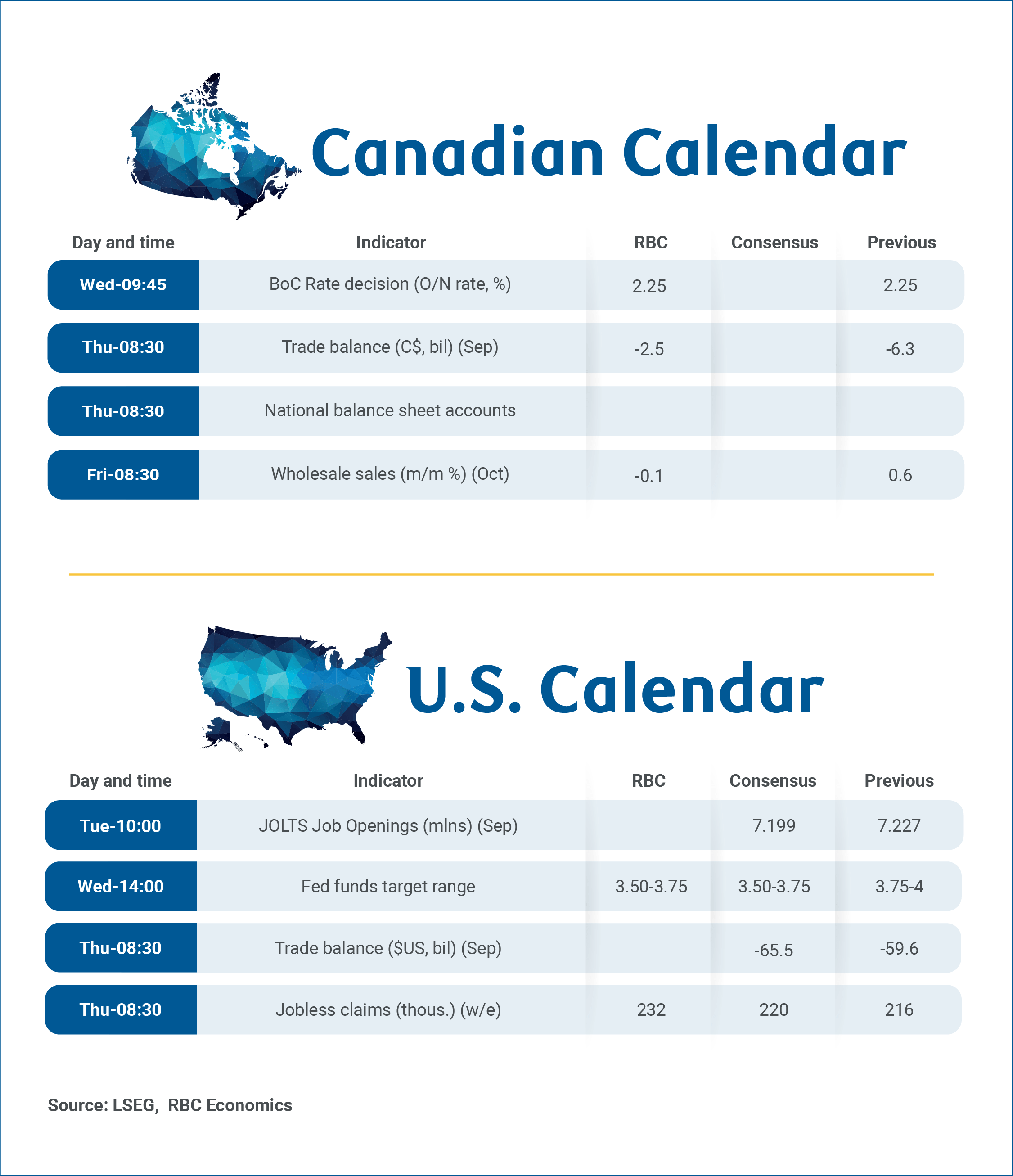

For the week of December 8th, 2025

Dual central bank interest rate decisions from the U.S. Federal Reserve and the Bank of Canada on Wednesday top the week’s calendar, with the BoC expected to hold rates, while a third consecutive 25 basis point cut from the Fed looks highly likely.

Our base case forecast a month ago did not assume a December cut from the Fed, given inflation in the U.S. remains above the central bank’s 2% target, and Chair Jerome Powell’s comments at the last meeting about cautiously proceeding in a foggy environment.

However, with an unusually divided FOMC committee, next week’s decision was always going to be a very close call. Fed communication over the last few weeks has also been leaning in the direction of a cut. With some softer data during the blackout, we doubt the hawks will put up a major fight.

A hold by the BoC in comparison should be relatively uncontroversial. After October’s rate cut, policymakers signaled that “the current policy rate is about the right level” to deliver low, steady inflation while supporting growth through uncertainty.

Delayed September Canadian trade data next week would need to show a 3.4% increase in merchandize export volume from August, and a 3.1% decrease in goods import volume in order to match the details in the third quarter GDP data from last week.

More important still are the trade details from U.S. census bureau on whether CUSMA exemptions have continued to hold up to support Canadian exports to the U.S. in September.

How the labour market plays into the BoC decision

BoC’s holding bias was contingent on the central bank’s forecast for soft but positive economic growth. Gross domestic product growth in Q3 surprised on the upside with a 2.6% annualized increase versus the BoC’s 0.5% projection, with mixed details.

But labour markets have also shown more signs of stabilizing with employment rising 54,000 in November after already firm increases in September and October. The (less-volatile) unemployment rate dropped to 6.5% in November from 7.1% in September. Weakness still exists among tariff-exposed manufacturing sectors, but economy-wide layoffs have remained low.

As a result, household spending has broadly remained resilient this year despite a tick lower in Q3. Spending was, in part, supported by earlier BoC rate cuts that have reduced debt service pressures. Financial market gains have bolstered net worth, adding to aggregate purchasing power.

We expect those trends will have persisted in Q3, and next week’s national balance sheet data to show little changes in households’ debt service ratio from Q2 level that was already below 2019, and further gains in financial assets and net wealth.

Today, underlying inflation pressures are running above the BoC’s 2% inflation target, and could prove stickier than the central bank would like in the future thanks to stronger-than-expected consumer and government spending in 2026. Our base case assumes per-capita growth will slowly improve in 2026 with no additional interest rate cuts from the central bank.

Week ahead data watch:

-

The Q3 national balance sheet account details next Thursday should show rising household net worth with asset expansion outpacing growth in liabilities. Robust stock market gains in Q3 (the TSX index were up 11.8% and the S&P 500 up 10.3%) were partially offset by lower home equity given an 1.8% drop in home prices. Households’ debt service ratio is expected to remain little changed at 14.4%, as debt payments continued to rise at a similar pace as disposable income.

-

The release of September Canadian (and U.S.) international trade data delayed by the U.S. government shutdown should show a narrowing in the Canadian trade deficit. But the magnitude of the improvement will be watched closely after Statistics Canada needed to impose imputed placeholders on Canadian export data to compile the contribution of net trade to Canada’s Q3 GDP report. Most of a 3.1 percentage point (annualized rate) add to GDP growth in Q3 came from a pullback in imports that was not impacted by the U.S. shutdown. But the quarterly GDP data also implied a 3 1/2% increase in September merchandise export volumes.

This report was authored by Assistant Chief Economist Nathan Janzen and Senior Economist Claire Fan.

Explore the latest from RBC Economics:

Canadian labour markets firmed again in November

Local Real Estate Markets: Buyers jump into Canada’s housing markets as 2025 draws to an end

Tracking the impact of U.S. tariffs on five targeted Canadian industries

Five themes for the US economy in 2026: Stagflation lite exacerbates growing K-shape divergence

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.