Executive Summary

-

Canada’s $30-billion supply management system has underpinned national food sovereignty and security for more than 50 years. Covering dairy, chicken, turkey and eggs, the system has ensured price and supply stability for food staples.

-

The system recognizes that producing food is costly. The arrangement fosters supply-chain stability, however, it could lead to higher consumer prices, especially amid rising input costs.

-

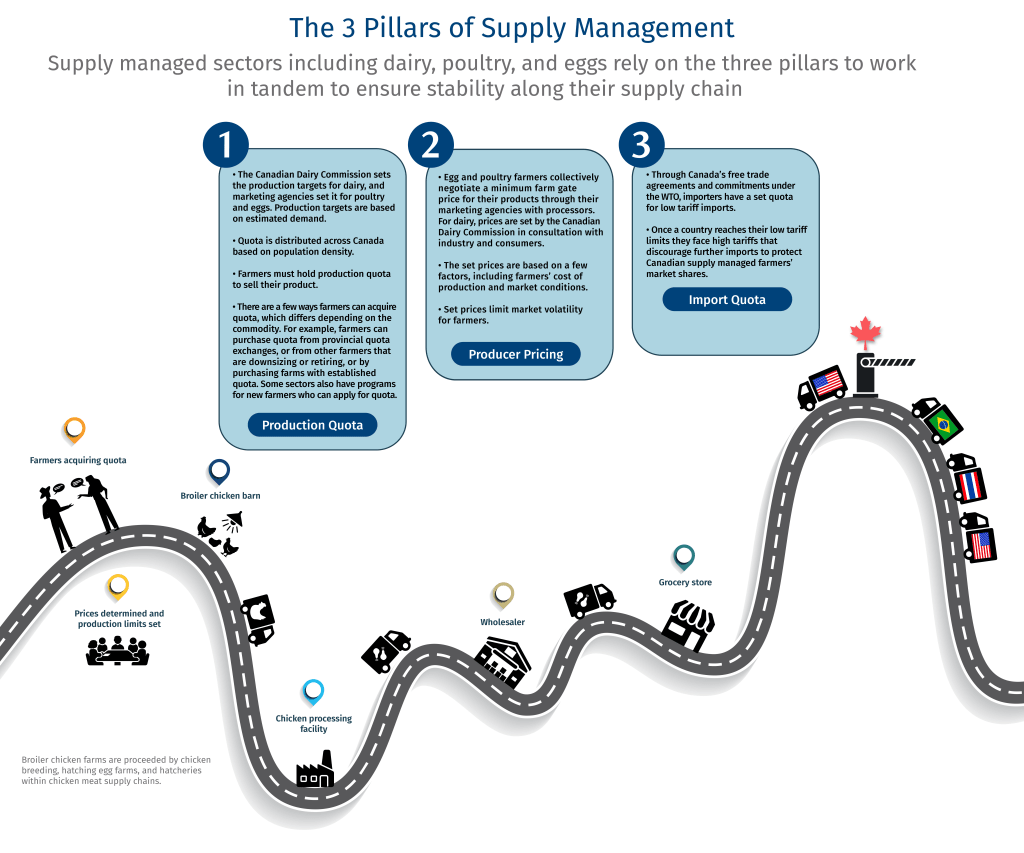

Supply management’s three foundational pillars are under attack—again. Production quotas, set pricing, and import quotas ensure the system’s integrity. But all three are facing calls for reform within Canada and from its biggest trading partners, including the United States (U.S.).

-

A new law limits Ottawa’s ability to open up the sector. The system’s advocates say Bill C-202 prioritizes national food security and restricts the Foreign Affairs Minister from making new concessions in any trade deal. Other experts say it could hurt Canada’s position in trade negotiations, including the impending Canada-U.S.-Mexico Agreement (CUSMA) review next year.

-

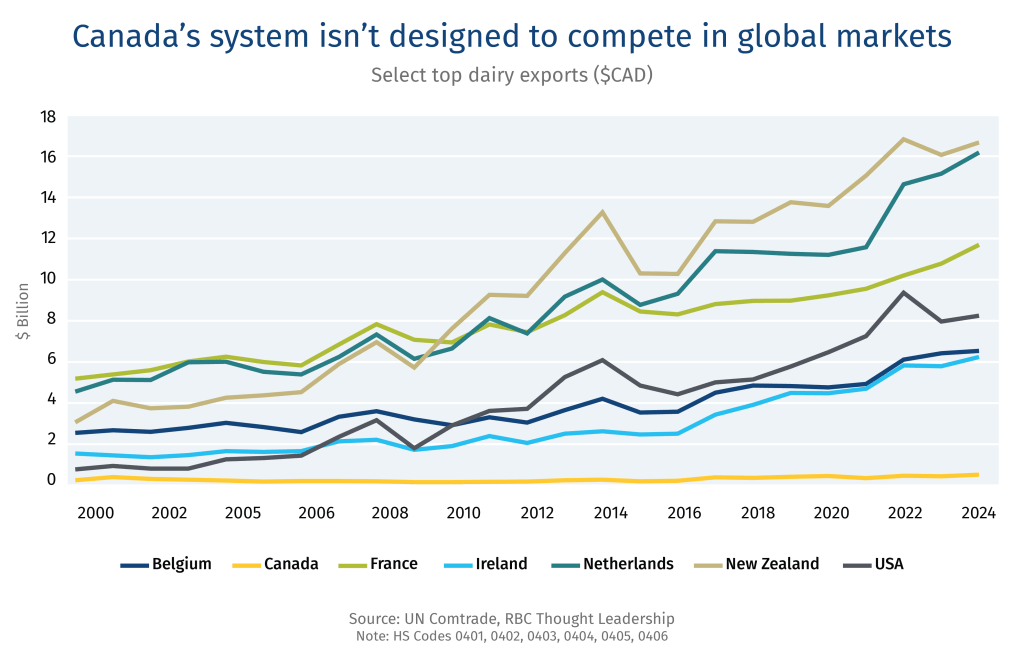

Trade deals are chipping away at Canadian producers’ dominance. Yet, expanded global market access for Canadian supply managed farmers may run counter to the system’s design. A small production base tailored to domestic consumption makes them ill-equipped to compete as exporters in global markets, where high volume and competitive pricing are crucial.

-

Canada is not alone in facing tough policy choices on agriculture. New Zealand agriculture is grappling with its outsized greenhouse gas footprint, while the United Kingdom is finding its feet post-Brexit. Brazil, second only to the U.S. in total agri-food export value, is eyeing greater global market share. Canada could draw some lessons from these international shifts as it evolves its domestic food sector.

Shifting trade policy landscape for supply managed industries

Canada’s supply management has caught the eye of the Trump administration, again, which has identified it as a major irritant as the two countries renegotiate their trade deal.

That has led to a new debate about Canada’s supply managed food industries, including dairy, chicken, turkey and eggs, that has been a staple of Canadian policy since the 1970s.

At its core, the system provides a stable price that fairly compensates farmers for producing high-quality food. The system’s advocates say it boosts food security, supports domestic producers, and ensures consistency of quality and supply for consumers, while critics say it stifles innovation, inflates prices and limits competition.

The system has come under scrutiny in nearly every trade negotiation and economic downturn, and will likely be a discussion item at the impending Canada-U.S.-Mexico-Agreement (CUSMA) review next year. It’s also being debated amid a domestic push to develop a unified market for goods and services. The conversations are evolving from polarizing calls between dismantling the system and business-as-usual, to a wider spectrum of ideas on reforming the system that’s been around for more than half a century.

Those looking to preserve the system are on the move. In June, Bill C-202 received Royal Assent with strong support from Canada’s supply-managed farmer associations. The Act instructs the foreign affairs minister to stop opening more dairy, poultry or egg quota to trading partners through international trade agreements. Still, the debate continues as stakeholders carve out specific areas for discussion, from the regional milk pooling systems to debating which part of the supply chain should get access to the foreign quota allotment.

The debate is not just bouncing off agriculture’s silo walls. It impacts many aspects of the Canadian economy, including food prices, choices, supply-chain jobs, and Canada’s trade diversification and growth prospects.

What’s at stake?

Supply management in numbers:

-

1%. The managed sectors’ contribution to Canada’s GDP, amounting to more than $30-billion. The entire agriculture and agri-food sector accounts for more than 7% of Canada’s GDP.1 2

-

339,000. The number of full-time jobs in supply managed industries, from farm to processor to distribution.3

-

14,699. The number of supply managed farms in Canada, or 8% of nearly 190,000 farms across the country.4

-

9,430. The number of dairy farms, primarily in Quebec and Ontario. Dairy farm numbers across Canada are down by more than 50% since the early 2000s, due to market consolidation.5

-

7%. The growth in the number of poultry and egg farms over the past two decades. They are largely concentrated in Ontario, British Columbia, and Quebec, with Prairie provinces also seeing an uptick.6

The 3S of supply management

The Canadian system is designed to uphold food sovereignty, stability and standards, which helps the industry prosper, but also presents challenges in a changing global food market.

Sovereignty

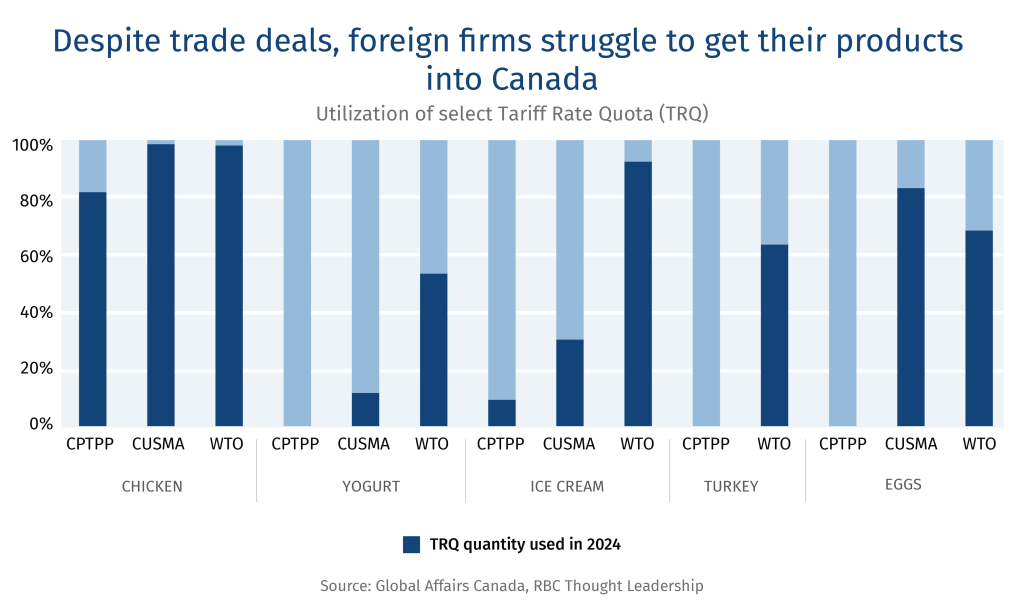

Supply management ensures stable prices and a robust domestic supply chain to meet demand. But as Canadian processors hold the majority of the tariff rate quota (TRQ), which is a set amount of low tariff imports, foreign importers have argued that they have limited access to Canada’s markets to fulfill their non-tariffed trade volumes negotiated in the agreement.

Supply management has emerged as a point of friction with Canada’s largest trading partners, especially the U.S., the European Union (E.U.), and, more recently, New Zealand. A key sticking point: Canada’s restrictions on import quotas.

The quotas are intended to limit imports within Canada’s supply management industries. In recent trade negotiations, however, Canada has made greater concessions, for example, in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) negotiations Canada agreed to provide participating countries, with an estimated 3.25% of Canada’s domestic dairy market.7 But as Canadian processors hold the majority of tariff import quotas, foreign importers have argued that they have limited access to Canada’s markets to fulfill their non-tariffed trade volumes negotiated in the agreement.

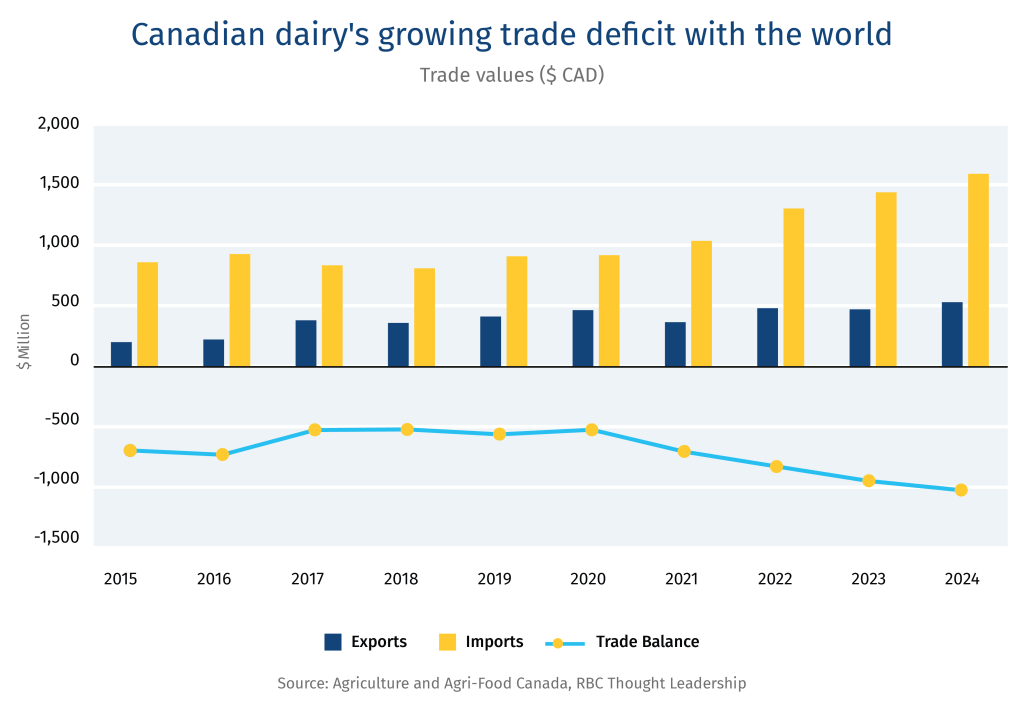

Trade deals are chipping away at domestic producers’ dominance: Trade concessions have resulted in Canada running a small trade deficit on all supply managed products, except chicken meat. For example, imports now represent roughly 4% of Canada’s dairy market.8 This has led to government payouts to dairy, poultry, and egg farmers and processors of $4.8 billion to compensate the industry’s forgone profits from foreign competition.9 Such payouts means Canadians are paying for their supply managed food at the cash register—and additionally through taxes.

Between 1995 and 2017 foreign access to Canada’s dairy TRQ was limited to commitments under the World Trade Organization (WTO). As CUSMA, the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) and CPTPP are phased in over the next ten years, Canadian foreign market access is expected to climb to roughly 10% of Canada’s dairy production.10 In return, Canada has expanded market access for dairy, poultry and eggs in these markets. Canada has a small production base with supply-chain logistics and relationships designed for domestic markets, which makes Canadian supply managed industries ill-equipped to be leaders in global markets where high volumes at competitive prices are critical for success.

Domestic supply chains are helping shield Canadians from trade wars: In times of global disruption, the domestic food supply chain has served Canadians well. Take the made-in-Canada movement that was kickstarted by U.S. President Donald Trump’s trade war. It drove down sales of American brands, with Canadians swapping them with domestic products, wherever possible. For dairy, poultry, and eggs, Canadians can remain especially confident they have immediate access to Canada-based supply chains.

Eliminating loopholes

-

Processed products such as prepared meals can blur the lines of which food products are traded under which HS code, which categorize the trade of goods and services.

-

These blurred lines have allowed importers to move products into Canada tariff-free, taking advantage of loopholes that sidestep Canada’s TRQ system, which sets the volume allotted to importers under free trade agreements, including CUSMA, CETA and CPTPP.

-

Some of these loopholes have been closed, such as cheese being imported tariff-free when it was classified as part of a prepared meal like pizza-making kits for restaurants, which fell outside of TRQ allotments. Other loopholes have yet to be closed such as spent fowl (i.e., old laying hens) which can be used as a category to trade misrepresented broiler chicken raised for meat consumption, to avoid paying Canadian duties.

-

While importers have TRQ allotments for dairy, egg and poultry products, this low-tariff pathway to Canada is often underutilized as Canadian processors control the majority of TRQs as well as earmarked space in grocery store shelves.

-

This underutilization of TRQs has been a mounting irritant between Canada and its trading partners, most notably by the Americans who say Canada has not “respected the spirit” of CUSMA, and made it challenging for their producers to access Canada’s market.

Stability

Supply management is synonymous with stability. But, at what cost and for whom? With global market disruptions on the rise, it’s critical to determine a pathway that benefits both Canadian farmers and consumers.

Canada-based food supply chains have distinguished themselves during the pandemic and other crises, such as the recent avian influenza outbreak that’s ravaged the U.S. industry.

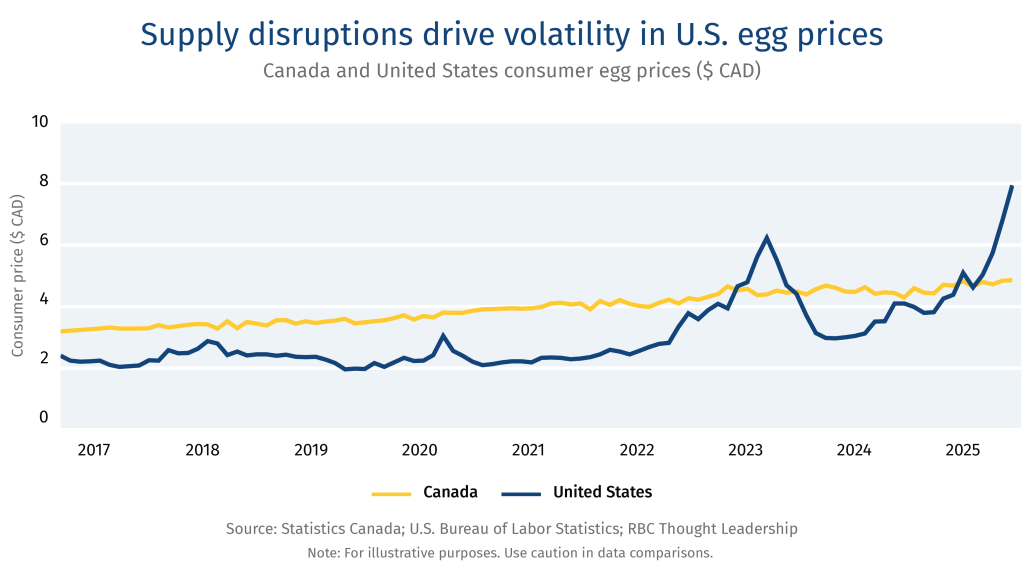

Indeed, egg prices in the U.S. have skyrocketed over the past year as the flu takes its toll on animal production, with 174 million confirmed poultry cases, and more than 1,074 dairy cow herds impacted in the U.S. by July 2025.11

The impact has been far less severe in Canada, with roughly 14 million birds infected and no reported cases among dairy herds.12 Canada’s poultry, egg and dairy farms have also been more resilient because of the industry’s standards in biosecurity and animal welfare. Smaller scale production that’s more dispersed compared to U.S. farms (aside from production-dense areas such as the Fraser Valley in British Columbia) has also helped. These on-farm factors have knock-on effects for stability in consumer pricing and product availability. On average, between 2017 and 2025, a dozen eggs sold in Canada was $1 more than in the U.S. However, that had flipped by February 2025 when a dozen eggs in the U.S. cost $3.52 dollars more than in Canada.13 14

Supply chain and market disruptions are anticipated to intensify from several issues, including a global movement away from rules-based trade and climate change triggering extreme weather events and spreading disease and pest outbreaks. It’s an important consideration for policymakers as frequent volatility impacts commodity market prices.

Producing food is a costly affair. Fixed quota and price in supply managed sectors generate certainty for farmers, which fosters stability in the supply chain. However, this stability comes with its own cost as it inherently leads to more expensive products as the cost of inputs rise in Canada. Worsening affordability disproportionally impacts food insecurity in low-income families; however significant price volatility is disruptive to average household spending, too.15 16

In contrast, non-supply managed farmers growing wheat and raising beef cattle, for example, are exposed to commodity markets, resulting in farmers’ profit margins and consumer prices fluctuating as markets shift. Non-supply managed farmers are often price receivers and cannot pass rising costs onto consumers.

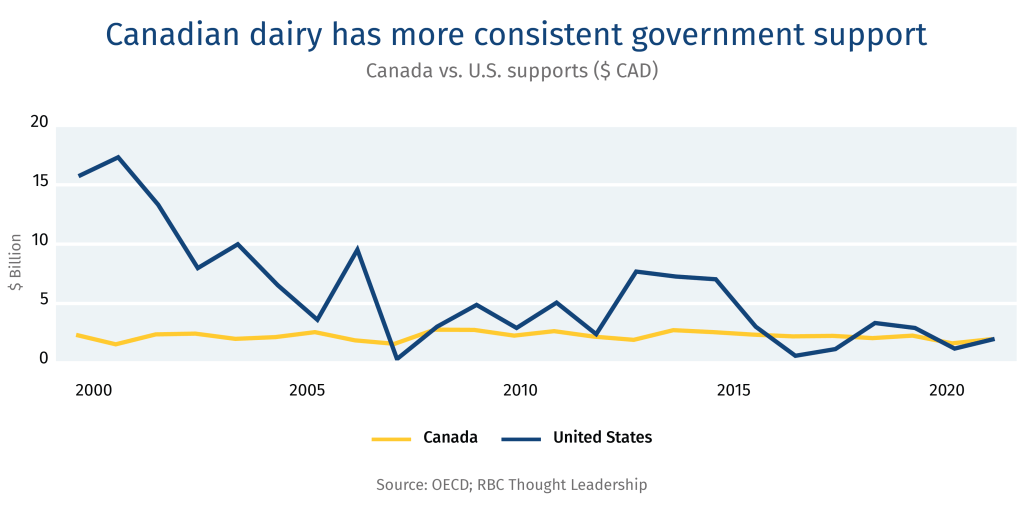

Canada’s support for farms is contentious—but comparable to the U.S. When comparing total direct producer supports, U.S. contributions are 6.5 times larger than Canada’s. Yet, the countries are roughly at par when estimating direct producer supports as a portion of value produced at the farmgate–around 7%.17 However, this support is not evenly distributed across all commodities. Specific to supply managed products, producer supports are clearly aligned with the respective countries’ approach. Canada’s contribution has been consistent with the price producers receive based on supply management, while U.S. farmer supports fluctuate in line with market volatility.

Supply managed farms contribute to Canada’s rural economy prosperity. Stability also plays a broader role in Canada’s rural economy. The most recent agriculture census data, shows the number of Canadian dairy farms fell 11% while herd size rose 13% over a five-year period (2016–2021).18 In the U.S., the number of dairy farms decreased by 34% and herd size increased by 48% over the same period.19 Consolidation enables larger dairy farms in the U.S. to achieve economies of scale. Yet, this recent rapid trend of fewer, bigger farms in the U.S. reduces the diversity of farm sizes, concentrates herd locations, making them more susceptible to disease and pest outbreaks, and can hollow out demand for supporting businesses and rural communities.

Standards

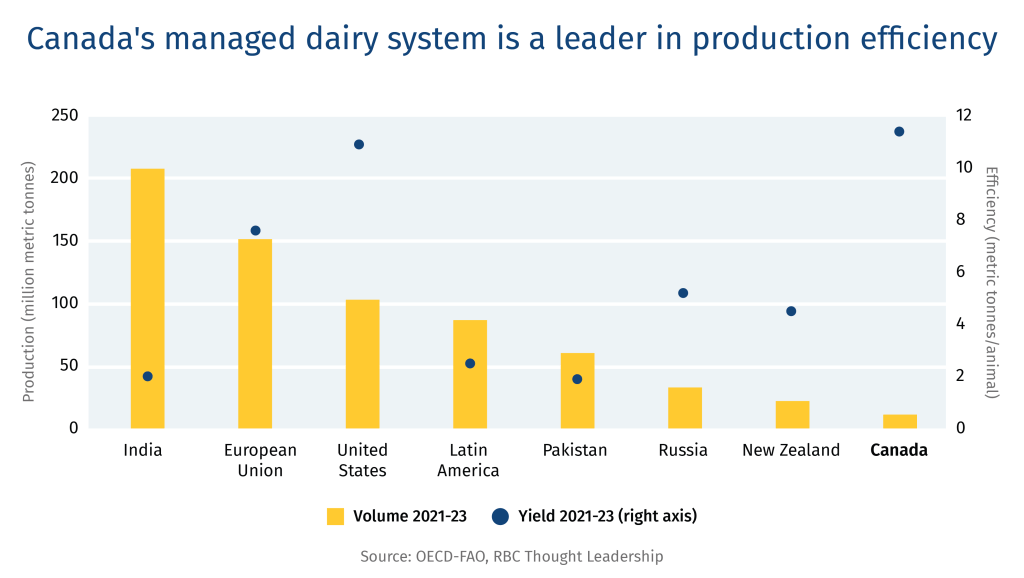

Canada’s supply management allows for a system that adheres to high standards, leading to greater efficiency and sustainability outcomes. However, the system is not designed to maximize production.

Canadian farmers are increasingly ramping up their capabilities to measure, report and verify their progress in adopting best management practices, especially those related to environmental sustainability and animal welfare. The strong governance and market control of supply management allows for widespread and consistent adoption of practices and standards at the farm and along the supply chain. To participate in the regulated market, supply managed farms adhere to an industry code of practice and regulated standards, which has raised Canada’s standards for animal welfare and health and food quality. Non-supply managed production systems in Canada such as beef also have quality assurance programs that ensure high standards on farms such as the Ontario Corn Fed Beef Quality Assurance Program. Yet, the governance system of supply management enables widespread and consistent adoption of practices—an ambition that’s challenging to achieve when there is less regulation and market control.

More stringent standards than the U.S. Nonetheless, on both sides of the border, milk is safe and produced to a high standard. ProAction is the Dairy Farmers of Canada’s framework for best management practices and standards across six themes: milk quality, food safety, traceability, biosecurity, animal care and the environment—with 99.7% of Canadian dairy farmers registered.20 Similarly, the U.S. has the National Dairy Farmers Assuring Responsible Management (FARM), which covers 99% of the U.S. milk supply.21 However, standards within these two programs and the complementary regulations differ, which can impact animal health and milk quality. The U.S. also allows for a higher Somatic Cell Count (SCC), which counts white blood cells in cows. Similar to humans, high white blood cells mean the body is fighting an illness or inflammation, which could negatively impact milk quality. Somatic Cell Count in the U.S. is 750,000 individual cells (IC) per millilitre (mL), while in Canada stands at 400,000 IC per mL.22 23

Industry is focused on efficiency and sustainability. The governance frameworks of supply management also provide a platform to scale farmer engagement in industry-wide initiatives on issues such as efficiency, innovation and sustainability. For example, egg farmers across Canada are measuring and reporting their progress on sustainability through the National Environmental Sustainability and Technology Tool (NESTT) platform. This unified approach sidesteps the increasingly fragmented landscape of sustainability and regenerative agriculture projects that many farmers are navigating for market access or to develop new revenue streams through mechanisms such as carbon credits and green premiums.

Global dairy lessons: How other markets are navigating transition and disruption

Food security and sovereignty are featuring high on government agendas globally as extreme weather interrupts food production and trade barriers disrupt trade flows.

Dairy, a nutrient and culturally significant staple in many diets around the world—from French cheese to lassi in India—, has high demand but also high volatility in international markets, resulting in the industry attracting elevated attention in policy, trade, and farmer support.

Here’s how other countries are managing their dairy sector during times of transition and disruption.

New Zealand: An international leader with a rising GHG footprint

New Zealand removed its production quota in the 1980s due to a budget crisis, transforming the country into the world’s largest dairy exporter. In 2001, the government launched Fonterra, a farmers’ co-op, which sets prices and is now the largest purchaser of domestic milk. Its price calculation is based on revenue from milk sales minus operating and overhead costs and capital recovery. New Zealand has more than doubled its national herd since the early 1980s, and individual herd sizes increased three-fold. Consolidation meant the number of herds fell from 15,753 in 1985 to 10,485 in 2024.24 Market liberalization has transformed the New Zealand dairy supply chain, especially powder milk production, which has grown 237% in volume since 2000, driven by free trade agreements with large importers such as China and targeted foreign and domestic investment in building capacity and automating manufacturing processes.25

The dairy sector has become highly efficient and competitive, as demonstrated by its herd consolidation, but the growth in the number of cows has raised the sector’s environmental impacts, such as greenhouse gas emissions (GHG). Led by dairy, agriculture now accounts for over 50% of New Zealand’s GHG emissions.26 Recent national GHG targets have created uncertainty in the sector, resulting in a review of national targets and agriculture’s role in meeting them. AgriZero, a public-private partnership, is focused on matching funds and accelerating climate action in agriculture. It’s seen as a unique model to stack funds at a time when attention on climate mitigation has slowed down.

Lesson for Canada: A first of its kind, AgriZero serves as an example for Canada to explore as pools of climate funds shrink and the need for coordinated, scaled action in agriculture grows.

United Kingdom: Transitioning away from the EU model

The U.K. is transitioning its policy approach to area-based subsides under the Environmental Land Management Schemes (ELMS) post-Brexit that’s underpinned by sustainable agriculture such as marginal land rehabilitation. Dairy producers in the U.K. received direct payments under the EU’s Common Agriculture Policy (CAP), but these types of payments are being phased out until 2028, as part of the U.K. departure from the economic bloc. This transition in farmer support imposes both financial and administrative burdens on the sector as farmers navigate change, amid rising costs of domestic production and competition from importers.

To enable greater agri-food trade among E.U. countries and the U.K., the two have agreed to move forward with establishing a common Sanitary and Phytosanitary area (i.e., shared standards on food safety and quality) that aims to ease the movement of agriculture and food products across the U.K. and EU. However, some say that the move could impact the U.K.’s ability to form trade agreements with countries outside of the E.U. and maintains the U.K.’s ties to the economic region.

Lesson for Canada: As Canada embarks on a mission to strengthen and diverse its international trade, it might avoid going from an over-reliance on the U.S. to over-indexing to another region or country via overly restrictive standard alignment of agri-food products for trade.

Brazil: The struggle to break into the global market despite high ambition

Brazil has transformed its agriculture sector and is now a leader in global agri-food exports—the second largest in the world, after the U.S. Yet, less than 1% of Brazil’s dairy production is exported.27 Domestic demand, market infrastructure that’s not export-oriented, and a highly competitive international market has impeded Brazil’s global push.

The country’s dairy production and processing infrastructure greatly varies from smallholder, subsistence farms to modern, large-scale farm businesses. The former is supported through subsidies for asset investments such as cooling tanks, pasture, and milking infrastructure. Farmer prices are mostly market-driven, but the government may intervene via CONAB (National Supply Company) to buy excess milk or offer storage subsidies.

With ambitions to break into the global market in a big way, Brazil is up against tough competition, notably from New Zealand, as it eyes the Middle East, Latin American and Asian markets. To grow globally, Brazil must also address its weaker standard and regulatory approach to land use, GHG emissions, traceability and cold-chain logistics.

Lesson for Canada: While Brazil and Canada have had different agri-food development trajectories to date, they are increasingly competing for the same piece of the global agri-food export pie. Brazil’s approach to enabling diverse scales of production, targeted at both domestic and export growth, should prompt Canada to investigate its own production, which continues to consolidate and faces rising foreign competition.

Market Outlook

Canada’s supply management systems is designed to protect the country from changes in international markets. Yet, policymakers still need to be alert to structural shifts and macro trends in the global industry.

Dairy

-

Real global dairy prices for farmers are projected to trend downward within this decade. But, relative to input costs, prices are expected to rise, especially as milk produced per animal grows.28 U.S. farmers could see an average annual drop of 8% year-over-year in real price, signalling lower returns for dairy farms in commodity markets that do not innovate and grow.29

-

Global dairy consumption is expected to modestly increase 1% per year, while production is projected to grow at 1.6% per year to 1,085 million tonnes, driven by production in India, Pakistan and Sub-Saharan Africa, primarily for their domestic consumption.30

-

Fresh dairy consumption in North America and Europe are stable or declining as consumers move away from full-fat milk and cream, and plant-based alternatives such as oat milk mature as an established replacement. Processed dairy consumption, including butter and powder milks are on the rise driven by their use in food manufacturing, including infant formula and baked goods. Finally, cheese consumption, which is closely connected to household income has been on the rise in growing international markets such as Mexico, the U.S., Brazil and Saudia Arabia.31

-

Only 7% of global milk production is traded internationally due to its perishability and as market infrastructure in many countries is primarily designed for domestic or regional distribution with few exceptions, such as New Zealand and Ireland. However, over 50% of milk powder, including whole and skim products, are traded.32

-

World dairy trade is expected to grow by more than 12% over the next eight years. Skim milk powder from the U.S. and cheese from the E.U., two of the largest dairy export segments, are poised for the highest growth.33

Poultry and eggs

-

Global prices for poultry and eggs are projected to decline as inflation and input costs fall. For example, U.S. farm prices per dozen of eggs are projected to decline by US$0.90 over the next decade, with an average year-over-year decline of 4%.34 However, U.S. production is expected to rise 12% by 2033, from a 2022 baseline.

-

Poultry production is expected to increase with growing demand, and account for nearly half of all meat produced. Global poultry consumption is expected to grow 16% over the next decade—the most among animal proteins. Poultry is projected to account for 43% of animal protein consumed by 2034, with notable growth in Brazil, Europe, and the U.S.35

-

China’s self-sustaining food policy and recent rebound from African swine fever and avian influenza outbreaks has resulted in a decline in global meat trade from its height in 2021, when China accounted for roughly a quarter of global meat imports.

-

Population and GDP growth in Africa and Asia are expected to rebound meat exports within the next decade, driven by poultry which is expected to account for over 40% of total meat imports.36

Contributors:

Lead author

Lisa Ashton – Director, Agriculture Policy

Editor

Yadullah Hussain – Managing Editor

Design and production

Caprice Biasoni – Graphic Design Specialist

Download the Report

Statistics Canada. GDP at basic price, by industry, province and territory, 2025.

Agriculture and Agri-Food Canada (AAFC). Overview of Canada’s agriculture and agri-food sector, 2025.

Dairy Farmers of Canada. What Supply Management Means for Canadians, 2024.

Statistics Canada. Farms classified by farm type, Census of Agriculture historical data, 2022.

Statistics Canada.

Statistics Canada.

Dairy Processors Association of Canada. Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Statistics Canda. Dairy statistics and market information, 2025.

Agriculture and Agri-Food Canada (AAFC). Supporting Canada’s supply-managed sectors, 2023.

Dairy Processors Association of Canada. Canada-United States-Mexico Agreement (CUSMA).

U.S. Centers for Disease Control and Prevention. Avian Influenza (Bird Flu), 2025.

Canadian Food Inspection Agency (CFIA). Status of ongoing avian influenza response by province, 2025.

Statistics Canada. Monthly average retail prices for selected products, 2025.

U.S. Bureau of Labor Statistics. Consumer Price Index – Average price data, 2025.

Statistics Canada. Household spending by household income quintile, Canada, regions and provinces, 2025.

Statistics Canada. Food insecurity by economic family type, 2025.

Organisation for Economic Co-operation and Development (OECD). Agricultural policy monitoring, 2024.

Statistics Canada. Number of cattle, by class and farm type (x 1,000), 2025.

United States Department of Agriculture, National Statistic Services (USDA NASS) 2022 Census of Agriculture, 2024.

Dairy Farmers of Canada (DFC). ProAction, 2025.

Farmers Assuring Responsible Management (FARM).Animal Care, 2025.

DFC. ProAction – Milk Quality, 2021.

USDA. Determining U.S. Milk Quality Using Bulk-Tank Somatic Cell Counts, 2018.

DairyNZ and LIC. New Zealand Dairy Statistics 2023-24, 2024.

USDA Foreign Agricultural Service. New Zealand: Dairy and Products Annual, 2025.

Ministry of the Environment, New Zealand. New Zealand’s Greenhouse Gas Inventory, 2025.

Food and Agriculture Organization, United Nations (FAO). Dairy Market Review: Overview of global market developments in 2024, 2025.

OECD and FAO. OECD-FAO Agricultural Outlook 2024-2033, 2024.

USDA Economic Research Service. USDA Agricultural Projections to 2034, 2025.

OECD-FAO.

FAO.

OECD-FAO.

OECD-FAO.

USDA.

OECD-FAO.

OECD-FAO.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.