The first major data release of 2026 will be the employment report, landing on Friday. We will finally be up to date on the state of US employment following the significant delays resulting from the government shutdown.

We expect to see +70K jobs were added to the US economy in December, but similar to previous months, the majority of job creation will reflect structural hiring in health care rather than cyclical. In fact, the double payroll report (for October and November) pointed to weaker cyclical services hiring. Still, following a strong November retail sales report, hiring in the retail sector will likely be the wildcard in the December report. Since 2015, on average we have seen 14k retail jobs added in December during the holiday shopping season. But this year, hiring in the retail space may be impacted to the downside because of the unwind of prior tariff front-running coupled with slowing immigration. Data from Visa cardholders suggests US spending momentum prevailed in November and should provide a tailwind for payrolls this year.

The previously released November employment report also included a jump in the unemployment rate, but we do not expect to see a repeat of this trend. In fact, we expect to see a partial reversal with the unemployment rate likely ticking lower to 4.5% in December. We typically see fewer permanent layoffs and temporary job completions in December as seasonal hiring peaks. If the unemployment rate were to hold steady, this would likely be a story of re-entrants returning to the labor market, which largely explained the uptick in November. For this reason, we considered the jump in November unemployment less worrisome as it also reflects a story of younger graduates struggling to find work rather than permanent layoffs of prime-age workers. While longer search times are a sign of a loosening in the labor market, its not as concerning for consumer spending in 2026 because new jobseekers who weren’t previously working do not represent a loss of labor income/spending power. Throughout the year, we expect to see the unemployment rate plateau around 4.5% – a historically low unemployment rate.

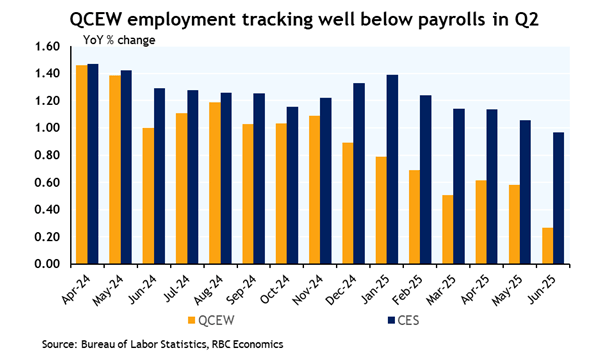

It is important to reiterate that the +70K pace of job creation that we expect in December does not factor in QCEW revisions, which will be published later this year. This means that it has become increasingly difficult to accept headline payrolls prints at face value. Hiring is likely much softer beneath the surface than headline payrolls suggest, with Baby boomer retirements and stringent immigration weighing on labor supply.

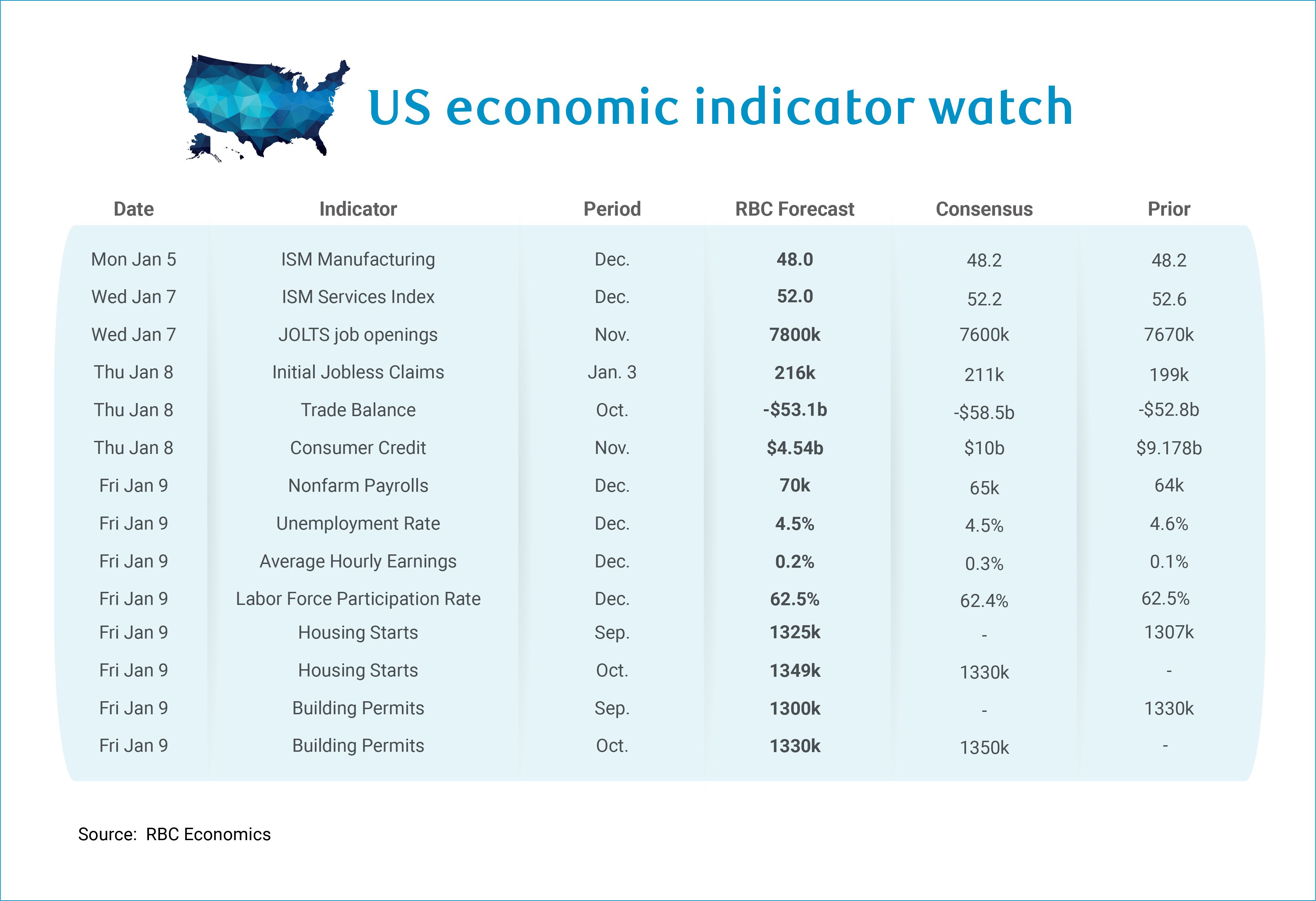

Aside from the December employment report, we have a few additional data releases this week:

-

We will be keeping our eye on developments in Venezuela, though our initial reaction is that the limited move in oil prices means our inflation outlook, for now, is not impacted. On growth, there is some potential for upside through defense spending, but this will not likely be enough to change the macro narrative in 2026.

-

ISM services will likely grind lower to 52.0 (from 52.6) for December. Three of four regional Fed surveys (including Philly, Richmond, and Texas) pointed to weaker services activity. Kansas city was the only outlier.

-

JOLTS data for November will be stale but we expect to see an uptick in job openings to 7800k from 7670k the prior month ahead of the holidays and after hiring ramped up in November.

-

We expect to see initial jobless claims tick up 216k for the week ending January 3rd after we saw a massive downside (199k) during the week of the Christmas holiday. We would expect some of the backlog in claims from the week ending December 27th to be cleared in subsequent weeks. Still, New Years fell on the week ending January 3rd, and another shortened holiday week could result in continued swings. We anticipate jobless claims will return to pre-holiday patterns in the coming weeks, highlighting a labor market that is stabilizing amidst a low-hiring, low-firing backdrop.

-

Housing Starts and building permits for both September and October are scheduled to be released on Friday as housing data continues to catch up following the shutdown.

About the Authors

Mike Reid is a Director, Head of US Economic Research at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior US Economist at RBC and a member of the US Economics team at RBC Capital Markets. Carrie is responsible for projecting key US indicators including GDP, employment, consumer spending and inflation for the US. She also contributes to commentary surrounding the US economic backdrop which she delivers to clients through publications, presentations, and the media.

Imri Haggin is an economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.