The trade war is derailing what was shaping up to be a solid recovery in Canada’s housing market. Concerns about the potential economic hit from U.S. tariffs have clearly unsettled buyers in the past two months, many of whom pausing their search for a home.

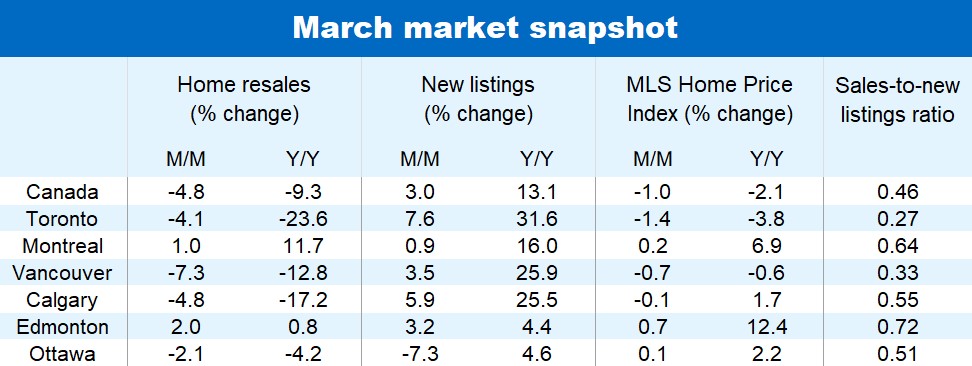

This has resulted in resale activity plummeting 12% nationwide since January, including a 4.8% drop between February and March.

The supply of existing homes for sale, meanwhile, is continuing to grow. New listings increased 3% from February to March, and the number of active listings reached a five-year high last month.

Buyers are able to extract price concessions from sellers with more options to choose from amid a murkier economic landscape. The national composite MLS Home Price Index fell for a third consecutive time in March, edging -1% lower from February and -2.1% from a year ago.

Ontario and B.C. markets are slumping

The market pullback is mainly concentrated in southern Ontario and British Columbia where persistent affordability challenges made the recovery especially vulnerable to a loss of confidence. Weakening labour markets and tariffs threatening to strike southern Ontario’s economy hard has significantly soured market sentiment.

Home resales are down -21% in Ontario in the past two months and -17% in B.C. The Toronto area (-27%), London (-25%), Fraser Valley (-23%), Vancouver area (-19%), Kitchener-Waterloo (-16%), Victoria (-12%) and Hamilton (-11%) have seen sharp drops in activity.

Nearly all these markets posted price declines in recent months, generally accelerating in March—ranging between -0.7% in Vancouver and -2.5% in London on a seasonally-adjusted basis.

Odds are prices in Ontario and B.C. will continue to slump in the near term given supply-demand conditions strongly favour buyers. In fact, we would expect to see larger drops if current imbalances persist.

Prairies and regions east of Ontario holding up better

Meanwhile, markets still look generally busy in other parts of Canada despite some slipping in activity in recent months—reflecting some trade war-induced buyer anxiety.

Home resales remain above pre-pandemic levels in Alberta, Saskatchewan, Manitoba, Prince Edward Island, and Newfoundland and Labrador. And, they haven’t fallen much below these levels in Quebec, New Brunswick and Nova Scotia.

For the most part, supply-demand conditions continue to be tight outside Ontario and B.C., supporting modest price appreciation.

The MLS HPI is up above year-ago levels in the Prairies, Quebec and Atlantic Canada—significantly so in several markets such as Edmonton, Winnipeg, Quebec City, Fredericton, Saint John and St. John’s. The pace of increase has slowed materially in Calgary, though, amid a rise in inventory.

We expect price gains to broadly moderate as the trade war weighs on local economies and undermines confidence.

U.S. trade policy poses material risks

Overall, Canada’s housing market outlook remains highly uncertain. Swings in U.S. trade policy could dramatically alter the picture—in a negative or positive way.

Further escalation in the trade war could certainly deepen and broaden the slump. Conversely, any development towards lifting the trade war fog would help shore up confidence and open the door to some of the substantial pent-up demand. The stimulative effect of lower interest rates would return once confidence rebuilds.

Download the Report

Robert Hogue is the Assistant Chief Economist responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.