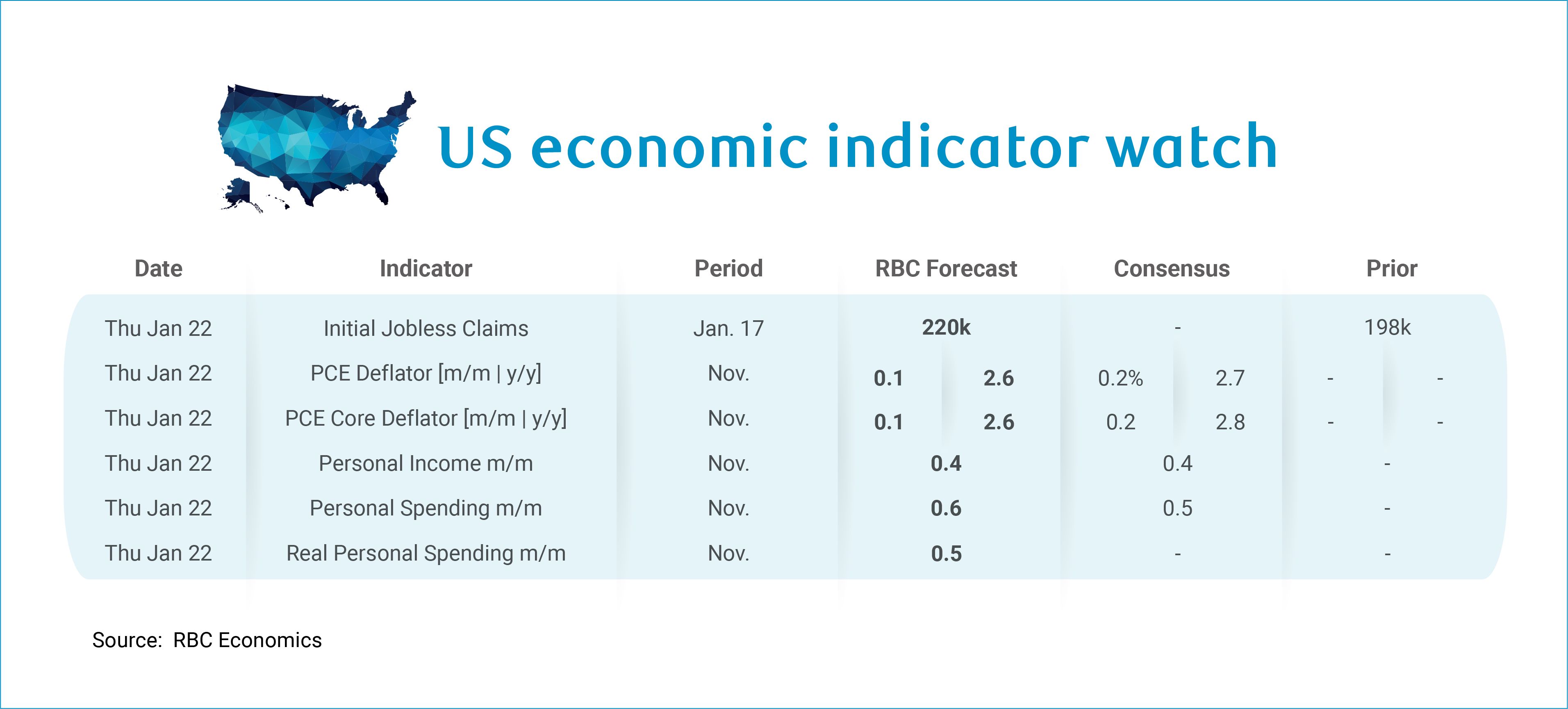

Next week we continue to play catch up with the release of the November personal income and spending report. Fortunately, with some November data already in hand, we do not expect any surprises. We look for both the headline and core PCE deflators to show a modest 0.1% m/m rise, in line with the November CPI data. The surprise in the November report was driven largely by a slowdown in housing, which carries a greater weight in the CPI basket. Still, in PCE, the weighting is skewed higher for medical care services – and the November inputs from the November PPI report show modest rises across most medical services. This means we should see a PCE print that mirrors CPI and if we do, we expect the y/y pace for both PCE and core PCE will slow to 2.6%.

We also get personal income and spending data for both October and November. There, we expect to see strong spending momentum continue, which has been reflected in the retail sales reports – the control group (which feeds directly into GDP estimates for consumption) saw strong growth in both October (+0.6% m/m) and November (+0.4% m/m). On the services front, growth has been very strong in 2025, as real services spending has accelerated since January. Given that retail sales are reflective primarily of goods spending, the upside surprise suggests personal spending is on track for a 0.6% m/m gain in November. For October, we expect a slightly softer reading (+0.2% m/m). Still, we think some of the spending momentum is coming at the expense of savings, which has dipped to 4.0% in September from 5.1% in January. We do suspect the savings decline is partly due to back to school and holiday spending coming at a time when tariff worries were top of mind – and could reflect a pull forward of consumption. We’ll be watching to see how consumers feel in January, when the seasonal noise dissipates. For now, consumer spending is on track to maintain strong GDP growth in Q4.

About the Authors

Mike Reid is Director, Head of U.S. Economic Research at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior Economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.