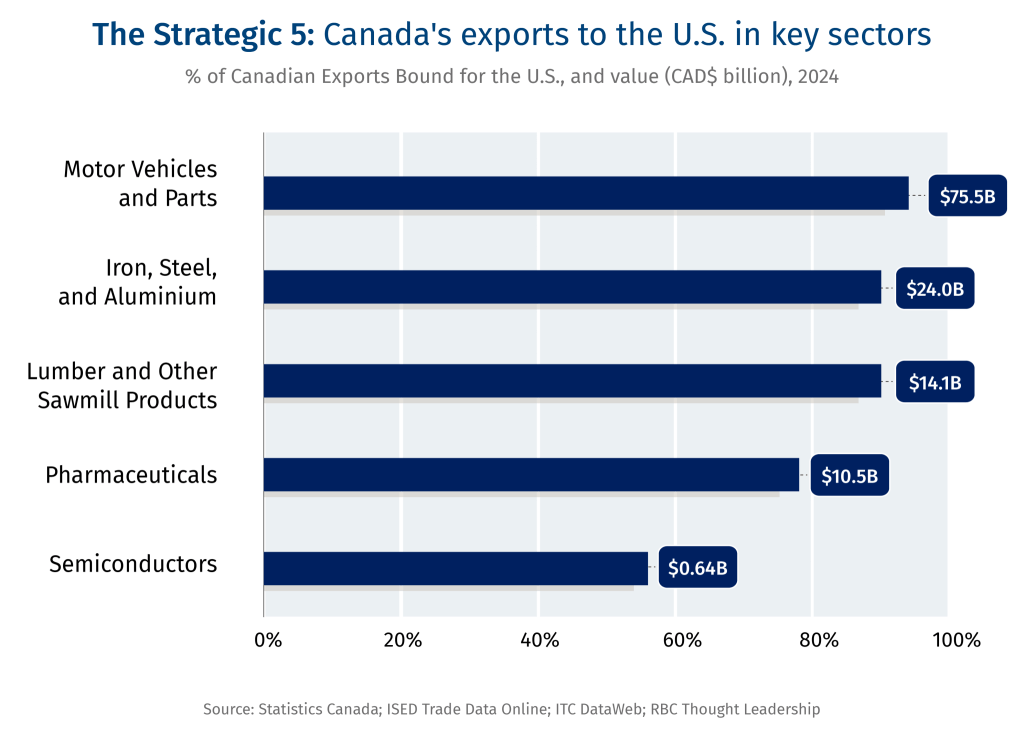

U.S. President Donald Trump believes autos, steel and aluminum, lumber, pharmaceuticals and semiconductors are the five strategic sectors that will drive American industrial revival. His overarching plans involves cutting imports (and trade deficits) and onshoring domestic production in each of the sectors and related industries. That’s emerging as a challenge for some of the U.S.’s top sector suppliers, including Canada.

These five domestic sectors rely heavily on shipments south of the border and are of strategic importance to Canada.

U.S. tariffs on the Strategic 5 will likely hurt Canada’s economic prospects and could trigger layoffs and flight of capital in sectors that are vital for our energy and national security.

Here’s a look at the importance of each of these sectors to the Canadian economy:

Automotive

-

Exposure to the U.S. market: $75.6 billion in exports (2024)

-

Total U.S. market: Sales of new vehicles in the U.S. reached 15.8 million units in 2024—second only to China’s 31.3 million.1

-

Global market: Just over 88.2 million vehicles2 are estimated to have rolled off assembly lines worldwide last year.

-

Canada’s role: Domestic auto- and part- makers’ market share in North American auto manufacturing has fallen over time, with Mexico gaining ground. However, 92% of Canadian auto exports are still shipped south of the border.

-

Tariff status: For CUSMA-compliant vehicles, the 25% tariffs are currently in force and apply to the value of non-US content.

-

Canada’s response: Ottawa’s countermeasures focus on 25% tariffs on all U.S. auto parts not compliant with CUSMA. The federal government and Ontario are also easing tariffs for U.S. auto parts for companies that remain committed to the Canadian auto supply chain.

-

The fallout: Stellantis and General Motors temporarily laid off staff in Ontario assembly plants.

-

What’s next: The Trump administration is mulling a potential pause on auto tariffs—primarily to give carmakers more time to onshore supply chains.

Aluminum, steel and iron

-

Exposure to the U.S. market: 91% of Canada’s aluminum and 89% of its steel exports were shipped to the U.S.

-

Total U.S. market: The U.S. consumed 93 million tonnes of steel in 2024—with Canada supplying 6.4 million metric tonnes of the total.3

-

Global market: Global aluminum demand has steadily increased over the past decade, driven mostly by growth in Chinese demand and from sectors like construction and transport.

-

The U.S. has had an average trade deficit in aluminum with Canada of about US$7 billion annually over the past five years.4

-

Canada’s role: We are a top foreign supplier of aluminum and steel to the U.S., ahead of China and Mexico.

-

Tariff status: The 25% U.S. tariffs on aluminum and steel imports from Canada are triggered by American efforts to bolster its domestic industry. The first Trump administration had also imposed tariffs on Canadian aluminum for 14 months, lifting them after USMCA was ratified in 2019.

-

The fallout: Hundreds of workers in the aluminum and steel industry have already been laid off since the latest tariffs came into effect.6 Ottawa is taking several measures to support Canadian workers and businesses.

-

What’s next: Commerce Secretary Howard Lutnick says reprieves on steel and aluminum tariffs are unlikely. With aluminum featuring on the USGS Critical Minerals list and a new probe on U.S. critical mineral imports underway, Canada’s aluminum industry may need to gear up for further uncertainty.

Lumber and other sawmill products

-

Exposure to the U.S. market: $14.1 billion in exports—90% of Canada’s total lumber exports.

-

Total U.S. market: The U.S.’s trade deficit against Canada in softwood lumber averaged US$5.8 billion annually over the past decade, according to the U.S. International Trade Commission.

-

Global market: The US$788 billion global wood products market is expected to nearly double in value by 2033. We wrote recently on how Canada can capture a greater share of the global opportunity.

-

Canada’s role: Canada’s domestic consumption of softwood lumber has fallen 11% from a decade ago. Domestic demand, which has generally followed housing starts, reached a 23-year low in 2023.

-

Tariff status: Under the Biden Administration, the U.S. raised duties charged on Canadian softwood lumber imports to 14.5% in August 2024. These tariff rates remain in place with additional hikes on the horizon.

-

The fallout: The lumber industry is already facing regulatory headwinds that have forced closures of sawmills in B.C.

-

What’s next: U.S. tariffs on softwood lumber imports are set to increase to 34.5% and could come into effect in the fall.

Pharmaceuticals

-

Exposure to the U.S. market: $10.6 billion in exports.7

-

Total U.S. market: Prescription drug sales in the U.S. were $716 billion in 20228 , or about 2.8% of U.S. GDP.

-

Between 2019 and 2024, the U.S. has run an annual $1.2 billion trade deficit in pharmaceuticals with Canada, according to U.S. International Trade Commission data.

-

Global market: Pharma R&D spending is expected to top US$200 billion9 this year.

-

Canada’s role: The U.S. is Canada’s primary pharmaceutical export market, accounting for 78% of its pharma exports in 2024. Japan, the next largest export market, received 5% ($720 million) of exports, followed by China, at 2% of exports, or $276 million. The Canadian pharma industry employed 35,367 workers in 2024.

-

Tariff status: Originally exempt from the April 2 reciprocal tariffs, the White House has now officially launched an investigation into the national security impacts of pharmaceutical imports.

-

The fallout: Industry is warning of a spike in costs of drugs and even shortages of key medicines.10

-

What’s next: Major tariffs on pharma could be on the horizon.

Semiconductors

-

Exposure to the U.S. market: $637 million, or 56% of Canadian semiconductor exports, in 2024.11

-

The U.S. runs a trade surplus in semiconductors with Canada, reporting a surplus of $764 million in 2024.

-

Global market: Global semiconductor sales were estimated at $627 billion in 2024.12

-

Total U.S. market: Companies involved in the semiconductor ecosystem plan to invest nearly US$450-billion in more than 90 new manufacturing projects in the U.S. across 28 states, according to an industry association.13

-

Canada’s role: Canada is emerging as AI hub with its clean and cheap electricity seen as a competitive edge. A recent RBC Thought Leadership report, published before the trade turmoil, estimated Canada could attract nearly $100 billion across 20-30 data centres. Disruptions to the nascent chip supply chain could disrupt that potential capital flow.

-

Tariff status: The U.S. announced probe into chip and electronics imports in early April, paving the way for new tariffs.

-

The fallout: Several tech companies have seen their stocks drop.

-

What’s next: Some reports suggest Trump will announce new tariff rates on imported semiconductors next week, with flexibility for certain companies. Secretary Lutnick said it would likely come in “a month or two.”15

Vivan Sorab is Senior Manager, Clean Technology.

1. https://www.coxautoinc.com/news/cox-automotive-forecast-dec-2024-u-s-auto-sales-forecast/

2. https://www.spglobal.com/automotive-insights/en/blogs/2025-auto-sales-forecast-global

3. US Geological Survey

4. ITC DataWeb

5. Ibid

7. Considering HS Codes 3003 and 3004.

9. https://www.ifpma.org/wp-content/uploads/2025/02/IFPMA_Always_Innovating_Facts__Figures_Report.pdf

10. https://www.ft.com/content/3d1cebdd-3670-4e8d-9bfc-2a6398ede14b

11. Considering HS Codes 8541 and 8542.

12. https://www.wsts.org/76/103/WSTS-Semiconductor-Market-Forecast-Fall-2024

13. https://www.semiconductors.org/2024-state-of-the-u-s-semiconductor-industry/

14. https://www.cnbc.com/2025/04/15/us-discloses-details-on-chips-probe-as-it-prepares-new-tariffs-.html

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.