➔ A Silicon Valley of direct air capture set to debut in Alberta

➔ Global abundance: Exploring the New Energy Age

➔ Brazil is cooking up sustainable soybeans for China

Hot takes

➔ The Silicon Valley of direct air capture is taking shape in central Alberta. Quebec-based Deep Sky, backed by a US$40-million grant from Bill Gates’ Breakthrough Energy, is opening its direct air capture innovation and commercialization centre in Innisfail in central Alberta this summer. The facility—seen as a hub for direct air capture activities—will serve as a sandbox for firms to test direct-air carbon-sucking technologies before they scale their operations commercially. Eight companies—from Canada, the U.S. and Germany and others—have already signed up. In a vote of confidence, the Alberta government also recently invested $5 million in DeepSky from the province’s Technology Innovation and Emissions Reduction Regulation (TIER) fund.

➔ Ontario is crafting a new wood construction strategy. The recently announced Advanced Wood Construction Plan aims to promote wood use in larger and taller structures to accelerate projects, lower costs by as much as 20%. Swapping cement and steel with wood would also help lower emissions in a sector that accounts for 18% of Canada’s total emissions. Widespread adoption of wood, specifically mass timber, as a substitute or complement to concrete and steel could cut embodied emissions in buildings by as much as 25%, according to our report Mass Timber. The five-year plan comes as the province’s $20-billion industry is facing punitive U.S. tariffs.

➔ Forecasters are scrambling to assess demand from data centres in the U.S. Electricity demand is now set to grow 25% by 2030 and 78% by 2050, compared to 2023 levels, according to a new report by ICF, a consulting firm. That’s an annual growth rate of 3.2% through 2030 (1.4% previously) and 2.2% (1.1% previously) through 2050 and contrasts with the past two decades when U.S. electricity demand was essentially flat. The strain on capacity could lead to a doubling of electricity prices by 2050, ICF warns. Texas, along with California and PJM region (covering 13 mid-Atlantic and Midwest states)—markets already importing Canadian electricity—will see the highest demand growth.

➔ Brazil is developing bespoke, sustainable soybeans for China. Inspired by its successful Boi China beef model, the Latin American country aims to develop “Soy China,” through a supply chain that aligns with China’s environmental standards and runs on renewable energy. It’s also seen as a way for China to counter the EU Deforestation Regulations (EUDR), which have much stricter rules. Many countries (inside and outside the EU) have raised concerns about the EUDR because of its stringent traceability requirements that do not align with conventional soybean supply chains. And Brazil and China’s move is alternate route for soybeans to flow. The U.S. Department of Agriculture recently warned that sustainable soybeans would directly challenge American and Canadian exporters’ market share in China.

Nature capital: Canada’s other green power

By Lisa Ashton

As climate change disrupts the U.K.’s landscapes—from the Scottish Highlands to the Somerset Wetlands—the country is facing a £97-billion ($181-billion) nature asset deficit. The Green Finance Institute (GFI) estimates that planned public spending on conservation and restoration by the government is well short of delivering on its binding commitments, including the 25-year Environment Plan and the U.K.’s 30×30 targets under the UN Biodiversity targets. It also presents real risks and losses of between £150-£300 billion of U.K.’s GDP by 2030. The U.K. government is now seeking ideas from businesses, investors, and innovators to protect the “natural foundations of its economy,” and spur growth in its “burgeoning” nature services sector.

Canada can draw lessons from the U.K. experience. It’s home to landmark investments in several initiatives including the Great Bear Sea project finance for permanence (PFP), and watershed policy commitments to protect and conserve 30% of Canada’s land and water by 2030.

Canada’s is truly a nature powerhouse with riches that are second to none:

➔ It’s one of just five countries that collectively contain more than 70% of the world’s remaining intact ecosystems;

➔ 20% of the world’s total freshwater;

➔ 25% of the world’s wetlands;

➔ 24% of the world’s boreal forests;

➔ the world’s longest coastline;

➔ the world’s longest coastline;

➔ ecosystems in Canada provide essential habitat for approximately 80,000 species.

But, Canada, like many others, has not been able to unlock nature finance at scale to address declining natural capital as a share of GDP—roughly 70% in 1995 to about 40% today—and mitigate the risks associated with a natural environment that’s experiencing more deterioration than the U.S. and the U.K. Wildfires year-to-date alone could risk 0.4% of Saskatchewan’s GDP and 0.2% for Alberta, according to Statistics Canada estimates.

Nature finance is in its infancy, but a pathway to build natural capital in Canada and investments is slowly being charted. In 2022, the Government of Canada issued its first green bond, valued at $5 billion, with a portion of funds going to nature-based projects including financing that supports the adoption of climate-smart agriculture practices.

Exploring nature finance is an opportunity to build greater resilience in Canada’s natural resource dependent economy driven by fuel, food, fertilizer and forestry production.

Sign up to receive RBC Thought Leadership’s newsletter, major reports and analysis on the biggest ideas shaping Canadian business and the economy.

Trends, tech & science

Gas flaring in Alberta is raising alarms among health professionals. The Canadian Association of Physicians for the Environment (CAPE ) Alberta chapter cited research that shows a 1% increase in flaring exposure led to a 0.73% rise in respiratory-related hospital visits. The warning comes after Reuters reported that gas flaring blew past the province’s self-imposed limit on annual natural gas flaring in 2024, for a second year in a row. In June, the Alberta Energy Regulator said it was ending limits on flaring.

Overcapacity is reinforcing steel’s hard-to-abate reputation. Around 30% of steel capacity remains unused globally, an excess that’s sent prices plunging to a four-year low. With margins under pressure, steelmakers are hardly in the mood to decarbonize. The problem is set to worsen: more than 40% of new steelmaking capacity—mostly from “non-market” forces such as China—that’s set to enter the market by 2027 will be emission-intensive, according to an OECD report . Strengthening international co-operation to address excess capacity and market distortions will be vital to improve the outlook for steelmakers in market economies, the OECD recommends. That would give steelmakers the space to advance decarbonization efforts. New anti-dumping tariffs in Canada and the U.S., primarily aimed at China, is also an opportunity to establish a green steel market.

Plastic bag bans and fees are making a difference. Several U.S. jurisdictions that enforced these policies have seen a 25-47% dip in plastic bags as a share of total items collected in shoreline cleanups, according to an extensive University of Delaware and Columbia University study. The ban also reduced the number of animals entangled along the shoreline. Still, plastic pollution overall remains a growing challenge. The final round of a Global Plastics Treaty is set for August in Geneva.

The New Energy Age

By John Stackhouse

More, more, more energy.

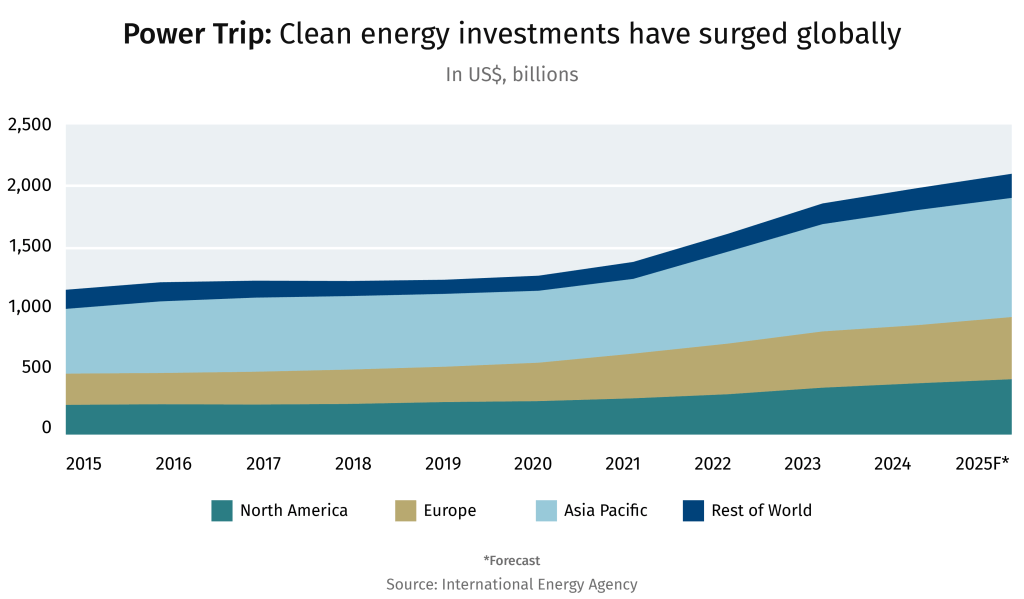

That was the big message in the IEA’s 10th annual investment report.

The International Energy Agency (IEA) tracks investment flows for all forms of energy, and this year is more relevant than ever, given the volatility we’ve seen in energy prices this decade. While a slower global economy may temper some investment patterns, what gets built today will shape energy patterns in years to come.

Some highlights:

-

Capital flows to the energy sector are on course to reach US$3.3 trillion this year.

-

China is leading the energy investment surge, accounting for nearly a third of global investment, split almost evenly between grid and storage, renewable power and fossil fuels.

-

North America saw a record US$700 billion in investments in 2024, but will see pullback to US$690 billion this year. Clean energy investment is at an all-time high.

-

Would the U.S. new “big, beautiful bill” that guts several clean energy incentives, and Canada’s Bill C-5, that promotes clean and conventional energy projects, move the needle on energy investments?

-

The biggest use of investment globally is electrification, which will consume almost half ($1.5 trillion) of all energy capital.

-

Only a third of investment will go to oil, natural gas and coal:

-

lower oil prices are likely to keep investment down;

-

LNG investment is on “a strong upward trajectory,” led by the U.S., Qatar and Canada;

-

nuclear’s renaissance continues, rising by 50% over the past five years;

-

coal-fired power in advanced economies has ground to a halt, while it’s showing a comeback in China and India.

The bottom line is the world will continue to need to invest trillions a year in energy, across a wide array of sources. As that continues, some long-term trends are clear—more energy investment will go to Asia, especially China; more will go to electrification; and as our new report, “A G7+ Strategy for Natural Gas,” lays out, more will go to gas infrastructure.

Countries that develop the right policies will generate and attract the bulk of that capital, in what’s shaping up to be a New Energy Age.

Must reads

➔ This massive new data centre is powered by used EV batteries (Fast Company)

➔ Would you recycle more if every bottle gave you a chance to win $1,000? (CBC)

➔ Net-zero push is still on at many companies: SBTi (WSJ)

➔ Why Canada’s orphan wells are a bigger methane menace than active wells (ACS Publication)

The Institute In Action

-

John Stackhouse and Lisa Ashton visited the Kelburn Farm in Manitoba in late June. The demonstration farm operates out of the Red River Valley, a growing hotspot for agri-food innovation. The Kelburn Farm is a place for farmers, students, researchers, and companies along the agri-food supply chains to test and trial new ideas that are advancing Canadian agriculture.

-

Shaz Merwat was at the RBC Energy Transition Conference in London last week. He also attended a virtual International Energy Agency Conference on certified natural gas this week.

On the team’s reading list:

-

Crisis: A Global Case Primer, by Jason Miklian and John Katsos, on leading when things are falling apart.

-

Shaz Merwat was at the RBC Energy Transition Conference in London last week. He also attended a virtual International Energy Agency Conference on certified natural gas this week.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Sarah Pendrith, Jordan Brennan, John Intini, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Lavanya Kaleeswaran.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.