Markets are still digesting a complicated Fed meeting that took all the focus from the (relatively better) economic data this week. Retail sales held up at a healthy pace even after adjusting for inflation. Our core takeaways remain:

-

One rate cut (or two or three!) will do very little to support what currently ails the US economy. Trade shocks, labor shortages, and geopolitical risks will prevail regardless of Fed policy.

-

This week’s “risk management cut” reset expectations – the Fed is clearly indicating which side of the dual-mandate will bear more weight when both sides are in tension – and labor is the clear winner. This may be a simple takeaway, but it is a powerful one.

While the economic data may have created space for a cut in September – and it’s likely that the Fed wants to continue with cuts ahead – we expect that the economic data will become more challenging in the coming months, particularly on the inflation front.

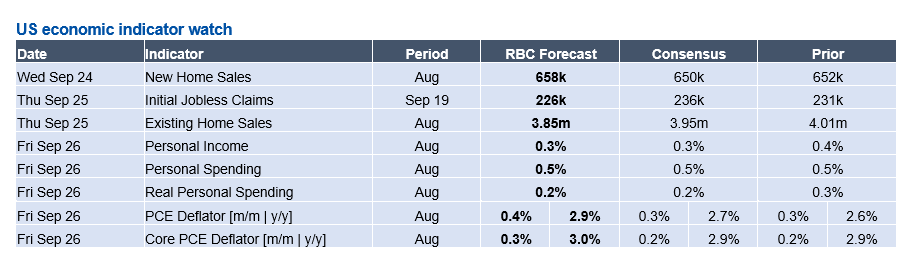

With the Fed temporarily in the rear view mirror, next week offers new PCE data on Friday. Much of the focus will be on the inflation metric in this release – and we expect core PCE to heat up slightly to +0.3% m/m – but we will be looking closely for inflation on the consumer expenditure side.

Heading into the release, we have three key questions:

1) Are consumers losing momentum?

This past week’s retail sales data suggested that while real retail sales (adjusted for inflation) have moderated – the pace of growth remains at a healthy clip, for now. We expect real personal spending posted +0.2% m/m growth in August. But once we start to see a meaningful passthrough of tariffs to consumer prices (or partial business absorption of tariff costs translating to job losses to preserve margins), consumer purchasing power is expected to weaken later this year and into 2026.

2) Is there a goods vs. services substitution playing out?

During the post-pandemic spending boom, consumers substituted discretionary goods sector spending for services. As inflationary pressures accelerate and purchasing power erodes, consumers facing tradeoffs must opt to pare back in either goods or services spending (or ramp up savings). Interestingly, in the first half of the year, we have seen a notable deceleration in services growth in favor of goods-sector spending. We know this was likely reflective of tariff front-running. The question remains – will the pendulum swing back to services once tariffs bite? Or will services growth become collateral damage?

3) Are incomes still being propped up meaningfully by government transfers?

We expect to continue to see personal income supported by government transfers including social security and Medicare payments thanks to a surge in retirements. We have personal income +0.3% m/m in August , as wages and salaries continue to grow above pre-pandemic trend driven by structural labor shortages. Still, wage and salary income is expected to grow at a slower clip than dividend income – as non-labor income (dividends and rental income, for example) have gained a notable share of personal income, a means of wealth generation only accessible to higher income and wealthy US households, further proliferating the fragmentation that has evolved in the US in recent years in a K-Shaped economy.

Also top of mind next week:

-

Initial Jobless Claims will likely come in at 226k for the week of September 19th after we saw a notable moderation after an upside-surprise in early September. The massive upside two weeks ago was largely concentrated in Texas and was most likely a seasonal quirk. We do not expect this to be repeated.

-

New and Existing Home Sales both land next week and will continue point to a lackluster housing market as long-end rates continue to stifle activity. This week, we saw single-family housing starts and permit issuance tumble – there is a low probability for a housing market reinvigoration in the months to come as short end rates will do little to move long-end yields.

About the Authors

Frances Donald is the Chief Economist at RBC and oversees a team of leading professionals, who deliver economic analyses and insights to inform RBC clients around the globe. Frances is a key expert on economic issues and is highly sought after by clients, government leaders, policy makers, and media in the U.S. and Canada.

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.