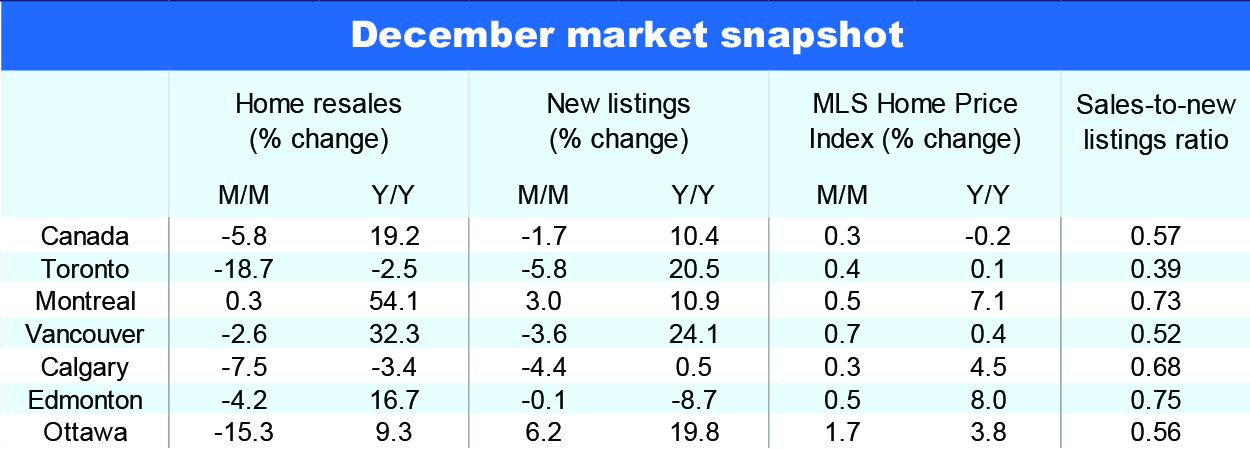

Interest rate cuts in Canada set the housing market on a recovery path in 2024, but there have been bumps along the way as demonstrated by activity in December. Home resales fell 5.8% last month from November, following solid advances totalling 16% in the previous four months.

Fewer sellers coming to market could be behind the pull back—narrowing the options for buyers. New listings declined in the last three months of 2024, including by 1.7% in December.

A slight uptick in fixed mortgage rates could also have played a role as longer-term rates came under renewed upward pressure from the U.S. in the fall—possibly causing some buyers to pause their search.

Still, we don’t read too much into one month’s volatility and see the recovery continuing in 2025. We expect the Bank of Canada to deliver further meaningful rate cuts over the first half of the year, and as a result, longer-term rates will ease. Lower borrowing costs are likely to draw both new buyers and sellers to the market and sustain growth in resale transactions.

Property values haven’t budged much over the course of 2024 nationwide. In December, the composite MLS Home Price Index edged up just 0.3% from November and was down -0.2% from a year ago. Generally balanced supply-demand conditions are keeping higher and lower price pressures muted.

The national picture largely reflects market realities in Ontario and British Columbia. But, home prices in the Prairies, Quebec and parts of Atlantic Canada are hotter. The MLS HPI is up significantly from a year ago in Edmonton (8%), Saskatoon (7.1%), Winnipeg (8.4%), Montreal (7.1%), Quebec City (11.4%), Fredericton (19.8%), Moncton (7.9%), Saint John (24%) and St. John’s (10%). Supply has been tight compared to demand in all these markets throughout last year—or longer in some cases.

Affordability challenges are also relatively more manageable in these regions, allowing buyers to bid up prices more freely.

On the other hand, intense affordability strains are a major weight holding back buyers in Ontario and B.C. They set an impossibly high bar to clear for many first-time homebuyers. We expect those strains will keep sales recovery gradual and price increases minimal in the year ahead. Toronto and Vancouver—Canada’s most expense markets—could even see further erosion of condo prices amid rising inventories.

Robert Hogue is responsible for providing analysis and forecasts on the Canadian housing market and provincial economies. Robert holds a Master’s degree in economics from Queen’s University and a Bachelor’s degree from Université de Montréal. He joined RBC in 2008.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.