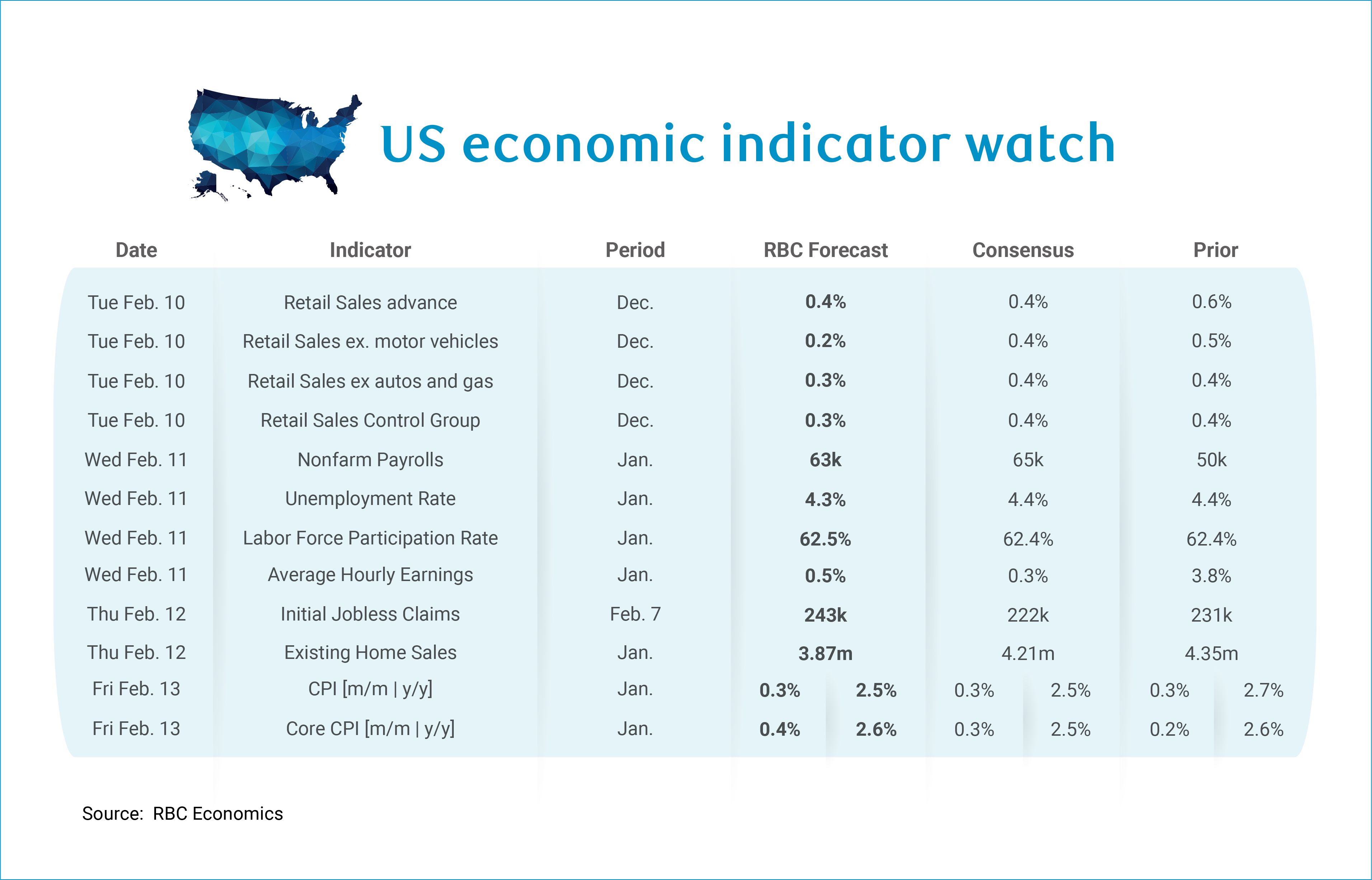

A second (partial) government shutdown ended this week, but not without disrupting the BLS release schedule. This will make for a crowded week, as we will get the delayed retail sales report for December, the employment situation for January on Wednesday, and the January CPI report on Friday.

After a slew of labor market data this week, we still expect to see 63k jobs added to the US labor market in January–slightly above our estimate of breakeven employment and consistent with a slight decline in the unemployment rate to 4.3%. Initial jobless claims were unseasonably low during the household survey’s reference week (the week including January 12th), though data from the week ending January 31st suggests we may be witnessing some degree of normalization through the end of the month. ADP’s January report was on the softer side, but we typically do not view the report as a strong indicator for nonfarm payrolls because of sample bias. Still, the ADP report highlighted that the bulk of weakness was concentrated in trade-exposed sectors and conversely, noted a surge in health care hiring – both aligned with our own assumptions for the January nonfarm payrolls report.

Turning to the other side of the Fed’s mandate, we have hopes that next week’s CPI print will give us a cleaner snapshot of the US inflation backdrop in January. This will be the first release since the October government shutdown that is not directly impacted by October data omissions or a constrained November collection window. We expect to see core inflation accelerate in January to +0.4% m/m, which would leave the y/y pace steady at 2.6%. We look for lower gas prices to help headline, but still expect a 0.3% m/m rise there, keeping the y/y pace at 2.5%.

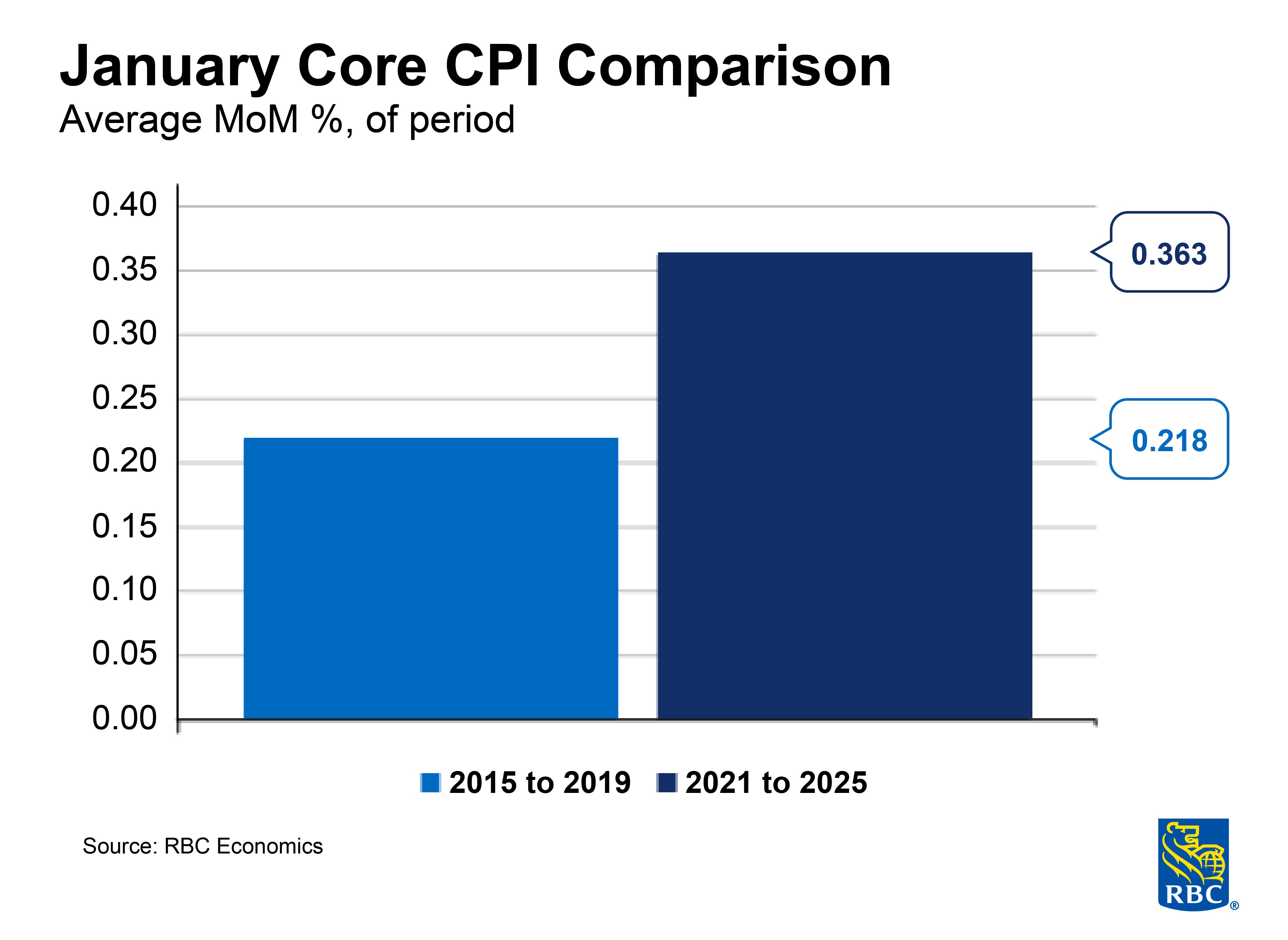

We are forecasting a hotter print for a few reasons. First, “the January effect” remains a factor in the post-Covid economy. We typically see inflation heat up in January as the combination of new year price increases and lagged seasonal factors have elevated January prints since 2021. Second, we expect to see early signs of tariff passthrough to the consumer take hold. December’s PPI data pointed to pressures in trade and transportation and warehousing – the former suggests wholesalers are pre-emptively passing off higher costs and the latter suggests explicitly higher costs faced by producers. We anticipate these higher costs will translate to an uptick in consumer prices. Both ISM services and manufacturing highlighted continued price pressures and Adobe’s digital price index (DPI) flagged an unusually strong January spike in online prices.

Here’s what else we’re watching next week:

-

Ahead of both employment data and CPI, we will get (lagged) retail sales data for December, which we expect to report a firm +0.4% m/m clip, bolstered by auto sales (+2.8% in Autodata’s December reading). We expect to continue to see nonstore sales hold up, and if the Adobe DPI is any indication, higher prices will boost nominal sales in that category. We have continued to witness resilience in the retail space but expect softer growth in Q1 2026 relative to 2025, which was the year of tariff front-running and resulted in a pull-forward in retail activity.

-

We expect to see an uptick in initial jobless claims to 243k for the week ending February 7th after witnessing unseasonably soft claims data through most of January. This past week, initial jobless claims hit 231k, a notable upside from consensus. At 243k, initial claims would still be consistent with our expectation that the unemployment rate will move sideways through 2026.

-

On Thursday, we expect to get another month of lackluster housing sales, with existing home sales likely falling to 3.9m as the housing market continues to hibernate amidst sticky long end rates.

Mike Reid is Head of U.S. Economics at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior US Economist at RBC Capital Markets. Carrie is responsible for projecting key US indicators including GDP, employment, consumer spending and inflation for the US. She also contributes to commentary surrounding the US economic backdrop which she delivers to clients through publications, presentations, and the media.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.