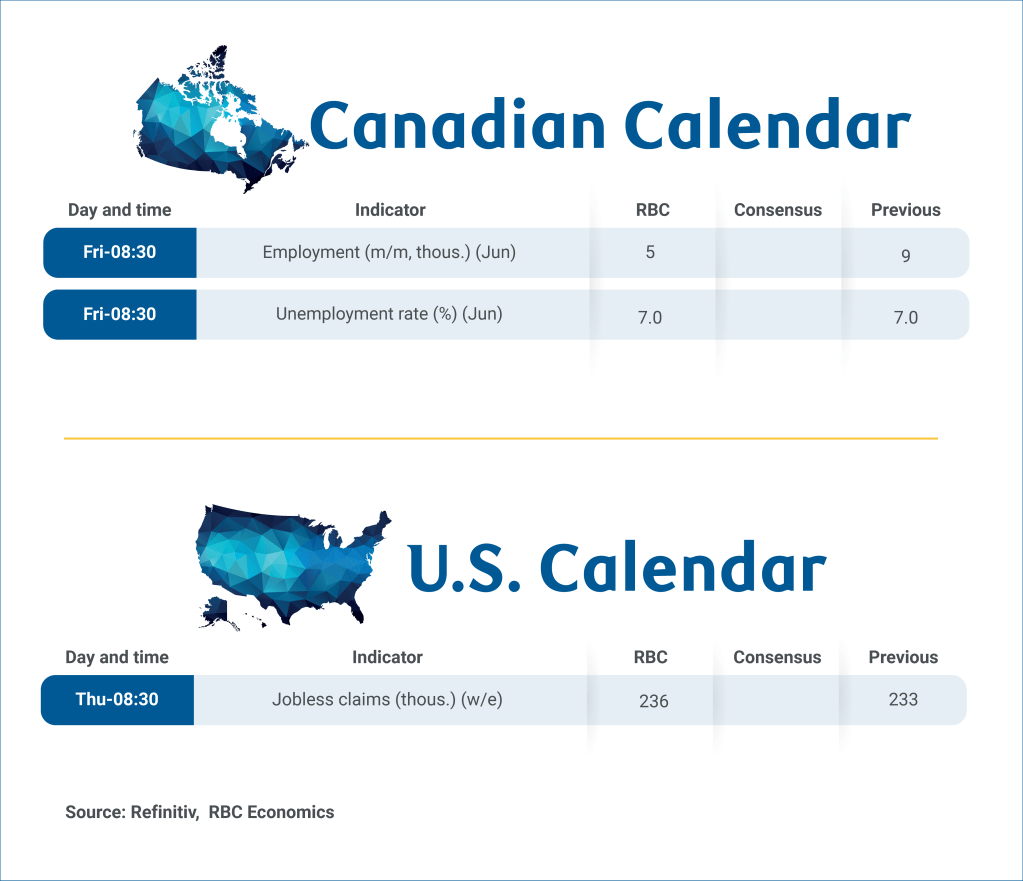

For the week of July 7th, 2025

Softening Canadian labour market may be reaching a bottom

The Canadian labour market has weakened significantly since the beginning of the year with the unemployment rate hitting 7% in May—but it may be reaching a bottom soon.

Slowing has been significant, but is concentrated in sectors and regions most exposed to international trade headwinds. Manufacturing lost 55,000 jobs since January and the unemployment rate in parts of Southern Ontario that are manufacturing hubs are well above the national average—reaching highs not seen since the 2020 pandemic lockdowns.

But with domestic demand broadly holding up, we don’t expect the weakness to spread. In fact, solid consumer spending trends into the summer is supporting job growth in domestic service sectors, leaving headline employment growth mostly positive this year.

In June, we expect a similar dynamic will play out. Potential losses in trade exposed sectors like manufacturing, wholesale and transportation would be offset by job growth in other sectors to leave overall employment and the unemployment rate largely unchanged from May.

The threat of further global tariffs remains, including the expiry of the 90-day pause on the most severe U.S. reciprocal tariffs announced in April in the week ahead.

But the most severely negative global trade scenarios still look less likely than they did a few months ago.

Crucially, we expect CUSMA exemptions to stay in place. The latest trade statistics continue to reaffirm that, for now, Canada is relatively well positioned among U.S. trade partners to compete for its import market. The majority of Canadian goods exports were crossing the border duty free in May, thanks to those exemptions.

Trade talks between the U.S. and partners are ongoing, and tensions will continue to restrain hiring. But, business confidence measures have improved from April to June and job openings posted on indeed.com have stabilized significantly since mid-April after falling earlier this year.

Barring more significant negative developments on trade, we expect the bottom is near for the Canadian labour market with the unemployment rate peaking not far from where it is today.

This report was authored by Assistant Chief Economist Nathan Janzen and Senior Economist Claire Fan.

Explore the latest from RBC Economics:

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.