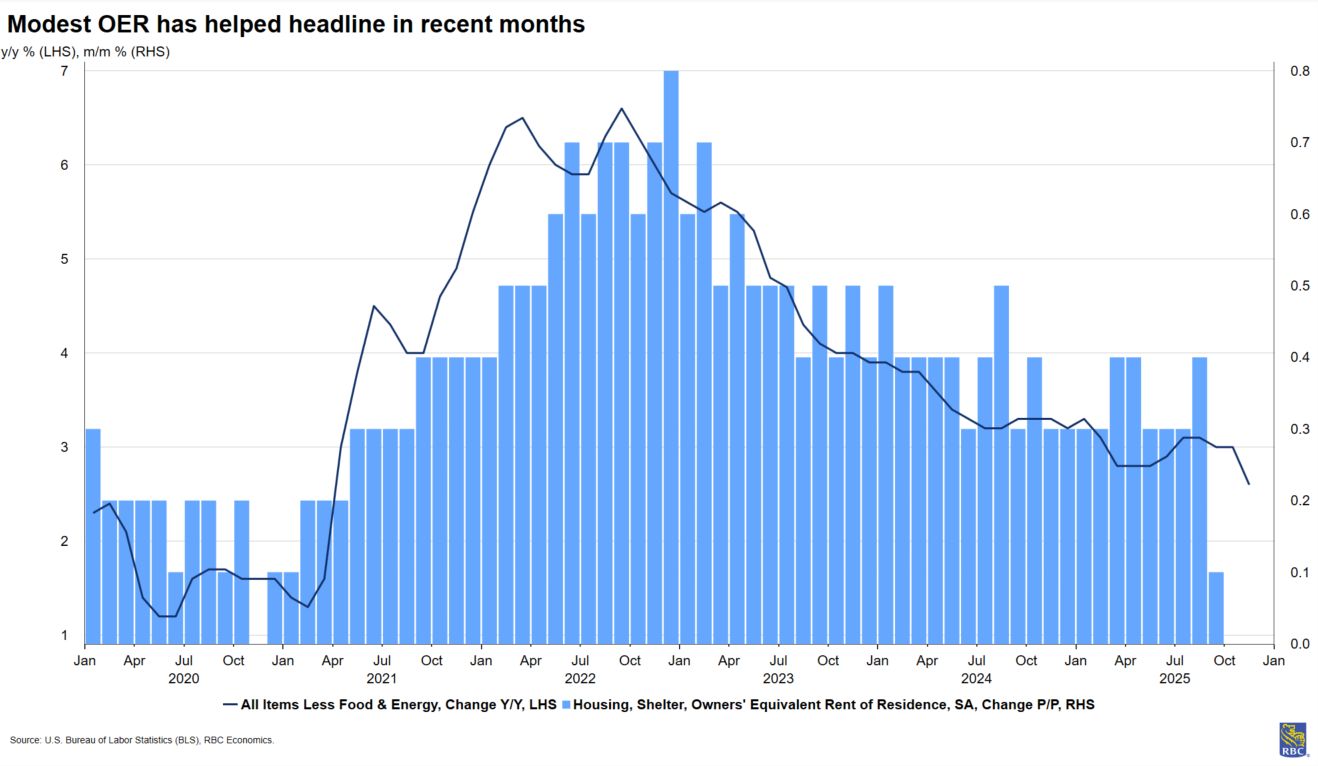

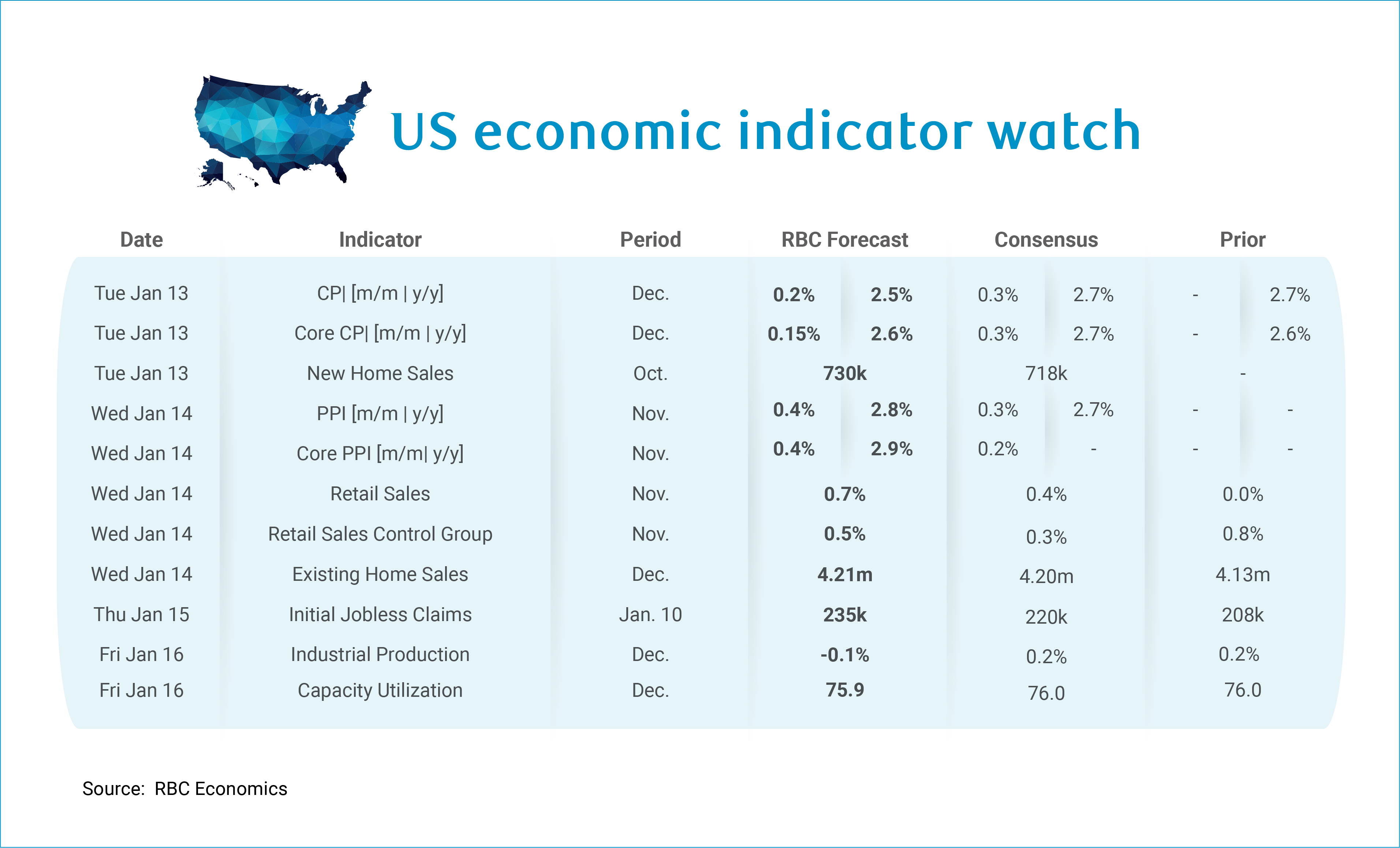

Next week is packed with data – front and center will be December CPI data, the final reading of 2025 reporting ahead of the next Fed meeting. We expect to see core CPI tick up by +0.15%, with the year-over-year pace of +2.6% maintained for the month of December.

Importantly, we expect another modest print from owners’ equivalent rent (OER) will provide the biggest help this month. We do anticipate a modest uptick in the pace of core goods, but still do not expect the tariff passthrough to fully show up just yet. Still, we maintain our view that companies are positioning to preserve market share during peak holiday shopping season. That said, we do expect to see tariff pressures show up more meaningfully in H1 2026.

Additionally, the 2026 data will bring new weights for the CPI basket. Starting in the January CPI report, the recently released 2024 CEX data from will replace weights based on the 2023 CEX. Comparing the CEX data we see US consumers allocated a slightly greater share of expenditures to services compared to 2023. While we expect a modest Owners’ Equivalent of Rent (OER) component of housing in December, we have this measure accelerating in 2026. And with more weight added to housing (33.4% of CEX in 2024 vs 32.9% in 2023), this dynamic will add to pre-existing services pressures. We continue to see limited scope for sizeable services deceleration as the labor market remains tight and wages comprise a large share of services inputs. Moreover, high income and wealthy consumers, many of them retirees, have continued to bolster exceptional services demand.

Next week’s retail sales print will give us insight into whether the goods sector continues to outperform or the pull-forward of activity earlier this year starts to weigh on consumption. We expect to see the headline retail sales print move notably higher +0.7% in November after flat spending in October (likely impacted by the government shutdown). Both motor vehicle sales and gasoline prices supported the overall reading. We expect to see the retail sales control group report a slightly lower (but still strong) pace of growth at +0.5% m/m. We could reasonably expect to see stronger durables spending in November, especially as consumers take advantage of Black Friday sales and ramp up holiday shopping.

Aside from CPI and retail sales, here’s what else we are watching:

-

The BLS is still playing catch up in the aftermath of the government shutdown. On Wednesday we will be getting PPI data for both October and November. We expect to see core PPI tick up +0.3% m/m in October and a slightly higher +0.4% m/m in November as pressures will likely continue to materialize in the trade-exposed transportation and warehousing sector in both months. December PPI data will be released at the end of January.

-

We anticipate an upward swing in initial jobless claims for the week ending January 10th – up 235K – after two holiday shortened weeks likely caused a backlog. We expect to see claims moderate in subsequent weeks once the backlog is processed, consistent with our view that the labor market is stabilizing in a low hiring, low firing backdrop.

-

We will be getting delayed new home sales data for both September and October and anticipate a continued moderation since the August spike as long end rates put a damper on housing demand.

-

Industrial Production is expected to tick slightly lower -0.1% in December, reflective of the fact that both manufacturing hours worked declined and so too did the ISM manufacturing index. This would nudge the capacity utilization rate down to 75.9%.

About the Authors

Mike Reid is a Director, Head of US Economic Research at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior US Economist at RBC and a member of the US Economics team at RBC Capital Markets. Carrie is responsible for projecting key US indicators including GDP, employment, consumer spending and inflation for the US. She also contributes to commentary surrounding the US economic backdrop which she delivers to clients through publications, presentations, and the media.

Imri Haggin is an economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.