Note: This page is now archived. Recent updates to RBC Canadian Inflation Watch here.

2024

By Nathan Janzen and Abbey Xu

-

The slowing in year-over-year price growth to a 2.0% rate – the lowest since February 2021, and right in line with the BoC’s 2% inflation target – was largely driven by lower gasoline (and oil) prices but broader underlying inflation pressures also showed further signs of easing.

-

The BoC’s preferred median and trim measures both posted ‘normal’ looking 0.2% month-over-month increases that pushed the closely-watched 3-month average annualized growth rate for the pair down to 2.4% from 2.8% on average in July.

-

Trim services ex-shelter prices (sometimes called BoC supercore) rose 0.2% month-over-month by our count, with the 3-month average annualized growth rate slowing to 2.5% in August from 3.0% in July.

-

Shelter costs are still one of the remaining pockets where prices are rising rapidly. Home rent prices were up 8.9% from a year ago in August. Mortgage interest cost growth has started to slow but are still 18.8% above year-ago levels in August. Those two price components accounted for ~two-thirds of the total year-over-year CPI increase in August by our count. higher shelter costs (among the most non-discretionary of non-discretionary purchases) will continue to cut into household purchasing power for other products.

-

By our count, 46% of the CPI basket was growing at an above 3% rate over the last 3-months (month-over-month annualized rates), down from 49% in July.

-

Food price growth held steady at a 2.7% year-over-year rate (unchanged from July) an energy prices fell 4.7% from a year ago on lower gasoline (and oil) prices.

Bottom line: Broader inflation pressures look to be back around the 2% inflation target, and interest rates are still at levels high enough to restrict economic growth and push price growth lower. Per-capita GDP already down in 7 of the last 8 quarters and the unemployment rate up more than a percent from a year ago. Against that backdrop, the path to further BoC interest rate cuts is clear. We continue to expect a gradual rate cutting path (25 basis points per meeting) down to a 3% overnight rate with risks tilted to potentially larger cuts if the economy softens significantly further.

by Claire Fan

-

Headline inflation kept easing in Canada in July to 2.5% year-over-year that was the lowest reading since March 2021.

-

The yearly readings for both food (2.7%) and energy inflation (0.4%) were little changed. Gasoline prices were slightly higher than both last month and July a year ago. That in turn means the moderation in headline CPI came from everything else – core ex-food and energy CPI dropped to 2.7% year-over-year in July from 2.9%.

-

In July, shelter inflation slowed to 5.7% year-over-year following persistent easing in CPI for mortgage interest costs (MIC) since fall of 2023. MIC inflation in July was still high, up over 20% from a year ago. Excluding that, headline inflation in Canada has been trending around the 2% target since January this year.

-

Rent inflation is another spot that pressures are easing but slowly – rent CPI in July was still elevated at 8.5% above last year. Meanwhile sluggish resale market performance is keeping a lid on inflation for owned home expenses, which remained negative on a yearly basis.

-

Bank of Canada’s preferred “core” CPI measures – CPI trim and median both grew at a slower pace in July, more in line with very small increases in the spring after having accelerated in May and June. On a month-over-month seasonally adjusted basis, the two measures averaged 0.1% above June.

-

The “supercore” CPI measure, i.e., BoC’s trim services ex-shelter index grew at a similarly slow pace, up 0.1% from June to leave the three-month annualized reading at 3%, down from 3.3% in June.

-

Among other components, a smaller than expected seasonal upswing in airfare and travel tours in July left prices for both dipping below levels a year ago. Improved auto inventory as supply chain knots continue to untie also led a persistent slowing in auto inflation. Prices for new cars were about 1% above last year and prices for used cars dropped to 6% below.

Bottom line: Today’s CPI print should be enough to quell concerns about sticky inflation pressures in Canada after two marginal upside surprises in May and June. Readings were unequivocally weak – with slowing evident among all core CPI measures. The scope of price pressures also continued to normalize – the diffusion index says the breadth of inflation in Canada is looking similar to pre-pandemic norm in 2019. That’s good news for the Bank of Canada, who is actively turning their focus onto a weakening economic backdrop and the disinflationary pressures that could stem from that moving forward. The hurdle for more BoC cuts this year is low and we continue to look for another 25 basis point cut at their next meeting in September.

By Claire Fan

-

After an upside surprise in May, inflation trends in Canada largely resumed lower in June with headline CPI dropping to 2.7% from 2.9%.

-

The decline in headline inflation mostly reflected easing in energy CPI growth (to 0.5% year-over-year in June) following a 3% drop in gasoline prices month-over-month from May. That was enough to offset a rise in food inflation to 2.8% from 2.4% in May.

-

June was the second month that growth in food prices accelerated. On a monthly seasonally adjusted basis, food prices rose at a 0.6% average rate in each of May and June, much faster than the -0.03% pace between January and April this year.

-

Excluding food and energy, core CPI held unchanged at 2.9% year-over-year from May. Other “core” CPI measures that the Bank of Canada pays close attention to, including CPI trim and CPI median both rose at a slower 0.2% (seasonally adjusted) in June. That leaves the yearly reading for CPI trim unchanged at 2.9%, and for CPI median slightly lower at 2.6%.

-

The “supercore” CPI measure, i.e. BoC’s trim services ex-shelter index again rose by a larger 0.3% in June on a seasonally adjusted basis, matching the reading in May. That pushed the three-month annualized reading of the same measure higher to 3.4% in June from 3%.

-

Nonetheless, from the BoC’s perspective the broader picture remains that inflation pressures are easing in Canada – the closely watched 3-month rolling average increases in the preferred core measures rose but that was following a string of earlier downside surprises so the 6-month rolling average continued to ease.

-

On the goods side, persistent unwinding in global supply chain challenges and diminishing demand over the past years continue to feed through to lower goods inflation in Canada. In June, prices for durable goods were 1.8% below a year ago, driven by price drops in used cars (-4.5%) as auto inventory improves, and in furniture (-3.9%).

Bottom line: June’s CPI print was a small relief after an upside surprise in May, with headline inflation matching consensus expectation prior to the release. Bank of Canada’s preferred CPI trim and CPI median both dropped lower on a monthly basis although the narrower “supercore” measure held slightly higher. Yesterday’s second quarter release of the BoC’s Business Outlook Survey largely confirmed further normalizing in a few key areas that the central bank has deemed critical to future inflation trends, including firms’ pricing behaviour, their expectations for inflation in the future as well as wage growth. All told, we expect the BoC will carry on with easing the monetary brakes on a weak economy, and follow up with another rate cut at its July meeting next week.

By Nathan Janzen

-

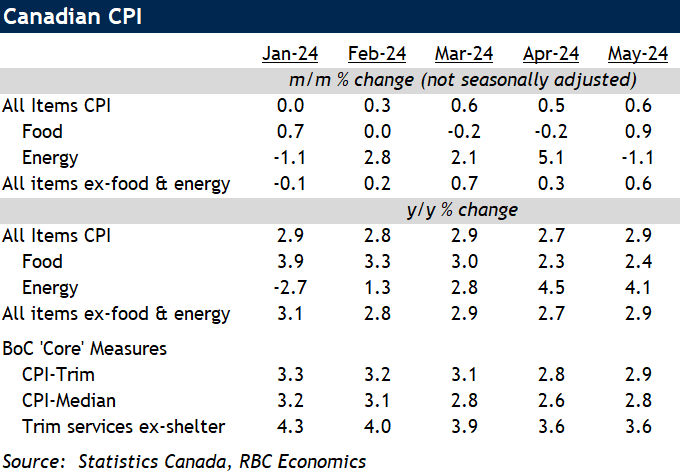

The increase in CPI growth (to 2.9% year-over-year from 2.7% in April) was the first upside surprise of 2024 following a string of softer readings.

-

The headline increase largely reflected an acceleration in underlying ‘core’ measures of price growth – lower oil prices caused energy price growth to slow slightly and food price growth was little changed.

-

Excluding food and energy, price growth rose to 2.9% year-over-year from 2.7% in April, with the gain led by higher travel prices (airfares, travel tours, and traveler accommodation).

-

The BoC’s preferred ‘core’ median and trim measures both posted their largest increases since December with 0.3% month-over-month gains that pushed year-over-year growth rates for the median and trim measures to 2.8% and 2.9%, respectively.

-

The BoC’s trim services ex-shelter index also rose 0.3% month-over-month, by our count, with the year-over-year growth rate holding steady at 3.6%.

-

The 3-month average share of the CPI basket growing at a faster than 3% rate in May (another metric the BoC has been watching closely) was little-changed by our count at 36% (and still close to ‘normal’ pre-pandemic levels).

-

Bottom Line: The acceleration in May CPI growth is the first significant upside surprise of 2024. The closely-watched 3 month growth rates for the median and trim measures ticked back above the 2% inflation target, but year-to-date (5-month average) increases are still essentially bang-on 2%. The BoC is highly data dependent, and the upside surprise in May CPI growth will put more focus on the June CPI numbers to be released ahead of the next policy rate decision in July. But softening per-capita GDP and rising unemployment also increase the odds that price growth will continue to broadly slow.

By Abbey Xu

-

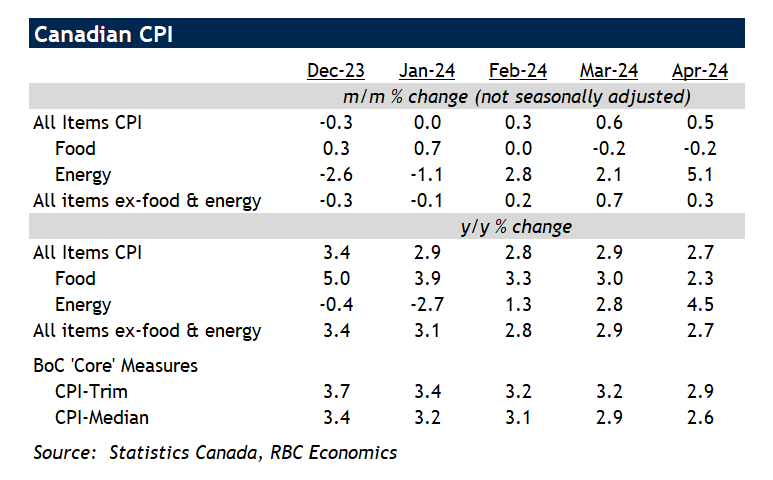

CPI growth decelerated to 2.7% year-over-year from 2.9% in March, remaining below the upper end of the Bank of Canada’s 1% to 3% target range for the fourth consecutive month and with details pointing to further softening in underlying inflation trends.

-

Energy price growth accelerated to 4.5% year-over-year due to higher gasoline prices (+6.1% from the prior year), boosted by higher oil prices and the annual rise in the federal carbon tax.

-

Food inflation continued to slow, dipping to 2.3% in April from 3.0% in March. Price growth at grocery stores decreased to 1.4% from 1.9% in the prior month. And price growth for dining out dipped to 4.3% in April, versus the 5.1% in March.

-

The Bank of Canada’s preferred core measures slowed further, with the median and trim measures easing to 2.6% and 2.9% above year-ago levels, respectively. The more recent 3-month annualized growth rates for both (closely monitored by the BoC) ticked slightly higher but were still at rates below the 2% inflation target.

-

Excluding food and energy components, inflation eased to 2.7% from a year ago. On a month-over-month basis, it decelerated to 0.1% in April from 0.2% in March. Rising rent and mortgage interest costs continue to account for a disproportionate share of price growth with shelter costs up 6.4% year-over-year. Growth in mortgage interest costs slightly decreased in April but remained 24.5% higher than a year ago.

-

The breadth of inflationary pressures narrowed again in April, with the proportion of the CPI basket experiencing growth exceeding 3% decreasing to 34% from 38% in March.

-

Bottom Line: April’s inflation readings largely met expectations, but with underlying details (including further slowing in the BoC’s preferred ‘core’ measures) pointing to further reduction in inflationary pressures. The Bank of Canada is as concerned about where inflation will go in the future as where it is right now, but a persistently softer economic backdrop in Canada (declining per-capita GDP and rising unemployment rate) increases the odds that price growth will continue to slow. The case for interest rate cuts from the Bank of Canada continues to build, with today’s report in line with our own base case for a first cut in June.

By Claire Fan

-

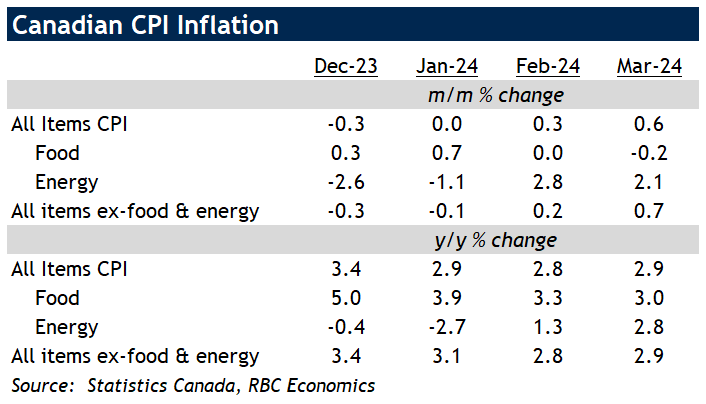

Canadian CPI growth ticked up to 2.9% year-over-year in March from 2.8% in the prior month, thanks to higher energy prices. Despite the rise, details in the report continue to point to price pressures broadly unwinding.

-

Trends in food and energy inflation continue to diverge. Food CPI growth slowed further to 3% with grocery inflation dropping to 1.9% year-over-year. Price growth for dining out in the meantime was higher at 5.1% and was unchanged for a second month in a row.

-

Energy inflation jumped to 2.8% year-over-year in March led by higher gasoline prices in the month. That was a result of rising oil prices that are tied to heightened supply concerns with ongoing geopolitical tensions.

-

The Bank of Canada’s preferred ‘core’ measures that are designed to gauge broader underlying price growth all showed further improvement. CPI trim and median both eased and averaged below the top end of the 1% – 3% inflation target for the first time since inflation started to rise more substantially, around the summer of 2021.

-

Excluding energy and shelter related components from services CPI, another preferred core inflation measure that is the Bank of Canada’s “supercore” dropped to 2.8% in March on a three-month annualized basis from 3.4% in February.

-

Shelter prices continued to account for a disproportionate share of overall price growth, especially in rent costs that saw inflation rise to 8.3% in March, highest since 1983.

-

Also in shelter, inflation for mortgage interest costs (a direct lagged result of earlier interest rate increases) continued to moderate but was still elevated at +25.4% year-over-year. That washed out a small increase in other owned accommodation costs, and left CPI for overall home owning related expenses slightly higher still, at 6.8% in March.

-

Bottom Line: Building on two prior months of CPI reports that were both downside surprises, March’s reading today confirmed that broad-based easing in price pressures in Canada are indeed underway. Different measures of core inflation all continued to decelerate and the diffusion index that measures the scope of inflation pressures also improved again and now tracks a breadth of price pressure that’s similar to pre-pandemic. The BoC in its last meeting agreed with those developments, highlighting increased confidence that “that inflation will continue to come down gradually even as economic activity strengthens”. We continue to look for slowing inflation will allow for a first rate cut from the BoC in June.

By Claire Fan

-

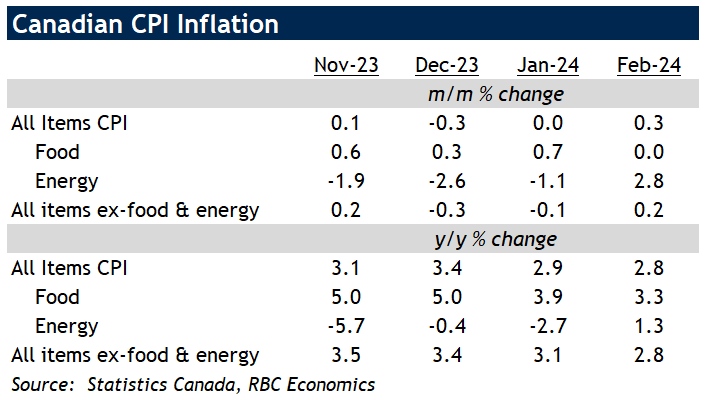

Canadian CPI growth was lower than expected in February, dropping to 2.8% year-over-year from 2.9% in January (expectations were for a 3.1% reading.) The downside surprise was broad-based as core CPI ex-food and energy inflation eased further to 2.8% from 3.1% in January.

-

Food and energy inflation were as expected – food CPI growth in February slowed further to 3.3% above last year, while energy inflation rose to 1.3% also year-over-year on higher gasoline prices.

-

Grocery inflation slowed to 2.4% in February with most food groups including meats, fruit and nuts seeing monthly (seasonally adjusted) price declines from January. Price growth for restaurant dining was little changed on a year-over-year basis from January, at 5.1%.

-

Shelter CPI growth continued to accelerate upon rising rent inflation that climbed to 7.9% in February. That was partially offset by slowing, but still-elevated price growth in mortgage interest costs (+26%) which should continue to trend lower as lending rates drop relative to a year ago.

-

Among other items, inflation for health care continued to trend lower to 2.7% in February, while prices for clothing and footwear (-4.2%), as well as air fares (-5.2%) both remained below where they were a year ago.

-

Slowing price pressures were more apparent in Bank of Canada’s aggregate core inflation measures – CPI trim (+3.2%) and CPI median (+3.1%) both eased further towards the top end of the inflation target range in Canada. The more recent three-month rolling average growth rates for those same measures averaged at 2.2% in February, or its lowest reading in three years.

-

Bottom Line: Building on the January CPI report that was already showing broad-based easing in price pressures in Canada, the February report today reaffirmed those trends. Different measures of core inflation all decelerated and the diffusion index that measures the scope of inflation pressures also improved. That measure however was still showing slightly broader price pressures than pre-pandemic “norms”, suggesting there’s still room for more improvement. Overall, we continue to expect a persistently soft economic backdrop to further slow inflation readings in Canada in the months ahead, allowing for the BoC to start lowering interest rates around mid-year.

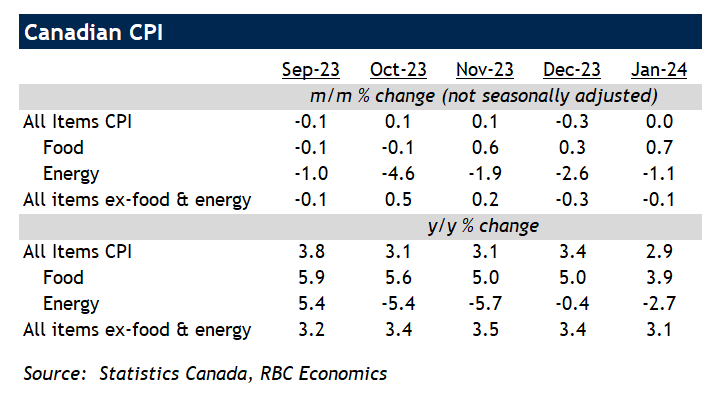

By Abbey Xu

CPI growth decelerated to 2.9% year-over-year from 3.4% in December – back under the top end of the Bank of Canada’s (BoC) 1% to 3% target range for the first time since June 2023.

Energy and food price growth continued to slow, but the Bank of Canada’s preferred ‘core’ measures of broader inflation pressures also unexpectedly slowed.

Energy prices fell 2.7% from a year ago on lower gasoline prices (1.0% lower than in December, and 4.0% lower than they were a year ago) and a drop in residential natural gas prices in Alberta and Saskatchewan (the latter due to the provincial government dropping the carbon tax from natural gas billing).

Food inflation also slowed on ‘base-effects’, from 5.0% to 3.9% (year-over-year). Much of that slowdown came from food purchased in stores, where price growth slowed to 3.4% from 4.7% in December. Price growth for dining out also dipped to 5.1% in January.

Excluding food and energy components, inflation slowed to 3.1%. The Bank of Canada’s preferred core median and trim measures also slowed, to 3.3% and 3.4% above year-ago levels, respectively. The more recent (and closely watched by the BoC) 3-month annualized growth rates for both also decelerated.

Airfare prices declined by -14.3% from the prior year. That also marked the tenth consecutive decline. Prices for clothing and footwear were 1.3% lower than levels from a year ago, potentially reflecting discounting of winter clothing after a milder than usual winter in much of the country.

The scope of inflationary pressures was little changed on a monthly basis, but still much narrower than peak pandemic levels. The share of CPI basket growing at more than 5% has declined from the peak of 68% in May 2022 to 28% in January 2024.

The effect of past rate hikes feed into consumer prices persistently with a lag. Year-over-year growth in mortgage interest costs edged lower in January were still up 27.4% from a year ago, and account for about a quarter of total price growth. Home rent prices continue to rise but another component under shelter – homeowners’ replacement costs inched lower on slower house price growth.

Bottom Line: The first CPI report in 2024 came in softer than expected with the breadth of inflation still showing signs of gradual easing, but also still wider than would be consistent with the Bank of Canada’s 2% inflation target. Shelter inflation will remain sticky as higher interest rates feed through to mortgage interest costs with a lag and undersupply of housing continues to boost rent prices. The most likely path for inflation going forward is still lower with per-capita GDP and consumer spending continuing to decline. But a strong start to 2024 for labour markets gives the BoC more leeway to wait for firmer signs that inflation is getting back under control before pivoting to interest rate cuts. As of now, our base case assumes the BoC starts to lower interest rates around mid-year.

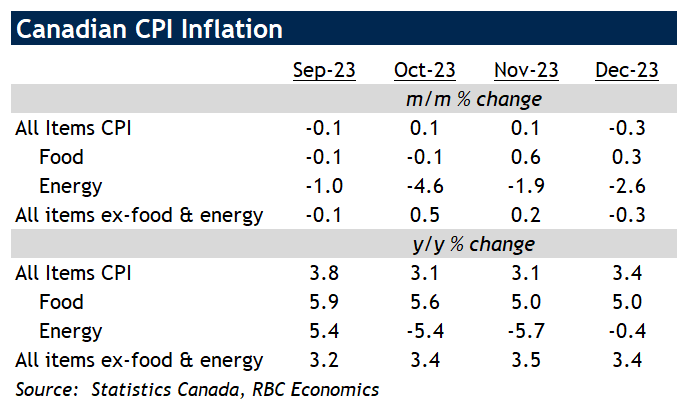

By Claire Fan

The increase in headline price growth to 3.4% in December (from 3.1% in November) matched expectations after surprising on the upside in November on a surge in travel tour prices.

Details, though, were more mixed. The rise in headline inflation in December was driven by a rise in energy inflation to -0.4% – gasoline prices actually fell by 4%, but that was smaller than the drop last year in December.

And food CPI growth held flat on a year-over-year basis from the 5% reading in November. On a seasonally adjusted month-over-month basis, food inflation after having moderated to 0.2% pace by late Q3 2023 started to reaccelerate into the end of last year. In December prices rose by a larger 0.4% from November, on increases from grocery items like meats and fruits. Price growth for dining out also picked up slightly in December.

Excluding food and energy components, prices grew by 3.4% on a year-over-year basis, ticking lower from 3.5% in November to match the reading in October. But the Bank of Canada’s preferred core measures showed no moderation – CPI trim rose higher to 3.7% in December from 3.5% while CPI median was unchanged at 3.6%. Monthly growth in both measures accelerated with 0.4% (seasonally adjusted) increases from November.

The surprise increase in November travel services was more than reversed in December but acceleration was instead seen in airfares, car prices and rent costs. Airfare prices rose in December but were still 9.7% below a year ago. Also in December, the introduction of new 2024 model-year vehicles drove up prices for new vehicles to 3.4% above a year ago.

Still, shelter inflation continues to account for a disproportionate share of price growth as past interest rate increases continue to pass through to mortgage costs with a lag. Shelter inflation rose to 6% in December on a yearly 7.7% increase in rents and 28.6% surge in mortgage interest costs (the latter now slightly off the peak of 31% in August).

Bottom line: Today’s CPI report was more mixed than the headline reading would suggest. The acceleration in airfares and car price growth in December is unlikely to be repeated and strength in the shelter component, especially in rent prices also persists. Still, over on a three-month annualized basis the scope of inflation pressures continues to narrow/improve – suggesting on balance that price pressures were still unwinding. The quarterly release of the BoC surveys yesterday also provided more indications that price growth should continue to slow, as businesses plan for smaller / less frequent upward price adjustments in the year ahead amid a slower economic backdrop and sluggish consumer demand. We continue to expect the BoC to tread cautiously and watch the data carefully, but for further slowing inflation to allow a pivot to interest rate cuts around mid-year.

2023

- Headline CPI growth held steady at 3.1% in November (just above the top end of the BoC’s 1% to 3% inflation target range) despite lower energy prices and easing food inflation.

- Mortgage interest costs and rents still driving shelter costs higher. But the prior is peaking at high levels

- Underlying details continue to point to easing inflation pressures – the breadth of price growth also narrowed again in November

- And the Bank of Canada’s favored inflation gauges continue to improve, gradually moving towards the target range

- Lower energy costs and slowing grocery price growth pushed headline CPI growth lower in October

- Stripping out food and energy components, price growth is still ‘sticky’ but edged lower

- Bank of Canada’s core measures are still above the 2% inflation target but continued to look better on a 3-month rolling average basis

- Abnormally high Inflation is impacting a smaller share of products in the consumer basket

- Growth in BoC’s preferred inflation gauges slowed, but still surpassed the 2% target.

- The latest BOS survey revealed that firms anticipated lower inflation than consumers in the near future.

- Businesses’ wage growth expectations trended lower as labour markets cool.

- Gasoline prices dipped down in September but still higher than the levels from a year ago.

- Mortgage interest costs are still disproportionately adding to overall price growth.

- Higher prices at the pump pushed Canadian headline inflation rate up.

- Food costs are still high but growing at a slower pace.

- Mortgage interest costs continue to drive a disproportionate share of headline price growth.

- But the Bank of Canada’s preferred inflation measures also accelerated further above the 2% target.

- The breadth of inflationary pressures remain wide in Canada.

- The uptick in headline CPI was largely due to higher energy prices, but broader price pressures still above the BoC’s target range.

- Recent month-over-month growth in ‘core’ measures showed signs of easing, but still stubbornly high.

- The breadth of inflation is still wider than normal.

- Food price growth still high but edging lower.

- Mortgage interest costs continue to surge.

Canada’s headline inflation back in Bank of Canada’s target range

- Lower gasoline prices continue to slow year-over-year growth in the consumer price index.

- Broader inflation pressures are also weaker than a year ago—but most of the BoC’s key core measures have been ‘sticky’ at about 4%.

- Businesses are planning smaller price increases in the year ahead. But these will still be larger and more frequent than in pre-pandemic times.

- Consumers continue to expect high rental price growth over the next year. But their expectations for higher food, automobile, and gas prices are moderating.

- Inflation pressures are increasingly driven by rising rents and mortgage interest costs.

- Global drivers like commodity prices and supply chain disruptions continued to ease—and domestic pressures started to come down.

- Ongoing moderation in supply chain pressures pushed raw material and industrial prices lower.

- The Bank of Canada’s preferred core measures were at rates still well-above the 2% target.

- Firms’ expectations on wage and inflation improved slightly in recent months, but remained at high levels.

- Inflation pressures still lower than they were, but did not ease further in April

- Growth in the Bank of Canada’s preferred core measures ticked up slightly on a 3-month rolling average basis

- Grocery price growth slowing in both Canada and the U.S.

- A slowdown in cost growth for rail and truck transportation have signaled further easing in supply chain pressures.

- Travel costs remain high as demand persists.

- The breadth of inflation pressures narrowed again in March.

- Prices at the grocery store remained elevated but price growth may be past its peak.

- Businesses expect input price growth will continue to slow.

- Expectations for wage growth are also edging lower, with consumers expecting more modest increases than businesses plan to pay

- Headline and core CPI continued to decelerate.

- Moderation in the farm product price index foreshadow easing in food inflation.

- Rent and mortgage interest still surging, offsetting slower inflation for home-buying expenses and travel costs.

- Breadth of inflation pressure has stabilized but remains elevated compared to pre-pandemic period.

- The cooldown in Canadian inflation continued in January despite higher mortgage interest costs.

- Growth in travel prices slowed after busy holiday season.

- Domestically-driven inflation pressures remained as foreign-driven price pressures subsided.

- Headline CPI continued to retreat and pressures narrowed across goods and services

- Shelter inflation still robust, as higher rent and mortgage costs more than offset falling home prices

- More easing to come – businesses expected slower growth in input and output prices in year ahead

- Inflation expectations stayed above 2% for most businesses for the next 2 years, but improved in the near term

2022

- Inflation still running hot, but price pressures have narrowed

- Travel inflation stalled before holidays after summer surge

- Lower commodity prices will put a cap on goods inflation in 2023

- Higher interest rates will cut into household purchasing power in 2023 and further ease inflation pressures

- Headline CPI ticked higher as food and gas inflation accelerates

- But broader measures of inflation pressures showing further evidence of easing

- Gasoline prices still down from earlier this year but elevated diesel prices expected to add to production costs down the road

- Costs for mortgage interest payments and motor vehicles will see more acceleration as home-buying related inflation slows

- Price pressures still running above Bank of Canada target, but further signs of easing mean end of interest rate hiking cycle could be close

- Headline CPI growth eased again in September on lower gasoline prices

- Core inflation still running hot despite early tentative signs of easing in breadth of near-term price momentum

- Lower price expectations from businesses not enough to prevent further aggressive BoC interest rate hikes

- Headline CPI continued to slow in August with falling home and industrial prices flagging more declines to come

- ‘Core’ measures also ticked lower, but are still exceptionally high

- Services prices still surging on strong demand for travel and hospitality services

- Inflation pressures still too broad to prevent further central bank rate hikes

- Slowdown was led by a drop in gasoline prices, to still elevated levels above last year

- Industrial prices cooled further, as supply chain challenges keep moderating

- With more pullback in consumer spending expected ahead, inflation likely has peaked

- Pressures still too broad to derail central bank from aggressive hiking path

- Canadian inflation pressures continued to surge in June

- Home prices have shifted from big tailwind to headwind for price growth

- Industrial price growth edging lower as global supply chain disruptions show signs of easing

- Markets are betting that aggressive central bank rate hikes will cool inflation pressures

- Surging inflation is cutting into year-ahead GDP growth expectations.

- Close to half of Canadian CPI growth fueled by global price pressures, with home buying costs adding to domestic growth.

- Cooling housing market could bring some relief; although price pressure has also continued to broaden.

- Wage growth should continue to accelerate, as labour shortage issues grow more acute.

- Industrial input and output prices are still surging, keeping pressures broadly based

- Grocery prices rising at fastest pace since the early 1980s

- But central banks rate hikes are expected to slow demand

- Home buying costs (accounting for ~20% of year-over-year CPI growth) will start to slow on lower housing demand

- Higher headline inflation partly a result of rising gas prices after Russia invaded Ukraine

- But price pressures continued to broaden

- Geopolitical headwinds also adding pressure to business input costs

- Inflation expectations remain elevated for the near-term, although anchored around 2% in longer-run

- More goods and services seeing faster price growth.

- Invasion driving commodity price volatility.

- Market expects inflation to stay above 3% over 5 years.

- Prices for commodities and industrial inputs continued to edge higher.

- To-date, home and auto remain the biggest driver for price growth but pressure’s also broadening.

- Strong household purchasing power will put a floor under consumer demand and inflation trends in the near-term.

- Surging house prices underpinning higher shelter costs.

- Share of goods/services seeing higher price growth continuing to broaden.

- Wage growth to pick-up; recent gains more present for highly-skilled jobs.

2021

- Inflation pressure in Canada has been broadening, with more goods and services seeing above-target levels of price growth.

- Energy commodity prices jolted on Omicron related concerns.

- Wage pressures are building, although unevenly across industries.

- Even excluding higher shelter costs, prices in Canada have bounced back above pre-pandemic trends.

- Inflation pressure is broadening with more of the consumer basket seeing above-target rate of growth.

- Inflation expectations, from market, businesses and consumers are still edging up.

- Share of CPI basket seeing above-trend price increases from pre-pandemic levels still rising

- Energy prices have increased; industrial input prices remain elevated

- More businesses reported capacity issues related to shortages of inputs and supply chain disruptions in Q3

- Shelter prices have surged but the pace of growth is now slowing

- Motor vehicle production disruptions expected to keep vehicle prices high

- Supply chain disruptions and increased services demand taking over as driver of price growth

Download report PDF

- Headline CPI growth still impacted by ‘transitory’ factors but growth in industrial prices beginning to slow

- Slower demand for homes will limit further gains in accommodation related expenses

- Rising agriculture commodity prices and firming consumer demand to keep floor under price growth

Download report PDF

- Cars and homes accounted for much of price growth in June

- Investors are still betting that the inflation spike will prove temporary

- Cooling commodity prices to temper soaring input costs

- Consumer price increases were more broadly-based in May

- Market inflation expectations plateau albeit at elevated levels

- Rising input costs pose a key hurdle for businesses though some offset from stronger loonie

Download report PDF

- Inflation pressure still manageable but broadening

- Market expectations have dialed higher

- Rising Input costs and firming demand to act as tailwinds for price growth

Download report PDF

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.