Canadian outlook

Canada’s economic trajectory has been quietly shifting constructively in 2025.

There have been encouraging signs of recovery after years of underperformance despite significant international trade uncertainty, and aggressive U.S. tariff hikes in some sectors.

Resource-dependent provinces and Atlantic Canada are expected to benefit from export diversification and commodity resilience, while trade-exposed ones will underperform as U.S. tariffs compound demographic headwinds.

Total gross domestic product growth has proven more resilient than feared in 2025 – in part due to upward revisions to output prior to the imposition of U.S. tariffs earlier in the year, but also a stronger-than-expected bounce-back in Q3 that more-than-reversed a Q2 decline.

That isn’t entirely a surprise. Early into the trade shock, we thought there were underappreciated reasons for cautious optimism about Canada’s outlook, including a critical exemption from U.S. tariffs that has continued to apply to the bulk of Canadian exports.

But, another more revealing metric tells an even more promising story. Per-capita GDP—a better measure of how individual households and workers experience the economy—is on track to post an increase in 2025 for the first time in three years.

Uncertainty about Canada’s future trade relationship with the U.S. remains, slower population growth will weigh on aggregate output, and weak productivity growth persists as a structural challenge. But, without another external shock, there is reason for cautious optimism.

We expect per-capita GDP growth will strengthen further, and the unemployment rate will drift lower in 2026.

Household-level indicators are improving despite slowing population growth

The improvement in per-capita GDP represents a significant milestone. International trade dominated 2025 concerns, but per-capita GDP had already declined for two consecutive years in 2023 and 2024 with the unemployment rate rising 2 percentage points from early-2023 lows by the end of 2024.

That softening was historically unique. An unprecedented surge in post-pandemic population growth from temporary resident arrivals increased both consumer demand and labour supply at the same time, keeping aggregate GDP positive. But simultaneously, global interest rate hikes to combat post-pandemic inflation caused declines in per-capita measures and rising unemployment, creating a per-household economic backdrop functionally indistinguishable from a recession.

Now, the reverse is happening. Curbs on temporary resident arrivals are lowering consumer numbers and labour supply simultaneously. We argued before that this will, all else equal, reduce total GDP growth, but not significantly impact per-capita GDP and unemployment—better indicators of how households and workers experience economic conditions.

And, those underlying measures are showing encouraging improvement. The unemployment rate continued edging higher into mid-2025 as U.S. tariffs and trade uncertainty rose, but at a slower pace than prior years, and it increasingly appears to have passed a peak. The 6.5% unemployment rate in November was down 0.4 percentage points from a year earlier with wages still growing faster than inflation.

Unemployment remains elevated, particularly in trade-impacted regions and for younger workers, and international trade risks linger. But, we remain cautiously optimistic that the economy will show further per-capita improvement in 2026 with the unemployment rate continuing to edge lower.

Key factors supporting Canada’s per-capita growth:

-

Trade policy stability. Exemption from U.S. tariffs for most Canadian exports remains critical. Tariffs still apply to targeted sectors, but most exports to the U.S. (86% as of September) have remained duty free.

While we don’t expect U.S. tariff hikes in 2025 to reverse, we also don’t expect more significant increases. The U.S. administration’s approach to trade policy remains unpredictable, but political appetite for additional tariffs appears to be waning ahead of the November 2026 U.S. midterm elections, and we have argued the current CUSMA exemption is also important for U.S. importers.

-

Monetary easing. Bank of Canada rate cuts support growth. The lagged impact of 275 basis points of reductions from June 2024 to October 2025 have eased monetary policy constraints, and lowered household debt servicing costs—see here for more on implications for household spending.

-

Fiscal policy tailwinds. Government budget deficits are ramping up, led by higher federal spending in the fall budget. Much of the growth impact extends beyond 2026, but near-term deficit increases are substantial and will add to growth ahead.

-

Global growth supporting commodity prices. The broader global economy continues growing, maintaining a floor under commodity prices and supporting revenue inflows into Canada’s natural resource sectors. Globally, tariff hikes have been largely limited to U.S. imports with 88% of global trade not impacted—allowing most advanced and emerging economies to continue growing.

-

Softer but still positive U.S. growth. Although most U.S. imports from Canada and Mexico remain duty free, aggressive tariff hikes on virtually all other U.S. trade partners have pushed the average U.S. effective tariff rate to its highest level since the 1930s, weighing particularly on the U.S. industrial sector. The U.S. unemployment rate has been edging higher as hiring demand edges lower. Still, domestic demand remains firm with support from Federal Reserve interest rate cuts, and a still exceptionally large government budget deficit for this point in the economic cycle.

-

Business investment. Trade uncertainty remains a headwind, but regular business investment—such as replacing aging equipment—can only be delayed so long. Businesses’ cash holdings remain high, corporate credit spreads are low, and tax measures in the fall budget are designed to free up near-term cash flow for investment. We look for Canadian business investment to edge higher in 2026.

Provincial overview

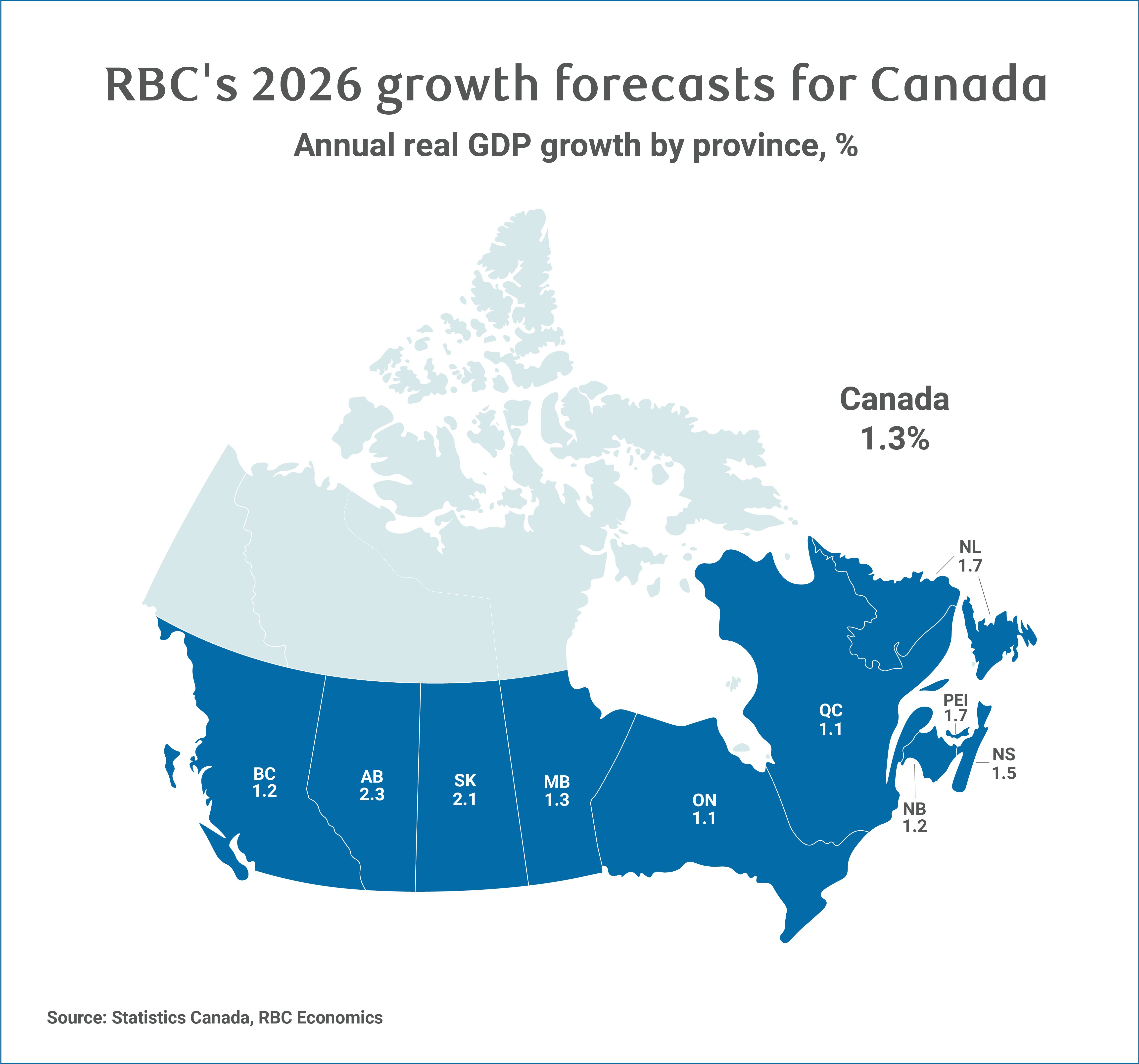

Tariffs, resources strength, demographics shape provincial economies in 2026

Canadian provinces will experience differentiated impact from tariffs and demographic shifts—with resource-dependent regions outperforming trade-exposed ones.

Trade-exposed provinces in central Canada face mounting pressures. Ontario and Quebec are both projected to grow 1.1% in 2026 as U.S. tariffs on steel, aluminum, and lumber weigh on manufacturing exports.

British Columbia faces similar headwinds and is expected to grow a modest 1.2% with lumber and aluminum tariffs offsetting gains from the LNG Canada Phase 1 completion. Manitoba, also at 1.3%, is among the most directly impacted by tariffs, and faces potential threats from expanded U.S. tariffs on heavy trucks and buses.

Resource-dependent provinces, on the other hand, are expected to maintain leadership positions. Alberta and Saskatchewan are projected to grow 2.3% and 2.1%, respectively, supported by energy infrastructure and agricultural output. But, Chinese tariffs on agricultural exports pose a notable headwind.

Atlantic Canada shows diverging performance in 2026. New Brunswick (1.2%) trails the national average amid softer U.S. demand and a slowdown in population growth, while Nova Scotia (1.5%), Prince Edward Island (1.7%), and Newfoundland and Labrador (1.7%) remain above average with export diversification and mineral production offsetting construction moderation.

British Columbia – Demographic tailwinds turn to headwinds

British Columbia’s economy is expected to post modest growth of 1.2% next year, lagging the national average. Slowing demographic growth driven by new federal immigration targets, tariff headwinds in lumber and aluminum, and softer residential investment will be partially offset by natural resource export gains and labour market improvements.

Exports have fared relatively better than in other provinces, declining just 0.9% (value basis) year-to-date, though tariff-targeted sectors like lumber and aluminum have seen steep losses. These headwinds are expected to persist next year, but the completion of Phase 1 LNG Canada will substantially ramp up liquefied natural gas export capacity, and announced federal fiscal measures supporting affected sectors should help mitigate some of the impact.

Like Ontario, B.C. is expected to be disproportionately impacted by new immigration targets. It has the highest share of non-permanent residents at 8.9% of the population. A drop in net non-permanent residents has already dragged population growth lower, and we expect this to continue and deepen next year with overall population growth expected to stall or potentially contract slightly. This will meaningfully weigh on household demand, though lower interest rates should provide some offset, given B.C.’s rate sensitivity.

Consumer spending has remained resilient with retail sales up nearly 7% year-to-date. We expect retail sales to moderate to +2.8% next year amid weaker demographic growth, but improvements in the labour market should keep spending a positive growth driver. Wages have been tracking 3.5% year-over-year, while the unemployment rate has shown early signs of moderation and is expected to average around 6% in 2026.

Sluggish housing construction is expected to continue dampening residential investment. We’ve seen a notable slowdown in residential investment in August, following a rebound earlier in the year. Housing starts are estimated at 37,000 annualized units next year, roughly 6,400 lower than in 2025. However, there’s been early evidence the mild recovery in home resales has resumed, and we believe will be sustained thanks to lower interest rates.

Elevated public infrastructure spending is projected through next year. It will go some way in offsetting softening business investment, along with preliminarily and continued work on a slate of new projects. Six of the 13 projects referred to Canada’s Major Projects Office are in B.C., including Phase 2 of LNG Canada, which offer meaningful upside potential to non-residential investment. A recent B.C. Supreme Court decision regarding an Indigenous land claim in Richmond could impact the investment outlook. We will closely monitor developments as the situation evolves.

Alberta– External pressures to weigh on growth

Alberta’s growth is expected to moderate slightly next year to 2.3% from an upwardly revised 2.6% expected this year.

Weaker global oil prices, Chinese tariffs weighing on agricultural exports, and softening demographic growth are expected to drive moderation, even though Alberta remains poised to be Canada’s top economic performer in 2026.

Oil production continues to set record highs, rising 4% year-to-date, largely driven by increased capacity on the Trans Mountain Expansion Project. Oil exports to non-U.S. markets have surged 142% so far this year, meaningfully narrowing the West Texas Intermediate-Western Canadian Select price differential.

Still, global oil prices have declined amid uncertainty surrounding global growth and rising OPEC production, pressuring price expectations for 2026. Combined with our expectation of a moderately stronger Canadian dollar, these headwinds could weigh on production and business investment in the sector.

Stronger-than-expected crop yields this year prompted an upward revision to our 2025 real GDP estimate. Major crops delivered impressive gains with barley up 26%, canola up 13%, and wheat up 24% from last year—with wheat production reaching record highs. But, Chinese tariffs are expected to be a stiffer headwind, and could weigh on farmers seeding plans for the spring.

Alberta’s economy continues to be bolstered by strong consumer spending, supported by rapid population growth. Immigration cuts are slowing the pace, but demographic underpinnings still compare very favorably to all other provinces next year. The province benefits from a natural increase in population, and its affordability advantage continues to draw strong migration flows (both international and interprovincial). This should keep household spending upbeat, complemented by lower interest rates.

Softening population growth should help rebalance the labour market, though we expect absorption issues to persist amid sustained inflow into the labour force. We project Alberta’s unemployment rate to stay above the national average for an eleventh consecutive year averaging 6.8% next year.

Housing starts are on track to average a record pace this year, but momentum is expected to moderate in 2026 as easing household formation, project completions and higher inventory of homes cool demand for new projects. Residential construction investment has slowed since the start of 2025, but government infrastructure spending has provided a partial offset, and is expected to continue to support growth next year. Additional tailwinds could emerge over the medium-longer term with the federal-Alberta MOU on a new pipeline development.

Saskatchewan – Chinese tariffs pose a threat to agriculture

Saskatchewan’s economy is expected to remain among the fastest-growing provinces in 2026 with real GDP projected to grow 2.1%—a moderation from our upwardly revised 2.7% forecast for 2025.

Growth is underpinned by robust construction and agricultural activity, though intensifying trade pressures present a notable headwind.

Exceptional agricultural production—including record canola output—has boosted our growth expectations for 2025, but Chinese tariffs cloud the outlook for 2026. These tariffs have contributed to lower canola farm cash receipts, declining by $594 million between January and September compared to the same period last year. Diversification has provided some relief—with export value to non-U.S. and non-Chinese markets rising 23% year-to-date—but, total nominal exports have still contracted roughly 4%.

Energy and mineral production show mixed momentum heading into 2026. Oil production has softened 4% so far this year amid weaker global prices, while potash production has remained largely flat and uranium production has declined 15%. Elevated prices for both potash and uranium support healthy receipts, and uranium prices are expected to firm further next year, providing continued support. We remain vigilant of potential escalation in U.S. potash tariffs, which could create additional downside risk.

The labour market remains one of the healthiest in the country with the unemployment rate at 5.6% in November—the second lowest among all provinces. Population growth has moderated to 1.5% year-over-year in Q2, but Saskatchewan could experience among the faster growth rates in 2026. Tight labour conditions and robust population inflows should continue underpinning consumer spending and housing demand.

Construction stands out as a key driver of economic momentum with both residential and non-residential investment accelerating through the past year, particularly in government-led projects. Housing starts are tracking at 6,300 annualized units—highest level since 2014. Major projects including the McIlvenna Bay Foran Copper Mine, designated as a federal “nation-building” project is about 64% complete, and on track for commercial production in mid-2026. The Jansen potash mine is expected to begin production in mid-2027. These projects will continue providing meaningful support to employment and construction.

Manitoba – Manufacturing facing mounting pressures

Manitoba’s economy is expected to grow 1.3% in 2026, slightly lower than our upwardly revised 1.4% forecast for 2025. It has been among the most directly impacted by tariffs, and that pressure could intensify next year with recent expansions of U.S. tariffs.

Manitoba’s exports face the third-highest effective tariff on shipments to the U.S. at 2.9 % as of August, just behind Ontario and Quebec. Total nominal exports have declined 11% year-to-date compared with last year, driven by a 17% drop in U.S.-bound exports, and a steeper 36% decline to China.

Exports to non-traditional markets have risen roughly 21% so far this year, but this diversification has only partially offset losses. Recent U.S. tariff expansions in October, which include 25% on the non-U.S. content of heavy trucks and 10% on buses, and potential tariffs on pharmaceutical products, which represent some of Manitoba’s largest exports to the U.S. in 2024, could put additional strain on manufacturing next year.

Despite a record wildfire season, agricultural production reached record highs in 2025 across a variety of crops, contributing to a modest boost to growth this year (now expected at 1.4% from 1.2%). However, the sharp decline in exports to China reflects mounting tariff pressure on key agricultural exports like canola and pork.

The labour market has weakened considerably with the unemployment rate climbing to 6.1% as of November. Consumer spending has remained resilient with retail sales gaining about 5% so far this year, but this masks underlying vulnerabilities. A softer labour market, slowing demographic growth, and tariff uncertainty are expected to dampen household spending in 2026.

Construction remains a critical anchor for Manitoba’s performance. Residential construction has risen over 20% year-to-date, and the continuation of large-scale government projects through the Capital Infrastructure Investment Plan will help sustain momentum.

Ontario – Two-speed recovery to take shape

Ontario will enter 2026 on better footing than anticipated. An unexpectedly strong Q3 has prompted a slight upgrade our 2025 and 2026 growth forecast despite ongoing trade headwinds.

We now expect Ontario to achieve real GDP growth rates of 1.2% in 2025 and 1.1% in 2026.

Headline numbers, however, continue to conceal stark local differences—with some areas facing persistent challenges while others show resilience.

Ontario sits in the crosshairs of U.S tariffs. Manufacturing-dependent regions in central and southwestern Ontario face the brunt of U.S. tariffs.

Layoffs and production shifts to the U.S. at steel and auto plants have weighed on manufacturing employment, and raised concerns about future industrial capacity. Meantime, trade tensions continue to dampen investment and exports, compounding pressures on a sector that never fully recovered from the pandemic.

Federal and provincial support—including tariff protections on steel, enhanced domestic demand through Buy Canadian policies, and improved financial and freight rates for key sectors—may provide struggling industries with breathing room while developments like Vianode’s $3.2 billion synthetic graphite facility and NextStar’s start of mass battery cell production in Windsor offer some promise. Still, it remains unclear whether these additions can quickly offset recent production losses.

All things considered, the outlook for trade remains challenging. Exports have weakened following a Q1 surge driven by front-loading ahead of anticipated tariffs. Absent another one-time boost, the province is unlikely to benefit from the same tailwind, keeping Ontario-U.S. trade under stress.

Despite these challenges, trade-related damage has remained relatively contained. Protection from the Canada-U.S.-Mexico Agreement (CUSMA) has limited spillover to other sectors—including most services where employment has held steady. This dynamic is fostering a two-speed recovery with the broader labour market expected to improve in 2026 as labour force growth slows, and trade policy becomes less opaque.

Lower interest rates will be a benefit too. The lagged impact of past interest rate cuts should encourage Ontario households to continue spending after holding back during the high-interest rate period. This should benefit interest-rate sensitive sectors, gradually reviving housing market activity and offsetting some weakness in autos.

Quebec – Domestic resilience keeps economy afloat

Quebec’s economy is navigating a challenging, but manageable environment as we head into 2026.

Trade-exposed sectors face serious headwinds from U.S. tariffs hitting some of the province’s top export commodities, particularly steel, aluminum, and lumber products. Yet, the broader economy is proving resilient with domestic-oriented industries providing a steady foundation for growth.

We project Quebec’s real GDP to expand by 1.1% in 2026—a modest pace, but one that reflects this mixed bag picture.

The outlook for provincial exporters remains foggy as manufacturers of steel, aluminum, and lumber products continue to grapple with painfully high U.S. tariffs. However, we don’t anticipate their situation will deteriorate further. Most exporters of other products should continue shipping tariff-free, allowing exports to stabilize next year. A meaningful boost will arrive in the spring when a new electricity contract with New York begins delivery.

Domestically, lower interest rates and tax relief measures are fuelling activity in sectors less exposed to trade turbulence. Private capital investment is unlikely to rebound given the thick layer of uncertainty clouding business decisions, but increased public infrastructure spending will sustain solid non-residential investment. The housing market should continue its gradual recovery, spurring residential investment and related household spending.

Quebec’s job market turned a corner this fall, and we expect further improvement in 2026. We expect the unemployment rate to fall slightly to 5.4% in 2026 from the 5.6% projected in 2025. This should bolster consumer confidence and keep household spending on an upward trajectory.

Still, a new wildcard has emerged: Sharp immigration cuts. Quebec’s new 45,000 permanent resident target—down from more than 60,000 in 2025—will essentially halt population growth in the year ahead, materially restraining growth in consumer spending. This demographic shift will also ripple through population-driven activities like homebuilding. We project housing starts to decline from 59,500 units in 2025 to 52,800 units in 2026.

Overall, Quebec faces a year of modest expansion driven by domestic resilience, offsetting weakness in trade-exposed sectors and the drag from slower population growth.

New Brunswick – Domestic slowdown compounds U.S. trade weakness

New Brunswick’s relatively low direct exposure to U.S. tariffs is proving insufficient to offset broader economic deceleration.

Strong exports in the first half of 2025 and higher-than-expected housing starts have prompted an upgrade to our 2025 growth forecast to 1.5%. But our outlook for 2026 reflects softening conditions in the U.S. and at home, which will weigh on exports. Households will also be challenged by a sharp population slowdown. Accordingly, we’re maintaining our 2026 real GDP growth forecast at 1.2%.

While low exposure to U.S. tariffs has spared New Brunswick from the worst of trade tensions affecting other Canadian regions, provincial exports to the U.S. are still declining. Weakness has been concentrated in energy as U.S. demand softens. Recent tanker activity at Port of Saint John’s, however, points to a rebound in recent weeks, underpinning our forecast for natural resource growth into 2026.

Broader export weakness can also be seen in forestry and building materials, reflecting the slowdown in U.S. homebuilding—which is not being offset by domestic demand.

Indeed, housing starts are expected to drop from 7,000 in 2025 to 5,300 in 2026. This comes amid a stark slowdown in population growth, which supported above-average housing starts in 2024 and 2025.

Government spending will temper the construction slowdown—a bright spot for the economy. The province put forward a large capital plan this fall, boosting expenditures by 21% in fiscal 2026-27.

Prince Edward Island – Growth to moderate alongside population and public investment

We expect growth in Prince Edward Island to expand by 1.7% in 2026—ahead of the national average after years of stronger relative growth. Still, this marks a deceleration from the projected 2% advance in 2025.

Investment and demographics were major tailwinds for the province in recent years, but as expected, they have shown signs of waning. As a result, these drivers won’t contribute as much to growth in 2026.

Construction is expected to moderate in 2026 after being a major growth driver in recent years. Housing starts are projected to slow alongside population growth and home price gains. Provincial capital investment is also showing signs of easing with a planned 5% increase for fiscal 2026-27, significantly down from the 18% year-over-year increase put forward this fiscal year.

The impact of tariffs on the province has been limited so far. Exports of aircraft and transportation equipment have performed well with strong gains in the U.S. market leading the way. The seafood industry has also weathered Chinese tariffs through increased exports to Europe. Still, trade remains a risk for the outlook given uncertainty surrounding U.S. and Chinese tariff policies.

Tourism, however, provides some upside for the outlook. Both domestic and international arrivals have strengthened so far this year and could continue gaining momentum in 2026. Lower interest rates and improved per capita GDP are keeping consumer spending resilient, and could bode well for tourism next year amid strained U.S. relations.

Nova Scotia – Export diversification buffers from tariff impact

Nova Scotia’s economy is expected to slow in 2026 after a relatively stronger year in 2025. Real GDP growth is forecast to come in slightly ahead of the national average at 1.5% next year, reflecting its relative insulation from ongoing trade headwinds.

Tariff impacts have been less severe for Nova Scotia than other provinces. Though the U.S. is the largest trading partner, exports to the U.S. represent a fairly small share of GDP.

Headwinds, however, are still showing up at the industry-level. Manufacturing has softened—likely driven by slowing tire demand as the auto industry faces broader challenges.

Chinese tariffs on seafood products have also been less disruptive than feared. Seafood exports to China have tanked 34% year-to-date following the introduction of 25% tariffs in March, but export diversification has limited the damage on aggregate.

Increased demand from Europe is helping to offset steep declines in Chinese demand. Still, deteriorating trade relations with its two largest trading partners creates persistent uncertainty for the outlook.

The lumber industry is facing challenges amid a slowdown in homebuilding at home and in the U.S. as well. Housing starts likely peaked in 2025 as slower population growth limits household formation and demand for new units. We see this weighing on the construction industry, which has been a major source of provincial growth in 2024 and 2025.

The investment outlook on the non-residential side, however, is less clear. Trade uncertainty won’t bode well for business investment, but the province’s aggressive capital spending could sustain momentum. Future investment will become more transparent when the 2026-27 Capital Plan is tabled in the new year.

Federal defense spending announcements present an additional upside through public spending. Nova Scotia is home to Canada’s highest concentration of defense personnel which could see the province benefit from increased defense spending—including on wages for defense workers. This could provide a boost to household incomes and consumer spending when deployed.

Newfoundland & Labrador– Construction slowdown to constrain 2026 growth

We expect growth in Newfoundland and Labrador to moderate to 1.7% in 2026 from a projected 2.8% in 2025. New and expanded mining production will provide support, but moderating construction activity, and a weakening household sector are likely to constrain overall growth.

Oil production momentum has eased after a strong first half of 2025. The restart and ramp up of oil production at a number of offshore vessels boded well for the oil and gas industry at the beginning of this year, but this boost is now largely behind us. Output will likely continue rising in 2026, however, the year-over-year impact on GDP growth is expected to be smaller than 2025.

That said, the natural resources sector unlikely to be a large drag on growth either. Mineral production presents a brighter picture with first gold poured at Valentine Mine ahead of schedule this fall. The Voisey Bay mine expansion was also completed roughly a year ago with full ramp-up expected in the second half of 2026. We see this offsetting some of the stabilization in oil production next year. Construction presents the greatest challenge as major projects wind down with few new capital ventures in the pipeline. In addition to the new and expanded mines that recently reached completion, the $4 billion west arm extension of the White Rose project wrapped up construction at the end of 2025. First oil is expected in Q2 2026, supporting marginal production growth. Residential investment is also likely to soften too given moderating population growth.

Likewise, the household sector is unlikely to sustain recent strong momentum. Retail sales have outpaced the national average for two consecutive years, but slowing population growth is likely to temper this performance in 2026. Employment is on track to contract slightly this year, and remains close to zero in 2026. We see this constraining consumption as softening employment gains weigh on household income.

Detailed forecast tables:

About the Authors

Frances Donald is the Chief Economist at RBC and oversees a team of leading professionals, who deliver economic analyses and insights to inform RBC clients around the globe. Frances is a key expert on economic issues and is highly sought after by clients, government leaders, policy makers, and media in the U.S. and Canada.

Robert Hogue is an Assistant Chief Economist, responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

Rachel Battaglia is an economist at RBC. She is a member of the Macro and Regional Analysis Group, providing analysis for the provincial macroeconomic outlook.

Salim Zanzana is an economist at RBC. He focuses on emerging macroeconomic issues, ranging from trends in the labour market to shifts in the longer-term structural growth of Canada and other global economies.

Download the Report

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.