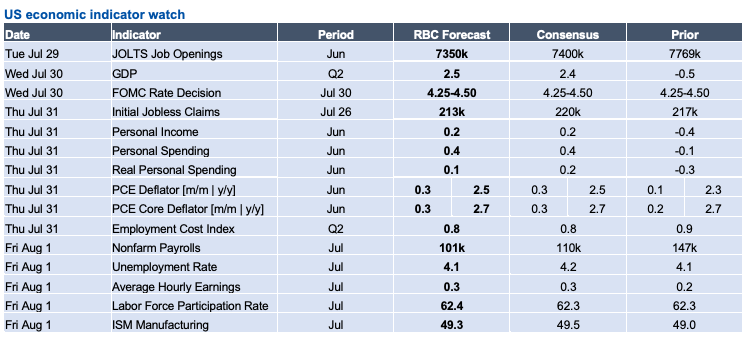

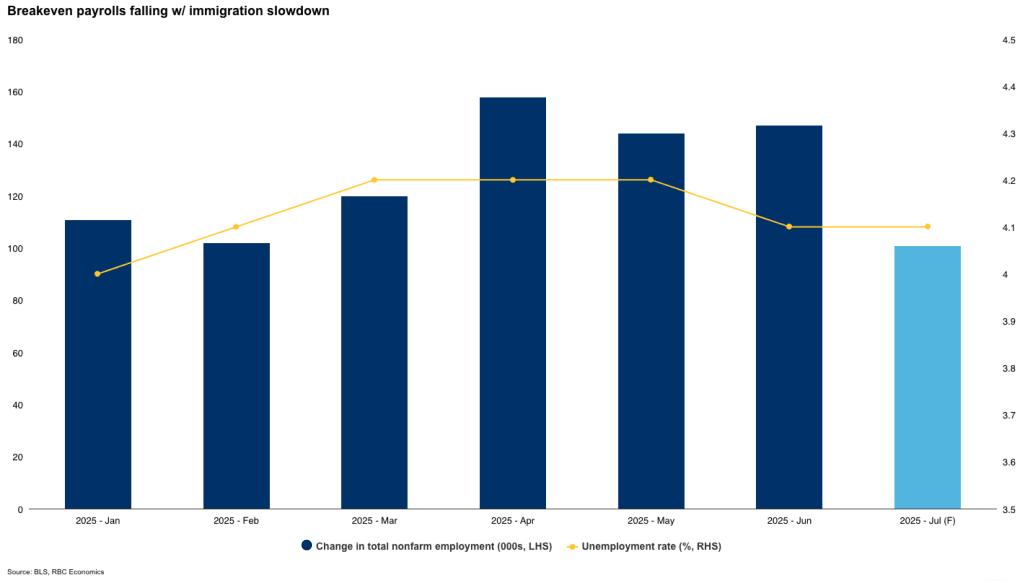

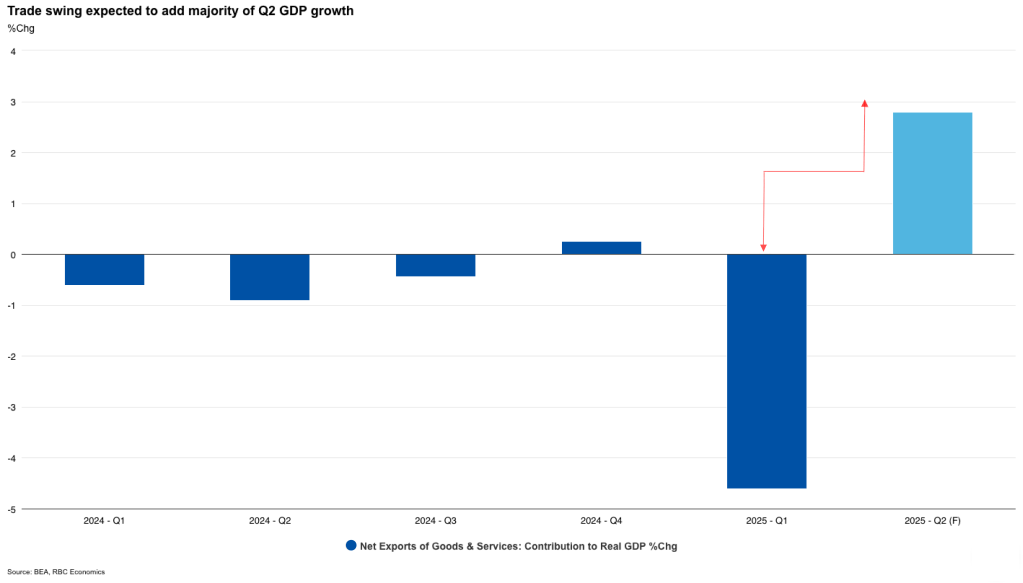

Next week’s FOMC meeting (Jul 30) is likely to be completely overshadowed by the slew of economic data on the calendar. The Q2 GDP report and the employment report will be the data highlights, but neither is likely to move the needle for the Fed as it relates to a shift in their economic narrative. We expect to see Q2 GDP growth rebound to 2.5% as the import surge subsides and consumers maintain positive real spending. To that end, we look for the labor market to remain tight with the unemployment rate holding at 4.1% and payrolls adding 101k jobs in July. While 101k certainly represents a slowing relative to the gains seen earlier this year, it comes at the same time as an immigration slowdown, which means the breakeven rate (i.e., the level of payroll gains needed to keep the unemployment rate steady) is falling. Additionally, we expect initial jobless claims to remain at low levels, after surprising to the downside this week, a reflection of the low firing environment that continues.

Following this string of stable economic data, we recently pushed back our call for the Fed to begin cutting by 25bps at the December meeting. What this means for the meeting next week is business as usual – we don’t expect to see any major shifts in the Fed’s views. But if our views on inflation materialize, we see a risk that the Fed will need to continue to wait to start a cutting cycle, until such time that the tariff impacts subside, likely not until 2026. A notable risk is that a continuation of section 232 tariffs on top of country-specific tariffs would create a more persistent inflationary environment. For now, we do expect to see the PCE deflators tick higher next week with both headline and core advancing 0.3% m/m. Notably, we don’t expect further progress towards the Fed’s 2% target, with the y/y pace for core PCE staying stuck closer to 3% – we expect it to hold at 2.7% y/y.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.