Pathways to 2030

Sector accounts for only 8% of national emissions, but is mandated to reach Net Zero by 2035—15 years before the rest of the economy.

Wind capacity will need to grow by 2.7 times to meet ambitious emissions goals.

The Year In Climate Policy

New federal Clean Electricity Regulations proposed rules aimed at limiting natural gas, a key energy source. The draft was opposed by provinces that are eyeing a longer runway for their fossil-fuel powered facilities.

Federal Budget 2023 introduced investment tax credits for clean electricity projects to compete with the U.S. Inflation Reduction Act’s supercharged incentives.

Alberta temporarily paused renewable energy projects, halting a boom in the sector. Emissions in the provincial grid have fallen by more than 50% since 2005, with plans afoot to phaseout coal by early 20242.

Ontario began exploring an expansion of the Bruce Power nuclear generating station, the first large-scale nuclear expansion in Canada in three decades. Ontario is also building Canada’s first grid-scale small modular reactors, with plans for three more.

Hydro-Québec said it plans to invest as much as $185 billion by 2035 to boost capacity and reinforce the province’s clean energy lead.

Canada Falling Behind In Renewable Energy Deployment

Renewable Capital Deployment (2022)

Source: BNEF, IMF, RBC Climate Action Institute

Three Things To Watch In 2024

Ottawa’s Clean Electricity Strategy, a Net Zero blueprint, to provide insights on the role of storage, transmission expansion and natural gas in a future grid.

B.C.’s multi-billion-dollar Site C hydropower project set to achieve first power in the fall of 2024, with all six units in service by 2025.

The independent Canada Electricity Advisory Council to submit a report in spring 2024, focused on accelerating investments to promote sustainable, affordable, and reliable electricity systems.

CASE STUDY

A New Model For Reconciliation

Wabun Tribal Council and Hydro One

Gogama, Ontario

THE SPARK

First Nations chiefs in northern Ontario were quite blunt when Hydro One asked them how the utility firm could meaningfully take part in reconciliation while developing new projects. Equal equity partnership, the chiefs said. While Hydro One had First Nation partnerships on other large-scale transmission lines in the province, equal partnership was uncommon at the time, even though the lines run through traditional territory.

"We’re not playing a passive role anymore,” said Jason Batise, executive director of the Wabun Tribal Council, which represents six First Nations in northern Ontario. “As a business matter, land ownership by us needs to be respected and translated into a relationship and partnership on an economic basis with whoever’s deciding to come work here.”

After some deliberation, the transmission and distribution utility not only decided that’s what it would do for the Waasigan project—it would be its model going forward.

THE CHALLENGE

Projections show the province’s electricity demand is set to more than double by 2050. That would require transmission lines to more areas as the province meets the needs of a rising population, and the development of remote lands for critical minerals and other resources. As the province’s largest electricity transmission and distribution provider, Hydro One is facing tremendous pressure to expand its grid capacity—quickly and sustainably.

The utility also couldn’t afford the delays and uncertainty that emerged in the past when equity stakes were being negotiated on a case-by-case basis with select First Nations.

“I think Corporate Canada's coming to the conclusion that this kind of infrastructure needs Indigenous partners,” Said Penny Favel, vice-president of Indigenous Relations at Hydro One.

THE SOLUTION

Hydro One’s First Nations Equity Partnership Model offers First Nations the opportunity to invest in a 50% equity stake in the transmission line component of all new large-scale capital transmission line projects exceeding $100 million. Under the Ontario Energy Board’s guidelines, the capital structure for new transmission lines must be 60% debt and 40% equity. First Nations have the option to invest in half of that equity portion. But Hydro One also does not require First Nations to buy their equity or exercise their equity option until just before the transmission line comes online to shield them from regulatory and construction risk, a move resulting from extensive consultation with First Nations.

In 2022, Hydro One and nine First Nations agreed to invest in the Waasigan Transmission Line in northwestern Ontario with 350-megawatt capacity—more than double the capacity it takes to power Thunder Bay, Ont.

The $1.2-billion infrastructure investment with the support of Lac des Mille Lacs First Nation and eight First Nation communities represented by Gwayakocchigewin Limited Partnership (GLP) will see the development of a 230-kilovolt transmission line in the first phase and another 270-kilovolt line in the second phase.

Hydro One is developing eight more transmission lines using that model and has partnered with the Wabun Tribal Council First Nations in hopes of being selected for an additional 230kilovolt line to connect the Wawa and Porcupine transmission stations.

WHAT’S NEEDED

Instead of bartering, Hydro One overcame skepticism by putting its money where its mouth is, drawing up term sheets right at the outset to outline the specifics of its 50% commitment.

While equity partnership opportunities are increasing, some First Nations still face barriers in accessing capital. On-reserve property can’t be used as collateral for a loan under the Indian Act, making it difficult to get financing from conventional lenders.

For the Wawa to Porcupine project, the Wabun Tribal Council was assessing multiple proposals from different utilities, all of whom were offering 50% equity. Batise described the financing component as a crucial decision point.

“We’re bringing the land, so to speak. You bring the money,” he said.

WHAT’S NEXT

Hydro One hopes to expand its relationships with First Nations and Indigenous communities beyond electricity distribution.

Batise also hopes that one day Hydro One and other utilities could help smaller, remote communities get off “dirty energy” and onto the grid despite the challenging economics.

“It’s a social good,” he said. “How do we convince them that it’s the right play just in and of itself?”

Deep Dive

Wind Power

- Wind is Canada’s fastest growing low-carbon electricity source. That will need to grow by 2.7 times to meet Net Zero goals by 2035.

- Regulations are behind wind power surge. Federal investment tax credits and rising demand are driving investments in the clean energy source.

- Wind projects costs have declined 70% since 2010. That makes it one of cheapest source of new electricity in the country.

- Industry still falling short of government-set goals. Only 6% of the necessary new wind generating capacity is under construction to meet the estimated 2035 requirements.

- Canada can be a wind power. There’s significant opportunity to harness wind power for both interprovincial and international exports.

Wind’s Taking Off in Canada

Wind energy has emerged as a significant player as Canada’s utilities strive to lay the foundation of a clean energy economy and help meet their 2035 Net Zero goal—15 years before the rest of the economy.

Wind power offers more consistent capacity delivering energy throughout the year compared to solar, which is mostly effective during sunny days. Wind has also become increasingly attractive to developers and electricity system operators as the costs to build new projects have declined approximately 70% since 20101.

Wind is now Canada’s fastest growing low-carbon electricity source with an estimated growth of 3.5 GW since 2016, helping vault the country to 8th place globally in terms of onshore wind power2. In contrast, hydro and solar capacity grew 3 GW and 1.6 GW, respectively. Wind capacity stood at 15 GW in 2022 and needs to grow approximately 2.7 times to meet ambitious Net Zero goals3 by 2035, accounting for 24% of Canada’s total capacity. Government forecasts anticipate that most of the new wind capacity will be added after 2030 with an increase of 11.5 GW by 2030 and an additional 30 GW from 2030 to 2035.

However, the anticipated expansion of wind power needs to be in tandem with energy storage solutions. Wind power, akin to solar power, is variable and intermittent—fluctuating based on weather conditions and time of year. System operators will need to rely on energy storage such as batteries or pumped hydro storage, which can smooth out fluctuations in renewable energy generation caused by changing weather patterns and can provide back-up during power generation disruptions. This is going to be crucial especially as extreme weather events become more common.

Wind Needs To Dominate Electricity Growth by 2035

Electricity Capacity, GW

Source: Canada Energy Regulator, RBC Climate Action Institute

Still Falling Short

While wind’s trajectory seems impressive, Canada is currently not on track to meet government-set wind capacity goals. Only 6% of the necessary new wind generating capacity is under construction to meet the goal of a Net Zero electricity grid by 20354.

Capacity will need to more than double the current level of planned projects, or 23 GW, to hit 2035 goals. That’s a steep task without a concerted policy push, additional financial support and streamlining of regulatory processes for wind and transmission projects from both federal and provincial government. To ensure projects get through to completion, wind developers will need stable to lower interest rates and predictable supply chains. Federal programs can help to ensure these projects remain economic for developers.

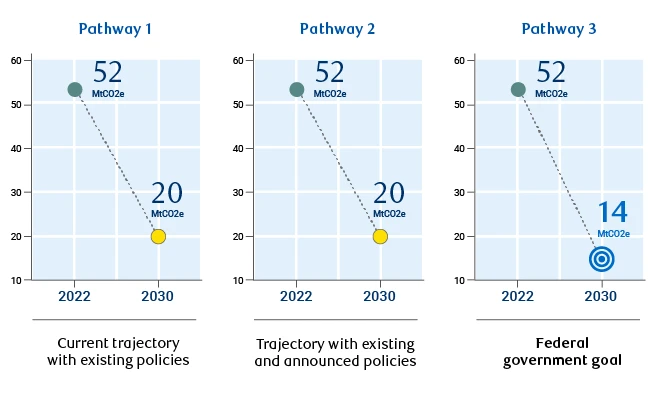

While electricity accounts for less than 10% of Canada’s emissions, much is at stake to keep emissions in check. A clean grid is the springboard for clean energy projects from electric vehicle manufacturing to low-carbon steel, and central to Canada achieving its emissions reduction target of 40% by 2030.

Wind power is cheaper and faster to deploy compared to nuclear and large hydro energy. However, like solar, it is variable and intermittent. To ensure grid stability and reliability, it requires backup or storage solutions. Integration with other electricity sources such as hydro, natural gas, or batteries is necessary for a consistent and secure electricity supply. Wind power also has a higher effective capacity factor compared to solar, thanks to increased capacity overnight and during the winter.

Planned Wind Projects Must Double To Hit Net Zero Goals

GW, electricity capacity addition

Source: SP CapIQ, Canada Energy Regulator, RBC Climate Action Institute

Sparking Investment Activity

The federal government’s draft Clean Electricity Regulations (CER) released last year could prove to be instrumental in cutting natural gas’s role, which currently powers 16% of the grid. If approved, the CER would be transformative for wind, and other clean electricity sources such as hydro and nuclear as the grid needs to more than double in size by 2050 to meet Net Zero targets.

Tax incentives in the 2023 budget should further support the decarbonization of the grid. The proposed budget includes multiple tax credits that could potentially reduce project costs for both private and public entities in the electricity sector. This could be highly beneficial for provincial governments’ plans to expand their generation capacity with clean electricity.

Countering the U.S. Inflation Reduction Act, the federal investment tax credits offer substantial incentives for clean investments such as EV battery and green hydrogen projects. New investment tax credits (ITC) would subsidize up to 30% of the capital costs of clean energy projects such as wind power and energy storage. Qualifying projects would be eligible for the ITC starting as early as 2023-34 and continue into the middle of next decade.

Wind Gains Ground

Electricity Capacity, GW

Source: Canada Energy Regulator; RBC Climate Action Institute

Wind Has Momentum

Despite rising inflation and supply chain challenges, wind remains one of the most cost-effective sources of new electricity in Canada. The Prairies also possess some of Canada’s prime wind sites. However, like other sectors in Canada, electricity has experienced rising costs since 2021 due to inflation, higher interest rates and supply chain issues. The cost of wind power has climbed back up over 40% since 2021, which is equivalent to an increase of almost US$15 per megawatt hour in 20235. As inflation and supply constraints start to ease, though, forecasts show that the levelized cost of electricity for wind and other resources could start to trend lower.

Rising capital costs have further reduced the return on capital for developers, making their projects less financially viable. As a result, some companies have abandoned development projects or sought higher contracted power prices where possible. This is quite prevalent in offshore wind projects with many large developers taking write-downs.

Recent provincial policy uncertainty could also dissuade investors. While some provinces have embraced wind power, others have attempted to slow down new wind development. Local opposition movements have further discouraged some provinces from pushing for more wind—a tension that could gain ground as provinces strive to meet growing electricity demand.

The Alberta government imposed a seven-month moratorium in mid-2023 on approvals of renewable power projects over 1 megawatt, including wind. The moratorium came at a time when the province had seen nearly $5 billion in renewable energy investment and the creation of close to 5,500 jobs since 20196.

Ontario also recently empowered municipalities with the authority to oversee the siting of new proposed electricity projects under the Planning Act, giving local communities the power to reject wind projects. (The Ontario government cancelled 750 renewable energy contracts in 2018, a decision that cost the government $230 million7. But fast forward to 2023, the province’s electricity system operator is looking to non-emitting sources such as wind to meet Ontario’s growing demand.)

There might be other headwinds beyond policy uncertainty. As the country expands wind capacity, location of new wind projects could be less productive and farther from population centers, leading to higher costs. Utilities will also need to integrate wind power with other electricity sources such as hydro, natural gas, demand management systems, and batteries/storage to ensure a consistent and secure electricity supply as well as possible dispatch capabilities for some systems.

Wind energy remains cost effective despite challenges

USD $/MWh, real 2022

Source: BNEF, RBC Climate Action Institute

Ontario And Alberta Expected To See A Surge In Wind Power

Electricity Capacity, GW

Source: Canada Energy Regulator; RBC Climate Action Institute

East Coast Potential

Canada is rich in wind energy potential, which could be harnessed for interprovincial and international energy export, especially through hydrogen. Canada’s abundant clean electricity potential, particularly wind power on the East Coast, presents an opportunity for additional investment and revenues.

The proposed Port au Port-Stephenville Wind Power and Hydrogen Generation Project in Newfoundland and Labrador serves as an example. The project can produce approximately 140,000 tonnes of green hydrogen annually powered by two new wind farms featuring 164 wind turbines each and generating 1 GW of electricity. The initiative will allow the province to tap into their vast wind potential and export green hydrogen globally.

Nova Scotia has approved the development of two green hydrogen facilities by EverWind Fuels and Bear Head Energy as part of plans to develop green hydrogen. Both facilities are expected to be wind powered. EverWind is in the process of developing three wind farms with a total capacity of 527 megawatt (MW), and has plans for additional capacity. In its second phase, EverWind expects the project to produce up to 1 million tonnes per year, while Bear Head Energy plans to produce up to 350,000 tonnes of hydrogen.

These projects could contribute to the growing domestic demand for green hydrogen and could also be exported to European Union markets as they try to move away from fossil fuels and access alternative energy sources to Russian natural gas. With the right infrastructure and strategic planning, Canada could not only contribute to its domestic clean energy demands but also become a significant player in the new global green hydrogen economy.

CLIMATE ACTION HERO

Greengate Power

Dan Balaban is the founder and CEO of Greengate Power, helping transform Alberta’s grid. The Calgary-based company has successfully developed the country’s largest wind and solar energy projects, representing over $2 billion of investment, and signed purchase agreements with leading technology companies like Microsoft.

Important Notice Regarding Information on this Website and Caution Regarding Forward-Looking Statements

The information on the Climate Action Institute website is intended as general information only and does not constitute an offer or a solicitation to buy or sell any security, product or service in any jurisdiction; nor is it intended to provide investment, financial, legal, accounting, tax or other advice, and such information should not to be relied or acted upon for providing such advice. Nothing herein shall form the basis of or be relied upon in connection with any contract, commitment, or investment decision whatsoever. The reader is solely liable for any use of the information contained herein, and neither Royal Bank of Canada and its subsidiaries (“RBC,” “we,” “us,” or “our”) nor any of RBC’s affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damage arising from the use of any information contained herein by the reader.

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including on this website, in filings with Canadian securities regulators or the U.S. Securities and Exchange Commission and in other communications. Forward-looking statements on our websites include, but are not limited to, statements relating to our economic, environmental (including climate), social and governance-related objectives, vision, commitments, goals and targets as well as potential events and actions. By their very nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties, which give rise to the possibility that our predictions, expectations or conclusions will not prove to be accurate, that our assumptions may not be correct, and that our objectives, vision, commitments, goals and targets will not be achieved. We caution readers not to place undue reliance on these statements as a number of risk factors – many of which are beyond our control and the effects of which can be difficult to predict – could cause our actual results to differ materially from the expectations expressed in such forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest Climate Report, available at our ESG Reporting site.

Except as required by law, none of RBC or any of its affiliates undertake to update any information on this website.

All expressions of opinion on this website reflect the judgment of the authors as of the date of publication and are subject to change. We do not guarantee the accuracy of the information or expressions of opinion presented herein and they should not be regarded as a complete analysis of the subjects discussed. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC or any of its affiliates.

All references to websites are for your information only. The content of any websites referred to on this website, including via website link, and any other websites they refer to are not incorporated by reference in, and do not form part of, this website. This website is also not intended to make representations as to ESG-related initiatives of any third parties, whether named herein or otherwise, which may involve information and events that are beyond our control.