing a phone number coming from your bank, law enforcement or government (spoofed phone number)

- Indicating that your funds in your account(s) are no longer safe

- Asking you to convert your funds to gold bars or other precious metals

- Arranging for pick-up of the gold bars at your home or another location

- Caller indicating that there is a need to provide a One-Time Passcode in order to identify you

- Caller may ask to create a new online banking password together

- Caller may ask for you to send money to yourself via e-transfer in order to secure your banking profile

- Caller may ask you to enter your PIN on your device to validate activity or require you to scan your ID on your phone

- Caller may ask you for an Interac e-transfer (Certapay) reference number

- Asking you to download a remote access application (i.e. Anydesk) in order to share your screen

What you should know:

A Royal Bank of Canada representative, law enforcement or government employee will NEVER:

- Ask you to convert funds into gold, silver, precious metals, cash, or gift cards in order to secure them.

- Make arrangements to retrieve your funds from your home or a ‘meet-up’ location to hold it for safekeeping.

- Ask you to refrain from discussing the situation with any other bank employee.

- Ask you to initiate any type of transaction on their behalf.

- Ask you to provide one-time codes sent through SMS, emails, or voicemail to identify yourself.

- Ask you to download a remote access application

- Access your online banking in order to add payees on your behalf

In addition, RBC will never ask you to assist in creating a new Online Banking password or ask you to share it. Online Banking passwords should only be created by the client, and never shared with anyone.

What should you do?

- Do not provide any banking information to anyone who calls you. This includes information such as Online Banking passwords, answers to security questions, client card/credit card PIN or account details.

- If a handoff is scheduled or someone is coming to your home, call the local authorities immediately.

- Never send a payment or Interac Etransfer at the request of someone advising you they are an RBC employee. Additionally, do not share the answers to security questions for Interac Etransfers or its reference numbers

- Hang up and call us back. If you receive a call from RBC that sounds suspicious, hang up, and call us using the number on the back of your debit or credit card. Even if it is an RBC representative contacting you, we will understand if you were more comfortable calling back. Better to be safe than sorry.

- If you’ve been a victim of a gold scam, immediately contact your financial institution, your local law enforcement and the Canadian Anti-Fraud Centre.

Fake RBC Social Media Scam

Scammers are using social media platforms to create fake ads impersonating known financial institutions. RBC has been the target of these fake ads, where a photoshopped image of RBC CEO David McKay is used to promote cryptocurrency training scams. To maximize their reach, these ads are often sponsored (paid) on the platform.

1. Details of the scams:

Social media users in Canada may see ads that appear to be from reputable financial institutions, promoting courses on cryptocurrency investment. These ads can redirect users to malicious websites where they will be asked to purchase a course promising to teach cryptocurrency investment strategies. In other scenarios, users are directed to a malicious website designed by the scammer to install viruses onto their devices.

2. What you should know:

- RBC has official social media pages (@rbc), which are the ONLY accounts used for legitimate promotions and communications.

- The scam ad may appear to be from RBC visually, but the account name, in the example shown as “Crypto Rich Guide Station,” reveals it is fraudulent.

- Legitimate courses can be verified by researching the individual or organization offering them.

3. Red Flags to look out for:

- A social media page name that does not belong to RBC.

- Although the ad mimics RBC's visual branding, the inconsistent marketing language and off-brand presentation show its illegitimacy.

- Your web browser or security software may warn you about the page if you click the link.

4. What should you do?

- Never give any information, such as an email or password, to the web destination of the fake ad.

- Report the ad as a scam on the social media platform.

- Report the scam ad to the appropriate authorities, such as the financial institution being impersonated.

- Close the website right away and run a virus scan on your device if you believe you have been compromised.

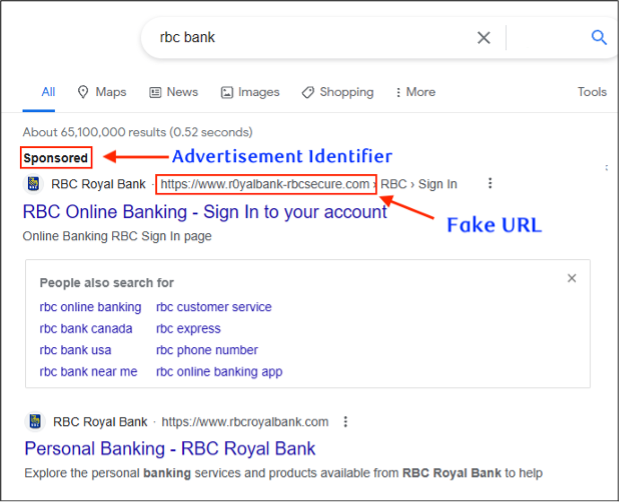

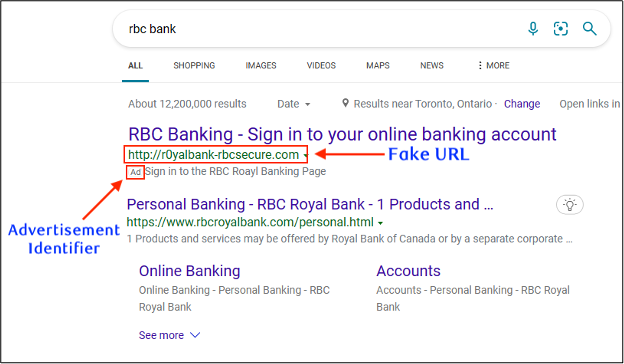

CRA Malvertising Scam

Scammers are increasingly targeting reputable government platforms, such as the CRA website, through malvertising campaigns designed to steal victims’ banking information. Malvertising occurs when threat actors purchase ad space on search engines and display deceptive ads that appear legitimate. Since search engines prioritize ads based on payment, bid amounts, and relevance, malicious ads can appear at the top of search results, increasing the likelihood that users will click on them. This prioritization creates a dangerous opportunity for scammers to exploit trust in search engines and redirect users to fraudulent sites.

1. Details of the scams:

In June 2025, a woman in London, Ontario searched “Canada Revenue Agency” intending to open a business account. Following expected CRA procedures, she provided her Social Insurance Number, banking details, and other personal information. However, she soon suspected she had unknowingly entered her information on a spoofed CRA website. Shortly afterward, her bank account was emptied.

2. What you should know:

- 3rd party government organizations like the CRA are a frequent target of malvertising campaigns.

- Search engines prioritize ads via a pay-per-click model where advertisers pay for priority placement. This can be exploited by threat actors who purchase ad space, often allowing malicious domains to bypass initial authenticity checks.

3. Red Flags to look out for:

- A domain name that doesn’t match the official CRA website.

- CRA websites with minimal content, often limited to a form requesting personal and financial information.

- Your web browser or security software may warn you about the page after clicking on the link.

4. What should you do?

- Never give any sensitive information, such as Social Insurance Numbers and bank account information, to government websites until you verify authenticity.

- Bookmark the official CRA webpage on your browser rather than relying on search engines to navigate to it.

- Report the ad as a scam to the appropriate search engine and authorities.

- Close the website right away and run a virus scan on your device if you believe you have been compromised.

AI Travel Scams

Scammers are increasingly leveraging emerging AI technologies to target individuals planning a vacation. There has been a 900% increase in travel scams since 2023, with AI-enabled scams resulting in losses of an estimated $265,000 USD. Scammers use AI to easily generate fake emails, fraudulent booking websites, and, more recently, voice cloning to impersonate travel agents. A single submission of payment information through a fraudulent site or vishing call can result in immediate financial loss.

1. Details of the scams:

This emerging technology makes scams more believable and harder to detect, significantly increasing the risk for travelers.

Here are two of the most common tactics to be aware of:

Fake emails and fraudulent booking websites: Clients receive fake emails or stumble upon fraudulent booking websites that appear legitimate, often with AI-generated content and fake reviews to build credibility.

Vishing (voice phishing) calls: Sourcing voices from legitimate ads or social media content, scammers use AI voice cloning to impersonate travel agents, making phone calls to clients and tricking them into revealing payment information or making fake bookings.

2. Red Flags to look out for:

- Unsolicited emails or calls offering exclusive travel deals or urgent booking requests.

- Booking websites with unusual URLs, poor grammar, or inconsistent branding.

- Overly positive, repetitive, or suspicious reviews that could be AI-generated.

- Travel agents who refuse to communicate through any official company channels or pressure you to pay quickly.

- Phone calls from agents whose voices sound unnatural, scripted, or machine generated.

3. What should you do?

- Always verify travel offers directly with the official company website or contact information.

- Avoid clicking on links in unsolicited emails, travel ads, or messages that sound too good to be true.

- Never provide payment information over the phone unless you have independently verified the agent’s identity.

- Use secure payment methods; avoid wire transfers or prepaid cards.

- Report suspicious websites, emails, or calls to the travel company and relevant authorities.

Beware of Deepfake Investment Scams

1. Details of the scams:

Scammers are using the recent tariffs and concerns regarding rising cost of living to trick Canadians into investing in fake investment opportunities. The deepfake investment scam is an AI-generated video that mimics legitimate organizations and uses the likeness and voice of a well-known political figure to promote an offer or partnership with an organization or business promising high returns on investment. These videos are often circulated on social media platforms and websites.

RBC has recently become aware of a deepfake investment ad impersonating a high-profile political figure promoting an inexistent program claiming to be supported by and backed by RBC. The ad promises high rates of return encouraging individuals to sign-up online by filling out their information and sending money to get started.

Be wary of investment scams – fraudulent deepfake ads will promote an opportunity to invest or make money, and will often utilize well-known political figures, CEO of large companies, actors, singers, or influencers to spread misinformation to ultimately obtain your funds.

2. Red Flags to look out for:

- Too good to be true offers and promises of quick, high rates of return on investment

- Deepfake videos may exhibit unnatural facial movements, blurry or warped facial features

- The audio may include lip-syncing issues, unnatural intonations, robot-sounding voice or feature a voiceover

- Low resolution or pixelated videos are often used as an attempt to hide AI imperfections

3. What should you do?

- Research and fact-check any opportunity with verified sources

- Guard your personal information. Do not share sensitive personal or banking information to unsecure websites. Legitimate platforms will not ask for unnecessary information

- When possible, report the ad to the platform or website where it is hosted – use the ‘report this’ button if available.

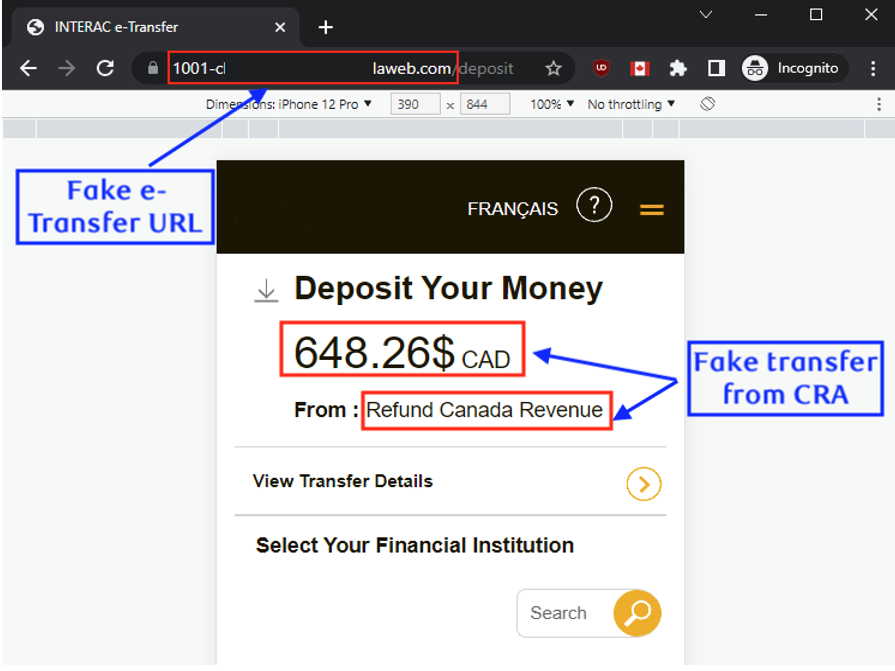

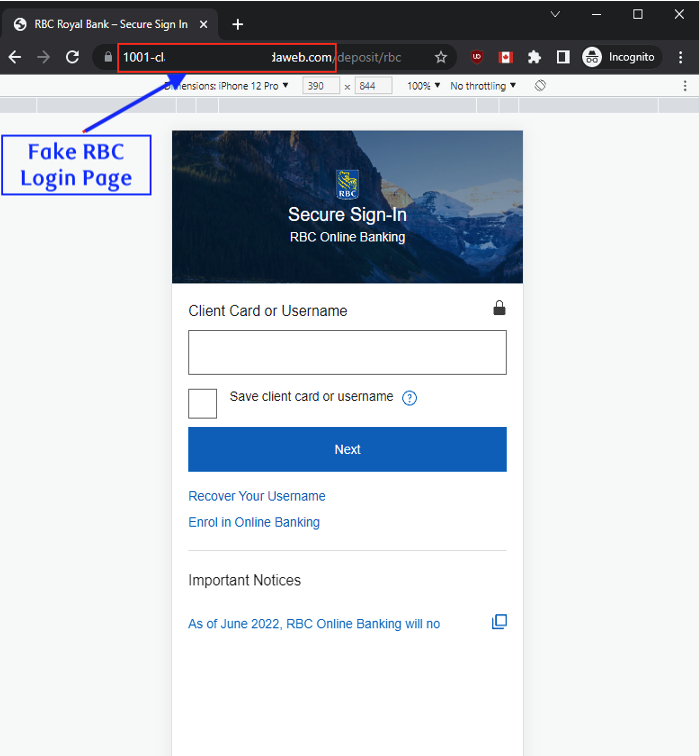

CRA Tax Refund Scam

Scammers are targeting Canadians during tax season with fake messages claiming to be from the Canada Revenue Agency (CRA) offering "unclaimed tax refunds" or stating that "the CRA owes you money." These scams trick people into sharing personal information or receiving fraudulent Interac e-Transfers.

1. Details of the scams:

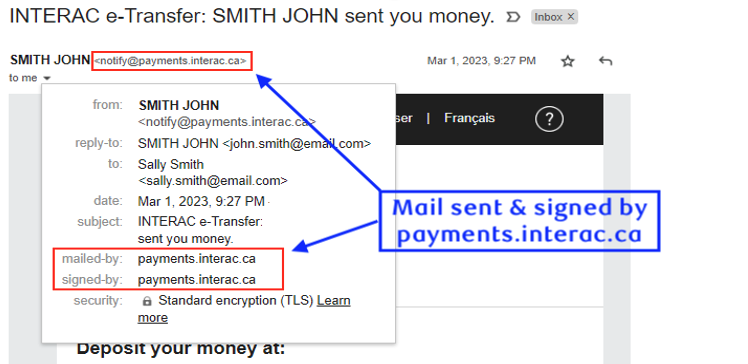

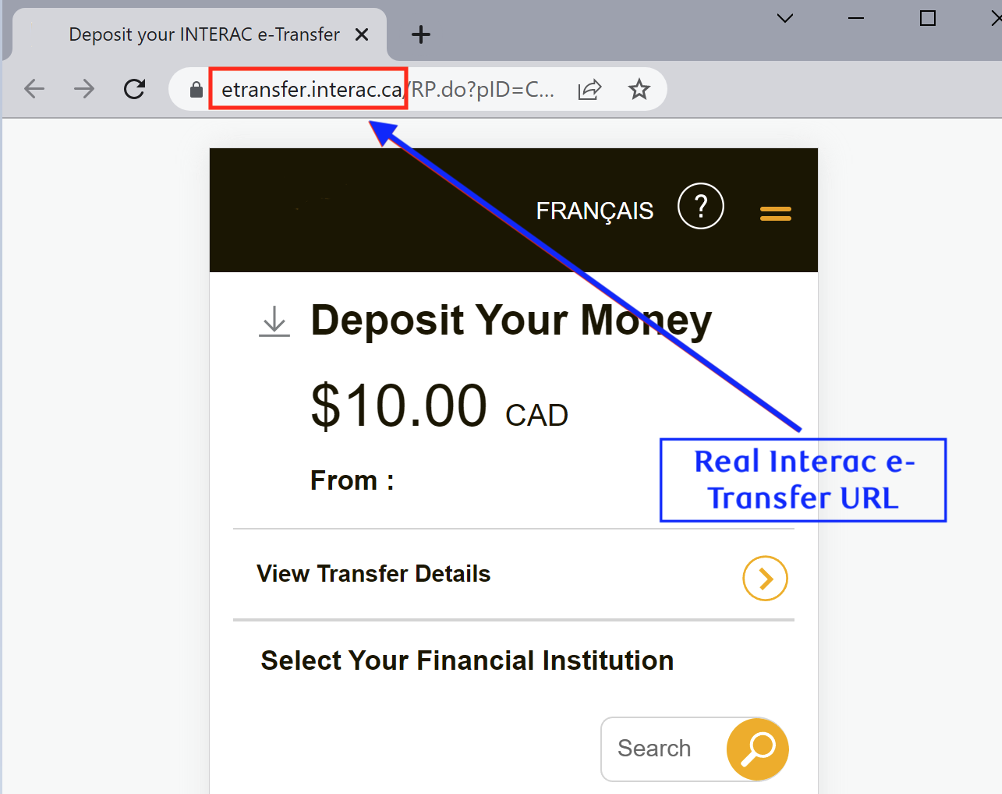

Canadians receive emails, text messages, or phone calls claiming to be from the CRA. The messages typically state that the recipient is eligible for a tax refund that hasn't been claimed or that the CRA has discovered they're owed money. The scammer offers to send the refund via Interac e-Transfer for "faster processing." To receive this supposed refund, victims are asked to provide personal information (like SIN numbers, banking details) or click on fraudulent e-Transfer links that either steal information or request a "processing fee" before releasing the non-existent funds. The scammers use the CRA logo and official-looking documents to appear legitimate.

2. What should you know:

- The CRA will never notify you about refunds by email, text message, or phone call as first contact.

- The CRA does not issue refunds through Interac e-Transfers.

- Real CRA refunds are either deposited directly to your bank account or sent by cheque.

- The CRA never sends links to claim refunds or asks for personal information through email or text.

3. Red Flags to look out for:

- Messages with urgent deadlines claiming "your refund will expire" or "immediate action required."

- Any mention of sending your tax refund via Interac e-Transfer.

- Requests for personal information like your SIN, date of birth, or banking details.

- Email addresses that look similar to CRA addresses but aren't from "@cra-arc.gc.ca" domains.

- E-Transfer notifications that don't match legitimate Interac formatting or contain suspicious links.

4. What should you do:

- Never click links in suspicious tax-related emails, texts, or e-Transfer notifications.

- Don't provide personal information to unsolicited callers claiming to be from the CRA.

- If you're concerned about your tax status, contact the CRA directly using the official number from their website.

- Report tax scams to the Canadian Anti-Fraud Centre.

- Check your CRA My Account directly by going to the official CRA website to verify any refund information.

CRTC Do Not Call Registration Scam

Scammers are targeting Canadians by pretending to be representatives from the Canadian Radio-television and Telecommunications Commission (CRTC) or the National Do Not Call List (DNCL) offering to register phone numbers to block unwanted telemarketing calls. These scams trick people into sharing personal information or paying fake "registration fees."

1. Details of the scams:

Canadians receive unsolicited phone calls or emails claiming to be from the CRTC or DNCL administrators. The scammers offer to add their phone number to the Do Not Call List to stop telemarketing calls. While the legitimate service is completely free and only requires a phone number, these scammers request extensive personal information (like full name, address, date of birth, SIN) and sometimes even demand payment for "processing fees" or "administration charges." Some variations include fake renewal notices claiming registrations are expiring and need immediate renewal (the real registration lasts for 5 years).

2. What should you know:

- Registration for the National Do Not Call List is completely free.

- The official DNCL never calls people to offer registration.

- No payment is ever required to register your number.

- The legitimate registration only requires your phone number, not personal information.

- Real DNCL registrations last for 5 years before needing renewal.

3. Red Flags to look out for:

- Unsolicited calls or emails offering to register you for the Do Not Call List.

- Requests for personal information beyond just your phone number.

- Any mention of fees, charges, or payments for registration.

- Pressure tactics claiming "limited time offers" or "immediate registration required."

- Caller ID showing government numbers (these can be easily spoofed).

- Emails with links to websites that mimic the official DNCL site but have different web addresses.

4. What should you do:

- Never provide personal information to unsolicited callers claiming to be from the CRTC or DNCL.

- Don't pay any fees for Do Not Call List registration.

- Register your number directly through the official website (lnnte-dncl.gc.ca) or by calling 1-866-580-DNCL.

- Report suspicious calls to the Canadian Anti-Fraud Centre.

- If you've already shared personal information, monitor your accounts and consider credit monitoring services.

Fake Phone Number In an Invoice Scam

Scammers are sending emails to trick people into sharing their financial information over the phone. Instead of including suspicious links or attachments, they now put a phone number in the email and encourage recipients to call them.

1. Details of the scams:

Recipients receive emails that look like they're from popular software or online services claiming there's a strange charge on their account. The email tells them to call a phone number if they want to dispute the charge. This phone number doesn't belong to the real company - it belongs to the scammers. When someone calls to dispute the charges, the scammers ask for payment information to "verify the account" and "reverse the charges," but they actually use this information to steal money.

2. What should you know:

These scams work because they create worry about unexpected charges. When people are scared about money, they might act quickly without thinking. Even though it feels bad when someone thinks they've been charged for something they didn't buy, it's important to slow down and think carefully before responding to these emails.

3. Red Flags to look out for:

- Emails that use urgent language pushing for quick action

- Charges mentioned for services or products the recipient doesn't use

- Support phone numbers in the email that don't match the real support number on the company's website

4. What should you do?

- Take time when reading emails about money or charges

- If you want to check if a charge is real, don’t call the number in the email. Instead, find the company's real phone number on their official website

- Report these scam emails using the spam or phishing reporting tools in email accounts

Fake Cloudflare CAPTCHA Scam

Scammers are using fake security verification pages to trick people into running harmful code on their computers, leading to virus infections and stolen information. This is a trick that takes advantage of people's trust and unfamiliarity with computer commands.

1. Details of the scams:

People visit a website and see a fake security check page (called a "CAPTCHA") that claims to verify they're human. Instead of the normal picture puzzles, the page tells them to copy and paste a string of code into a special program on their computer (called "PowerShell"). This harmful code then installs viruses on the computer. The scammers use website addresses that look legitimate but aren't.

2. What should you know:

- Real websites never ask you to paste code into command programs to prove you're human.

- Genuine security checks just ask you to click on images or solve simple puzzles.

- Running unknown code on your computer can give scammers complete access to your information.

3. Red Flags to look out for:

- A website asks you to copy text into a black command window on your computer.

- The code looks complicated with lots of strange symbols and text.

- Your web browser or security software warns you about the page.

- The website address looks almost right but has small spelling differences.

4. What should you do?

- Never copy and paste code from websites into your computer's command programs.

- If a security check asks you to run code, it's a scam. Stop immediately.

- Close the website right away.

- Run a virus scan on your computer.

- Report the suspicious website to authorities.

- If you already ran the code, get professional help to clean your computer.

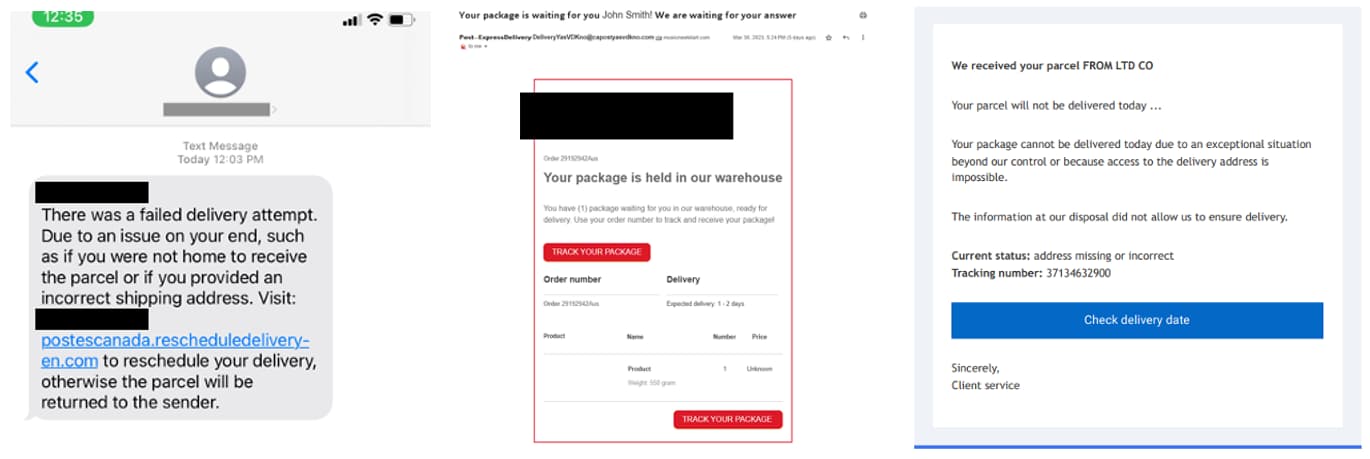

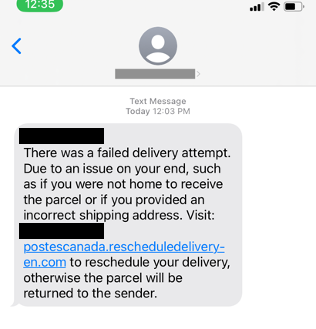

Package Delivery Scams

During the holiday season, scammers are taking advantage of the high volume of deliveries to steal information from clients. We have observed fake text messages and emails pretending to be from Package Delivery/Courier Services, or RBC regarding a pending delivery.

1. Details of the scams:

Scammers are sending fake shipping notices from popular courier services. They are sending phishing SMS and emails claiming that the recipient has a parcel waiting but must pay a customs or rescheduling fee, which needs to be done online via the attached link. This link directs the recipient to a genuine-looking phishing site for the courier service, where they will be tricked into either entering their credit card or banking information.

Scammers are also impersonating Delivery Agencies and RBC by calling clients, claiming to be assisting with a package delivery for which they require access to your online banking and personal and banking information.

2. What should you know:

- Unless the client has signed up for SMS or email notices, popular couriers servicing Canada will inform recipients of missed deliveries by leaving a delivery notice at the customer’s door or in their mailbox.

- Couriers will never complete any transactions via Interac e-Transfer.

Red Flags to look out for:

- You receive an unexpected email or text message claiming to be from a courier service regarding a package. The text in the email, text message, or the URL has spelling or grammatical errors. You may also receive a request for some form of payment

- You receive a call requesting that you provide sensitive details, such as passwords or one-time codes, to proceed with your package delivery. You might be asked to log in to your Online Banking.

3. What should you do?

- Don’t click on links in email or text messages. Take care when clicking on any link, even those appearing at the top of search engine results. Float a cursor over the URL before you click or enter credentials.

- Delete the email or text message immediately. Do not click on any unsolicited links that appear to be from courier services.

- Pay attention before and after you click on links. Before entering your passwords or personal information, verify the URL is a genuine website. Keep in mind that scammers can create very realistic-looking fake websites.

- Do not provide any personal and confidential information to anyone who calls you. This includes information such as Online Banking passwords, answers to security questions, one-time passcodes, or your client card/credit card PIN.

- Hang up and call back. If you receive a call that sounds suspicious, hang up, and call back using the information available on the company’s website.

Beware of Scams Targeting Online Sports Betting

What you should know:

With the overwhelming popularity and accessibility of online sports betting, fraudsters have adapted their tactics to target unsuspecting sports bettors. These scams often fraudulent offers, fake betting platforms, or manipulated odds to trick individuals into revealing personal information or sending money to accounts impersonating sports betting sites.

What to look out for:

One common tactic is offering "guaranteed wins" or "insider tips" in exchange for upfront payment or deposit into a fake account. Once the payment is made, the fraudsters either disappear or request further funds, claiming there is an issue with the initial deposit.

Fraudsters may also pretend to be legitimate sports betting platforms and ask for sensitive banking and/or personal information, claiming it is required to process winnings or refund an "overpayment".

What should you do?

- Research the platform. Verify the legitimacy of any online betting platform by checking reviews, licenses, reputation.

- Verify payment communications. Be wary when being asked to transfer funds to platforms through unconventional methods, such as e-Transfer, wire transfers, gift cards, or cryptocurrency.

- Guard your personal information. Do not share sensitive personal or banking information to unsecure websites. Legitimate platforms will not ask for unnecessary information.

RBC Cyber Fraud Alert: Taxi Scam

Details of the scam:

The taxi scam involves a card swap and a stolen PIN. In recent situations, an individual will be approached by a scammer claiming that they are attempting to pay their taxi fare, but they only have cash, and the taxi driver will only accept a card payment. The scammer will ask the individual if they can give them the cash and, in return, borrow and use the individual’s card to pay for the taxi fare.

The taxi driver, who is also a scammer, will ask the individual to complete the payment by inserting their card into a device and entering their PIN. The device is rigged to capture the entered PIN; meanwhile the taxi driver will secretly swap cards and hand back a different, but similar looking card to the individual.

With the card and PIN in hand, the fraudsters will then utilize it aggressively in a short period of time for in-store purchases or ATM withdrawals until fraud is detected or reported and card is blocked.

There has also been reports of scammers working alone, posing as a taxi driver and completing a card swap when the individual is paying for their ride

What should you do?

- Do not participate in transactions that you have not initiated

- When possible, use a contactless payment option. A PIN is not required when using the tap option

- Set up alerts on your account(s) to be notified when there’s a purchase or withdrawal greater than a specified amount

- Regularly review your statements for unusual transactions

- NEVER let your credit card or client card leave your sight, and verify that you receive the correct card when it’s handed back to you

- If you’ve fallen victim of this scam and/or you no longer have your card in hands, contact RBC immediately to secure your account

- You can lock your RBC client card or credit card temporarily at any time by simply logging in to the RBC Mobile app and navigating to your account details page.

- 1-800-769-2511 (telephone banking)

- 1-800-769-2555 (online/mobile banking)

- 1-800-769-2512 (credit cards)

- 1-800-769-2535 (RBC Express online banking Client Support Centre)

- RBC Bank (Georgia), N.A.: 1-800-769-2553

- TDD/TYY: 1-800-661-1275

- Outside Canada and the U.S.: Reach us using our International Toll-Free Service

- If you live in the U.S. please also contact your local authorities as well as the FTC (Federal Trade Commission) at 1-877-438-4338.

- For personal credit card, you can also report fraudulent activity through Online Banking or the Mobile App

- Be sure to report the incident to your local police and file a report with the Canadian Anti-Fraud Centre

Card pick-up scam

Details of the scam:

Individuals, especially seniors, are receiving phone calls from fraudsters pretending to be a bank employee. The caller will create an urgent scenario; in most cases, they will inform you that they’ve identified fraudulent activity on your account(s), and the card(s) needs to be cancelled immediately.

The fraudster will then instruct you to put your card(s) and PIN in an envelope, and hand it over to someone who will come to your door to pick up. Within a few minutes, the other fraudster will come to the door dressed as a courier service staff, while you are on the phone with the caller. You are then instructed to hand over the envelope to the person at the door.

The fraudster proceeds to deplete funds quickly through various means. This includes ATM withdraw, Point-of-sale purchases, and online purchase for credit cards.

To gain your trust, the caller will usually provide some details regarding your personal information (e.g. name, address). Or they sometimes will ask you to cut the card into pieces but leave the chip on the card intact before you put the pieces in the envelop. However, once they receive the card pieces they can tape it back and will still be able to use it for POS purchases since the chip is still functioning.

What should you do?

- NEVER divulge your PIN to anyone. RBC will never ask you for this information.

- NEVER let your credit card or client card leave your sight and never give your card to anyone else

-

If you’ve fallen victim of this scam and/or have provided your PIN number, contact RBC immediately to secure your account(s).

- 1-800-769-2511 (telephone banking)

- 1-800-769-2555 (online/mobile banking)

- 1-800-769-2512 (credit cards)

- 1-800-769-2535 (RBC Express online banking Client Support Centre)

- RBC Bank (Georgia), N.A.: 1-800-769-2553

- TDD/TYY: 1-800-661-1275

- Outside Canada and the U.S.: Reach us using our International Toll-Free Service.

- If you live in the U.S. please also contact your local authorities as well as the FTC (Federal Trade Commission) at 1-877-438-4338.

- For personal credit card, you can also report fraudulent activity through Online Banking or the Mobile App

-

Report the unsolicited fraudulent phone call to:

- Local police

- Canadian Anti-Fraud Centre (CAFC) 1-888-495-8501

- Canadian Radio-Television and Telecommunications Commission (CRTC)

Beware of Overpayment Scams Targeting Commercial Clients

What to look out for:

Fraudsters are targeting commercial clients using counterfeit cheque that are couriered to RBC branches. These cheques come with instructions to deposit funds into the commercial client’s account.

After the deposit is made, the fraudster contacts the commercial client pretending to be a legitimate customer who has accidentally made a payment in excess of an agreed upon price or quote (“overpayment”). The victim is asked to wire the difference to an overseas account to correct the error.

When the counterfeit cheque is inevitably returned, the account is at a loss for the funds that were sent to the bad actors.

What you should know:

- Perform due diligence when fulfilling a request to resolve a payment error that involves reimbursement. Confirm that the initial payment was received and that any cheques are cleared of any holds or restrictions before using the funds.

- Verify with your customer if the request sounds suspicious. If it’s someone you’ve dealt with before, try to initiate contact through a trusted phone number or email address to confirm payment information (Remember: Phone numbers can be spoofed by fraudsters. It’s always better to be safe than sorry).

-

Be wary of red flags when communicating with customers, including, but not limited to:

- Payments sent in excess of the expected amount

- Instructions to send payment to overseas accounts and/or countries that do not align with the companies physical location(s)

- Unreasonable requests to divulge personal or banking information, outside of what is expected to complete a regular transaction and/or is publicly available

-

Regularly review your banking statements and account activity. Several victims advised that they were not expecting to receive a cheque. If you see a credit or deposit that you do not recognize or were not expecting, or otherwise suspect that you may be the victim of a scam, contact RBC immediately to secure your account(s).

- 1-800-769-2512 (Credit Cards Business Clients)

- 1-800-769-2520 (Business Banking)

Beware of the risks associated to Bank Impersonation Scams

What to look out for:

Recent scam campaigns involve bad actors contacting clients as fraud representatives within their financial institution, including RBC. These are not actual representatives of the bank but are impersonating them to take advantage of unsuspecting victims. These calls may involve but are not limited to the following:

- Caller ID showing a phone number coming from your financial institution (spoofed phone number)

- Caller indicating that there is fraudulent activity on a banking profile or credit card

- Caller indicating that there is a need to provide a One-Time Passcode in order to identify you

- Caller may ask to create a new online banking password together

- Caller may ask for you to send money to yourself via e-transfer in order to secure your banking profile

- Caller may ask you to enter your PIN on your device to validate activity or require you to scan your ID on your phone

- Caller may ask you for an Interac e-transfer (Certapay) reference number

Other red flags of a scam to look out for on any call, not just those purporting to be from RBC:

- Asking you to download a remote access application (i.e. Anydesk) in order to share your screen

- Asking you to go to a store and buy gift cards

What you should know:

A Royal Bank of Canada representative or employee will NEVER:

- Ask you to provide one-time codes sent through SMS, emails, or voicemail to identify yourself.

- Ask you to send money to secure your profile

- Ask you to initiate any type of transaction on their behalf.

- Ask you to download a remote access application

- Access your online banking in order to add payees on your behalf

In addition, RBC will never ask you to assist in creating a new Online Banking password or ask you to share it. Online Banking passwords should only be created by the client, and never shared with anyone.

What should you do?

- Do not provide any Online Banking information to anyone who calls you. This includes information such as Online Banking passwords, answers to security questions, or your client card/credit card PIN.

- Never send a payment or Interac Etransfer at the request of someone advising you they are RBC.

- Never share answers to security questions for Interac Etransfers

- Never share your Interac Etransfer reference number with anyone

- Hang up, and call us back. If you receive a call from RBC that sounds suspicious, hang up, and call us using the number on the back of your debit or credit card. Even if it is an RBC representative contacting you, we will understand if you were more comfortable calling back. Better to be safe than sorry.

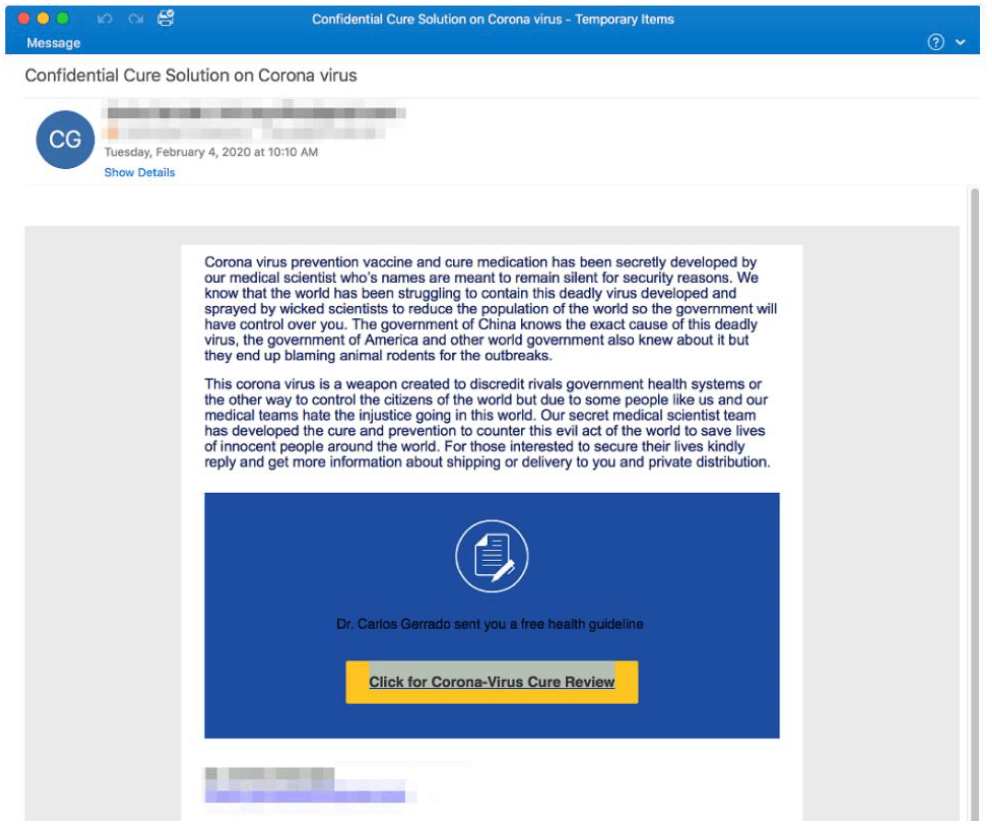

Beware of Phishing Scams Targeting Canadians During Tax Month

What to look out for:

As the tax filing deadline approaches in Canada, we are once again observing a spike in phishing attacks targeting Canadians via SMS, emails, and phone calls. These scams may claim to be notifications and links regarding the following (but are not limited to):

- Outstanding tax owing

- Eligible tax refunds

- Fake CRA sites

- Tax filing portals

- Tax filing services or assistance

These scams may also contain the following keywords if there is a linked URL (but again, are not limited to):

- CRA

- revenue

- refund

- gst/hst

- tax

What you should know:

The CRA will not ask you by text message or email for personal information, bank information, payments by e-transfers or gift cards. While the CRA may notify you of new tax-related communications via email, these messages must be read by signing in to your CRA account at Canada.ca.

In addition, the CRA will never issue refunds via Interac e-Transfer. Should you click any link directing you to an Interac page, close the page immediately. All CRA payments are sent through Direct Deposit or mailed to you by cheque.

What should you do?

- Do not click on links in unsolicited emails and text messages. This applies to all messages, but remain especially vigilant regarding tax matters this month.

- Only file your taxes through the Official methods. Never attempt to file taxes through links sent to you, or over the phone with someone you do not know and trust. Available CRA tax filing options are listed here: https://www.canada.ca/en/services/taxes/income-tax/personal-income-tax/get-ready-taxes/ways.html

- Delete the email or text message immediately. If you receive a message you suspect to be spam, delete it immediately.

For more information about protecting yourself against CRA Scams, please visit https://www.canada.ca/en/revenue-agency/corporate/security/protect-yourself-against-fraud/scam-alerts.html.

Be Aware of Phishing Messages Containing RBC and Other Bank Logos

What to look out for:

In previous Scam Alerts, we’ve discussed some tricky text-related methods that Fraudsters use to lure clicks, such as:

- Replacing letters with numbers, other types of “lookalike” characters, or adding extra letters.

- Hiding a phishing link behind a URL that looks like a legitimate RBC URL.

However, sometimes all it takes is the use of a familiar, “trusted” image (like the RBC logo) to get a victim to fall for the scam. Malicious messages may utilize bank logos or include image previews from their phishing websites to appear trustworthy, and the use of familiar logos can create a false sense of security – making it easier for unsuspecting individuals to fall victims to these scams.

What should you do?

- Exercise caution. Remain vigilant about messages from unknown senders, even if the message contains RBC logos, or logos from other reputable brands.

- Exercise caution when clicking any links. If you were not expecting a message from RBC or suspect that it is not a legitimate request, do not click on the link.

- You can help us by forwarding the phishing email or attaching a screenshot of a fraudulent text message to phishing@rbc.com

- Delete the email or text message immediately. If you receive a message you suspect to be spam, delete it immediately.

Fake Job Opportunities

Details of the scam:

Social media platforms are being increasingly leveraged by cyber criminals to spread malicious software (malware). Fake job postings or business opportunities might be used to lure users to download the malware.

Victims will receive direct messages from false recruiters with very attractive job opportunities, via LinkedIn or Facebook. The message contains a link to what is supposed to be the job description. When clicking the link, the malware will be downloaded.

Note: The job description could be hosted in a legitimate website (e.g. Dropbox, Google Drive, iCloud etc.)

Red Flags to look out for:

Before clicking any links or downloading any attachments:

- Always check the legitimacy of the recruiter sending you the message.

Does their profile have enough information about their experience and background? If not, it may be a fake profile. - Check the legitimacy of the job post.

Is the job posted on LinkedIn or on the company’s website? If not, it may be a fake opportunity. - Beware of opportunities that seem too good to be true. A salary that is way above average, unrealistic profits for a new business, or unusual benefits are all red flags.

What should you do?

If you received a fake job posting:

- Don’t click on links from unknown senders. Even if the sender’s address looks legitimate, remain cautious as it is possible for fraudsters to craft fake email addresses to appear real.

- Delete the email or text message immediately. If you receive a message you suspect to be spam, delete it immediately.

- Report it to the job site immediately.

Good afternoon, sorry to disturb you.

We are looking for 1,000 online media workers.

The only condition: must have a Canadian SIN or (foreigner who has worked here for more than one year)

Job Description: Requires review of product web pages to increase product awareness and sales.

- No investment, no work experience, age (25-60 years old).

- Salary: 150 to 300 Canadian dollars per day.

- Working on the mobile phone is easy and convenient, and the work can be completed in 50-80 minutes of free time.

- The first 100 participants on the day will have a chance to win $10 CAD.

If you are interested, please answer 1 and click on the Whats App link to learn more! https://

Fake QR Codes - Quishing

Details of the scam:

You may have noticed that QR codes gained popularity during the pandemic - especially at restaurants as an alternative to printed menus. QR codes also continue to be a popular way to link to a website while attending an in-person event. Although convenient, QR codes can be used to trick you! Hackers are taking advantage of their popularity and sending phishing e-mails with malicious QR codes.

Red Flags to look out for:

You receive an unexpected message with a QR code attached, requesting you to scan it.

- Scanning the QR code will take you to a malicious website that can steal your credentials or download malware (malicious software).

- The e-mail might mimic well-known brands, like Adobe or Docusign, or emulate a message from a client.

- The attachment could be any file type that displays an image. Some common file types include: .pdf, .docx, .html and .eml (Outlook e-mail format).

Other Red Flags:

- Senders you don’t recognize: Avoid clicking on any links received from an unknown sender.

- Unexpected QR codes: QR codes are typically used for in-person events, so an email with a QR code is out of the ordinary and can be suspicious.

- Domain of the website: If you happen to scan the QR code, review the link before clicking the website. If it’s from a website you don’t recognize, that’s a red flag.

What should you do?

- Don’t click on links or scan QR Codes from unknown senders.

- Delete the email or text message immediately. If you receive a message you suspect to be spam, delete it immediately.

- Exercise caution when scanning any QR Codes. Rather than scanning the code, go to the website directly.

Telecom Refund Scams

Details of the scam:

Like other methods discussed in previous posts (Package Delivery scams – May 2023, Interac e-Transfer scams – March 2023) another common tactic targeting Canadians is the use of fake Telecom company refunds by masquerading as companies like Rogers, Bell, or Telus.

Victims will receive smishing and phishing messages stating that they are eligible for a refund due to a variety of reasons, such as outages, goodwill, or account corrections. These messages include a link directing them to a realistic-looking Telecom company phishing page and will appear to offer a refund via Credit Card or Debit. If Debit is selected, the victim will be directed to a fake Interac e-Transfer page where they will proceed to select their bank.

Keep in mind that Telecom companies will never send SMS messages regarding refunds, or issue refunds via e-Transfer or Credit Card. Any messages received should be deleted immediately.

Red Flags to look out for:

- You receive any SMS/emails informing you of a refund with a Telecom company regarding any reason.

- You receive a message regarding a refund or credit that you were not expecting.

What should you do?

- Don’t click on links from unknown senders. Take care when clicking on any links received from an unknown sender.

- Exercise caution when clicking email links from known senders. Even if the sender’s address looks legitimate, remain cautious as it is possible for fraudsters to craft fake email addresses to appear real.

- Delete the text message immediately. If you receive a message you suspect to be spam, delete it immediately.

Beware of investment scams involving cryptocurrency:

1. Details of the scam:

An investment scam is when a fraudster offers an individual the opportunity to invest, often using cryptocurrency, and promises a high rate of return in a short amount of time. These offers can be solicited through online ads where the victim is redirected to a website, but may also be unsolicited; in either case, there is time pressure to ensure the individual commits before they have time to complete their research on the investment opportunity.

Scammers will create fake accounts on websites or on social media that appears to be legitimate. They will reach out to individuals to invest in cryptocurrencies and promise them massive profits, even sharing ‘screen captures’ or live ‘trend graphs’ showcasing the progress of their investment. Note that these types of returns cannot be guaranteed, and anyone who promises a no-risk investment is most likely a scammer.

Cryptocurrency, along with other forms of payment such as gift cards, are often preferred by scammers because they are untraceable once they have left your account.

In most cases, victims of an investment scam will lose not only their investment but also their personal and financial information, leaving them vulnerable to identity theft.

2. Red Flags to look out for:

- Be mindful of individuals or services promising high (or quick) returns and unrealistic investment opportunities. If an opportunity sounds too good to be true, it’s a scam.

- If the individual contacts you in an unsolicited manner for an investment opportunity, either by phone, online or via social media, it is likely not legitimate.

- Investment scams are often tied to romance scams; if you are dating online and a romantic interest suddenly turns into an investment opportunity, you are dealing with a fraudster.

- Fraudsters will often showcase testimonials from "satisfied customers" to increase their credibility – do not let these hinder your decision making.

- Watch for grammatical errors in communications with the buyer. It may indicate that they are not the professional they claim to be.

3. What should you do to prevent becoming a victim of an investment scam?

- Do your homework and take time to research the offer. Scammers will rush you to into making a decision by telling you it’s a limited offer or that you can get a rebate if you invest today.

- Only send cryptocurrency to people you trust; it is always best to know the person to whom you are transferring money.

- Avoid sending funds to a third party. All transactions should be completed with the same person you initially engaged with.

- Complete your due diligence to verify the individual’s accreditation by making telephone calls and sending emails using trusted sources.

- Contact or visit your provincial security commission’s website to verify if the entity who you are in contact with is legally allowed to provide financial services in your jurisdiction. Contact Us - Canadian Securities Administrators (securities-administrators.ca) (Opens in new tab)

- Never provide copies or images of your identification or banking details.

- Ensure you have direct access to your investment account and can independently verify performance. Be wary of investing via a third party.

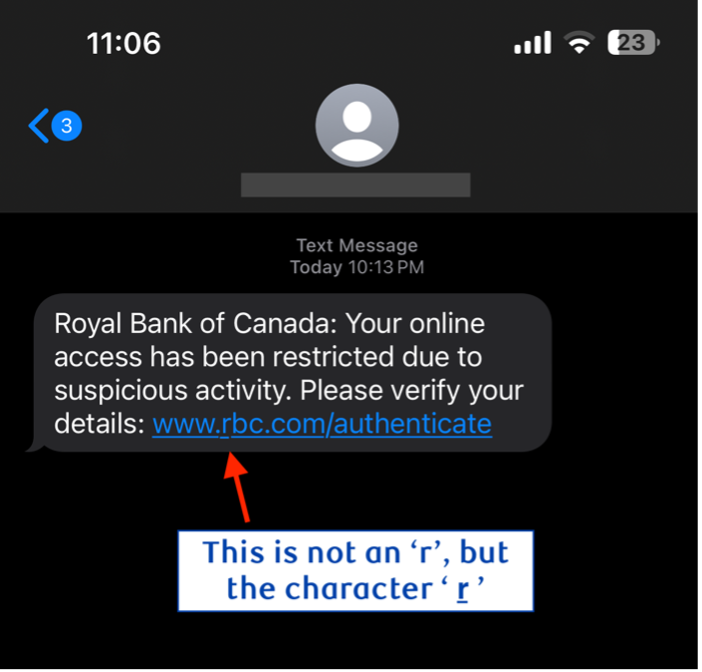

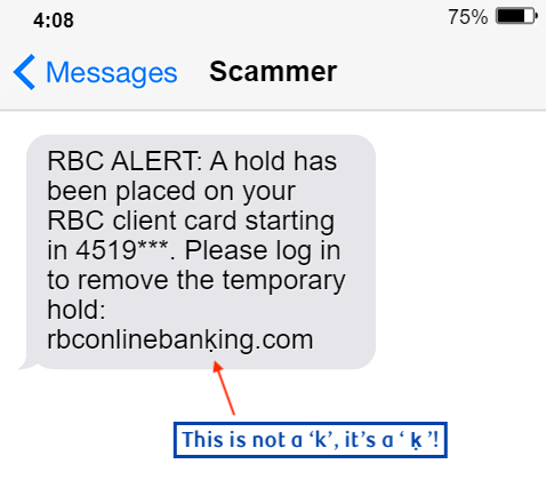

Realistic Looking URLs from Fake RBC Text Messages

1. Details of the scam:

With the increase in scam SMS messages (“smishing” messages) sent to Canadians targeting their bank accounts, clients must exercise caution when clicking on URLs sent to them. However, even the most eagle-eyed recipient may fall for the use of Punycode to disguise phishing URLs, making them look like legitimate domains.

In this scam method, punycode is what Fraudsters can use to replace “regular” characters in a URL with a different, similar character, directing clients to a phishing site. This can make it very tricky to differentiate between a legitimate and fake URL, since these links may look almost exactly like the real thing at first glance.

See the following example of a smish using punycode:

This may look like the legitimate domain belonging to RBC. Pause and look carefully, you may notice that the ‘r’ in ‘rbc.com’ is underlined and is the character: ‘ṟ ‘. By clicking this link, the scam victim would be directed to a phishing website using the domain “ṟbc”, which is not the same as “rbc.com”.

In this second sample, it seems like the legitimate ‘rbconlinebanking.com’ domain at first. Assess closely and you will notice the dot under the ‘k’, replacing it with a ‘ḳ’ (a ‘k’ with a small dot underneath):

Red Flags to look out for:

- You receive any SMS asking you to log in to your RBC account.

- You receive any SMS stating that there is an issue with your RBC account.

- You receive any SMS with a link to any RBC website, even if it looks legitimate.

- Any kind of password reset is requested.

2. What should you do?

- Don’t click on links in email or text messages. Take care when clicking on any links received from anybody, even if you know the person.

- Don’t click on links from unknown senders. Take care when clicking on any links received from an unknown sender.

- Delete the text message immediately. If you receive a message you suspect to be spam, delete it immediately.

- You can help us by forwarding the phishing email or attaching a screenshot of a fraudulent text message to phishing@rbc.com

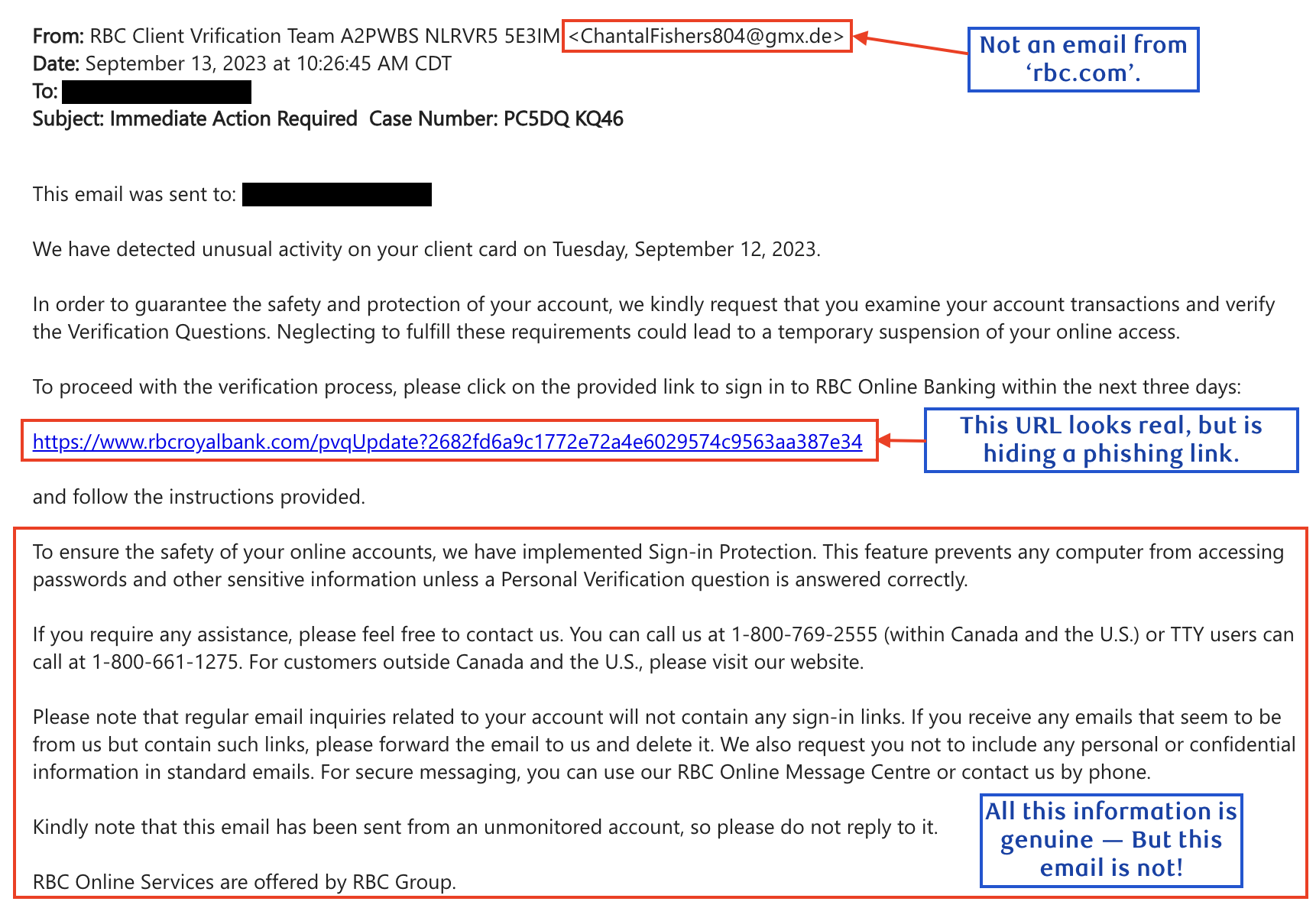

RBC will never send an email requesting a password reset if there is a problem with your account.

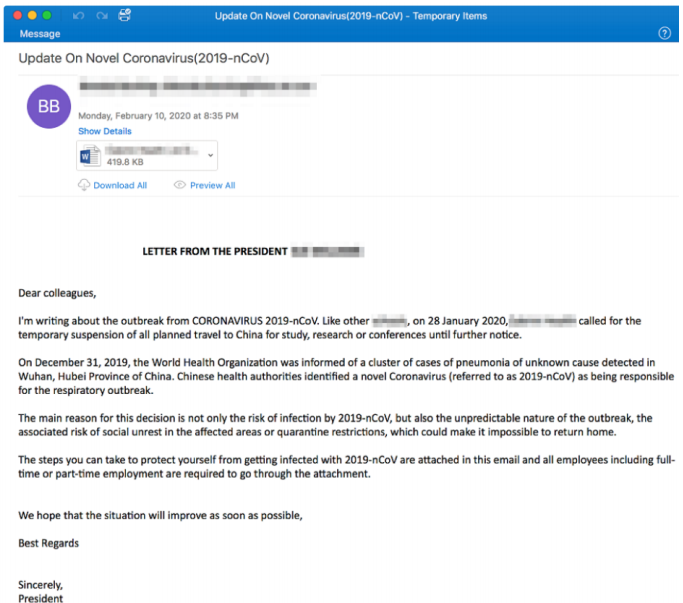

1. Details of the scam:

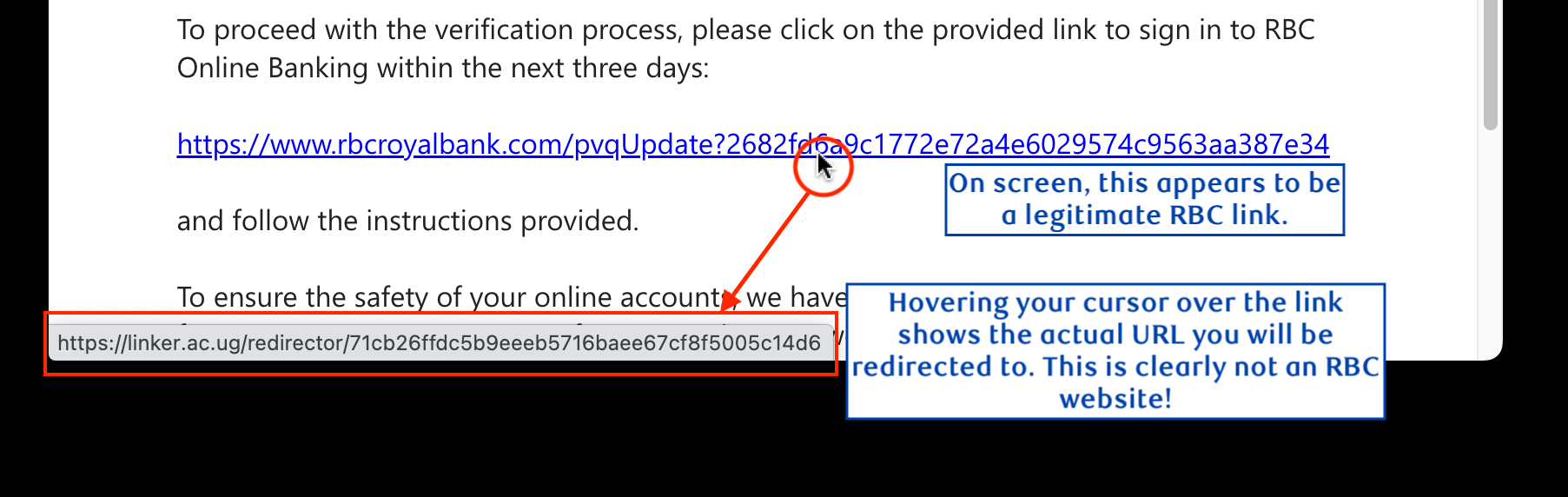

RBC clients are seeing an increased number of sophisticated phishing emails impersonating RBC and requesting that the client resets their password due to suspected fraud on their account. When the link is clicked, the client will be redirected to a fraudulent RBC Online Banking site that steals client credentials.

At first glance, these emails may appear very legitimate due to the message’s urgency and formality. Some of the information (like phone numbers and instructions) may even be real, in attempt to further increase the chances of luring a victim. Additionally, legitimate-looking links in the message will hide the true URL behind it, which directs the client to a phishing site.

2. Fraudsters may attempt to use some of the following fake reasons to lure clients into their scams:

- Your account is locked.

- Fraud was detected on your account.

- There is an error with your bank account.

- Your credit/debit card is locked.

- Your account has been compromised.

RBC would never request a password reset for any of the above reasons! If RBC detects fraudulent activity on your account, we will contact you directly via the phone number associated on your account.

Examples

Red Flags to look out for:

- The sender of the email does not end in “rbc.com”.

- Any kind of password reset is requested.

3. What should you do?

- Don’t click on links in email or text messages. Take care when clicking on any link, even those appearing at the top of search engine results. Float a cursor over the URL before you click or enter credentials.

- Delete the email or text message immediately. Do not click on any unsolicited links.

- Pay attention before and after you click on links. Before entering your passwords or personal information, verify the URL is for a genuine website, and not an IP address. Keep in mind that scammers can create very realistic-looking fake websites.

- You can help us by forwarding the phishing email or attaching a screenshot of a fraudulent text message to phishing@rbc.com

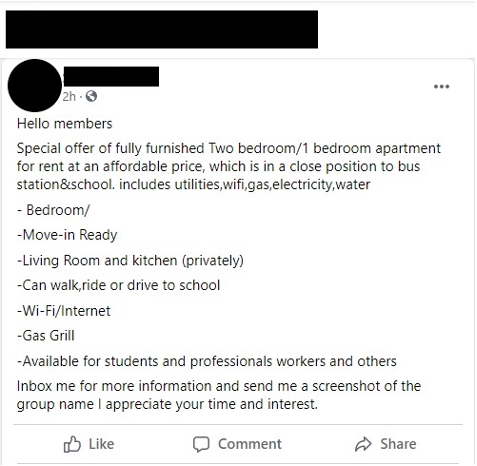

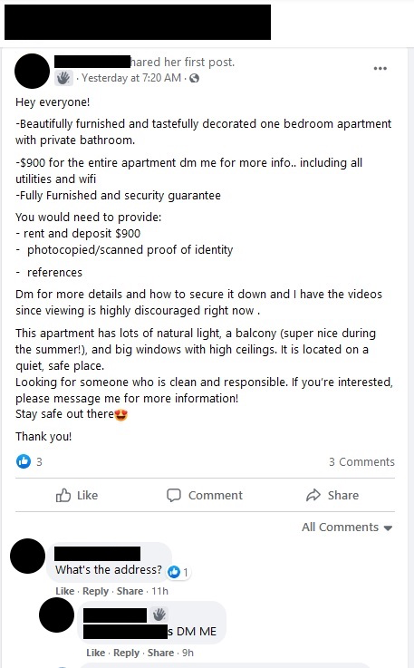

Beware of Rental Scams and Fraudulent Renters:

1. Details of the scam:

A Rental Scam is when a fraudster creates a fake advertisement for a room or property rental to steal money from interested renters. In this scam, would-be tenants are tricked into paying an upfront fee or deposit to secure the rental, when the property does not exist, has already been rented out, or has been rented to multiple people at the same time.

On the flip side, Fraudulent Renters target legitimate landlords. There are several ways that fraudulent renters commit scams:

- They pretend to be a renter aiming to get financial or personal information from the landlord.

- They say they are moving in but plan to use it as a rental property to generate income for themselves.

- They send a payment (cheque, e-transfer) in an amount greater than the cost of rent and ask for a partial refund due to over payment.

- The payment is subsequently identified as fraud and debited from the account, leaving the victim responsible for any losses.

2. Red Flags to look out for:

As a Renter:

- Multiple ads for the same property but with different contact information for the landlord.

- The listing is vague or has typos, poor grammar, or excessive punctuation.

- The asking rent seems too good to be true.

- The landlord does not want to meet in person or states that they are out of the country.

- They do not allow you to visit the property before signing the lease.

- They ask for rent or a security deposit before signing the lease.

- There is pressure to sign or make a payment right away.

As a Landlord:

- The renter is not interested in learning more about the property or coming to see it first.

- The renter does not consent to a credit check or are hesitant to provide references.

- The account holder name on the deposit cheque does not match the name on the rental application or lease.

3. What should you do?

As a Renter

- Only rent via reputable websites and sources.

- Schedule a face-to-face meeting and research the landlord, real estate agent or property manager that’s listing the property.

- Whenever possible, visit the property in person and complete a walkthrough.

- Make sure you properly read through the contract before signing a lease to ensure that it is complete and that you are sufficiently protected by the terms and conditions.

- If you are a victim of a rental scam, contact local law enforcement immediately. Ensure that you cancel any pending payment transactions to the landlord and/or put a hold on cheques that have not been cashed.

As a Landlord:

- Offer to have the potential renter come by for a walkthrough of the property.

- Vet rental applicants by verifying ID documents, performing background and credit checks using reputable websites and contacting references.

If you are the victim of a fraudulent renter, contact local law enforcement immediately. Do not accept any additional payments from the renter or cash any cheques that have been provided. If you have accepted funds from the renter, it is important that you do not withdraw or spend the money. Once the payment has been confirmed fraudulent, the funds will be debited from your account.

Examples 1

Examples 2

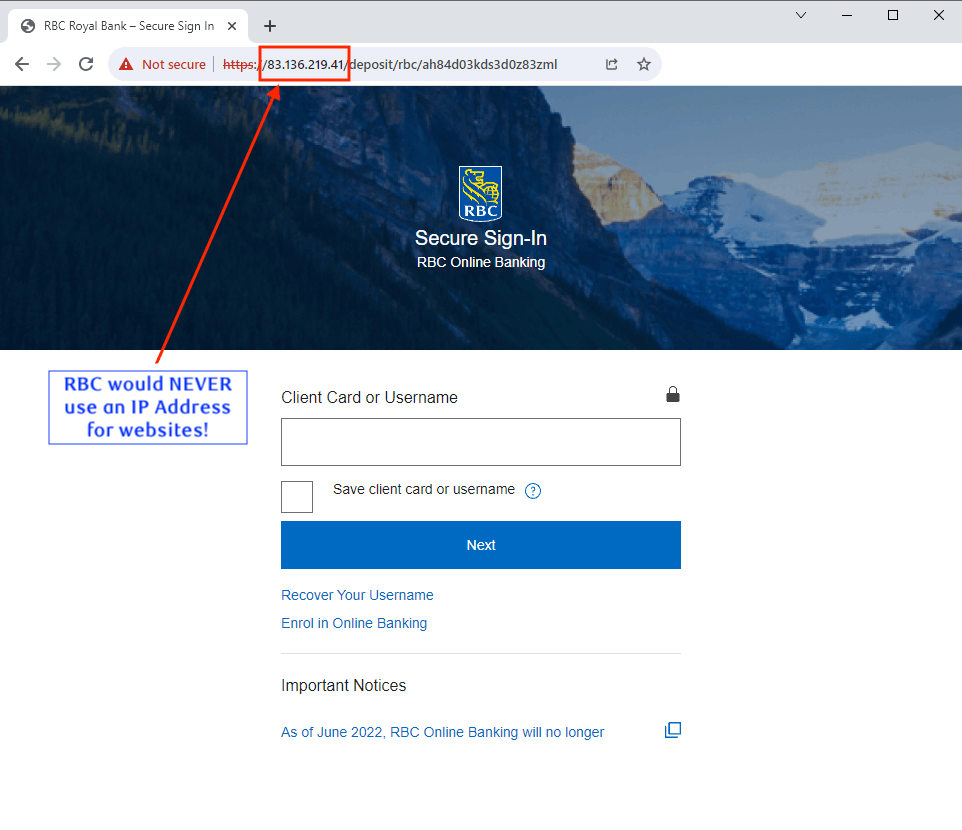

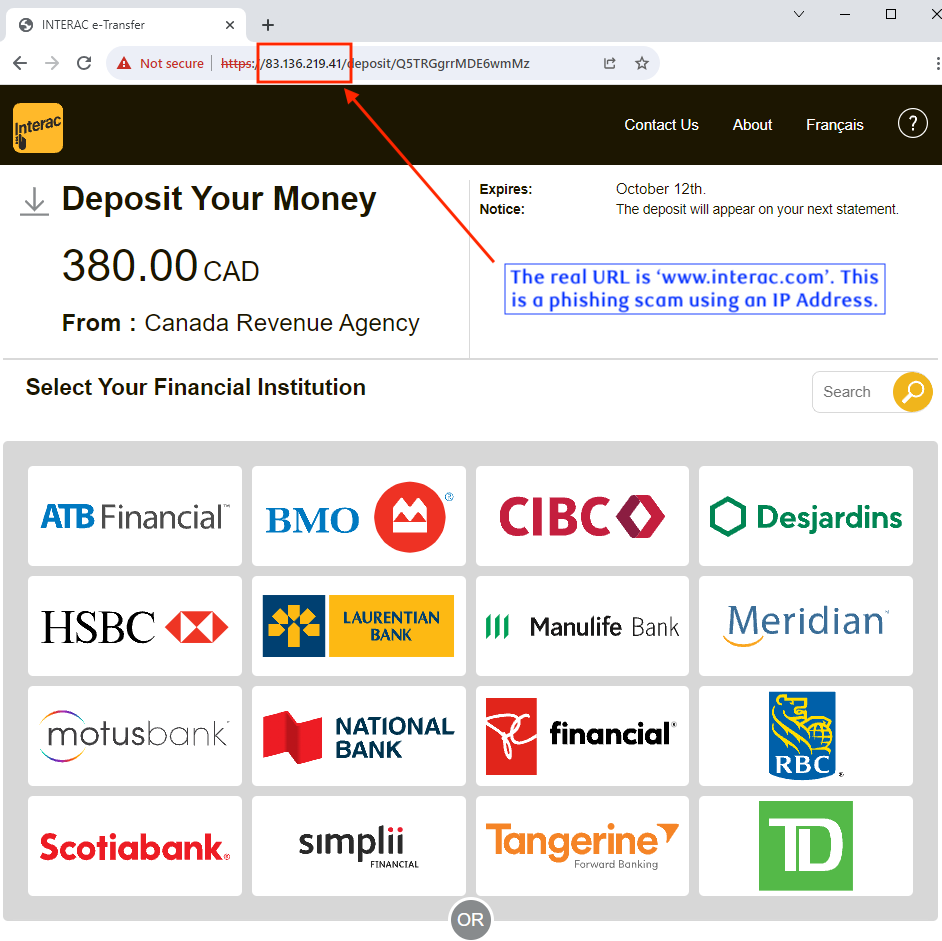

Pay Attention to the Website Address (URL) in the Address Bar When Entering Banking Information

1. Details of the scam:

With rapidly evolving technology, events, and social trends, scammers continue to develop creative methods of luring victims into phishing attacks. However, many of these attacks often have commonalities that we can use to easily identify scams.

One easy method of identifying a phishing scam is by paying attention to the website address (URLs) that the Banking site is hosted on and checking if it is an IP Address. You will never be asked by RBC or any other Financial Institution to conduct transactions or enter banking information on websites hosted on IP Addresses.

2. What is an IP Address?

To put it simply, an IP address is a string of numbers (such as 192.168.1.1) that the internet uses to translate the human-readable website addresses we use into computer language. Since words and characters are easier for us to remember, legitimate website owners will use a web address to direct users to their websites (e.g., www.rbcroyalbank.com, www.royalbank.ca, www.rbc.com, etc.)

RBC (or any legitimate organization) will never ask their customers to access their websites via an IP address. However, this is a common practice by scammers as it prevents them from needing to purchase a new phishing web address each time one is identified as a scam.

Examples

Red Flags to look out for:

- The text in the email or text message contains numbers instead of words and letters.

- Your browser’s address bar contains numbers instead of words and letters even though you see RBC content.

3. What should you do?

- Don’t immediately click on links. Take care when clicking on any link, even those appearing at the top of search engine results. Float a cursor over the URL before you click or enter credentials.

- Delete the email or text message immediately. Do not click on any unsolicited links.

- Pay attention before and after you click on links. Before entering your password or personal information, verify the URL is for a genuine website and not an IP address. Keep in mind that scammers can create very realistic looking websites.

- You can help us by forwarding the phishing email or attaching a screenshot of a fraudulent text message to phishing@rbc.com

Fraudulent Phone Call Regarding Visa Charge

1. Details of the scam:

A call is received from what is displayed on a caller ID as a toll-free number. A recorded message states the call is from RBC and pertains to a fraud issue however no client name is mentioned.

After a moment which may include hold music, the caller may be transferred to a voicemail and asked to leave their contact information. A scam perpetrator will subsequently call the victim back and attempt to obtain Personal Identifiable Information (PII) and banking information while impersonating a VISA credit card security department representative. The goal being to conduct financial fraud.

2. What should you know:

Always remember that RBC Fraud Prevention representative will never ask a client to divulge banking or personal information on an outbound call. RBC relies on various methods to authenticate transactions and we may send you a SMS with One-Time Passcodes under various circumstances. RBC employee will never ask you to share this code by reading it back to us or by entering it on your phone keypad.

Red Flags to look out for:

- An automated system that calls you to place you on hold right away.

- A supposedly national, large operation call center that relies on a voicemail to compile client call back requests. RBC does not have/use a voicemail to facilitate call backs.

- A caller identifying themselves as an RBC staff asking you to confirm personal and banking information or to read out a code you receive by SMS.

3. What should you do?

- Remember to never disclose any personal information or banking to strangers or unverified persons including PIN, One-Time Passcodes, and answers to digital banking Personal Verification Questions (PVQs)

-

If you believe your confidential information may have been stolen or obtained by a fraudulent party either online, by telephone or through any other means, please call us immediately.

- 1-800-769-2511 (telephone banking)

- 1-800-769-2555 (online/mobile banking)

- 1-800-769-2512 (credit cards)

- 1-800-769-2535 (RBC Express online banking Client Support Centre)

- RBC Bank (Georgia), N.A.: 1-800-769-2553

- TDD/TYY: 1-800-661-1275

- Outside Canada and the U.S.: Reach us using our International Toll-Free Service.

- If you live in the U.S. please also contact your local authorities as well as the FTC (Federal Trade Commission) at 1-877-438-4338.

-

Report the unsolicited fraudulent phone call to:

- Local police

- Canadian Anti-Fraud Centre (CAFC) 1-888-495-8501

- Canadian Radio-Television and Telecommunications Commission (CRTC)

- If you answer the phone and the caller - or a recording - asks you to hit a button to stop getting the calls, hang up. Scammers often use this trick to identify potential targets.

- Do not respond to any questions, especially those that can be answered with "Yes" or "No."

Example of recorded message:

Thank you for calling RBC fraud prevention center. One of our fraud specialists will be with you shortly. Please hold while I try to connect you.

Voicemail for RBC fraud:

No one is available to take your call. At the tone, please record your message, when you finish recording you may hang up or press the pound key for more options.

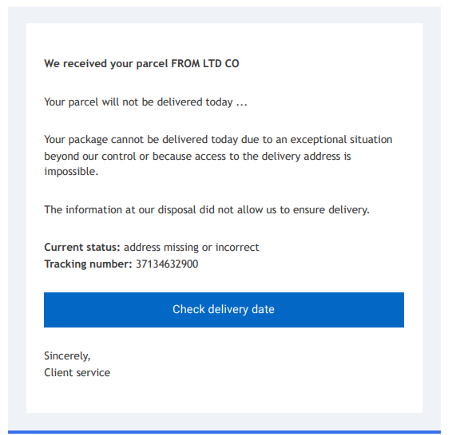

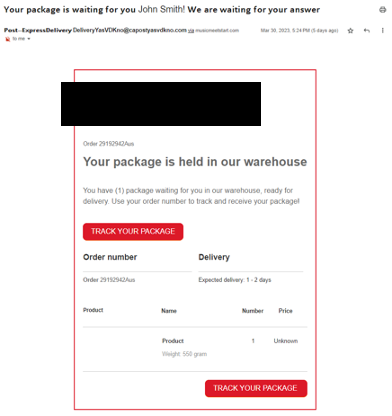

Package Delivery Phishing/Smishing Scams

Use Caution When Opening Links from Package Delivery/Courier Services

1. Details of the scam:

The drastic rise of e-commerce has resulted in an increase of scammers sending fake shipping notices from popular courier services. Scammers are taking advantage of this by sending phishing SMS and emails to trick unsuspecting Canadians into submitting their banking information.

The messages claim that the recipient has a parcel waiting but must pay a customs or rescheduling fee, which needs to be done online via the attached link. This link directs the recipient to a genuine-looking phishing site for the courier service, where they will be tricked into either entering their credit card or banking information.

2. What should you know:

- Unless the customer has signed up for SMS or email notices, popular couriers servicing Canada will inform recipients of missed deliveries by leaving a delivery notice at the customer’s door or in their mailbox.

- Couriers will never complete any transactions via Interac e-Transfer.

Red Flags to look out for:

- You receive an unexpected email or text message claiming to be from a courier service regarding a package.

- The text in the email or text message has spelling or grammatical errors.

- The URL in the message has spelling or grammatical errors. If you are unsure of the genuine URL, use a search engine and go directly to the company’s website.

- The website claiming to be the courier service is requesting some form of payment.

3. What should you do?

- Don’t click on links in email or text messages. Take care when clicking on any link, even those appearing at the top of search engine results. Float a cursor over the URL before you click or enter credentials.

- Delete the email or text message immediately. Do not click on any unsolicited links that appear to be from courier services.

- Pay attention before and after you click on links. Before entering your passwords or personal information, verify the URL is a genuine website. Keep in mind that scammers can create very realistic-looking fake websites.

Examples of Package Delivery Scams

The scam messages sent can range from being good imitations, to primitive or very off-brand:

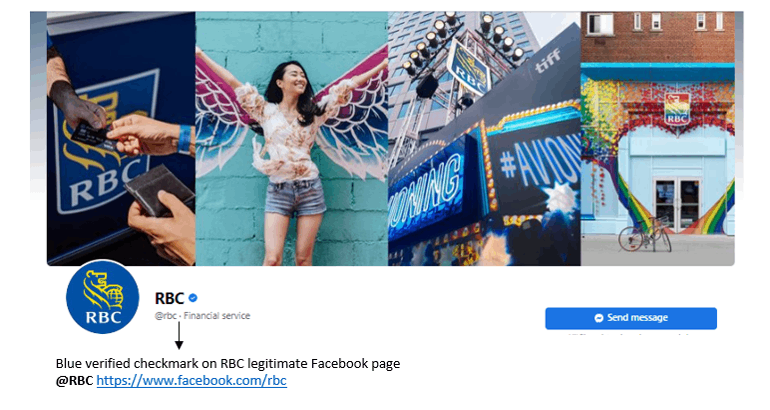

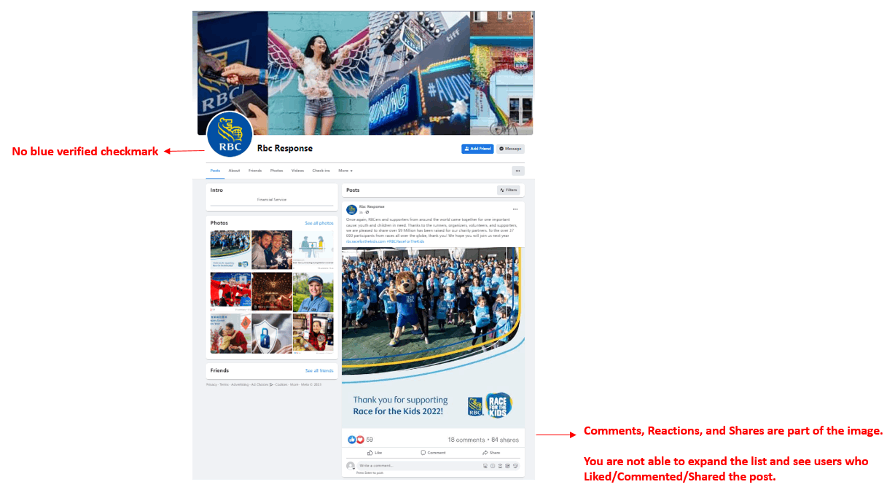

Fake RBC Facebook Pages

Exercise Care when Interacting on Social Media

1. Details of the scam:

Fraudsters continue to impersonate RBC by creating fake RBC Facebook pages. Unsuspecting clients may interact with the fake pages and provide personal information, assuming that it is a RBC legitimate Facebook page.

2. What should you know:

These fake Facebook pages may look deceivingly close to the legitimate RBC Facebook page (https://www.facebook.com/rbc) as they often copy images, posts, and reactions from the RBC page.

RBC legitimate Facebook page has the blue verified checkmark, which confirms the authenticity of a page.

Red Flags to look out for:

- The fake Facebook pages do not have the blue verified checkmark.

- The fake Facebook pages have no or low follower counts.

- The likes, comments, and reactions are part of the image and you are unable to view users who commented/reacted/liked the post.

3. What should you do?

- Go directly to the official website.