For week of Mar. 2

A quiet Canadian economic data calendar will leave focus on U.S. jobs next Friday—particularly on the disproportionately trade impacted industrial sector where cross-border economic ties with Canada are closest.

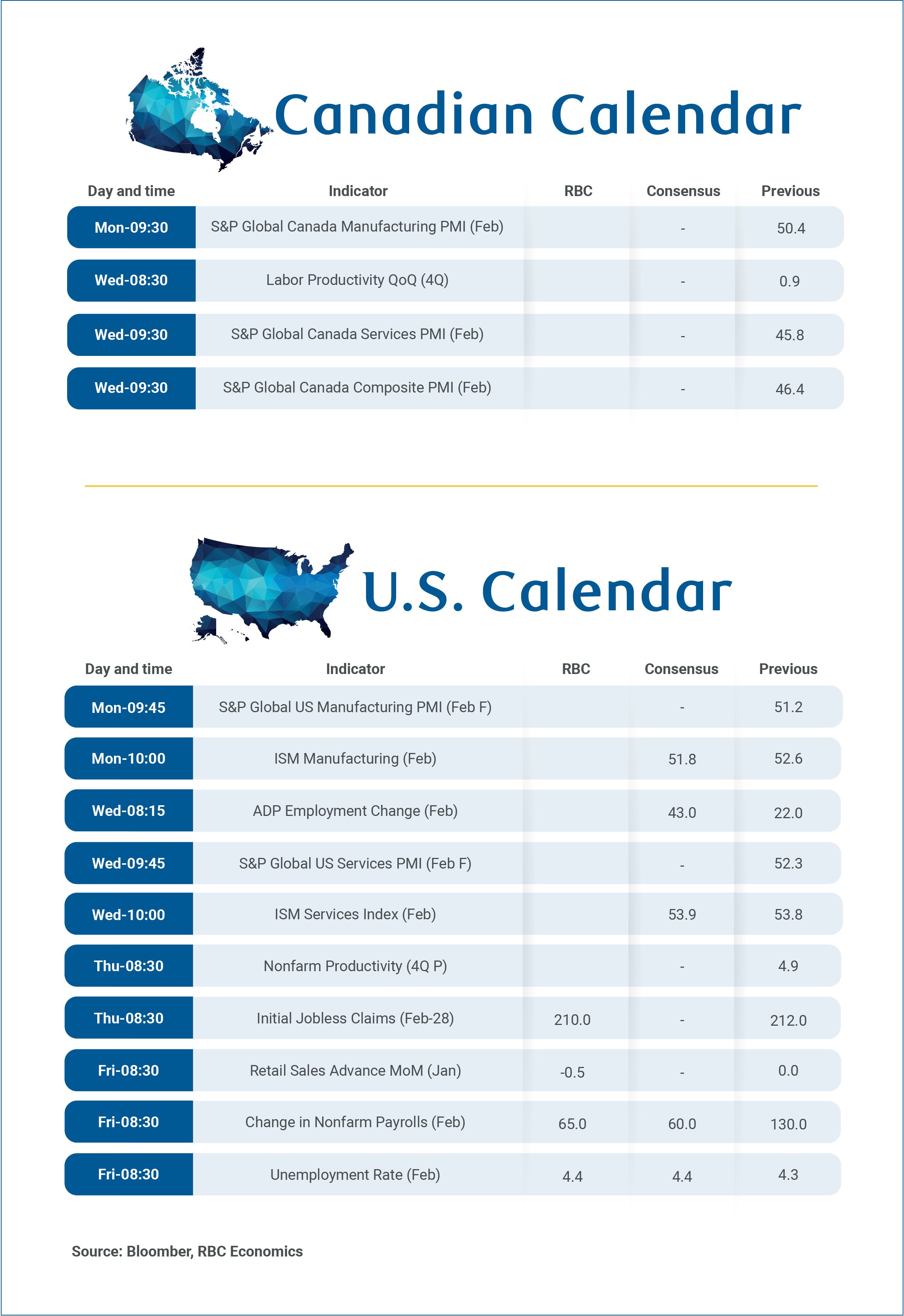

We look for the February report to be consistent with stabilizing broader U.S. labour market conditions. We expect the unemployment rate to tick up to 4.4% to reverse a decline to 4.3% in January, but hold below the recent 4.5% peak in November.

Job growth likely remained subdued (we expect a 65,000 increase), but slow underlying labour force growth due to an aging population and immigration curbs has lowered the breakeven rate of employment needed to keep the unemployment rate from rising more significantly.

Employment in the heavily tariff-exposed U.S. manufacturing sector has underperformed—mirroring conditions north of the border given tight Canada/U.S. industrial integration. But, it posted a small increase for the first time since November 2024 in January.

For Canada, we’re watching the February S&P manufacturing Purchasing Manager’s Index on Monday after it ticked above the neutral growth 50 level in January for the first time in a year.

U.S. tariff regime shifting with rates edging lower

U.S. trade policies are in flux again after the Supreme Court ruled against the use of IEEPA to impose broad-based tariffs last week. The U.S. administration announced a new 10% global tariff via Section 122 on the same day as the ruling, citing balance-of-payments deficit concerns.

The administration has already threatened to raise that to 15% (maximum allowable under that authority), but the list of exemptions from the measures is also long. Critically for Canada, trade compliant with CUSMA rules of origin is exempt as it was under IEEPA rules.

There is a list of more than 1,600 products where tariffs don’t apply “because of the needs of the United States economy.” By our count, products on that exemption list accounted for roughly half of U.S. global imports in 2025. For some trade partners, that share is substantially higher—for example, the exemption list covers more than 80% of U.S. imports from Taiwan in 2025.

Accounting for the exemptions, the new Section 122 tariffs likely represent a step lower in the average effective U.S. tariff rate overall. This aligns with our expectation that U.S. tariff collection may have already peaked given elevated affordability concerns.

Canada’s tariff backdrop unchanged after court ruling

The new measures don’t significantly change the international trade backdrop for Canada.

CUSMA exemptions mean Canada should retain among the lowest average U.S. effective tariff, even as significant targeted tariffs remain in effect on products like steel, aluminum and the auto sector (measures not impacted by the U.S. Supreme Court ruling).

We’ve long highlighted the importance of preserving CUSMA and related exemptions to our Canadian outlook. But, the U.S. administration’s decision last week to uphold these exemptions underscores the agreement is mutually beneficial on both sides of the border—including lowering costs for the 22 U.S. states that counted Canada as their largest source of imports in 2025.

This report was authored by Assistant Chief Economist Nathan Janzen and Senior Economist Claire Fan.

Explore the latest from RBC Economics:

Alberta Budget 2026. Lower resource royalties take a heavy toll

Podcast: The 10-Minute Take. What’s next for U.S. tariffs after IEEPA strike down

Canadian Analysis. Decades of trade disputes reshape Canada’s softwood lumber sector

Nova Scotia Budget 2026. Departs from previous deficit reduction plan

U.S. Analysis. US Supreme Court ruling does not mean tariffs are going away

Canadian Analysis. Preserving CUSMA exemptions: Canada’s real priority amid U.S. IEEPA ruling

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.