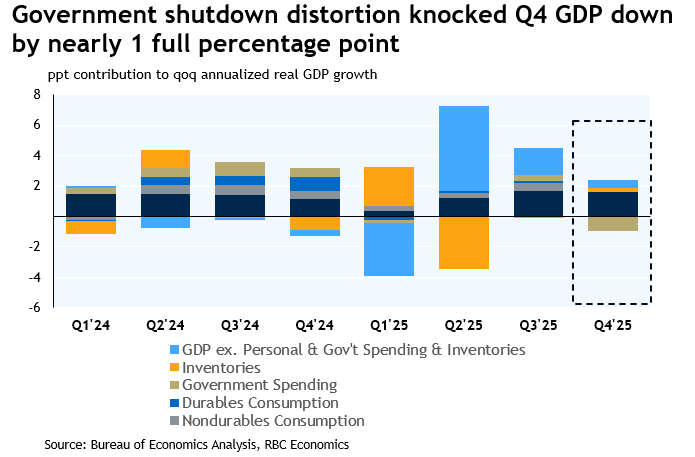

The Q4 GDP Advance was a prime example of data distortions obscuring the bigger picture. Headline growth came in significantly below expectations at +1.4% q/q annualized but this was largely a result of the government shutdown. The shutdown subtracted nearly a full percentage point from headline growth, meaning absent the disruption, the US economy would still be growing above its potential.

With this in mind, we are turning our attention to the final sales to private domestic purchasers (FSDP) measure, which strips out more volatile measure including inventories and government spending from broader GDP. This gives us a better snapshot of the health of the US economy and at +2.4% q/q in Q4 (vs. +2.9% q/q in Q3), it tells us that the underlying momentum in the US economy is robust.

Under the surface, here’s what stood out in this morning’s GDP Advance:

-

Consumers continue to be the primary driver of US growth, with continued strength in services spending adding 1.6 percentage points to headline growth. This reflects the K-shape story of high income and wealthy consumers driving the bulk of consumption.

-

Conversely, goods spending signaled to us that tariff front-running exhausted Americans’ need to accumulate physical goods after purchases had been pulled forward to the first half of the year. Spending on durables outright declined (-0.9%) in Q4. Meanwhile non-durables growth was tepid (+0.4%).

-

Government spending growth slowed -5.1% in Q4, reflective of a drag from the government shutdown. BEA estimates that the reduction in services provided by the federal government subtracted about 1 percentage point from real GDP growth in the fourth quarter.

-

Business investment added substantially (+ 0.5 percentage point) to headline growth, and intellectual property was the majority of this. This acceleration in investment spending is illustrative of the broader AI story and we expect will remain a bright spot in 2026.

-

Trade, once again, was of little help to growth (adding +0.1 to headline) as both imports and exports were weaker in Q4.

-

Interestingly, Q4 marked a third consecutive quarter of inventory drawdowns. As we have highlighted, this is highly unusual outside of recessions and continues to be reflective of pre-tariff inventory ramp up that has helped businesses delay passing on higher prices to consumers.

About the Authors

Mike Reid is Head of U.S. Economics at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior US Economist at RBC Capital Markets. Carrie is responsible for projecting key US indicators including GDP, employment, consumer spending and inflation for the US. She also contributes to commentary surrounding the US economic backdrop which she delivers to clients through publications, presentations, and the media.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.