-

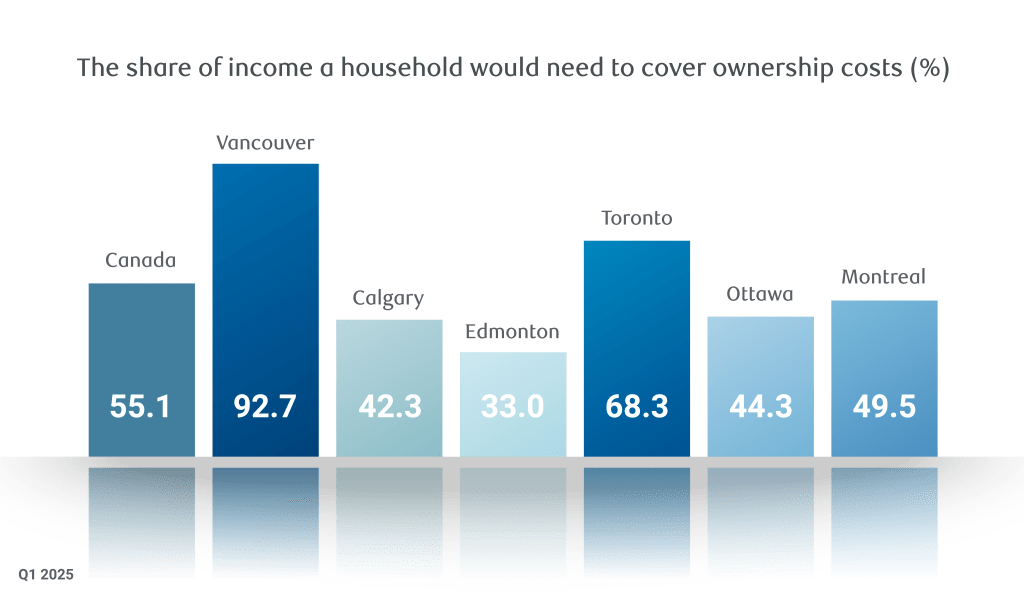

Interest rate cuts continue to drive homeownership costs lower. A slight easing in home prices and sustained household income gains also contributed to lowering RBC’s aggregate affordability measure for Canada to 55.1% in Q1 2025 from 60.7% a year earlier.

-

Prices are still a long way from more attainable pre-pandemic levels. Steady improvements in the past five quarters have reversed only roughly a third of the loss of affordability nationwide. Buying conditions remain extremely challenging in many major markets.

-

Ownership costs dropped in most markets. Vancouver and Toronto recorded the largest decreases in Q1, but they are still Canada’s least affordable markets. Quebec City, Montreal and Victoria saw costs rise.

-

Generally improving trends are likely to be sustained. We see earlier interest rate cuts continuing to favourably impact affordability with price declines in some markets further aiding the process. Whether this will spur potential buyers into action will depend on whether de-escalation of the trade war continues to boost confidence.

Affordability stress eases more for condo buyers

The positive shift in the last five quarters has helped homebuyers’ prospects across all regions and housing market segments. However, it’s been condo buyers that have seen the most significant turnaround.

In some parts of the country—including Edmonton, Saskatoon, Regina, Winnipeg and even Toronto—the condo affordability measure is now effectively back to where it was before the pandemic. Little resetting was needed in most cases as condo affordability had not deteriorated much during the pandemic.

But Toronto’s condo measure returning so close to its pre-pandemic level is noteworthy, because it spiked from 2021 to 2023. Moderate price declines have significantly amplified the generally positive effect of lower interest rates.

Price drops also quickened the improvement in condo affordability in Vancouver and Victoria—Canada’s two other priciest markets—though both still have a lot more lost ground to recover.

Continued growth or smaller dips in prices has somewhat stalled the easing process in Calgary, Ottawa, Montreal and other markets.

The same applies to all single-detached homes segments we cover across the country. Despite material improvement, affordability remains worse than it was before the pandemic—substantially so in Vancouver and Victoria.

Most of the improvement likely behind us

On an aggregate basis, we think interest rate cuts, further price drops in some markets and sustained income gains are set to reverse approximately half the rise in RBC’s composite affordability measure for Canada during the pandemic by year end—up from about one-third most recently.

Any further progress gets trickier once interest rates stabilize, because than it rests entirely on the evolution of home prices and household income (the denominator in RBC’s affordability measures).

Price drops or strong income gains would be required to further drive significant improvement. However, we expect generally stable prices in Canada over the next two years—with some local exceptions—and modest wages growth amid persistent labour market slack.

Are affordability issues back on the front burner?

The trade war derailed Canada’s housing market recovery this spring as worries about the potential economic fallout prompted many buyers to retreat to the sidelines. Recent de-escalation of tariffs, however, could be alleviating some fears.

Early signs emerged in May that point to resale activity possibly turning a corner—yet prices remained under downward pressure in Ontario and British Columbia.

Rebuilding confidence is clearly positive for the housing market, but it is unlikely to trigger a broad-based rally. Housing affordability issues are poised to be top of mind again in many parts of the country, and a major obstacle hindering recovery.

Victoria: Affordability relief stalls

An increase in single-detached home prices earlier this year temporarily halted the easing trend in affordability in Victoria.

RBC’s aggregate measure rose 0.5 percentage point to 70.6% in Q1—the first rise since Q4 2023. Condo affordability continued to improve, though, amid falling prices in the segment. Home resales stumbled this spring under the weight of heightened economic uncertainty. This has given buyers more bargaining power, while sellers continued to enter the market in high numbers. We expect prices will fall more broadly as a result, helping affordability return to its improving trajectory.

Vancouver area: More headway but ownership costs still steep

The huge spike in ownership costs during the pandemic continues to unwind. Lower mortgage rates and moderating property values drove RBC’s aggregate affordability measure down for a fifth consecutive quarter in Q1.

Still, at 92.7%, the measure remains by far the highest (worst) in the country and poses a serious challenge to local homebuyers. It’s no wonder home resales have slumped to cyclical lows this spring with trade war worries adding even more stress to the market. We expect prices to fall further near term with supply-demand conditions tilted squarely in buyers’ favour.

Calgary: Buyer prospects look slightly better

Owning a home in Calgary has become more affordable in the past year. RBC’s aggregate measure continued to improve in Q1, inching 0.2 percentage point lower to 42.3%.

Don’t blame homebuyers if they aren’t jumping in the market in greater numbers, though. Progress has only partially restored the loss of affordability during the pandemic. Current conditions likely still pinch many potential buyers—RBC’s measure remains above its long-run average (39.1%). But with market conditions having significantly re-balanced from earlier tightness and prices softening recently, we see further improvement ahead.

Edmonton: Strong momentum easing

Edmonton still ranks among the busiest markets in the country despite seeing activity moderate this year.

Home resales continue to hover far above pre-pandemic levels. A relatively favourable affordability picture is keeping buyers motivated—even in the face of increased economic uncertainty. RBC’s aggregate affordability measure was 33% in Q1, which was very close to the market’s historical norm (32.2%). It drifted steadily lower since the spring of 2024.

The picture is likely to brighten further now that supply-demand conditions have re-balanced, and price gains are moderating. Property values in Edmonton had been appreciating among some of the fastest rates in Canada.

Saskatoon: Sustaining a solid pace

There have certainly been bumps this year, but the general state of the Saskatoon market remains robust—supported by migration inflows and largely manageable ownership costs.

RBC’s aggregate affordability measure at 31.8% is essentially back to its long-run average. It eased for the fourth time in the last five quarters in Q1. Resales have run hot since the pandemic. It’s still close to 25% above early-2020 levels this year despite dipping in spring. Recent developments have helped reduce some of the earlier market tightness, which if sustained, would temper price increases and drive further improvements in affordability.

Regina: Buyers enjoy favourable conditions

Regina continues to be the most affordable market we track in Canada with an RBC aggregate measure of 26.1%.

It’s also the only market below its long-term average—suggesting buyers benefit from better-than-usual conditions. Many of them are taking advantage, keeping sales higher even in the face trade uncertainty. Supply is short, however, which is likely to sustain rapid home value appreciation.

Winnipeg: Solid fundamentals stay top of mind

There’s little evidence the trade war has undermined the Winnipeg market. Home resales and prices still tracked higher this spring—up 8% and 9% from a year ago, respectively.

The number of sellers entering the market is modest and largely stable, keeping options limited for buyers. Strong market fundamentals—including solid, if slightly moderating population growth—seem to overtake tariff worries. Lower interest rates have reduced ownership costs somewhat in the past year as an added bonus for buyers. RBC’s aggregate measure was unchanged at 31.8% in Q1 or just marginally above its long-run average (29.3%).

Toronto area: Buyers don’t bite despite easing affordability

Times are tough in the Toronto housing market. Demand slumped this spring amid trade war concerns and deteriorating job prospects, not only foiling a burgeoning recovery, but driving sales to decades’ lows outside the pandemic lockdown period.

Pressure is coming off ownership costs, but progress—while material—has been insufficient to make a real difference. RBC’s aggregate affordability measure at 68.3% is still an extremely high bar for most buyers to clear. Our outlook is for further progress as prices continue to fall. A rise in inventory has significantly increased competition between sellers, especially for condos.

Ottawa: Owning a home still a stretch for many

Buyers have seen a more balanced market, moderating price gains and improving affordability over the past year in Ottawa. But, owning a home is still out of reach for many.

RBC’s aggregate affordability measure (44.3%) remains at a historically high levels despite dropping a sizable 4.3 percentage points since Q1 last year. This was not lost on those on the verge of entering the market when the trade war erupted. It may have seemed an inappropriate time to take the plunge in such less certain circumstances. The end result has been a pullback in demand this spring that drove resales down 6% from a year ago. We expect a rising inventory of homes for sale will temper values and further restore some affordability.

Montreal area: Buyers bid up prices vigorously

Montreal was among the few markets that recorded a slight loss of affordability in Q1. RBC’s aggregate measure edged 0.2 percentage points higher to 49.5%—marking a break from the modestly improving trend over the past year.

Buyers continue to face more strenuous affordability conditions than in more than three decades, but they’re still bidding up prices rapidly as supply remains tight relative to demand. That could change, though, if this spring’s stalling in resales persists, and inventories start climbing again. Any cooling of price growth would ease pressure on ownership costs.

Quebec City: Low inventory keep things hot

Quebec City is one of the hotter markets in Canada with a low supply of homes for sale putting sellers unquestionably in the driver’s seat.

Home prices are rising solidly—up more than 13% from a year ago in Q1—with strong gains in all categories. The downside is that it has limited the improvement in affordability. The situation deteriorated slightly in Q1 as RBC’s aggregate measure rose 0.3 percentage points. Still, at 34.1%, the measure looks relatively favourable against many other markets—including Montreal—which has likely been a prominent factor keeping buyers engaged.

Saint John: Last year’s price run-up still stings buyers

Sharp increases in property values last year have significantly offset the decline in ownership costs arising from lower interest rates in Saint John.

RBC’s aggregate affordability measure has fallen only 0.8% since Q1 2024—the second smallest drop among the markets we monitor. It remains close to its worst point ever at 32.2%. Saint John compares favourably to most other markets, but this suggests local buyers face tougher-than-usual conditions. Those were likely exacerbated by the trade war, which sapped confidence and derailed the recovery started in the fall.

Halifax: Buying strains persist

Soaring demand and the resulting spike in prices during the pandemic have transformed Halifax into an affordability-strained market.

Lower interest rates have brought some relief in the past year, but ownership costs remain onerous for many potential buyers. RBC’s aggregate measure (42.9%) is still more than 15 percentage points above pre-pandemic levels. Further relief could be on the way, though. A pullback in demand this spring—in part reflecting slowing population growth—has eased market tightness and moderated the pace of home value appreciation. It could lower ownership costs in a more meaningful way if sustained.

St. John’s: Manageable ownership costs sustain strong activity

The trade war has so far had no discernable impact on the St. John’s market. Home resale activity continues to be historically strong—up 15% from a year ago and some 50% above pre-pandemic levels—and prices remain firmly on an upward trajectory.

Buyers have seen only minimal easing in costs of owning a home since the Bank of Canada initiated its rate cutting campaign, but its likely broadly manageable. RBC’s aggregate affordability measure (28.2%) is the second lowest among the markets we track, and the best in the Atlantic region. We see little improvement in affordability near term as tight supply-demand conditions drive up prices.

Read the full Housing Trends and Affordability report for extensive market-by-market analysis.

Robert Hogue is an Assistant Chief Economist, responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.