For the week of October 6th, 2025

Labour and trade reports critical for BoC’s next rate decision

Canadian labour market and international trade reports will be closely watched ahead of the Bank of Canada’s next interest rate decision on Oct. 29 after last month’s cut.

The BoC made the move in September following a deterioration in the labour market over the summer, and highlighted the evolution of exports as a key indicator for considering the need for additional cuts, given uncertainty about the impact of U.S. tariff policy.

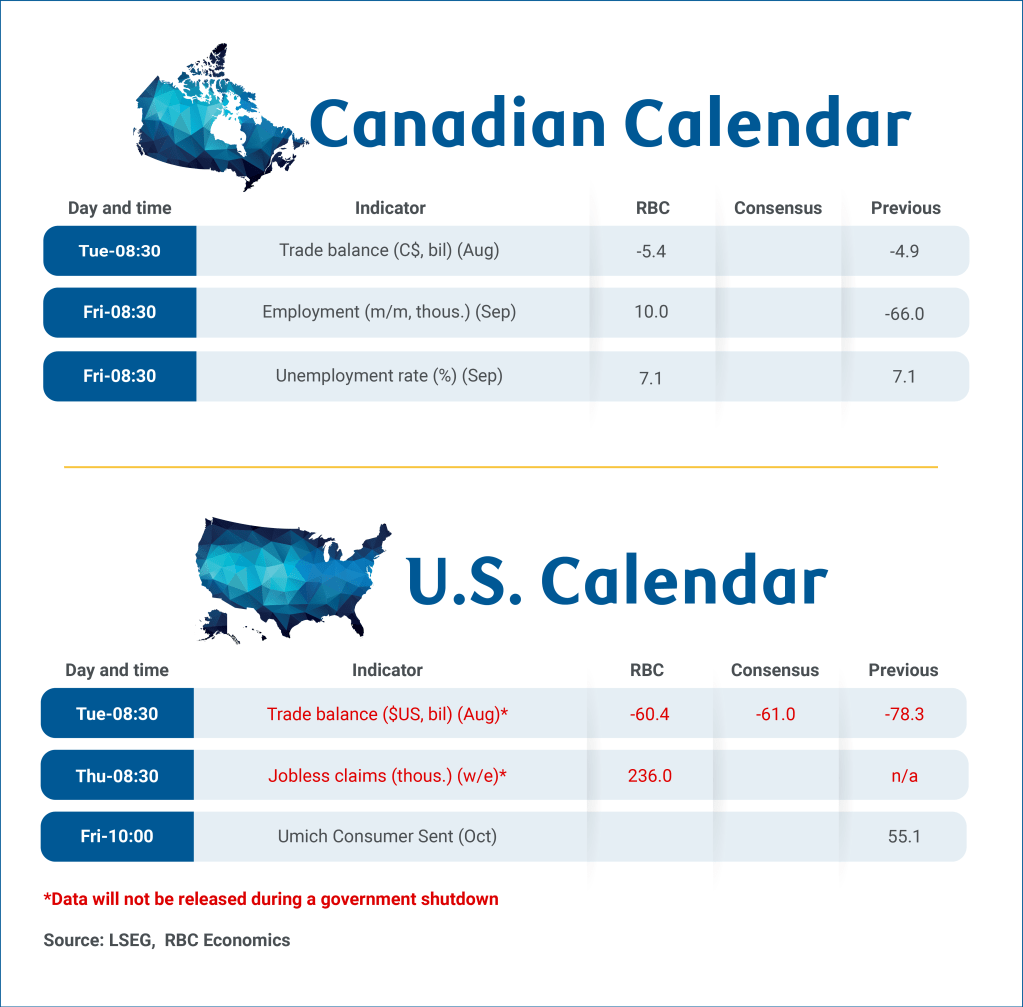

We expect labour market data to show signs of stabilizing in September with 10,000 jobs added, which would leave the unemployment rate unchanged at 7.1%. The labour market weakened significantly through July and August, but early data on hiring demand (indeed.com job openings), and business confidence are not pointing to more significant deterioration.

Beyond the headline, heavily trade exposed sectors, particularly manufacturing, are expected to remain under pressure. The numbers will be analyzed for further signs that weakness is (or not) spreading more broadly across the economy. As of August this year, Canadian employment is down 25,000 in the manufacturing sector, but still up 38,000 overall (and up 1% from a year ago).

The composition of jobs also matters. Any rebound that leans on part-time work would provide less reassurance about underlying strength in the market compared to gains in full-time positions. The increase in employment as of August this year is entirely a result of growth in part-time positions. Hours worked will also be in focus as a key signal for Q3 gross domestic product momentum.

Canada’s trade data to be released despite U.S. government shutdown

Meanwhile, tracking exports could become more difficult if the U.S. government shutdown continues to drag on. Statistics Canada relies on import data from the U.S. Census Bureau to create Canadian export estimates, and that will not be provided by the U.S. agency as long as the shutdown lasts.

For now, our understanding is the data for Canadian trade in August had already been collected, and will be released as scheduled on Tuesday. We expect the Canadian trade deficit to widen slightly to $5.4 billion, although in large part due to a 4.8% pullback in energy prices.

Other important detailed data from U.S. sources, for example, tariff revenues collected by country and product, will not be available until the U.S. Census Bureau is back on the job.

Week ahead data watch:

-

U.S. trade deficit likely narrowed to $60.4 billion, down from $78.3 billion in the previous month. According to the U.S. advance trade report for August, goods imports fell by 7%, fully reversing July’s gain, largely due to pullbacks in industrial supplies. Exports also declined, but to a lesser extent, dropping by 1.3%.

This report was authored by Assistant Chief Economist Nathan Janzen and Economist Abbey Xu.

Explore the latest from RBC Economics:

-

Canada’s population growth slows even as outflows fall increasingly short of targets

-

Podcast: The 10-Minute Take. International trade 101—the Canadian edition

-

Q2 Canadian household net worth rises again despite economic uncertainties

-

Housing Affordability. Easing homeownership costs could soon slow in Canada

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.