Next week is quiet on the data front but will give markets time to digest the news of the US Supreme Court striking down IEEPA tariffs. While the decision appears to be a major blow to the administration’s tariff agenda, it remains likely that this administration will pursue tariffs through other avenues. Whether importers will be entitled to refund and what those refunds look like remain to be seen. Either way, this new development, if sustained, improves inflation’s trajectory and could boost growth prospects this year after the government shutdown distorted the Q4 2025 GDP Advance print.

At this juncture, we are giving more weight to the PCE measure of inflation over CPI because housing-related data quirks are disproportionately impacting CPI. This stems from the government shutdown (in Q4 2025). The fact that the PCE inflation continues to run hotter than CPI (core PCE 3.0% y/y vs core CPI +2.5% y/y) adds conviction to our view that focus should be on PCE in the coming months for a better read on inflation’s path because housing carries more weight in CPI.

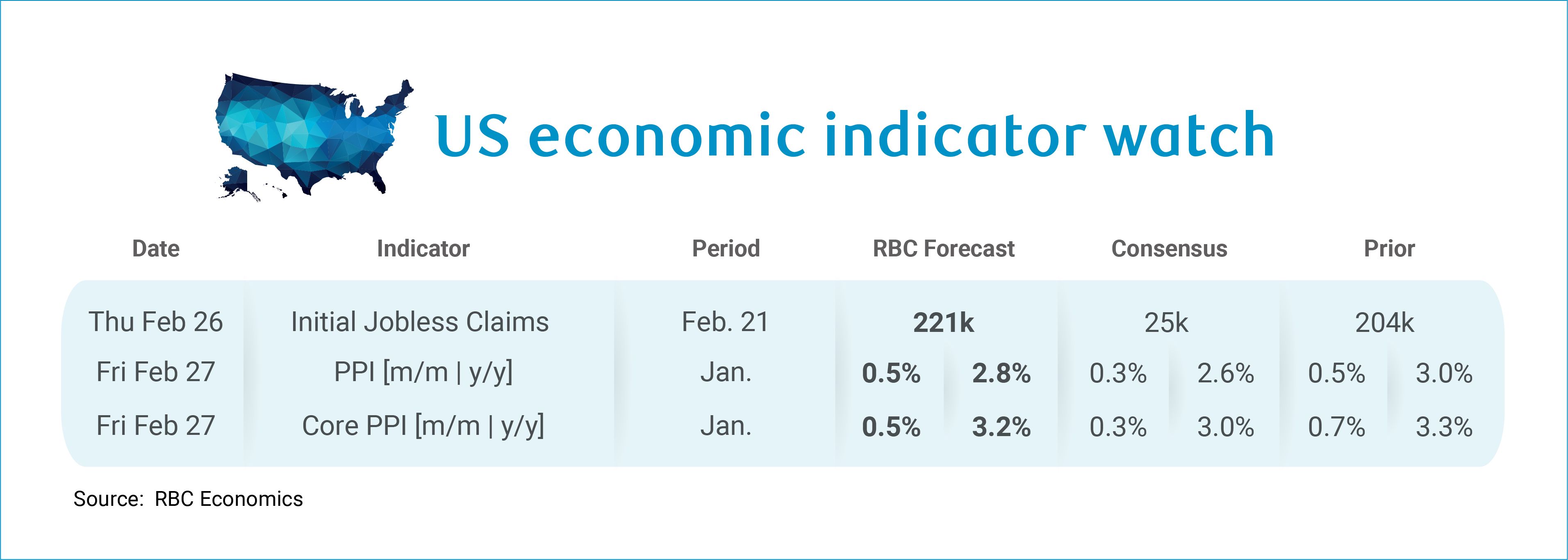

With that in mind, next week’s PPI release will be especially important to give us more direction on the trajectory of PCE in January. We expect to see another reasonably hot PPI print – with both headline and core price growth rising +0.5% m/m in January, nudging the year-over-year prints up to 2.8% and 3.2% for headline and core respectively. In December, a massive upside in PPI was driven by a spike in wholesale trade for machinery and equipment, suggesting that wholesalers were likely passing off higher costs along the supply chain. Medical care services will be less important with respect to January tariff passthrough but will be important for estimating the direction of PCE since the medical sector bears relatively more weight in the PCE basket compared to CPI. If medical care services were to heat up, this would be an important clue for the direction of the January PCE release, slated for March 13th.

Aside from PPI, here’s what else we’re watching next week:

-

After initial jobless claims came in quite a bit lower in the week ended February 14th, we expect to see claims tick up to 221k for the week ended February 21st. Continuing claims have trended quite a bit lower since November but have inched higher in recent weeks from their January bottom.

-

On Tuesday we also get February Consumer Confidence data from the Conference Board. We will be monitoring the consumer confidence metric, which nosedived in January to its lowest level in over a decade (since early 2014). This is after December retail sales were weaker across most categories.

About the Authors

Mike Reid is Head of U.S. Economics at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior US Economist at RBC Capital Markets. Carrie is responsible for projecting key US indicators including GDP, employment, consumer spending and inflation for the US. She also contributes to commentary surrounding the US economic backdrop which she delivers to clients through publications, presentations, and the media.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.