This week we got a better picture of both sides of the Fed’s mandate from labor market and CPI data. These data points further solidified our view that the Fed will remain on pause for the foreseeable future. A downshift in the unemployment rate to 4.3% alongside strong job gains suggests that additional interest rate cuts are not imminently needed to support the US labor market. And although core inflation – at +0.3% m/m – was one of the lower core January prints in a post-Covid economy, we continue to see tariff pass-through contributing to sticky inflation throughout 2026.

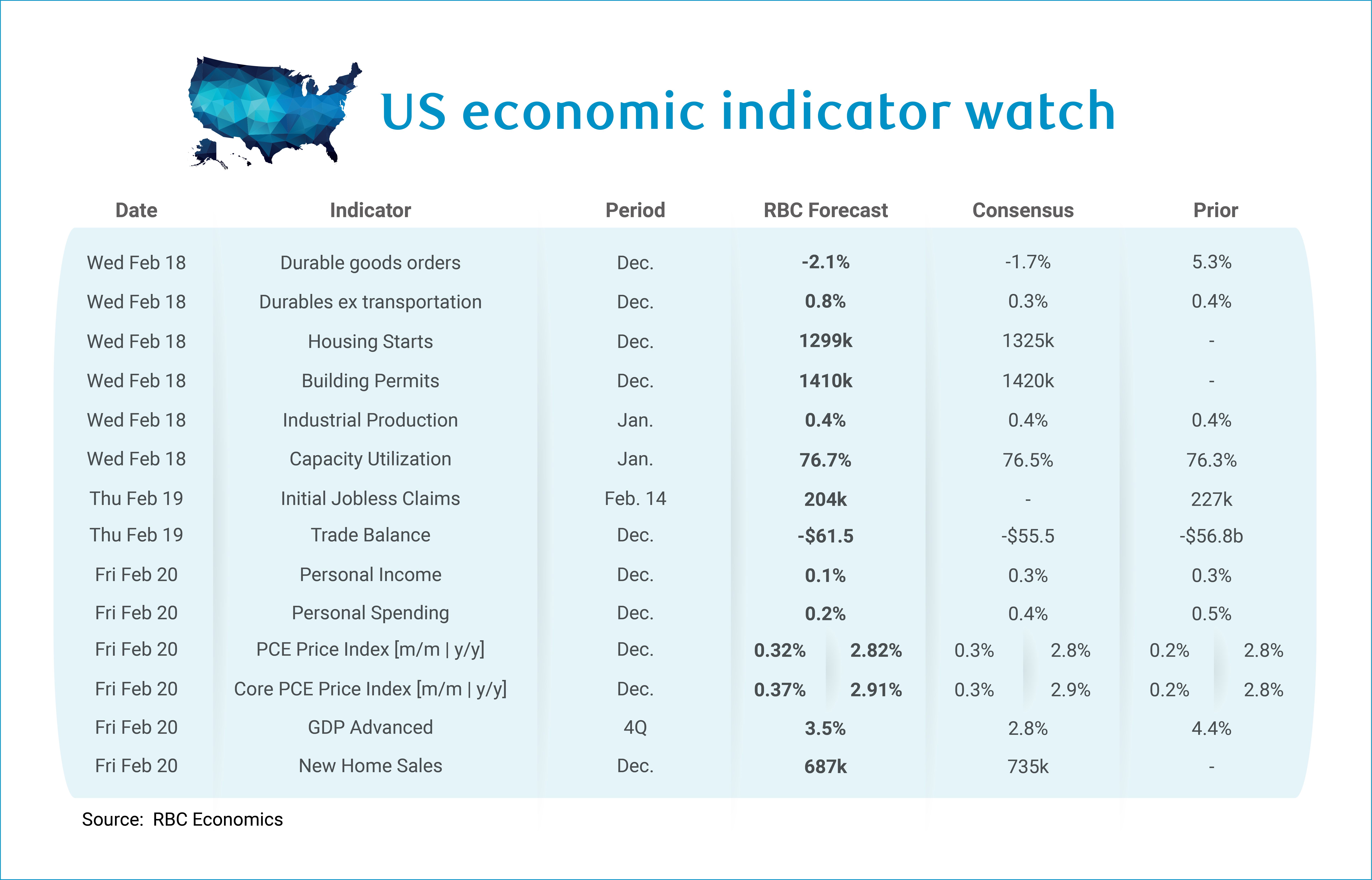

Next week we will get a snapshot of how the US economy fared at the end of 2025 and we expect to see it ended on solid footing. Our forecast calls for Q4 GDP growth of 3.5%, a slight downshift from Q3 but still well-above the typical 2%. The growth driver remains a story of high-income consumer strength, but it is important to acknowledge that the momentum in Q4 was concentrated in October and November. Retail sales activity in December was entirely flat with declines across most categories, which will look worse in real terms. This means that after adjusting for inflation, goods sales outright declined in December. This should be unsurprising – a pullback in wages could be the culprit as aggregate hours worked fell in December. With this in mind, we expect that next week’s personal spending data will report a more muted pace (+0.2% m/m) of consumption in December given limited personal income growth (+0.1% m/m).

We do expect a third consecutive quarterly drawdown of inventories will subtract from GDP growth. It is exceptionally rare to see this trend unfold outside of a recession. We are in this especially unique situation as a result of a massive surge in inventories in Q1, a direct result of tariff front-running. The influx of inventories in Q1 allowed businesses to stave off tariff passthrough to consumers in the short-term as goods sold out of inventory were not subject to tariffs. However, we do expect pre-tariff inventories will soon be depleted so the upshot is that we can expect to see a rebuilding of inventories in the coming quarters. But it will be done at post-tariff prices which will have ramifications for inflation’s path – ultimately forcing firms to raise prices for consumers to preserve margins (or else cut jobs).

We will be closely watching next week’s inflation data as the Fed’s preferred measure (PCE) will give us a clearer picture of where pressures are emerging. Uniquely, we are operating in an environment where data quirks related to the housing component of the CPI basket have driven CPI lower than PCE, since shelter carries relatively less weight in PCE. Considering this, we expect a hotter December PCE print than CPI. We expect to see core PCE rise 0.4% m/m in December, which will nudge the year-over-year pace of price growth higher to 2.9%. Headline is expected to rise +0.3% leaving the year-over-year pace steady at 2.8%.

Here’s what else we’re watching next week:

-

We anticipate a weaker durable goods print mid-week (-2.1%) but this is reflective of weaker Boeing aircraft orders relative to a November surge.Excluding transportation, we expect to see durable goods orders tick up by a sizeable +0.8%.

-

Industrial production is likely to continue to tick up by a meaningful +0.4% in January as manufacturing hours worked ramped up and the ISM manufacturing index moved into expansionary territory. This would nudge capacity utilization higher to 76.7%.

-

Our forecast calls for the trade deficit to worsen slightly to $61.5 billion, and this is aligned with our view that firms, having run-down pre-tariff inventories, will likely have to ramp up imports in the near-term.

-

We will also get more color on the US housing picture after an abysmal January decline in existing home sales. We expect, similarly, to see softness in new home sales and building permits and housing starts data are expected to continue to reflect the continuing story of limited demand in an environment of sticky long-end rates.

Mike Reid is Head of U.S. Economics at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior US Economist at RBC Capital Markets. Carrie is responsible for projecting key US indicators including GDP, employment, consumer spending and inflation for the US. She also contributes to commentary surrounding the US economic backdrop which she delivers to clients through publications, presentations, and the media.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.