Canada’s housing market action got hotter as the temperature cooled this fall. The Bank of Canada’s series of interest rate cuts since June set the stage for home resales to jump nearly 10% nationwide over October and November.

This put the recovery on a stronger footing after a slow and patchy course in the past two years. The market is now back to levels that prevailed in late-2019 just ahead of the pandemic.

We expect the upswing will continue in the months ahead, but at a measured pace. The prospects for further rate cuts will likely draw more buyers from the sidelines, but significant affordability issues will restrain the flow of those entering the market.

The local picture still varies considerably across the country. Activity remains more hectic in the Prairies and parts of Quebec and Atlantic Canada—well above pre-pandemic levels in many cases. The recovery is still a work in progress in British Columbia and Ontario despite solid back-to-back sales gains in Vancouver and Toronto over the last two months. It will take deeper rate cuts to fully reinvigorate these markets.

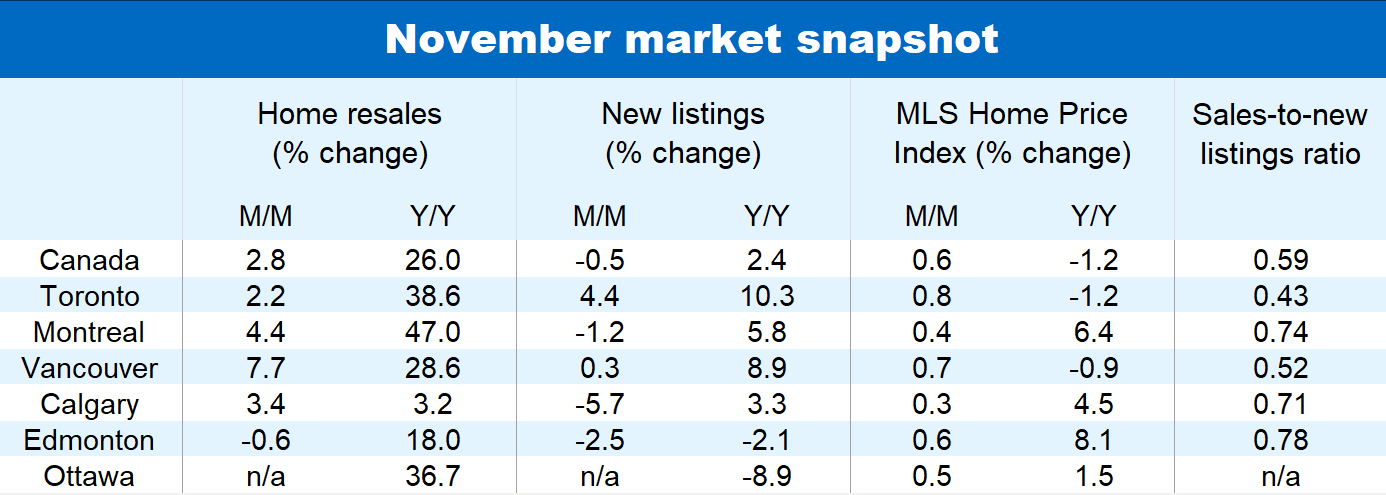

The supply of homes for sale has trended higher in Canada this year. This has contributed to boosting inventories—recently reaching a four-and-a-half-year high—giving buyers more options. But, new listings fell in October and November, which has tightened supply-demand conditions. At 0.59 in November, the national sales-to-new listings ratio indicates upward pressure on prices.

Conditions are especially firm in the Prairies, Quebec, and Atlantic Canada where property values are up the most compared to a year ago. Relatively softer markets in B.C. and Ontario have tightened as well this fall. This has put some heat on Vancouver and Toronto prices in November with their composite MLS Home Price Indexes rising from October at the fastest pace in more than a year.

Nationally, the composite MLS HPI increased 0.6% between October and November—the strongest monthly advance since July 2023. This followed slight declines earlier this year that drove the index below year-ago levels.

The index in November was still 1.2% off the mark from the same period last year.

It’s bound to move higher as the market’s recovery progresses into 2025. But, we continue to believe that any price appreciation will be gradual until interest rate cuts restore ownership affordability more significantly next year.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.