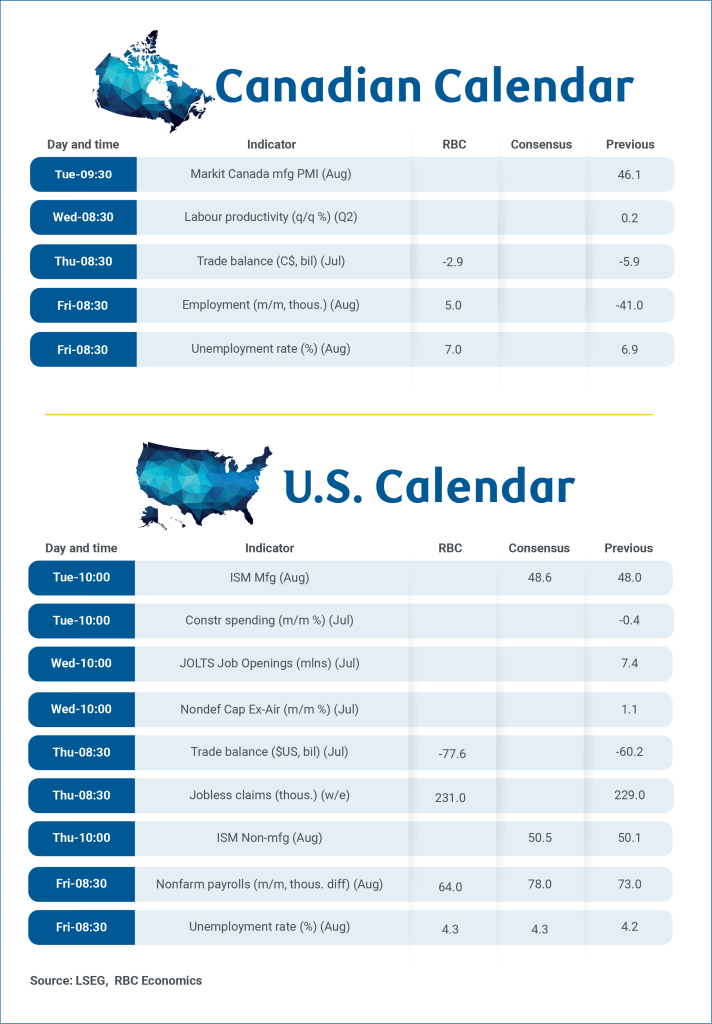

For the week of September 2nd, 2025

North American labour market and international trade data in spotlight next week

Next week’s labour market and international trade reports for Canada and the U.S. will again be watched closely for the impact that U.S. tariffs are having on economic activity.

A softer round of U.S. July jobs data, followed by subsequent comments from Federal Reserve Chair Powell that interest rate cuts could be warranted soon, have put a brighter than usual spotlight on the next round of U.S. labour market numbers. Our own expectation is for another softer payroll gain of 64k in August, and a tick higher in the unemployment rate to 4.3%.

Canadian job markets, on the other hand, have shown some signs of stabilizing in recent months with the unemployment rate ticking down to 6.9% in June and July from a 7.0% rate in May.

We don’t expect Canadian labour market weakness has fully run its course, and look for Canada’s unemployment rate to edge back up to 7% in August alongside minimal employment growth (+5k.) Lingering trade uncertainty still appears to be stalling hiring demand – early data on job postings from indeed.com has been edging lower into late summer – but conditions also haven’t softened enough to drive widespread layoffs.

Critically, the bulk (90%) of Canadian exports to the United States through June have remained tariff-free under an exemption for CUSMA compliant trade. Because of it, we look for Tuesday’s international trade data to show Canada maintained the lowest average effective tariff rate of major U.S. trade partners despite tariff revenues that continued to rise in July

Tariffs on the remaining 10% of Canadian exports to the U.S., concentrated in metal products, are still having a significant impact – manufacturing employment in Canada ticked higher in July but was still down nearly 40,000 from where it was at the beginning of this year.

But the bleed in the Canadian jobs market for now appears contained to the more trade-exposed sectors and has not been spreading – employment in service producing sectors was still up 146k from the end of last year in July, led by a 71k increase in wholesale and retail jobs.

Week ahead data watch:

-

The Canadian trade deficit likely narrowed in July from elevated levels in Q2, including a record large deficit in April as U.S. imports plunged after a surge to build inventories ahead of tariffs in Q1. Oil prices remained largely unchanged in July, after surging 10% in June. This stability is expected to have kept the energy trade balance steady during the month. A reported $2 billion import of a single large piece of machinery for Canada’s offshore oil production sector in June is considered a one-off event, and imports are likely to decline as that effect unwinds.

-

International trade data from the U.S. Census Bureau, released at the same time as the Canadian trade data, will continue to be scrutinized for insights into the broader impact of U.S. tariffs on trading partners. Recent reports have indicated that most Canadian exports continue to access the U.S. market duty-free, thanks to exemptions for products that comply with USMCA rules of origin.

This report was authored by Assistant Chief Economist Nathan Janzen and Senior Economist Claire Fan.

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.