The first 100 days for any new government are filled with a flurry of activity. For Mark Carney’s Liberal minority government that will include tabling a budget, trade talks with the Trump administration and hosting the G7 in June. Zoom out, and the key priorities come into focus. Here are five that RBC Thought Leadership has been keeping a close eye on and ones we believe will have Parliament’s full attention in the coming months—and beyond.

Securing an economic and security pact with the U.S.

During upcoming negotiations with the U.S., expect Canada to minimize concessions until duty-free trade is secured and the current trade agreement is honoured. The U.S., meanwhile, will seek to have a wide-ranging discussion that includes border and security concerns.

At a minimum, the agreement could include:

-

Energy and economic security: Negotiators will want to address longstanding irritants, including the digital services tax, attempting a resolution to the softwood-lumber dispute, and strengthening rules of origin. Expect movement and strategies on gas, nuclear and critical minerals, which dovetails nicely with the upcoming G7 meeting.

-

Defense and Arctic security: This includes everything from the plan to meet 2% defence spending targets, to NORAD modernization, dual-use accounting, social and economic infrastructure investments in the North, including an Arctic port, and expanding shipbuilding/icebreaker commitments.

-

Border security: Although Canada has made investments in border security, further collaboration, especially on money laundering, immigration and drug/arms trafficking, will likely come up during negotiations.

This won’t be the first attempt at a comprehensive continental economic and security agreement. In the mid-2000s, the Security and Prosperity Partnership of North America included the private sector in an effort to enhance continental competitiveness. While it didn’t come to fruition, many ideas—cooperation on infectious diseases, emergency management, and border security—have persisted. This attempt has a better chance of succeeding if it is targeted and time bound.

Address the housing affordability crisis

In The Great Rebuild, we outlined seven ways to address Canada’s housing shortage and affordability. When comparing the recommendations in our April 2024 report to the Liberal election platform, a number of key items line up:

-

Focus on prefab: Factory-built dwellings can be more time and cost-efficient. And the government has promised $25 billion in financing to prefab home builders—as well as a focus on sustainable building materials.

-

Cut red tape: Project approval timelines in Canada, as we noted, “can be among the lengthiest in the world.” Simplifying national building codes, streamlining regulations and leveraging standardized designs are all part of the Liberal platform.

-

Build affordable options: Government has pledged $10 billion worth of low-cost financing for lower- to middle-income Canadians.

None of this gets done, however, without shovels in the ground. We estimate that more than 500,000 additional construction workers are needed to build the homes required between now and 2030. The Liberal’s plan to incentivize companies to hire recent grads and offer apprentice programs is a start. But finding half-a-million construction workers requires more. Options include prioritizing construction skills of new immigrants, growing the enrollment of trade schools, and enticing older construction workers from retiring.

The affordability crisis has made it an imperative that Canada acts promptly and with more streamlined coordination across all levels of government.

Build Energy Corridors

Building out major energy infrastructure enhances economic resilience through the diversification of key commodity exports. In 2024, Canada’s major resource exports (minerals, metals and fuel) were among Canada’s largest, generating $175 billion in aggregate net exports–almost offsetting Canada’s global trade deficits across all other goods categories.

Success in taking projects from blueprint to buildout depends on policies directed at mobilizing private capital and reducing red tape. To date, existing key Liberal policies around Bill C-69, Bill C-48, the Oil and Gas Emissions Cap have not been conducive to large-scale investment. An ‘amended’ approach with a greater focus on pragmatism could establish a climate more conducive to attracting capital. Key focal points for Ottawa include:

-

Industrial carbon pricing: ‘Axe the tax’ likely shifts the burden of carbon pricing onto large industrial producers. A rising industrial carbon price likely remains, presenting competitiveness challenges relative to U.S. leadership focused on deregulation. A 50% carbon capture investment tax credit derisks capital costs, but projects need revenue certainty. To date, The Pathways Alliance, a consortium of Canada’s largest oil sands producers, has been unsuccessful in negotiating carbon credit guarantees from Ottawa. Of course, this comes at a time of competing fiscal priorities. Ottawa is already on the hook for 50% of CCUS capital costs (conservatively estimated between $60-75 billion). Contract for differences for Pathways would likely require tens of billions in additional funding (10-12 million tonnes at $125-150/t for 10 years).

-

Regulation/Permitting: Regulatory delays has led to drawn out timelines, leading to cost overruns and/or cancellation of key projects, as capital is ultimately redistributed to shareholders rather than towards growth-enabling infrastructure. Policies such as ‘One Project, One Review’ and declaring more energy projects as in the ‘National Interest’ are helpful. This is likely most beneficial to natural gas pipelines and LNG infrastructure, given the greater political alignment on the LNG file (B.C. and Ottawa).

-

Provincial trade barriers: East-west trade through greater use of interties yield a more resilient, flexible and efficient grid system—increasingly important given rising load growth over the next 25 years (up to 3x) and the need for cheap power for industry/manufacturing.

Safeguard federal finances

As RBC Economics wrote recently, a lot will be demanded of fiscal policy. A slowing economy and the risk of a greater trade-linked recession imply fiscal supports of varying degrees. And structural challenges loom–weak productivity, strained affordability, an aging population, export concentration, and shifting geopolitics could trigger more federal spending. Monetary policy has its limits—and won’t be able to address the areas of greatest need. As a result, Ottawa will need to keep the following in mind to keep the federal debt burden sustainable:

-

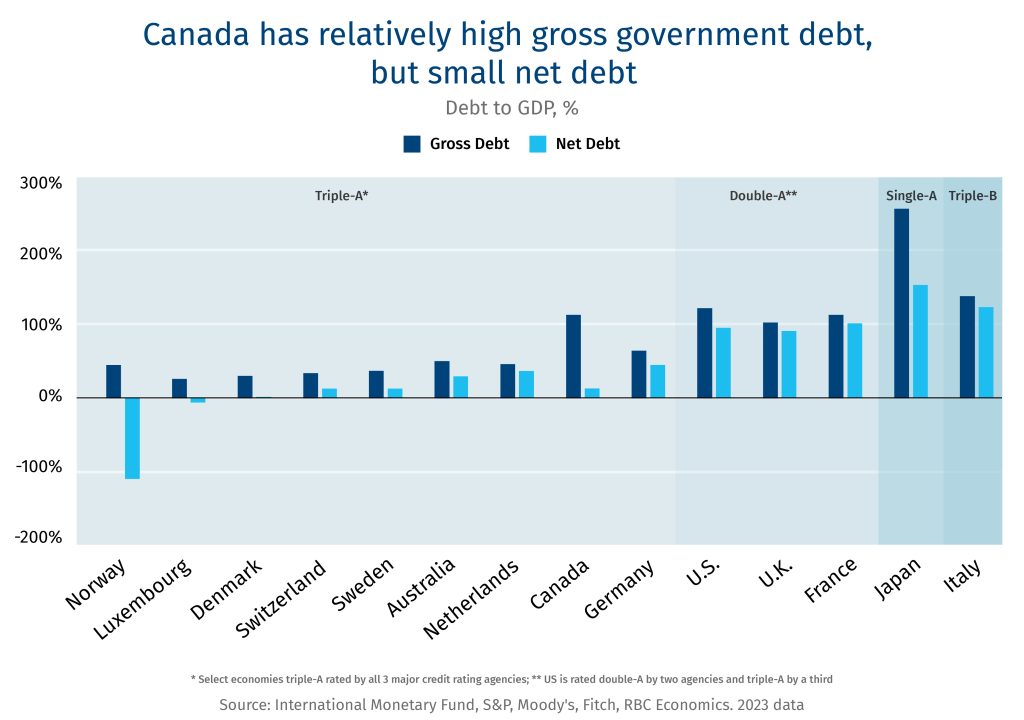

It’s not unlimited, but Canada has some fiscal space. Canada’s gross debt burden (debt-to-GDP-ratio) is high, but its net debt burden is the lowest in the G7.

-

Supporting the economy through a potential recession is expected by markets, and unlikely to raise red flags if sized and targeted appropriately. COVID-style supports that ‘bridge’ the economy is not the correct playbook in a trade shock where the economy, structurally, could look quite different in the aftermath.

-

Growth-positive investment is key to keeping federal debt levels sustainable. The more that each dollar of public spending delivers greater growth dividends, the more the federal debt burden will remain in check, even with higher spending.

-

Rebalance social and business investment measures. Canadians have benefited in recent years from an expansion in federal government spending on often broad-based social programs without absorbing the costs. Now, the feds have a new laundry list of to-dos, including kick-starting business investment. Non-spending measures like removing red tape help, but fiscal space will be needed for spending, as well.

-

Make social and other ‘must-do’ spending more growth positive. Major investment needs across the economy beg the question of sufficient capital and labour resources to achieve timely results without crowding out. Public spending in essential areas like housing, defence, and healthcare can promote efficiencies, innovation, and other growth drivers to ensure the economy can grow in multiple areas.

-

Transform AI into a productivity engine

Canada is rich in AI talent but short on the three things that can translate that talent into prosperity: modern computing infrastructure, large-scale deployment, and robust domestic demand. Only 26% of Canadian firms report having implemented AI—eight points below the global average—and the country continues to slip in AI-readiness indexes. With labour-force growth flattening and labour costs rising, closing the AI adoption gap is Canada’s most direct route to higher productivity, greater economic efficiency, and continued competitiveness.

Ottawa could pursue a three-pronged approach—acting simultaneously as facilitator, champion, and early adopter—to transform AI from a fragmented set of R&D bets into a nationwide productivity engine.

-

Facilitator: Treat compute capacity as critical infrastructure, marshalling patient capital, procurement guarantees, and partnerships with global players to facilitate access to GPU clusters. Further, government might consider targeted tax credits and grants favouring projects that embed Canadian IP and high-value jobs at home.

-

Champion: Ministers could become visible ambassadors for domestic AI successes, weaving them into every productivity, healthcare and defence announcement. Demand-side tools—procurement quotas that reserve, say, 25–30% of relevant contracts for qualified AI firms, first-reference-customer letters, accelerated tax refunds for AI pilots—have the potential to generate the domestic demand needed to keep promising startups from fleeing south.

-

Early Adopter: In the immediate term, the government could equip frontline analysts, auditors and service agents with secure co-pilots to yield productivity gains and build AI fluency. Longer term, the government could work to re-engineer programs around models that learn across departmental silos, enabled by a U.S. Department of Defense-style fast-lane tech funding agreement, a shared sovereign large language model stack, and performance incentives for senior bureaucrats who are able to effectuate AI solutions.

Contributors:

Cynthia Leach, Assistant Chief Economist, RBC

Varun Srivatsan, Director, Policy and Strategic Engagement

Shaz Merwat, Energy Policy Lead, RBC Climate Action Institute

Reid McKay, Director, Technology Policy Lead

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.