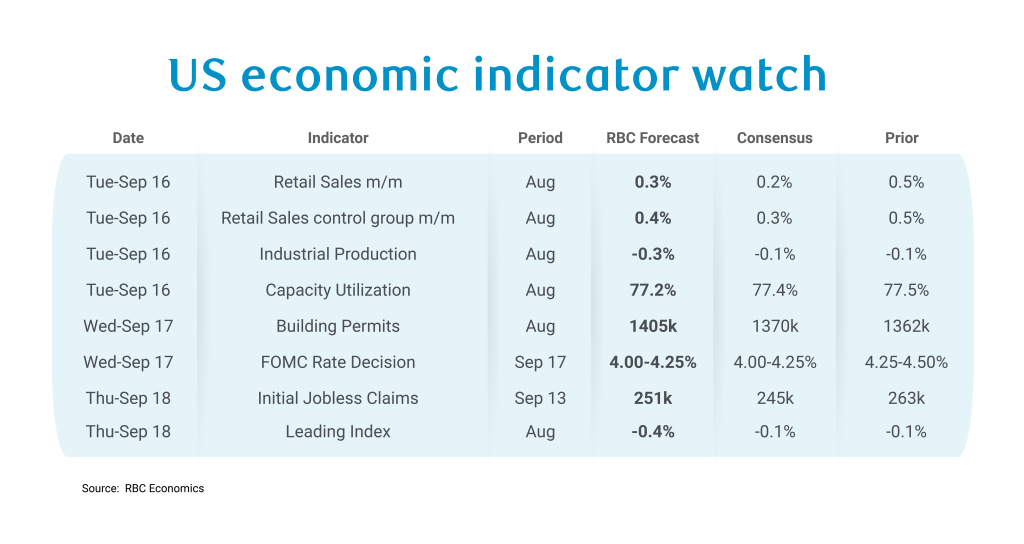

Next week is a big week for markets and economists alike with all of the focus on the highly anticipated Wednesday FOMC meeting. The Fed is expected to return from the sidelines with a 25 basis-point cut in September as the August nonfarm payrolls data pointed to weak job growth after sizeable downward revisions to prior months.

At the same time, the uncomfortable reality remains that inflationary pressures are mounting. As we saw this week, core services and goods pressures are now building in tandem, and we expect this to continue as producers facing tariff costs begin to pass off (at least some of) the burden to consumers. While recent inflation data will not likely be sufficient to keep the Fed in “wait and see” mode this month, our US Rates Strategists Blake Gwinn and Izaac Brook emphasize that the next cutting cycle can be viewed as a resumption of rate “normalization” back towards more “neutral” levels rather than a move into accommodative territory. Of course, the Fed’s path to this perceived neutral could be derailed should inflation concerns begin to trump cyclical weakening of the labor market. Subsequent cuts will continue to be considered on a meeting-by-meeting basis, pending developments in the economic data.

Retail sales will be the most important economic data point for the week but will pale in comparison to the Fed meeting and is thus likely to take a secondary market focus. We expect August retail sales will post a +0.3% m/m uptick – as weaker auto sales volumes weigh on the overall figure. Our forecast calls for the retail sales control group – which excludes motor vehicles, building materials, gasoline, and food services – to grow at a slightly stronger clip +0.4% m/m. We expect upward price pressures in trade-exposed sectors will make grocery sales appear somewhat stronger.

Zooming out, consumption activity and retail sales in particular have continued to chug along, not accelerating but not meaningfully decelerating either. We see a few factors at play:

-

A labor market that is still tight (which has propped up wage growth despite cyclical weakening), with job losses so far more concentrated in younger participants (that tend to spend less)

-

Resilient high income households disproportionately lifting activity and

-

Given retail sales are in nominal dollars, some inflation picking the figure up. For context, real retail sales are tracking largely flat this year, on average, despite nominal retail sales growth still appearing solid.

Outside of retail sales, we have a few other notable data releases landing next week:

-

Initial Jobless Claims will likely come in slightly lower at 251k after initial claims rose to the highest level in nearly four years last week.Texas was the standout posting a sizeable uptick in advance claims. Tennessee, New York, and Illinois noted layoffs in trade-exposed sectors including manufacturing, transportation and warehousing, and wholesale and retail trade.

-

Industrial Production and Capacity Utilization lands on Tuesday alongside retail sales. Weaker manufacturing sector hours-worked on the back of a lower ISM manufacturing index signals industrial production likely continued to fall in August (we expect by -0.3% m/m), with capacity utilization moving lower to 77.2%.

-

Building Permits data on Wednesday is likely to show August building permits ramped up relative to July, though still remain soft as a higher-for-longer rates environment (and a sticky long-end) disincentivizes existing homeowners from moving and unaffordable monthly payments price many prospective buyers out of the market. Housing has been continuously stuck, and we do not expect this to change any time soon.

-

We expect that the Leading Index from the Conference Board will post a weaker reading in August reflective of a decline in hours worked, weaker growth in the S&P and an erosion in consumer expectations.

About the Authors

Frances Donald is the Chief Economist at RBC and oversees a team of leading professionals, who deliver economic analyses and insights to inform RBC clients around the globe. Frances is a key expert on economic issues and is highly sought after by clients, government leaders, policy makers, and media in the U.S. and Canada.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.