➔ A battery storage project going live and an approved SMR project suggests Canada can build

➔ Mark Carney’s cabinet: The fixer, the insider and the skeptic

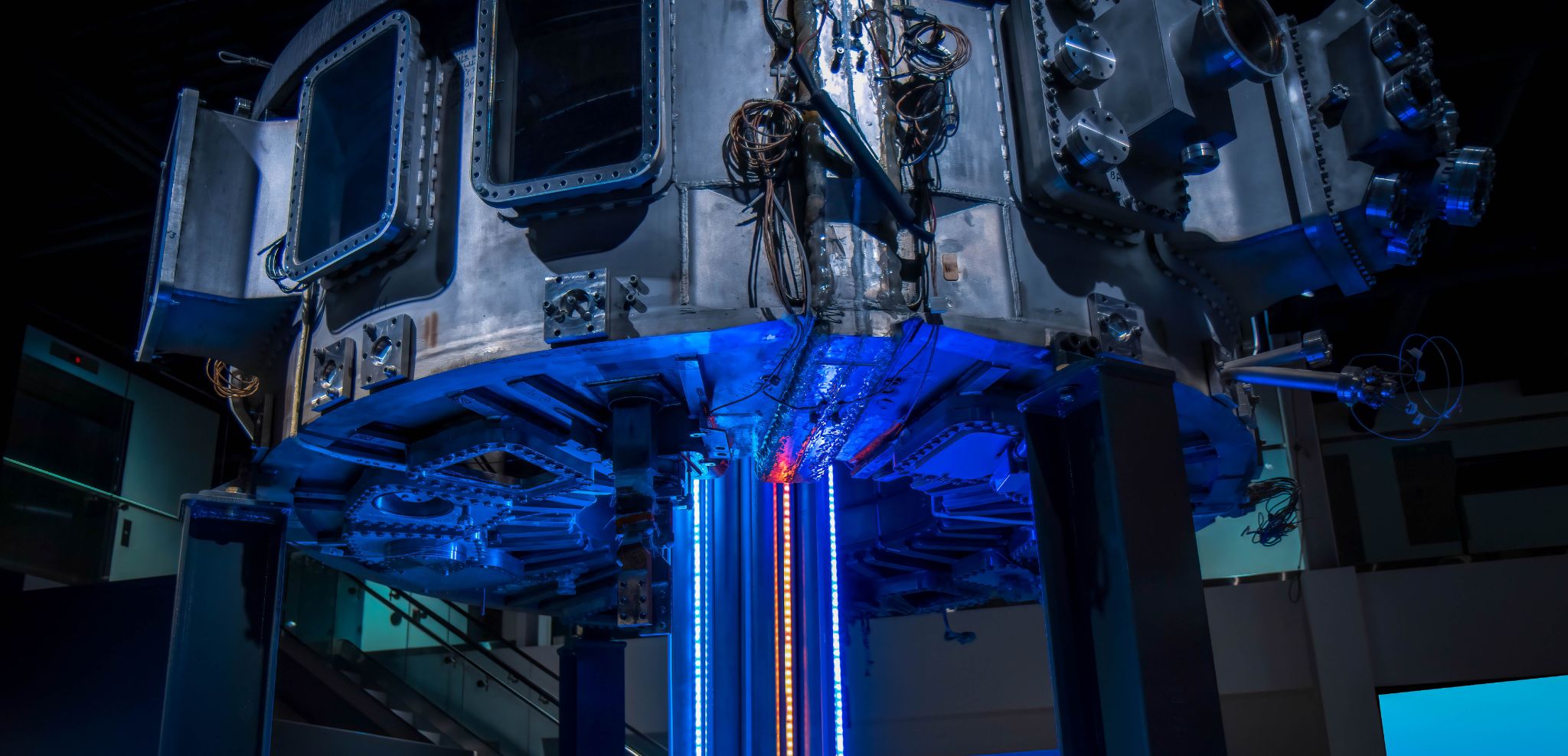

➔ General Fusion needs financial infusion

Hot takes

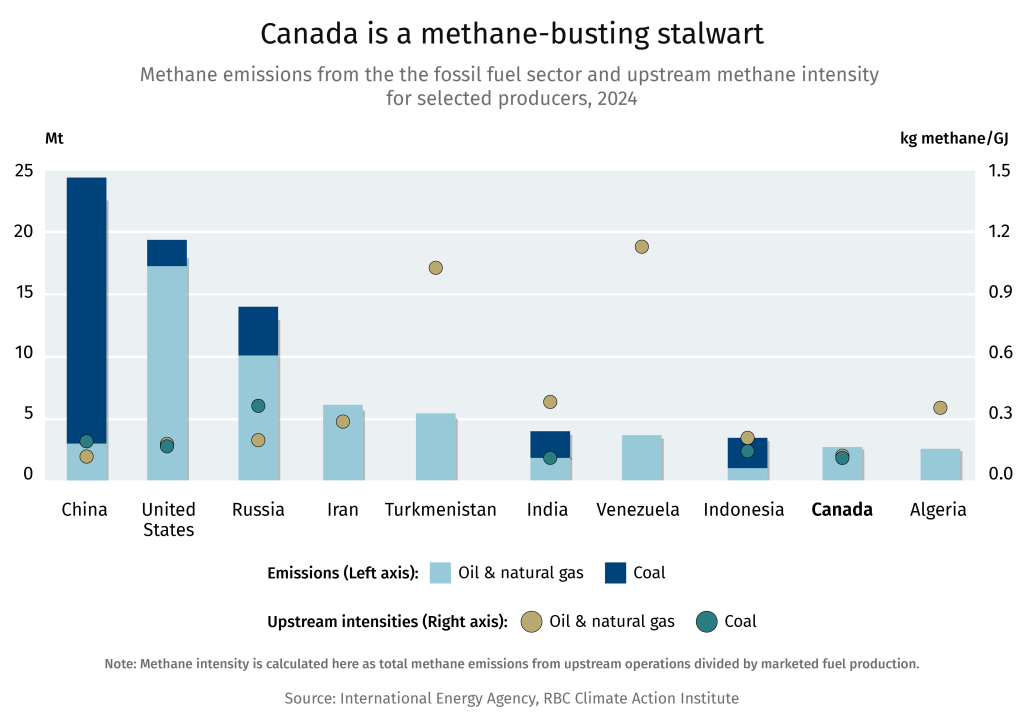

➔ Canada is a methane-busting powerhouse. The International Energy Agency ranks Canada as among the lowest in methane intensity among major oil and gas producers including the United States, Russia and Iran. Emissions from methane, a far more potent greenhouse gas than carbon dioxide, remains at a high level globally despite pledges and available solutions that can lower fossil fuel emissions at “near zero” costs, the IEA estimates. Worse: methane emissions remains widely underreported globally, the agency said in its latest Methane Tracker report.

➔ The U.S. is going after solar power—and showers. A new U.S. Republican proposal aims to rollback popular tax credits for home solar and electric vehicles. The sweeping proposal to gut several incentives in the Inflation Reduction Act and other programs will save the government US$560-billion over a decade, but raise U.S. household costs by 7% by 2035, analysts say. The cuts could also impede U.S. efforts to cut emissions by 43% to 48% below 2005 over the next decade. Another U.S. proposal aims to scrap rules that conserve water in shower and toilets; also on the block: the Energy Star program that’s been credited for boosting energy efficiency and cutting utility bills.

➔ The number of rare earth projects in Canada currently stand at 12. These constitute projects that are active in the exploration, resource estimation, or the preliminary economic assessment phase. Three separation and processing facilities and two rare earth elements (REE) recycling plants already exist, according to a report by Vivan Sorab, senior manager, clean technology. Fixing a couple of bottlenecks could help fast track the 12 projects. First, government investment, such as provincial funding in Saskatchewan, can help bring rare earth processing facilities closer to commercialization. Offtake agreements at competitive prices could also help Canada’s REE industry get a foothold.

➔ Planting trees isn’t enough to tackle climate change. The world needs a global industry focused on removing carbon via nature-based and man-made solutions from the atmosphere at scale. Listen to a new episode of Disruptors X CDL: Innovation Era, where John Stackhouse and Sonia Sennik sit down with David Keith, a pioneer in carbon removal and founder of Carbon Engineering, to explore what it will take to build a low-carbon future.

POLICY

The fixer, the insider and the skeptic

Tim Hodgson, the new federal energy and resource minister, has been charged by his boss Mark Carney to make Canada a “leading energy superpower.” Hodgson will have to play the role of fixer in the resources sector, that includes mending relationships with Western provinces and Indigenous groups to make that dream come true. So far, he has been warmly received in the West, where grievances over Ottawa’s attitudes towards fossil fuels run deep—and remain live.

Julie Dabrusin, the Minister of Environment and Climate Change of Canada, has elicited a different reaction from oil and gas provinces. Her bio boasts a “strong stance against oil sands expansion,” raising concerns. But her insider knowledge as a parliamentary secretary to the Ministers of Natural Resources and Environment and Climate Change, and a member of the Natural Resources Committee, will be vital for Ottawa to streamline and fast-track project developments, including oil and gas pipelines. The Prime Minister seems open to the idea of new fossil fuel pipelines, as is Quebec. “Quebecers are saying, ‘There’s no way Trump is going to control the oil we produce in Alberta.’ So, can we export it to Europe through Quebec instead of being stuck with Trump? There’s openness. I feel things are shifting,” Premier Francois Legault said recently, adding that no concrete projects had been proposed.

While former environment minister Steve Guilbeault is now in charge of the heritage file, his skepticism about the economics of an east-to-west oil pipelines on his first day back in parliament, has also raised eyebrows. His portfolio appears to include Parks Canada, which gives him a platform to raise issues of biodiversity and nature erosion brought about by climate change. Committee to watch: Cabinet committees are where most of the business of government is transacted. One committee to watch will be the Build Canada committee, tasked with considering issues as diverse as housing, infrastructure, Indigenous economic prosperity, climate action and a host of others. The tag-team of Hodgson and Chrystia Freeland–chair and vice-chair of the committee–will provide a mix of private sector expertise and cabinet experience.

CLEANTECH

Financial infusion for General Fusion

General Fusion needs fresh capital. The B.C.-based nuclear fusion company announced a technological breakthrough that brings it one step closer to bringing zero-carbon fusion tech to the electricity grid. But the company also cut its headcount due to “unexpected and urgent financing constraints,” and is seeking new capital “to finish the job,” CEO Greg Twinney said.

Nuclear fusion mimics how stars create energy—an incredibly complex technology that’s perpetually “five years away,” but has gained investor interest in recent years on the back of several tech advances.

General Fusion also needs the stars to align. While the Canadian federal and provincial governments have injected funds in the company in the past, Twinney is looking for more financing including from the private sector, as the company’s competing with “nationally funded fusion programs around the world.” Since 2002, the company has raised US$440.53 million, according to PitchBook, and include counts Temasek, BDC Capital, and Chrysalix Venture Capital and Jeff Bezos as investors. The company recently hired the former CEO of the Amazon.com Inc. founder’s rocket company Blue Origin LLC as a strategic adviser.

The U.S. has been spending US$800 million annually in fusion technology in recent years, while China has injected between US$1-billion to US$1.5 billion annually. There are now around 98 demonstration plants or prototypes operating globally, another 13 under construction and 33 more planned.

Domestic rivals are also nipping at General Fusion’s heels. Montreal’s Fuse Energy raised US$32 million in new funding late last year, with the U.S. National Nuclear Security Administration (NNSA) as its largest collaborator and potential customer. The idea is to make Fuse to NNSA, what SpaceX is to NASA, said its 24-year-old CEO JC Btaiche. Last year, the Canadian Nuclear Laboratories called for a Canadian Fusion Strategy to help the country advance its net-zero emissions target by 2050. Canada provides the least government support for fusion development on a per capita basis among its G7 peers, CNL noted.

Trends, Tech & Science

➔ Ontario is set to build the G7’s first SMR. The province gave Ontario Power Generation the greenlight to start building the first of four small modular reactors at its Darlington New Nuclear Project—the first nuclear project in the province in three decades.

➔ The Oneida energy storage operation is now live. The development in southern Ontario, near Hamilton, in Haldimand County is the fourth largest battery storage facility in the world. Its 278 lithium-ion battery units will store enough power to keep southern Ontario buzzing when demand peaks, or other sources get too expensive. Powered by renewable sources, the Indigenous-led project will reduce Ontario’s emissions by up to 4-million tonnes, equivalent to taking nearly 850,000 gas-powered cars off the road for a year. It may soon become a model for big demand users (such as datacentres) as they explore options. Read John Stackhouse’s blog on how battery storage gives us even more optionality to ensure costs remain low, relatability remains high and Canada’s climate commitments are fulfilled.

➔ Recycling seems to be going out of fashion. A report by think-tank Circle Economy found only 6.9% of the 106-billion tonnes of materials used annually by the global economy came from recycled sources, a 2.2% point drop since 2015. While the use of recycled materials rose 200-million tonnes from 2018 to 2021, overall material consumption rose much faster, offsetting these improvements, Circle noted.

The Institute In Action

➔ John Stackhouse attended the B7 Conference in Ottawa last week, where he presented preliminary findings from RBC’s joint project with Columbia University’s Center on Global Energy Policy, focused on exploring policy options for gas and LNG.

➔ On April 30th, John and Lisa Ashton presented our latest research on agriculture, food, and postsecondary education to the Deans Council-Agriculture, Food and Veterinary Medicine in Ottawa, highlighting key insights on talent development, innovation, and sector resilience.

➔ Read Head of Climate Research Myha Truong-Regan’s four key takeaways from a recent gas and electricity event organized by the Toronto Region Board of Trade.

➔ As part of the Salazar Center for North American Conservation’s symposium in Vancouver this month, the RBC Climate Action Institute co-hosted a roundtable with Nature United. Lisa hosted the discussion, which focused on how nature conservation and stewardship can be positioned as a strategic asset in pro-growth plans for nature-dependent sectors, including forestry, agriculture, and mining.

➔ On the team’s reading list: The Measure of Progress: Counting What Really Matters by Diane Coyle Bad Company: Private Equity and the Death of the American Dream, By Megan Greenwell; Transcend: Unlocking humanity in the age of AI, by Faisal Hoque.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Sarah Pendrith, Jordan Brennan, John Intini, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Lavanya Kaleeswaran.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.