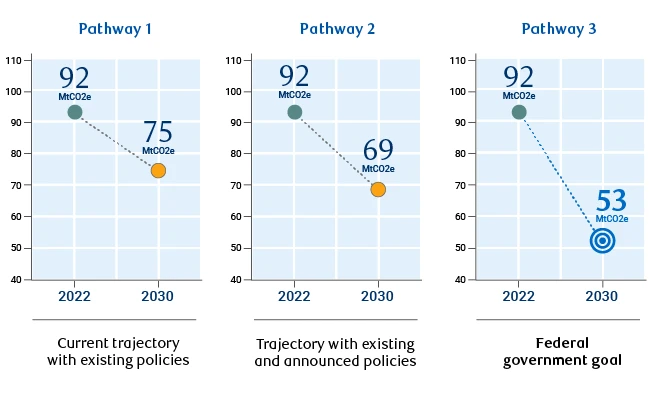

Pathways to 2030

Emissions declined by 1% from a pre-Covid peak in 2019, but have risen 9% since 2005.

Reaching Net Zero will require retrofitting half of Canada’s existing 16.7 million homes.

The Year In Climate Policy

The federal government exempted its carbon tax on home heating oil for three years.

Ottawa released its first National Adaptation Strategy, focused on climate adaptation and resilience and changes to the National Building Code.

Canada and the UAE launched the Cement and Concrete Breakthrough initiative at COP28 to boost global production and use of low-carbon cement by 2030.

Prince Edward Island led other provinces in the development of energy efficient homes: 1 in 5 new PEI homes is certified as Energy Star.

Shipments of heat pumps surpassed shipments of conventional furnaces in Canada.

Canada Lags Peers In Building Retrofit Policies

Retrofit Index Score (/100)

Source: 3 Keel, Global Retrofit Index Report, RBC Climate Action Institute

Three Things To Watch In 2024

Provincial compliance with Canada’s 2020 National Model Codes, including those for building and construction, starts in March 2024.

The Buildings and Climate Global Forum in Paris, featuring first ministers and CEOs, will gather to establish a global framework for decarbonizing the building sector.

Almost all the 35 Paris Olympics venues are upcycled, and new construction uses timber as its primary building material.

CASE STUDY

The Net Zero Community Playbook

Land Ark Homes

Westport, ON

THE SPARK

Stephen Rolston, a retired home builder and a full-time volunteer, had a spark of inspiration walking through Niagara-on-the-Lake: the tree-lined streets and homes with massive front porches were reminiscent of the ecologically minded, small-town community he grew up in.

After seeing the postcard-perfect town in Ontario’s Niagara region, Rolston returned to Land Ark Homes(opens new window) – a company he had founded and then left dormant -- to work on his New Urbanism idea. He could see more than an idyllic community in the use of mixed-use, pedestrian centric neighbourhoods with abundant public parks and green spaces, and walkable “Main Street” commercial areas with shops and businesses. As his 10th project, Watercolour Westport could be Land Ark’s greenest community yet.

THE CHALLENGE

Many of the features that Rolston sought to include in Watercolour Westport are responses to things they noticed were missing in towns and cities across Canada. For instance, land plans do not incorporate Net Zero walkable communities that connect people to nature and each other. The development of suburban sprawl that forces residents to use their cars and contend with traffic for daily errands, most new homes aren’t built to endure the test of time requiring major retrofits in the next 25 years. And there is a lack of knowledge amongst buyers about the value of Net Zero construction.

The hollowing out of small towns has also been going on for decades, exacerbated by the decline in manufacturing as well as closing of mills, fisheries, and factory farms in rural areas. Rolston and general manager Kevin Rankin were motivated by “the vision of bringing year-round sustainability and resilience to a remarkable village.”

THE SOLUTION

Watercolour Westport is a walkable, Net Zero community development in Westport, Ontario—a picturesque village on the UNESCO-designated Rideau Canal Waterway, and with proximity to the 1000 Islands. Westport is situated on the Upper Rideau Lake, only an hour and a half to downtown Ottawa, and 45 minutes to Kingston. All its homes are built to Net Zero Ready standards (that are set to be mandated in 2030) for comfort (improved insulation), for efficiency (cold-climate air source heat pumps), for indoor air quality (super-tight building envelope), and available EV charging station—part of Land Ark’s desire to build future proof homes that last—why build obsolete? The company is also dedicating 15% of the Watercolour development for parks and preserving greenspace (i.e., ponds, trails, walking paths) for public use.

Rolston and Rankin credit their success, in part, to the fact that Land Ark Homes had been on a pause for a dozen years. “If it hadn't been for that break, I don't think we would have evolved the way we did. We would have just been the same old, same old,” said Rolston.

WHAT’S NEEDED

Getting Watercolour Westport built required “stumbling and fumbling and bumbling and brain cell death, a lot of money and a lot of coaching,” according to Rolston. What helped was a large network of associates and subject matter experts who stepped in to consult on building Net Zero ready and train staff and contractors. Additionally, the Land Ark team believes in the importance of third-party validation, including from Natural Resources Canada, to build trust with potential buyers. Along the same vein, the homebuilder has invested in content and education (including numerous YouTube videos and video, webinars and on-site events) to spread the word and disseminate their playbook. Raising consumer awareness of the value and benefits will also drive industry changes to achieve Net Zero construction targets sooner.

As for what advantages are conferred from being in Canada? Ontario’s clean grid helps. Rolston and Rankin also see an immense opportunity to replicate Watercolour across the country. At least a thousand communities could be revitalized in a similar vein, spurred by greater affordability in smaller towns and a belief that people will choose to live in places with core amenities within walking distance, combined with easy access to nature, rather than paying higher prices and propagating suburban sprawl.

WHAT’S NEXT

A key challenge that Rolston and Rankin face in building homes to full Net Zero energy is Ontario’s restrictions on connecting renewable power systems to the grid. An essential part of Watercolour’s value proposition is coaching residents on how to best maximize renewable sources of electricity to fully power their homes, including energy storage solutions for worry-free living during electrical grid outages. Safe and reliable solutions to address energy price inflation, and the impact of electrical outages, are available today. A homeowner need not even experience a ‘flicker’ when the power goes out. The problem: each homeowner is constrained by a 10kW generation capacity limit. (There are exceptions to the 10kw limit, but regulations make it cost prohibitive).

This limit is 10 times lower than the 100 kW in B.C., and five times lower than Quebec’s 50kW limit. It has forced Watercolour to scale back, including reducing renewable energy storage options with Tesla Powerwalls, and limiting roof-top solar to a maximum 5kW if a homeowner wants worry-free, maintenance free electricity supply during an outage. Ontario is behind. The fix is simple for the Ontario energy regulator to make, and follows on proven safe and reliable examples from around the world. Of course, the changes would also align with Canada’s sustainability objectives, and would unlock personal private capital to fund renewable energy generation immediately.

Deep Dive

Heat Pumps

- Heat pumps penetration hit a new high. Around 7% of Canadian homes had heat pumps in 2023.

- Subsidies and early adopters have driven demand. The challenge now is to scale heat pump installation through market forces.

- Home-building spree could exacerbate emissions challenge. But home builders have been slow to adopt new playbooks and technologies.

- Market barriers are limiting growth. High upfront costs, limited consumer awareness and value chain complexity pose challenges to adoption.

- The Netherlands may have an answer. The Dutch concept of lower costs, higher customer awareness and alleviating supply chain challenges, or Energiesprong, is coming to Canada.

Canada is in the early stages of a historic building boom, which by the end of the decade may transform the way we live and organize our communities. It’s not just about the current squeeze of affordable housing. Canada is the only G7 country with an ambitious immigration plan that is projected to add 500,000 new permanent residents per year—more than 1% of the population—through the rest of the 2020s, requiring 260,000 new homes a year, on average, to be built.

It’s no surprise, then, that governments are pouring money and other policy supports into home-building, which is only adding to tensions between affordability and sustainability. Our national building stock already accounts for 13% of Canada’s emissions, which could rise both with population growth and extreme weather as roughly 75 to 85% of building emissions are generated from heating and cooling.

How we build homes and develop communities may need a rethink if we’re to add millions of new units and reduce our overall emissions. Yet home builders have been slow to adopt new playbooks, relying instead on the 20th century model of speed, quantity and price. Single detached homes, for instance, which account for 52% of Canada's housing stock, are much larger than condos. They are 1.7 times bigger typically, and require more energy to heat and cool. In most communities, heating continues to rely on oil and gas.

Homeowners Are Embracing Heat Pumps

Source: Statistics Canada

NB: Figures do not add up to 100% due to exclusion of several types of heating systems; 2030 figure is an estimate by the RBC Climate Action Institute

Cooling On Conventional Furnaces

Increasingly, builders and owners are looking to heat pumps as a solution. Nationally, such devices could cut annual residential operating emissions by up to 24 million tonnes or 26% of the buildings sector’s footprint—the equivalent to removing six million gas powered vehicles from the road each year or all cars in Quebec1.

Heat pumps work like air conditioners, but in reverse using electricity to gather heat from the outside and moving it inside, even in cooler months. For cost as well as climate-minded homeowners, heat pumps have become a compelling option to oil and gas furnaces2. In 2023, the penetration of home heat pumps reached a new high of 7%.

The growth curve for heat pumps, though, needs to be steep, and not just for new builds. Oil- and gas-powered furnaces can be found in almost half of Canada’s 16.7 million homes. But there are signs that Canadians may be cooling on fossil-fuel powered furnaces with sales declining at an annual rate of 1% starting in 2017. Moreover, 2021 saw another historical first—shipments of heat pumps surpassed shipments of conventional furnaces3.

Heat pump adoption is on course to reach 10% by 20304. That kind of adoption rate is critical for technology adoption because it’s the point when growth typically starts becoming exponential, moving beyond market traction to market maturity, and finally market saturation. Although still at an early stage, there are signs that the shift in homeowner preferences has staying power. But it may take more than market forces to narrow the green premium gap.

To date, half of all homeowners who received the federal government’s Canada Greener Homes Grant chose to buy a heat pump5. Nova Scotia and New Brunswick both introduced heat pump subsidies programs in 2017, and their impact on heat pump adoption was evident by 2019. The Nova Scotia program, administered by the province’s energy efficiency agency, EfficiencyOne, led to a four-percentage-point increase in the share of homes with a heat pump from 14% to 18%6. The impact in New Brunswick was even more profound. The share of homes with a heat pump jumped from 17% to 28%7.

For these homeowners, government subsidies tilted the economics of heat pumps in their favour, especially for standard ducted heat pumps. The “green premium” for a base model standard ducted heat pump disappears with a maximum grant of $5,000. For more expensive cold-climate ducted heat pumps, where average cost is between $10,000 to $19,000, a $5,000 subsidy can cut upfront costs from between 26% and 50%. (Energy advisers are also driving demand through their recommendation of heat pump retrofits over other types of building envelop and insulation upgrades, and the federal government is funding the training of 2,000 additional people for such jobs.)

Keeping The Cheques Coming

The success of the Canada Greener Homes Grant puts the federal government in a precarious position of closing the program to new applicants starting in March 2024, just as broader public interest in heat pumps reached its highest point in late October 20238. The grant will have directed an estimated $1.3 billion towards heat pump adoption by the time the last cheque is cut9. This figure is roughly equivalent to the amount of capital spending required to electrify homes with heat pumps10.

Supply chain challenges remain another concern as demand for heat pumps from Munich to Minneapolis grows. Around 40% of the world’s heat pumps are manufactured in China, which is both a leading exporter and domestic user of the technology. Limited data makes it difficult to assess the role of supply chain constraints, but our market assessment suggests that there’s no mismatch between supply and demand for heat pumps, technicians and energy advisers currently11. That said, the market could be strained soon. Globally, the world bought more heat pumps than fossil fuel-based heating systems in 2022, according to the International Energy Agency, crossing that divide for the first time.

Greener Home Grant's Popularity Has Led To A Backlog

Source: RBC Climate Action Institute analysis of NRCan and CMHC data

Googling of Heat Pump by Canadians

Search interest, 100 = peak popularity for the term

Source: Google Trends, RBC Climate Action Institute

An Energy Leap

For the past two decades, European governments have been developing and experimenting with different market-based solutions that address the eventual need to end government subsidies and subsidized demand for building retrofits including for heat pumps. The Dutch government, in particular, is noted for its Energiesprong concept. Created in 2010, Energiesprong, which loosely translates into “energy leap,” is the Netherland’s approach to lowering upfront costs, raising consumer awareness, and alleviating supply chain coordination challenges that are holding back the country’s home retrofit and climate ambitions.

Energiesprong is a concept of mass retrofits at a neighbourhood level. These retrofits are led by market development teams (MDT), whose role is to convene and coordinate supply and demand side actors to broker retrofit projects. The concierge like services provided by MDTs address the known informational and supply chain challenges that homeowners face, and which are material barriers to adoption. The bundling of retrofits across groups of similar dwellings enables bulk buying and greater power to negotiate on prices, leading to lower equipment, materials, and labour costs. Cost savings are passed down to homeowners. Energiesprong is most effective when the groups of buildings are similar in design and build. Similarity creates less variance in the type of work and building materials required, resulting in lower costs.

Given the uniformity of Canada’s housing stock, much of which was built after World War II with a limited number of designs, it’s not surprising the concept has been studied for its viability for almost a decade. Pockets of Energiesprong exist across Canada including a 59-unit retrofit of a 1970s townhouse complex in Edmonton by ReNü Engineering.

But the concept has yet to gain traction. The federal government is aiming to change that through its Greener Neighbourhoods Pilot Program. The $35.5 million program announced in 2023 will provide six communities with funding to assess whether the aggregation of regional demand and a “concierge” approach can help accelerate the greening of Canada’s building stock. The success of this program could very well shape the trajectory of heat pump adoption through the 2020s.

European Demand in Heat Pumps Driven by Generous Subsidies

| Countries | Maximum Subsidy |

|---|---|

| Canada | $5,000 CAD |

| France | € 15,000 |

| Germany | € 18,000 |

| Italy | 50 to 110% of heat pump costs |

| United States | $8,000 USD |

Source: RBC Climate Action Institute analysis of publicly available program data, for each listed jurisdiction

Important Notice Regarding Information on this Website and Caution Regarding Forward-Looking Statements

The information on the Climate Action Institute website is intended as general information only and does not constitute an offer or a solicitation to buy or sell any security, product or service in any jurisdiction; nor is it intended to provide investment, financial, legal, accounting, tax or other advice, and such information should not to be relied or acted upon for providing such advice. Nothing herein shall form the basis of or be relied upon in connection with any contract, commitment, or investment decision whatsoever. The reader is solely liable for any use of the information contained herein, and neither Royal Bank of Canada and its subsidiaries (“RBC,” “we,” “us,” or “our”) nor any of RBC’s affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damage arising from the use of any information contained herein by the reader.

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including on this website, in filings with Canadian securities regulators or the U.S. Securities and Exchange Commission and in other communications. Forward-looking statements on our websites include, but are not limited to, statements relating to our economic, environmental (including climate), social and governance-related objectives, vision, commitments, goals and targets as well as potential events and actions. By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, and that our objectives, vision, commitments, goals and targets will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors – many of which are beyond our control and the effects of which can be difficult to predict – could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest Climate Report, available at our ESG Reporting site.

Except as required by law, none of RBC or any of its affiliates undertake to update any information on this website.

All expressions of opinion on this website reflect the judgment of the authors as of the date of publication and are subject to change. We do not guarantee the accuracy of the information or expressions of opinion presented herein and they should not be regarded as a complete analysis of the subjects discussed. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC or any of its affiliates.

All references to websites are for your information only. The content of any websites referred to on this website, including via website link, and any other websites they refer to are not incorporated by reference in, and do not form part of, this website. This website is also not intended to make representations as to ESG-related initiatives of any third parties, whether named herein or otherwise, which may involve information and events that are beyond our control.