➔ Meet Coalie, the hard-hatted American mascot

➔ Ottawa’s auto strategy comes with a climate-action twist

➔ What should be the North Star for Canada’s proposed national electricity strategy?

Hot takes

➔ Canadian companies aren’t waiting for Ottawa’s signal to advance the U.S.’s mineral ambition. While the federal government is holding off signing any formal deals with Washington on critical minerals, Toronto-based Cyclic Material is investing a strategic US$82 million in a rare-earth recycling facility in South Carolina, after securing new funding from the Canada Growth Fund, among other investors. It’s a trend: Vancouver-based Lithium Americas is building a massive project in Nevada, while Trilogy Metals is developing a copper-zinc-gold district in Alaska—with the U.S. government taking the unprecedented step of buying small stakes in both recently. North America’s market and geographical gravitational pull would hopefully overcome political posturing.

➔ Climate Adaptation and Resilience (CA&R) could be the next frontier in climate investing. RBC Capital Markets’ report Private Markets Innovation in Climate Adaptation and Resilience highlights five areas where capital could make a difference: earth data, insurance solutions for businesses and society, wildfire and the grid, water, and the built environment. CA&R secured only US$65 billion in capital flows in 2023, compared to US$1.8 trillion in traditional mitigation investments such as renewables and energy storage. Climate Action Institute’s Clean Tech Lead Vivan Sorab believes while mitigation efforts’ address both current and long-term trends in emissions, their immediate impact tends to be muted; CA&R investment can potentially deliver more visible and quicker results in the form of less downtime and assets protected. The insurance costs are already mounting: 34 extreme-weather events triggered insured losses of US$1 billion or more in 2024—the second-highest number on record.

➔ “Coalie,” the hard-hatted American mascot, may struggle to revive coal This carbon-intensive lump is getting a makeover for the AI meme era as the U.S. government promotes coal as vital for the economy. Despite its critics, coal saw a resurgence last year: U.S. coal-fired electricity jumped 13% year-on-year in 2025, while natural gas—which is about 50% less emission-intensive than coal—fell 3.6%, according to the International Energy Agency’s latest electricity outlook. However, coal’s dominance is slipping elsewhere in what the IEA describes as an “uncharacteristic” shift: major consumers China and India saw a drop in coal power generation in 2025 for the first time in more than five decades. While coal is projected to remain the single largest source of global electricity through 2030, the IEA predicts declining consumption in China and the European Union. Even the U.S. is expected to see a drop in coal consumption by 2030, Coalie’s charms notwithstanding.

EV spring comes after winter

– By Farhad Panahov, Economist, RBC Climate Action Institute

Canada’s new strategy to boost EV sales has a twist: a cap of $50,000 for the total transaction value to be eligible for a subsidy. A more stringent rule—to boost mass market models—compared to a previous program that allowed purchases of more expensive trims.

Average price Canadians paid last year for a new vehicle was $55,000, and nearly $70,000 for an EV. And while each $1,000 could add 11% to the EV demand, based on Canadian Climate Institute’s analysis, only 13 of the 163 battery-electric models available in Canada are priced below that level, according to the Canadian Automobile Association. Another 10, priced at around $55,000, are potential candidates to be marked down to claim the subsidy.

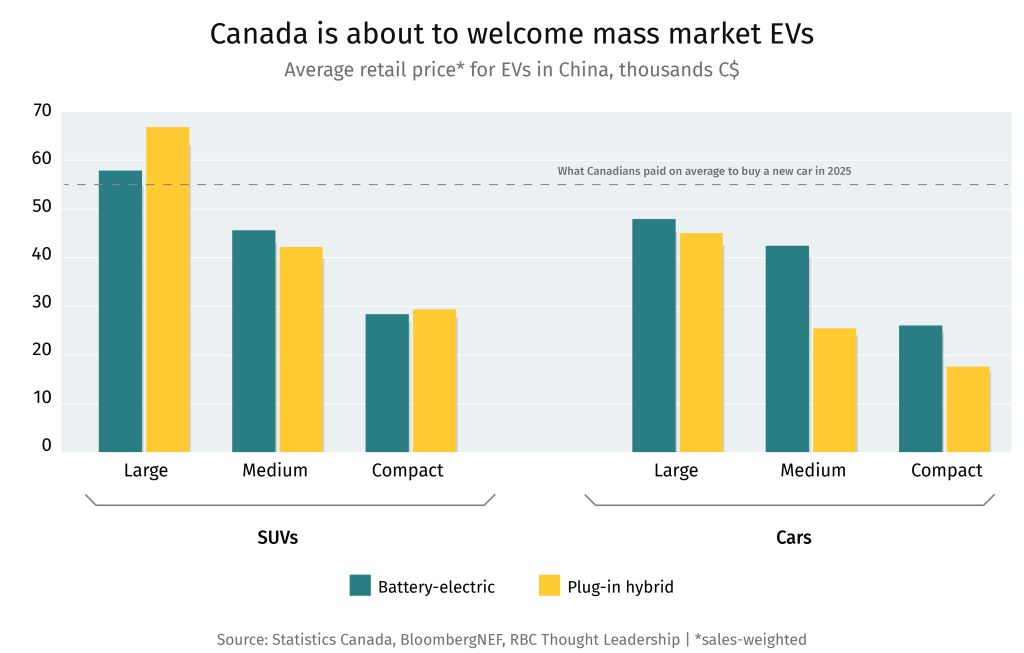

Meanwhile, the 49,000-quota for Chinese EVs, should add further impetus to vehicle transition. Crucially, while these vehicles are excluded from the incentive program, they could enter the market at the lower end of the price range, as models like BYD and Geely made up about a quarter of global EV sales last year, are sold for $35,000 in China—roughly half of what Canadians paid for EVs in 2025.

But North America is notoriously in love with large cars, such as trucks and SUVs, a segment where Chinese EVs might not have the same price leverage. And don’t forget the 6.1% Canadian tariff that still applies on Chinese cars, plus shipping costs. Chinese EVs, facing less intense competition than at home, could also seek higher markups for their models in Canada.

The success of the Canadian strategy could rest as much on consumer trust as it does on the final price tag. Nearly half of Canadians are still not in the EV camp based on recent poll from Clean Energy Canada; and only one in 10 would buy a Chinese EV with another two in the “maybe” mindset.

The previous federal program of $2.7 billion helped put about half a million EVs on Canadian roads. The fresh round of subsidies, with a lower $2.3-billion allocation, could add 840,000 new EVs, the government projects.

The new auto strategy could help transport—a stalwart sector for emission cuts over the past five years (see our Climate Action report)—deliver the following in climate action:

-

EV mandates out, standards in. Abolishing the much contested EV sales mandates in favour of emissions standards will aim to achieve 75% EV sales share by 2035.

-

Emissions standards. Emissions standard are a common practice for automakers and allows for higher compliance flexibility compared to sales mandate while still incentivizing a pivot towards emissions-free vehicles. Since 2011 alone, emissions per mile from passenger cars and light trucks have declined 50% and 30%, respectively.

-

U.S.-Canada policy is diverging. Historically, Canada aligned its emissions standards with the U.S. It’s different now as Canadian policy diverges from the U.S. Environmental Protection Agency (EPA) push to roll-back Biden-era standards (that would have halved emissions per mile by 2032).

-

…As is Detroit 3’s strategy. The auto policy supports another $3 billion investment in the EV sector “positioning Canada as a place where the vehicles of the future are built.” However, the Detroit Three—Ford Motors, General Motors and Stellantis—are scaling back EV roll-out plans that has cost them around US$50 billion, amid tepid customer demand.

-

Networks are getting a supercharge. Ottawa is committing $1.5 billion to expand the charging network, adding to the $1.1 billion in funding, which so far has helped add 7,000 installations. Canada’s public charging network is already sufficient for current levels of EV adoption, at ratio of ~21 EVs per charging port, but will need to significantly expand as adoption accelerates.

Also check out: RBC’s Electric Car Cost Calculator

Climate Conversations

A scan of notables and notable developments

-

Lisa Ashton, Interim Head of the institute, is in Ottawa for Agriculture Day festivities, a timely opportunity to share insights from Seeding Scale, our new research on the growth capital pipeline in the agri-food sector. Lisa heard that the innovation pipeline needs focused improvements as well and universities and industry are working collaboratively to devise a clear vision for the sector ahead of the agriculture ministers meeting in July.

-

As the U.S. convened allies, including Canada, on critical minerals last week, John Stackhouse shared a few thoughts. His first point: even the U.S. knows it can’t go-it alone on mining.

-

Canadian Climate Institute’s Rick Smith finds another climate angle on a recent Canadian court ruling that reinforced Ottawa’s right to list plastics as “toxic”: “…polluting industries and some provinces have been spinning a yarn that the federal government’s Clean Electricity Regulations, also enacted under CEPA, are an illegal over-reach. As of today, those arguments look like the thinnest of gruel.” Read the ruling.

-

As Canada develops a national electricity strategy, Polaris Strategy’s Dan Woynillowicz has some thoughts on what the strategy should set as its North Star: Double energy productivity, double production, and double the share of final energy demand met by clean electricity.

-

Nugget from a House of Commons report on climate change, from Janis Sarra of the Canada Climate Law Initiative, on the importance of Canadian taxonomy: “An estimated $115 billion annually is required for Canada’s low-carbon transition, and a science-based taxonomy will create the market integrity, clarity and interoperability, globally, necessary to accelerate global capital to come and invest in Canada’s businesses.”

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Sarah Pendrith, Jordan Brennan, John Intini, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Lavanya Kaleeswaran.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.