Pathways to 2030

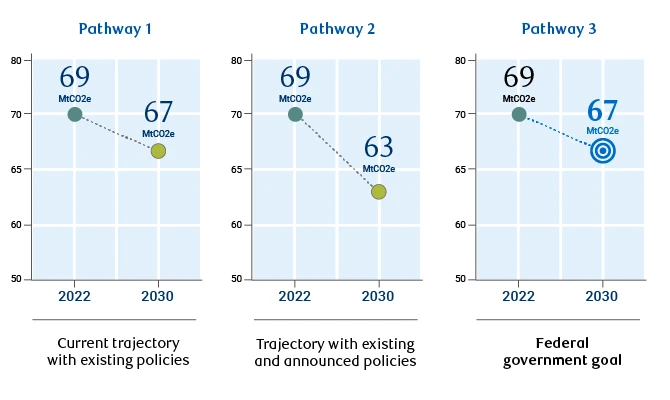

Sector is on track to meet its 2030 targets, with the potential to surpass them.

Agriculture can remove 35-38 million tonnes of carbon by 2050 if it adopts smart climate practices.

The Year In Climate Policy

New draft federal rules to reduce enteric methane emissions (released into the air by cows) laid the groundwork for a cap-and-trade market for cattle farmers.

Ottawa launched consultations with the sector to develop a sustainable agriculture strategy for the country. A final report is awaited.

The UN’s Food and Agriculture Organization released a three-year roadmap aimed at reducing livestock methane emissions by 25% and food waste emissions in half by 2030.

Principal crop production fell 13% year-over-year, 8.3% below the previous five-year average, due to widespread droughts across the Prairies. Wildfires also disrupted food production in B.C. and elsewhere.

U.K.-based CNH Industrial N.V. rolled out the world’s first methane powered tractor.

Canada's Ag Emissions Lower Than Most Peers

Emissions (CO2eq)(kt)

Source: Food And Agriculture Organization, RBC Climate Action Institute

Three Things To Watch In 2024

Funds for federal programs such as On-Farm Climate Action Fund, part of the Agricultural Climate Solutions program, end in fiscal 2024–25.

U.S. Congress expected to pass a bipartisan Farm Bill focused on food security and sustainability.

The European Commission allocating €185.9 million in 2024 to promote sustainably produced agri-food products.

CASE STUDY

A Biological Awakening

Beattie Acres & Trucking Ltd.

Kyle, Saskatchewan

THE SPARK

Saskatchewan farmers Robert and Glenda Beattie have a front row seat to climate change. They’ve seen rainfall patterns decline to a low of four inches since 2017, compared to an average of 8-12 inches in previous years. These are near Sahara Desert averages.

“Either you figure out a way to reduce the costs on input side and increase profits, or basically put it for the sale. Why would you run everything into the ground?” Glenda told Robert after crunching the numbers.

With drought conditions worsening and his synthetic fertilizers and chemical fungicides not aiding their soil’s water retention, Robert resorted to biological solutions to decrease soil degradation—to solve a chronic issue that’s costing North American farmers US$3 billion annually.

THE CHALLENGE

The Beatties came to farming late in life. Robert, an electrical engineer, retired from Sasktel, and dabbled in investment securities before he and Glenda bought their farm. Now they grow wheat, legume and canola on their 3,500-acre operation near Kyle, in southwestern Saskatchewan.

THE SOLUTION

The challenge the Beatties are trying to resolve is removing synthetic fertilizers to a point where they’re paired in a balanced relationship with biologicals.

Products such as bio-controls, bio-stimulants, bio-pesticides and bio-fertility can serve as critical add-ons or substitutes to traditional agricultural solutions such as chemical pesticides and fertilizers. Together, these solutions can promote healthier soils and increase efficiencies.

Among their strengths, biologicals help plants manage heat stress and improve access to water, an especially important characteristic during frequent extreme weather and drought conditions.

The Beatties synthetic fertilizer use has dropped from 150 pounds to 30-50 pounds per acre, with biologicals replacing them. The decision to stop using environment-harming fungicide five years ago has also paid off with higher profits for the Beatties.

“The biology fell into place once we got the process going and saved around a minimum of $40 per acre. Over 1,000 acres, that’s $40,000,” Robert said.

WHAT’S NEEDED

The Beatties got into biological methods around four years ago as droughts became a frequent occurrence and synthetic chemicals exacerbated the soil’s inability to hold water.

“The most important thing is, if we don’t introduce biology then we can’t help our “drug addicted” soil to make up for losses from NPK (nitrogen, phosphorus and potassium),” says Robert.

While the current drought is slowing the Beatties’ ability to use more biological solutions, it will eventually lead to greater environmental and financial outcomes.

However, most agrochemical companies do not actively promote biological solutions. Regulatory hurdles, such as delays in registering innovative products into the market, is also holding back biologicals. There’s also a lack of access to solutions and materials. That limits the options to access a wide array of biological solutions or materials to make your own biological options.

Another barrier to biologicals is the benefits that synthetic chemicals offer, including packing a higher density of nutrients in smaller amounts and longer shelf life.

WHAT’S NEXT

In a market that could be worth US$12 billion, Canada is in a unique position to lead, given the resources required and their abundance in rural regions where firms making biologicals tend to be located.

Robert argues that both types of fertilizers have their place in a farmer’s toolkit: together they increase soil health that would boost carbon sequestration, ensure the proliferation of microbial life such as worms increase food yields boost profits and ensure more resilience to extreme weather events.

Canadian farmers can adapt quickly to change. “Following the lead of Commonwealth countries, a mandate to reduce synthetics could motivate Canadian farmers to use biologicals,” Robert suggests.

Deep Dive

Carbon Markets

- Agriculture can help cut Canada’s emissions. The sector has the potential to capture 35 million tonnes of carbon.

- There’s an appetite for carbon markets. Food producers and retailers are willing to pay to offset their own emissions.

- But Canada’s missing out on the big opportunity. More than half of new voluntary carbon market projects globally focus on agricultural and forestry, but only a handful are Canadian.

- A key carbon market pre-requisite is flawed. Measuring carbon sequestration is complex, making farmers’ efforts risky and costly.

- A national approach is needed to credibly measure, report and verify carbon sequestration. That’s going to be key for private carbon markets to thrive.

As one of the world’s leading food producers, Canada was an early player in what’s become known as climate-smart agriculture, and emerging economic models that reward farmers for those practices

Prairie farmers began adopting no-till and other regenerative agriculture practices in the 1970s, largely to prevent soil erosion but indirectly also securing organic carbon matter in their land. More recently, federal and provincial programs have helped farmers cut nitrous oxide and methane emissions. B.C. has successfully removed an estimated 8.7 million tonnes of emissions through efforts like the Fuel Switch and Greenhouse Gas Offset Protocol: Methane from Organic Waste.1 Alberta, which established North America's first carbon market in 2007, has issued over 84 million carbon offset credits.2 And Quebec's cap-and-trade system, linked to California, allows farmers to access credits for both methane reduction and increased carbon sequestration for agro-forestry.3

For its part, the federal government introduced the Reducing Enteric Methane Emissions from Beef Cattle draft protocol in 2023 to generate credits for producers if they can demonstrate their activities or measurements are reducing ruminant methane emissions.4 It’s one of the most substantial policy developments the sector has seen over the past year to tackle methane.

Agriculture accounts for 10% of Canada’s emissions, which can be turned into valuable assets that food companies and investors can trade to offset their carbon footprint or lower a company’s Scop3 emissions.5 Carbon markets focused on agriculture provide a way to reward farmers for environmentally-minded practices and can be a lucrative opportunity for farmers to diversify risk and revenues. That’s going to be especially important as farmers face frequent extreme weather conditions that can disrupt business models and erode their ability to invest in climate technologies. What Canada is missing is a framework for a carbon market to take off.

On the supply side, private carbon markets encourage farmers to adopt sustainable agricultural practices such as conservation tillage, cover cropping, and methane reduction strategies. They can also help fund expensive carbon sequestration practices. Preserving forestlands on a B.C. farm, for example, can cost $63,000 to support annually.6 Soil measurement systems can also be expensive to maintain across the average Canadian farm spanning more than 800 acres.7

Climate Smart Agricultural Practices Are Costly

Source: UBC study for BC Ministry of Agriculture, Food and Fisheries, RBC Climate Action Institute analysis8

On the demand side, such carbon markets can provide companies with credible options to reduce their own net emissions through the purchase of credits. Internationally, this has become especially appealing through “inset” models that allow companies in the food supply chain—processors, packagers and retailers—to buy credits that help them reach their own Net Zero targets.

Competitors Are Moving Fast

The world is moving ahead with novel solutions to power carbon markets. Last year saw significant momentum to build viable carbon markets, especially through robust monitoring, reporting and verification (MRV) guidelines that enable transparent and credible markets. Chinese policymakers recently set up a national MRV framework, a key pillar of the country’s carbon action plan before 2030. The U.S. invested US$300 million to create a new MRV framework. The EU also approved a carbon removal certification process that recognizes practices that sequester carbon.10,11 In Canada, policymakers have held roundtables with the sector focused on developing sustainable agriculture programs, but there is no Canadian strategy to date.

In recent years, the U.S., India, South Africa, Indonesia, and Vietnam have also established crediting mechanisms to drive growth of their carbon markets and demand worldwide. In 2022, 54% of new voluntary carbon markets projects globally that created credits were focused on agricultural and forestry, although only a few were Canadian.12

According to a recent report by the Organisation for Economic Co-operation and Development (OECD), if the public and private sectors only funded the adoption of new abatement practices and technologies, farmers could remove 5.1% of global emissions for less than US$50 per tonne of carbon dioxide equivalent (CO2eq).13

A recent wave of projects is driving demand with global carbon markets expected to grow between 1.5 and 2 gigatonnes of carbon dioxide equivalent (GtCO2e) by 2030 and increase to 7 to 13 GtCO2e by 2050.14 Some projections suggest the average price of carbon in such markets could reach US$38 per MtCO2e by 2039 in the U.S. compared to the average voluntary carbon price today of US$6.97.15,16 If carbon markets only limited themselves to removals and did not allow the sale of avoidance credits, prices could potentially grow to US$250 per MtCO2e.17

Canada Trails U.S. And China In Voluntary Carbon Markets

Credits issued by issuance year of forestry and land use projects

RBC Climate Action Institute analysis from the Berkeley Public Policy Voluntary Registry Offsets Database18

What Canadian Farmers Want

Nearly 90% of Canadian farmers believe environmental practices help increase soil productivity and production, according to a survey by the RBC Climate Action Institute. Inherent environmental benefits such as carbon sequestration and increased biodiversity are integral to these practices, but for most farmers, the primary driver of any practice change is profitability.

Farmers told us they have been integrating climate smart practices for more than a decade but require financial incentives, perhaps through the carbon market mechanism, to further increase adoption. Around a third of respondents articulated a strong preference for private market solutions like carbon credits or insets. Government funding for such action is limited and doesn’t have the scale to meet projected demand. A $200 million On-Farm Climate Action Fund that began in 2021 only met the needs of 2.6% of all farms in Canada.19

What Farmers Want

Share of respondents

Source: RBC Climate Action Institute | Sum across categories doesn't equal to 100% due to multiple selection

Farmers Face Barriers To Adoption

Share of respondents

Source: RBC Climate Action Institute survey | Note: Sum across categories doesn't equal to 100% due to multiple selection

What Ails Carbon Markets?

Even in the most advanced economies, carbon markets for agriculture are still at an early stage of development. Most lack either the breadth or depth to attract major sources of capital, or to mobilize large numbers of farmers to adjust their practices. Recent controversies in Brazil among others, which failed to fulfill the promise of carbon credit programs, have also dampened confidence, raising questions about the quality of credits—and whether land preservers were either doing what they pledged or rewarded by intermediaries. Measuring carbon is complex and can be flawed. Participating in a program can be costly for farmers, and credits that are ultimately issued may not be valuable.

In Canada, carbon markets face two additional drawbacks. First, Canadian credits pay out $25 per acre on average compared to the U.S., where John Deere and Cargill pay producers around US$35 per metric ton of carbon sequestered with the higher payout a reflection of more credible data.20 Now in its third year, the program is available in 24 states in addition to France, Poland, Romania, and Germany. Similar Canadian efforts are not online yet. Second, even higher credit prices may not be profitable if transaction costs, such as verification and registry fees, exceed that figure—which is a common challenge.

A national MRV framework could be key to building a private carbon market for farmers and investors. Currently, a significant number of producers are unsure of how to participate in an offset program. A framework would set guidelines to quantify emission removals, and reduce measurement and quantification costs, boosting the value of any credit generated. It would also help lower quantification costs and streamline such requirements.

A national MRV framework could help develop the pathway for such direct investment in technologies and practices, help farmers boost their incomes and promote carbon sequestration.

CLIMATE ACTION HERO

Colborn Farms

Shawn Colborn, a fifth-generation farmer, is blending the tradition with innovation in his agricultural operation encompassing cattle, grains, and poultry in Saskatchewan. Shawn explains how employing climate-smart practices like 4R fertilizer efficiency and no-till, has made his farm more productive, sustainable, and resilient.

Important Notice Regarding Information on this Website and Caution Regarding Forward-Looking Statements

The information on the Climate Action Institute website is intended as general information only and does not constitute an offer or a solicitation to buy or sell any security, product or service in any jurisdiction; nor is it intended to provide investment, financial, legal, accounting, tax or other advice, and such information should not to be relied or acted upon for providing such advice. Nothing herein shall form the basis of or be relied upon in connection with any contract, commitment, or investment decision whatsoever. The reader is solely liable for any use of the information contained herein, and neither Royal Bank of Canada and its subsidiaries (“RBC,” “we,” “us,” or “our”) nor any of RBC’s affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damage arising from the use of any information contained herein by the reader.

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including on this website, in filings with Canadian securities regulators or the U.S. Securities and Exchange Commission and in other communications. Forward-looking statements on our websites include, but are not limited to, statements relating to our economic, environmental (including climate), social and governance-related objectives, vision, commitments, goals and targets as well as potential events and actions. By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, and that our objectives, vision, commitments, goals and targets will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors – many of which are beyond our control and the effects of which can be difficult to predict – could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest Climate Report, available at our ESG Reporting site.

Except as required by law, none of RBC or any of its affiliates undertake to update any information on this website.

All expressions of opinion on this website reflect the judgment of the authors as of the date of publication and are subject to change. We do not guarantee the accuracy of the information or expressions of opinion presented herein and they should not be regarded as a complete analysis of the subjects discussed. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC or any of its affiliates.

All references to websites are for your information only. The content of any websites referred to on this website, including via website link, and any other websites they refer to are not incorporated by reference in, and do not form part of, this website. This website is also not intended to make representations as to ESG-related initiatives of any third parties, whether named herein or otherwise, which may involve information and events that are beyond our control.