In this week’s edition: The challenges that lie ahead now that CUSMA consultations have kicked off and what a redrawing of the critical minerals map would mean for Canada

The challenges that lie ahead

By John Stackhouse

Mark Carney’s Mexican charm offensive—and successful visit with Claudia Sheinbaum—may soon seem like a happy vacation memory. The two countries return this weekend to harsher realities, especially in their shared as well as separate relationships with the United States. Here’s how it could play out:

-

The Trump administration has triggered a review of the Canada-U.S.-Mexico trade agreement, by launching public consultations. Canada is expected do the same this weekend, opening the door for 45 days of lobbying, teeth-gnashing and perhaps genuine reflection.

-

Expect the three amigos (2 amigos + 1 amiga) to then amass small armies of trade and industry experts to begin the more formal dialogue. The Canadian government is already recruiting people to speak with their American and Mexican counterparts, especially in energy, autos, steel, aluminum and lumber. They’re a little worried the Americans won’t show up anywhere near as well prepared and may even push for a quick (and perhaps flawed) deal.

-

Mexico has taken a different tact, working with U.S. Secretary of State Marco Rubio on a range of non-trade issues like curtailing drug cartels. They’re hoping that will gain goodwill for the next round of trade talks, which for Mexico are not shaping up well. The U.S. has effectively banned hothouse tomatoes and is clamping down on remittances—all signalling tough times ahead for Mexico.

-

The biggest issue for Mexico will be “rules of origin,” i.e. how to reverse the massive increase of Chinese investment and trade that turned Mexico into a side door to the U.S. market.

-

For Canada, early signals suggest Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer want to protect the foundation of a trilateral trade agreement, with special interest in Canada and enhancing two-way trade. Side agreements or subordinate deals under a North American umbrella could evolve.

-

For Canada, the biggest existential concern remains autos, and Trump’s apparent desire to move as much Canadian production to U.S. soil. We’ll see if the American industry can persuade him of the economic logic of cross-border production.

-

Would Canada accept a “market access” tariff of, say, 10% to secure some kind of second life for Canadian factories?

-

Beyond autos, U.S. concerns continue to focus on dairy and digital. We all know the dairy challenge. On digital, U.S. tech platforms continue to complain about Canada’s treatment of online news. And yet, having compromised on a digital sales tax, the Carney government will be challenged to give again, especially since any concession would likely hurt struggling media and publishers.

-

For the U.S., the biggest challenge may be more political. Does Trump push for a quick win on CUSMA? And then focus on the bigger challenges of China, India and Brazil? Or does his team work on deep and lasting changes to CUSMA, aiming to present a win ahead of next year’s midterm elections?

-

Worth noting: Trump’s closest friends continue to suggest he’s open to tearing up CUSMA. Maybe bluster. Maybe leverage. But as the hard work begins, expect some hard challenges to continue to pop up.

The week that was

-

Speaking at a Halifax Chamber of Commerce event, U.S. Ambassador Pete Hoekstra said he is disappointed by the “anti-American, elbows up” rhetoric from Canadians.

-

U.S. and Chinese officials gathered in Madrid for their fourth round of talks—to talk about TikTok.

-

In 2024, China imported US$12.6 billion worth of soybeans from the U.S. Last week: 0. A clear indicator that Beijing isn’t afraid to use agriculture as leverage with Washington.

-

Trained on 25 years of shopping data, Amazon is releasing a retooled AI agent to assist sellers with inventory decisions to manage the increased volatility caused by the trade war.

Redrawing the critical minerals map

By Shaz Merwat, Energy Policy Lead

A pair of U.S. senators introduced the Restoring American Mineral Security (RAMS) Act, a bipartisan Senate Bill that would establish a Critical Minerals Security Alliance, granting duty-free access among trusted partners and require allies to match U.S. tariffs on Chinese supply.

Here are three implications for Canada:

-

Alliance membership comes with obligations. Canada would need to mirror U.S. tariff levels on Chinese minerals and strengthen enforcement against Chinese supply/transshipment. Heading into formal CUSMA renegotiations, the U.S. is looking again to allies to close the Chinese back door (note: Mexico increased tariff rates on a number of Chinese goods). Specific to minerals, shutting out Chinese supply is crucial for industry to scale. RAMS makes that firewall a requirement.

-

Capital will follow the club. Perhaps the most novel element is the U.S. plan to recycle tariff revenues from non-alliance imports into allied projects–20% specifically to support international critical mineral projects in member nations. Still, given our close minerals trade relationship (we are each other’s #1 minerals trade partner), Canada directionally wins from reinvestment in U.S. mineral projects. That could provide ‘cheap’ capital to Canadian miners—historically an obstacle for junior miners.

-

Preferential access is only useful if we scale. Duty-free treatment would give Canadian producers a cost edge into the U.S. market. But without faster project approvals and similar investments in accompanying transport infrastructure, we lose our advantage. It’s worth noting that there are two minerals projects in the first tranche of Prime Minister Mark Carney’s fast-tracked Major Projects list: McIlvenna Bay (copper and zinc) and the Red Chris mine expansion (copper).

Bottom line

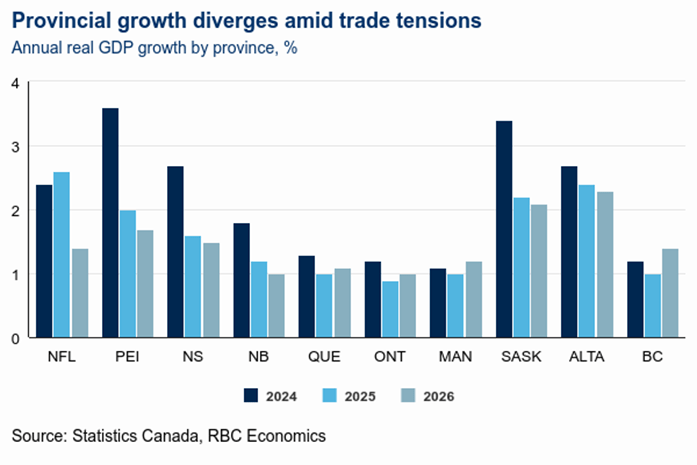

While Canada faces a national shock from its trade relationship with the United States, the provinces are facing differentiated trade shocks that are creating divergences in both growth and growth drivers, according to RBC Economics. Read the full report – Quarterly Canadian outlook: Low but positive growth ahead – RBC

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.