What’s Needed to Hit Canada’s 2030 Goals

Key Findings

- Investment flows to climate action have grown by 50% since 2021. Capital flows, from public and private sources, grew from $15 billion to $22 billion, but need to reach $60 billion a year for the rest of the decade for the economy to be on a course to Net Zero by 2050.

- Provinces need to significantly increase climate-oriented spending. Ottawa has covered roughly 80% of the cost of climate action since 2016, and is reaching its fiscal capacity.

- Business capital flows need to rise significantly. Public markets and private equity capital flows into climate and cleantech reached $14 billion last year—just 12% of all new capital financing.

- Business leaders believe they can achieve their climate goals. Our survey shows more than half of Canadian businesses have set emissions reduction targets for 2030, and 96% of CEOs surveyed are confident they can hit them.

- Around two-thirds of Canadians want to do more to tackle climate change. But they feel they need more awareness of their options. Roughly half don’t favour actions that erode their standard of living.

- Early adopters are leading a shift in consumer spending. Although spending remains concentrated among early adopters, Canadians spent about $13 billion on electric vehicles and heat pumps in 2023.

- EV and heat pump sales are gaining traction. One in every 10 cars sold in Canada is an EV, and heat pumps hit a historical high of 7% in 2023.

- Rapid deployment of proven technology can slash oil and gas emissions. At least $15 billion will be needed for methane abatement technologies for conventional oil and natural gas producers, which will be critical if oil and gas exports rise as projected.

- Wind power is the leading new source of clean energy, and growing faster than it has in a decade. But 11.5 gigawatts more—equivalent to powering all homes in British Columbia and Alberta—will be needed to meet 2030 renewable energy goals.

- Buildings sector is lagging on retrofits. The sector is well behind what’s needed in emissions cuts with only marginal gains since the pandemic. The annual rate of retrofits remains at 1% compared to the 3% needed.

Where We Are At

In every corner of the country, Canadians are engaging more with climate action. In 2023, one in 10 passenger cars sold was an electric vehicle (EV), and a fifth of those sales required no government subsidy. We also bought more heat pumps than in previous years as sales of these low-emission devices overtook natural gas furnace sales for the first time.

The federal government is well on its way to putting 5,000 electric buses on Canadian roads, or 8% of the current fleet, while Ontario has embarked on one of the world’s most ambitious nuclear energy expansions. Hydro-Quebec has committed roughly $200 billion to making its electricity grid a magnet for low-emissions factories and industrial plants, and British Columbia recently rolled out a 10-year, $36-billion electrification and emissions-reduction infrastructure program.

In short, climate action is happening at every level and sector; it’s just not happening fast enough.

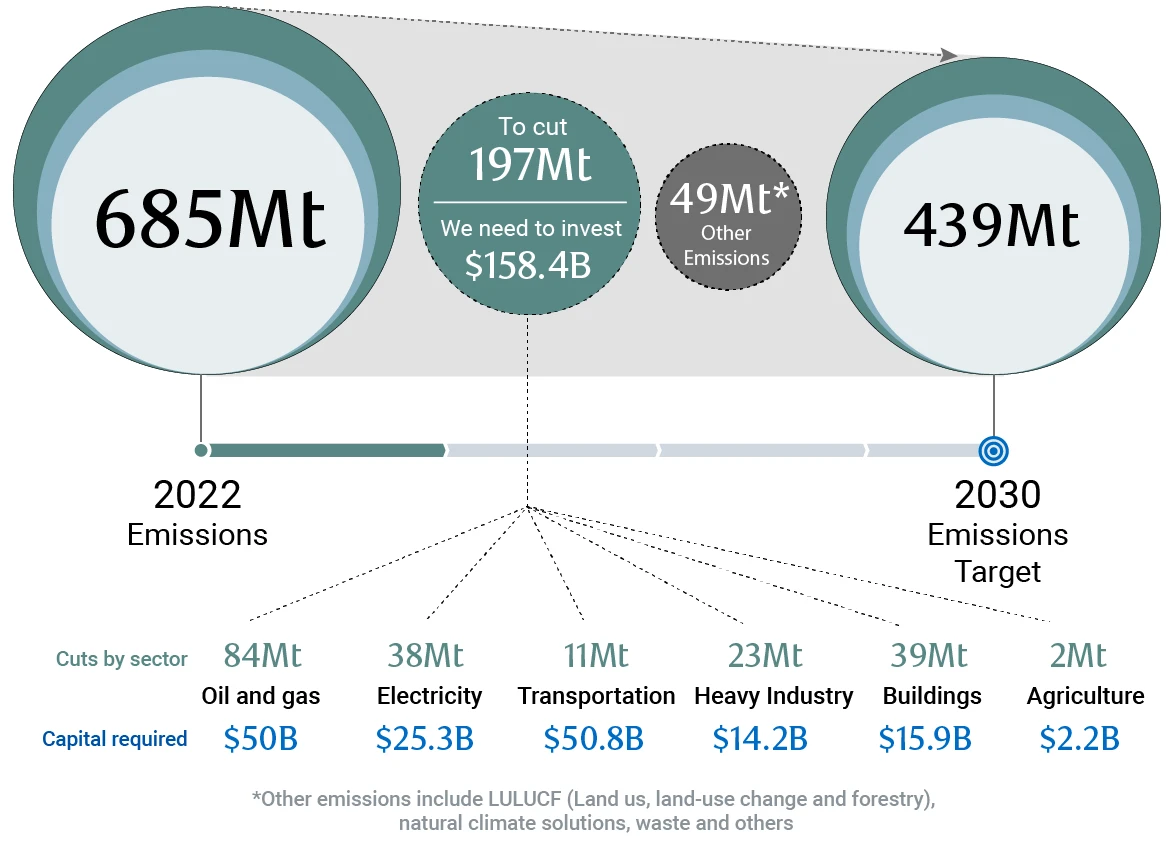

To get on a more sustainable path, Canadians will need to invest even more in new energy, food and transportation systems, and accelerate changes to how we live, work and travel. RBC’s inaugural Climate Action report estimates Canada needs to nearly double climate spending from recent levels of about $22 billion a year in supply-side spending, plus $13 billion in consumer spending, to $60 billion1 in annual investments each year through 2050 as outlined in our report, The $2 Trillion Transition: Canada’s Road to Net Zero(opens new window). Moreover, most of the new public investment will need to come from provinces and municipalities as the federal government, according to our estimates, has covered roughly 80% of the bill and is reaching its fiscal limits. Public markets, private equity and venture capital will need to step up and channel more of their capital into green investments as they’ve injected just 8% of overall capital flows, or $61 billion, since 2021.

The stakes are clear. In 2023, Canada recorded the hottest day, month and year on record. There was an economic toll, too, with $3.1 billion in insured losses from climate-related disasters2. To mitigate those losses and put the country on a faster track to Net Zero, more action will be needed from individuals, businesses and governments.

Consumers Are Cautious

Let’s start with Canadians. We inhabit and navigate one of the largest and coldest countries on Earth and continue to be called on by the world to produce more of everything—from oil, gas and timber to fertilizer, canola and beef. It’s not surprising, then, that our total emissions likely went up in 2023 after a pandemic dip as air and car travel and consumption levels rebounded. Technology is helping us, but we’re not doing enough to help ourselves or the planet. In fact, our research shows most Canadians are not willing to change their lifestyles for high-impact climate action.

According to Our Ongoing RBC-Ipsos Tracking Survey of Attitudes on Climate:

- Only 28% of us are willing to pay more—the so-called green premium for products and services that are verified Net Zero —for food, energy and travel to ensure fewer emissions, and that view is held primarily by younger Canadians.

- The importance of climate change rose slightly after the summer of 2023 when wildfires and other climate-induced disasters captured the world’s attention.

- Nearly half of Canadians (43%) said they had been impacted personally by climate change, and two thirds believed that making small changes in our daily lives could add up to significant impacts3.

- Three-quarters (76%) felt more support and education is needed, and a very large plurality believed the onus for climate action is on businesses (44%) and the government (35%). Expectations of government are even higher in all provinces other than Alberta and Quebec.

- Overall, three-quarters of us felt that given the state of the economy, now is “not the right time” to spend money combatting climate change.

- Fully half feared such measures would result in lower standards of living.

If consumers aren’t willing to pay more or drastically change their habits, we will need to rely more than ever on new technologies. And a big question will be how fast these technologies can be sold affordably and at a mass scale.

Two leading technologies—electric vehicles and heat pumps—are making impressive and important inroads but remain marginal parts of our neighbourhoods and communities. We know from the history of technology disruptions that the speed of change has been accelerating ever since electricity was introduced in the 1900s. It took 30 years for electricity to break through the 10% adoption threshold, 25 years for the telephone, and less than 5 years for tablet computers. Reaching that penetration rate will be critical for EVs and heat pumps, as it’s considered to be the inflection point at which consumer demand is sufficiently robust to sustain and accelerate, exponentially, the pace of adoption.

Governments, through subsidies, have tried to get the market closer to that threshold. But so far, most of that spending has gone to the innovator segment of consumers, who account for 2.5% of the market. To reach the remaining 97.5% of Canadians, more action will be required from manufacturers, distributors and sellers of climate-minded technologies—in how they market and promote their products—and more pressure is likely to fall to governments to continue to pave the way.

Governments Are Wavering

The biggest force in climate action in 2023 was the implementation of the U.S. Inflation Reduction Act of 2022, which in its first full year started to transform the auto industry, electricity sector and renewable energy production with US$310 billion in investments committed to nearly 400 new clean energy projects. The two biggest emitters—the U.S. and China—also set aside geopolitical differences and agreed to triple renewable production, while the European Union adopted a Carbon Border Adjustment Mechanism as a kind of climate tariff on countries with weak climate policies. Perhaps most remarkably, the world agreed for the first time in December 2023—at COP28 UN Climate Change Conference—that we need to transition away from fossil fuels, and triple renewable energy production this decade.

Centrist and left-of-centre governments in North America and Europe continued to drive these state-led approaches to climate action, but that may be difficult to carry through the middle part of the decade. Inflation, at home and abroad, was the dominant political force of 2023—and led many climate leaders from Germany to Britain to Japan to slow down or even reverse course on climate action. Among them, the Canadian government removed its carbon tax on home heating oil and slowed down plans to cap oil and gas emissions.

The federal government’s Budget 2023 also laid out $58 billion for climate action through tax breaks and subsidies, particularly for clean electricity. And it put meat on the bones of the $15-billion Canada Growth Fund.

In total, we estimate Canadian governments have budgeted $200 billion for climate action since 2016, and the bulk of that funding has been directed to just five areas—carbon capture, utilization and sequestration (CCUS), and related clean technologies (47%); clean fuels including hydrogen (11%); energy efficiency and retrofits (10%); and electric vehicle and charging infrastructure (9%).

Provincial spending still accounts for only 20% of that spending over that period. Quebec has been dominant, committing $17 billion since 2016 (3.8% of Quebec’s 2022 GDP), well ahead of Ontario ($12 billion, 1.4%), British Columbia ($6 billion, 1.2%) and Alberta ($3 billion, 0.9%). About two-thirds of those commitments were made within the last two years as a wider range of provinces began to invest more significant dollars in climate action.

Government investments and subsidies are essential to kickstarting any industrial transformation, which is why the federal, Ontario and Quebec governments have committed so much public money to battery plants. The two biggest provinces have announced 12 EV battery plants worth $35 billion. But in an age of competitive industrial policy, can the fiscal taps keep flowing? We may see that tension addressed more directly this year through national elections in the United States, the European Union and India, and as Canada and the U.K. prepare for national elections either in 2024 or 2025.

In a heightened state of public discontent, governments may choose to curtail their ambitions and place more demands on businesses.

Highlights Of A Year In Climate Action

January 2023

- Several northern European countries face record heat on New Year’s Day.

- U.S.-based Piedmont Lithium strikes deal to supply lithium from Quebec to Tesla and LG Chem.

- California storms cause US$1B in damages.

February 2023

- EU proposes Green Deal Industrial Plan.

- Australian government rejects coal mine near Great Barrier Reef

- Ottawa allocates $1.7M for St. John’s Corporate Climate Plan.

March 2023

- British Columbia outlines Net Zero framework.

- UN holds first water conference since 1977 as global warming trigger more droughts.

- U.K. releases Carbon Budget Delivery Plan.

April 2023

- Shenzhen-based EV carmaker BYD Auto Co. becomes China’s best-selling car.

- Alberta outlines plan to reach Net Zero by 2050.

- Chile announces lithium nationalization plan to support EV industry.

May 2023

- EU approves new law aimed at banning imports of commodities linked to deforestation.

- North America’s tallest solar-integrated building begins operating in Saint Mary’s University campus in Halifax.

- Efforts to decarbonize Manitoba’s heavy-duty vehicles gets federal backing.

June 2023

- Vancouver approves Climate Emergency Action Plan.

- Canada’s first renewable diesel refinery built in British Columbia.

- First ever youth-led constitutional climate case goes to court in the U.S.

July 2023

- Canada’s Clean Fuel Regulations come into effect.

- Ontario strengthens nuclear sector with Bruce Power expansion and three small modular reactors.

- First EU Day for the Victims of the Global Climate Crisis.

August 2023

- Canadian wildfire carbon emissions double 2014 record.

- Ottawa’s Clean Electricity Regulations outline Net Zero electricity grid by 2035.

- Australian miner Rio Tinto announces largest solar power plant project in Canada’s North.

September 2023

- First Africa Climate Summit takes place in Kenya.

- U.S. revokes Alaskan Arctic drilling licenses affecting 19.6-million-acres of wildlife habitat.

- EU mandates airlines to increase sustainable aviation fuel targets.

October 2023

- EU dedicates €118B to climate change—a third of its 2021-27 budget.

- Ottawa announces low-income household funding to accelerate heat pump adoption.

- Ottawa pauses carbon tax on heating oil in the Atlantic; Saskatchewan did the same for natural gas bills.

November 2023

- Parkland Corp. secures $210M investment from Canadian Infrastructure Bank to expand EV network.

- Taylor Swift postpones Rio de Janeiro concert after extreme heat wave.

- Fertiglobe ships world’s first certified renewable ammonia produced using green hydrogen.

December 2023

- Mississauga installs 32 EV chargers, becoming Ontario’s largest charging hub.

- Canada aligns with Global Methane Pledge by strengthening oil and gas methane regulations.

- 15 Canadian youth activists file lawsuit challenging governmental inaction on climate change.

Business Is More Committed

With consumers unwilling to pay more and governments tapped out, the onus for climate action in the year ahead may fall disproportionately on businesses, especially large companies. Many executives told us they’re ready for the challenge.

Businesses are already at the forefront of Canadian climate action whether it’s WestJet establishing some of North America’s first flights with sustainable aviation fuel or Mountain Equipment Co. committing to cut emissions by 55% by 2030. For this report, we joined forces with the consultancy EY Canada to survey CEOs on their own strategies and confidence on climate action.

Here’s What They Said:

Two-thirds of firms have implemented a greenhouse gas emissions reduction strategy with larger companies more likely to do so.

Most say their strategies are driven by C-suite thinking, followed by customer and client demand.

More than half (56%) have interim emissions reduction targets for 2030, and two-thirds (67%) have executive compensation targets based on the company’s climate performance.

Most (96%) are confident they will hit those interim targets with energy and industrial firms expressing the most confidence.

The biggest worry: politics Business leaders are concerned most about policy disruptions and regulatory uncertainty, followed by erratic approaches to tax incentives and technology uncertainty.

With that level of confidence and the abundance of public money we discussed above, it’s no surprise there’s a climate-focused building boom underway in many parts of the country. We analyzed major projects announced in 2023, and 60% could be classified as clean tech or clean energy. Even as the economy was slowing, billions of dollars in new investment flowed across the country to heavy industry, oil and gas and renewable energy. In Edmonton, German-owned Heidelberg Materials began work on the world’s biggest carbon capture and sequestration project for a cement facility, which eventually will prevent 1 million tonnes of emissions from entering the atmosphere. Tidewater Renewables opened Canada’s first renewable diesel refinery in Prince George, B.C., replacing oil as a feedstock with canola oil and other biofuels. And in the Northwest Territories, Rio Tinto broke ground on the Canadian north’s largest solar power facility with 4,400 solar panels that will power the Diavik Diamond Mine with emissions-free electricity.

Higher Education: Laying New Foundations

Colleges and universities have become climate leaders by transforming campuses and buildings to be more sustainable, enriching curricula with climate-oriented courses, and advancing efforts to build the skills needed for a Net Zero economy.

Our research shows universities now offer about 400 post-graduate programs and courses in which climate and sustainability are a central focus. These offerings are concentrated in two provinces—Ontario and Quebec—which account for 54% of programs. And although most are built on existing environmental science and engineering programs, a growing number can be found in business, social science and law programs.

Colleges and polytechnics are playing a significant role in filling the skills trade demand that is needed to build and install millions of car batteries, heat pumps and hydrogen plants. Canada needs three million people to be trained or reskilled for the energy transition, according to RBC research. And yet, 70,000 skilled workers are expected to retire over the next five years.

Post-secondary institutions are also showing what can be done with the built environment, greening campuses and buildings in ways that are catching international notice. In the 2024 QS World University Rankings, five Canadian schools were listed among the top 30 most sustainable universities including the University of Toronto, which placed first with strong ratings for environmental and social impact.

Private markets are generating more than sufficient capital to finance more of this transition. Of the $248 billion dollar raised in 2023, in public and private markets, $14.2 billion or 6% of overall capital flows, were earmarked for green projects or to support clean-tech companies. Reaching our 2030 targets will require an additional outlay of 39% or $9.1 billion annually, based on our updated cost estimates.

Will companies and investors maintain confidence to drive innovation through the mid-2020s? An expected drop in interest rates should help with the cost of capital. And the public supports announced in the first part of this decade—in Canada, the U.S. and Europe—will likely continue for their budget periods at least, which many companies will be keen to take advantage of during a slow growth period.

Shareholders may also continue to push for climate action. With such forces at play, companies looking for a competitive and innovative edge through a mid-decade economic expansion may see climate action as a strategic opportunity and not just a cost of doing business.

But history shows that change cannot be sustained solely by the supply side of an economy. For Canada to drive more climate action—indeed, to drive the action necessary to meet our collective commitments—we will need to see much more change in consumer demand, individual choice and community action.

Perhaps the message to Canadians is this: everyone will need to double down.

Reconciliation: Building Equity

With a third of wind, and two-thirds of solar capacity deployed by private Canadian players in partnership with Indigenous communities in recent years, the slow motions of Indigenous reconciliation is finally picking up speed. Expanding these partnerships may hold the key to tapping more opportunities, as more than 10% of Canada’s planned wind and solar capacity are in areas that could impact Indigenous lands.

Sensing a new momentum, private and public entities are drawing new rules of community engagement across the energy spectrum. Hydro One’s Waasigan Transmission Line Project in northwestern Ontario approved in 2023 is the first of its kind to include 50% equity partnership with nine First Nations. Meanwhile, 23 First Nations and Métis communities acquired an 11.57% non-operating interest valued at $1.12 billion in seven Enbridge pipelines in northern Alberta. The Alberta Indigenous Opportunities Corp. provided a loan guarantee that made the project financially viable for Indigenous groups. In addition, the First Nations backing – indeed, spearheading two liquefied natural gas projects on the West Coast (the Nisga’a Nation’s Ksi Lisims LNG project and Haisla majority-owned Cedar LNG) underscore the desire of many Indigenous communities to write a new chapter in natural resource development.

This new approach to reconciliation may be critical to Canada’s climate goals given the vast land, energy and mineral resources now under Indigenous control or stewardship. Canada ranks second only to Australia in potential for the minerals needed to power a lower-emissions economy. But much more progress will be needed to secure access to those resources. For critical minerals, which will be essential to the EV and battery industries, at least 56% of the $60 billion in identified projects involve Indigenous lands including 26% within 20 kilometres of Indigenous reserves, settlement lands, and other title-like areas, and another 30% on unceded territories where Indigenous rights are asserted4.

Many resource companies remain wary of attempting projects in the face of uncertainties around disputed lands and protected areas as well as regulatory delays. In Ontario, for example, 18% of mining companies see disputed lands as a strong investment deterrent. Legal standards for meaningful consultation, and consent have pushed the timeline for typical projects to the 10 to 15-year range.

Ontario’s Ring of Fire could serve as a litmus test. The remote northern area is brimming with nickel, chromite and other metals worth an estimated $60 billion. But the mining region also faces challenges including lack of infrastructure and insufficient Indigenous support, in part because of disagreements over economic benefits and governance. Negotiations may continue, and they are not without hope—or partnership models. A good example is Oneida Energy Storage project in Haldimand County, Ontario The 250-MW project, which is set to be operational in 2026, is a joint venture between Six Nations of the Grand River Development Corp., Northland Power, NRStor and Aecon Group. Not only will it reduce emissions and create opportunities, it also provides the community with equity, training and employment. “The world was effectively built around us,” said Matt Jamieson, CEO of the Six Nations of the Grand River Development Corp5. “The green energy economy … was really an opportunity for us to participate in a new paradigm of economic development and ownership.” Reconciliation, in other words.

Important Notice Regarding Information on this Website and Caution Regarding Forward-Looking Statements

The information on the Climate Action Institute website is intended as general information only and does not constitute an offer or a solicitation to buy or sell any security, product or service in any jurisdiction; nor is it intended to provide investment, financial, legal, accounting, tax or other advice, and such information should not to be relied or acted upon for providing such advice. Nothing herein shall form the basis of or be relied upon in connection with any contract, commitment, or investment decision whatsoever. The reader is solely liable for any use of the information contained herein, and neither Royal Bank of Canada and its subsidiaries (“RBC,” “we,” “us,” or “our”) nor any of RBC’s affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damage arising from the use of any information contained herein by the reader.

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including on this website, in filings with Canadian securities regulators or the U.S. Securities and Exchange Commission and in other communications. Forward-looking statements on our websites include, but are not limited to, statements relating to our economic, environmental (including climate), social and governance-related objectives, vision, commitments, goals and targets as well as potential events and actions. By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, and that our objectives, vision, commitments, goals and targets will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors – many of which are beyond our control and the effects of which can be difficult to predict – could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest Climate Report, available at our ESG Reporting site.

Except as required by law, none of RBC or any of its affiliates undertake to update any information on this website.

All expressions of opinion on this website reflect the judgment of the authors as of the date of publication and are subject to change. We do not guarantee the accuracy of the information or expressions of opinion presented herein and they should not be regarded as a complete analysis of the subjects discussed. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC or any of its affiliates.

All references to websites are for your information only. The content of any websites referred to on this website, including via website link, and any other websites they refer to are not incorporated by reference in, and do not form part of, this website. This website is also not intended to make representations as to ESG-related initiatives of any third parties, whether named herein or otherwise, which may involve information and events that are beyond our control.