As was widely expected, the FOMC went ahead with a 25 basis-point cut in today’s meeting. But this meeting wasn’t about a cut (or two). It felt more like a reset of expectations for what the Fed sees ahead and how they will navigate this ongoing uncertainty surrounding their dual mandate. Powell expressed this as a reset of risk management for the Fed following notable downward revisions to payroll data seen over the past few months that painted a much weaker picture of the labor market. This aligns with our view that the Fed will sympathize with weakness in the labor market over the still-above-target inflation…for now.

How much is 25bps going to impact the U.S. economy?

We don’t expect today’s rate cut to have a meaningful impact on the U.S. economy. That’s in part because the Fed simply met market expectations, which have already priced in today’s cut and four more. For lower market-rates, the Fed will have to ease beyond current expectations. We also continue to emphasize that the challenges facing the U.S. economy are not as interest rate sensitive as they have been in past cycles: monetary policy can take some pressure off the economy but labor shortages, trade shocks and global geopolitical risks will persist regardless of Fed policy. Indeed, we continue to see fiscal policy as being an increasingly important driver, especially relative to monetary policy, of this cycle.

That said, for now, this cut (and any additional cuts) might help the low- and middle-income households facing mounting debt costs and with it, ease some of the divergence in economic circumstances between that group and high-income Americans (although equity market gains off of Fed easing further add wealth support to the upper-shape of his “K-shaped” economy). But longer-terms headwinds will persist, and it remains uncertain which side of the mandate will become a more serious issue for the Fed. As Powell noted “We’ve seen much more challenging economic times but from a policy standpoint, the stand point of what we’re trying to accomplish, it’s challenging to know what to do. There are, as I mentioned earlier, there are no risk free paths now.”

For now, we know what side of “Stagflation” Lite the Fed is biased towards

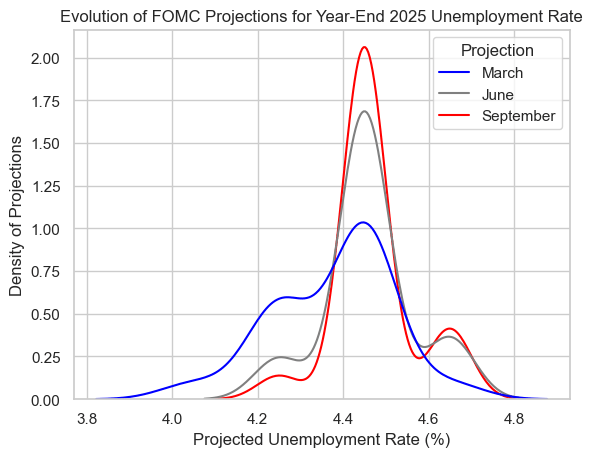

At the heart of the Fed’s challenge: stagflationary dynamics pull the central banks’ mandate of full employment and price stability in opposite directions. Powell framed the Fed’s cut in terms of a shift in terms of relative risks to their mandate: “look at the revised job creation numbers for May, June, July and August… So, what that means is that the risks which, the risks were clearly tilted toward inflation, I would say they’re moving toward equality.” From our perspective, it’s certainly clear that job creation has slowed. But it’s also worth continuing to emphasize that the unemployment rate remains historically low at 4.3%, and the rest of the economy has remained mostly resilient – notably the consumer continues to spend despite headwinds and GDP growth remains positive, albeit slightly below trend. Meanwhile, inflation has been running above its 2% target for over four years and there are clear upside risks heading into year-end for prices. The Fed, however, is triaging nascent weakness in the labor market over the still-above-target inflation. That may be a simple takeaway, but it’s a powerful one.

The data now is giving them the ability to cut; we expect the path to further cuts will be harder ahead

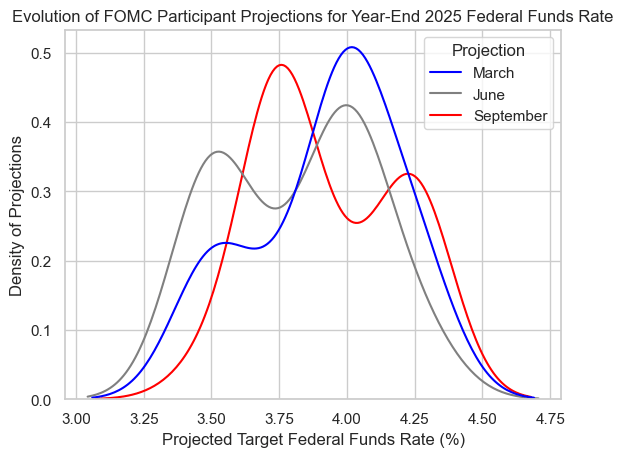

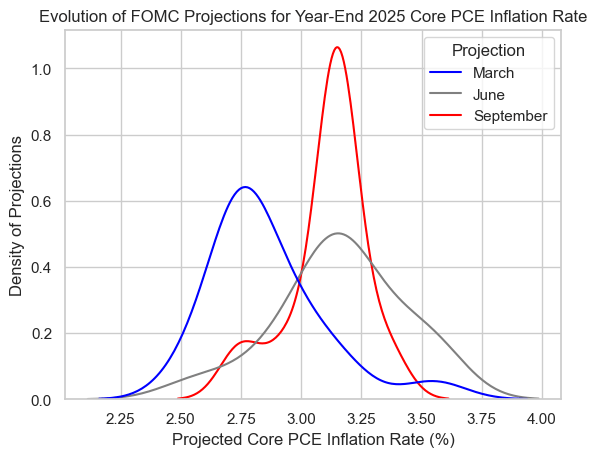

We expect the biggest challenge going forward will be inflation and the uncertainty surrounding the pass-through of tariffs to consumers. Even before accounting for the impacts of tariffs, we expect to see inflation accelerating into year-end off the back of (i) goods prices rising (ii) services prices remaining sticky viz a viz wages and (iii) a floor under housing prices. Before the next meeting, we expect the September CPI data will continue to show early signs of tariff pressures building, but we likely will not see material passthrough until we get closer to the December meeting, at which point, we expect core CPI to have reached 3.4%. We think the Fed’s preferred measure (core PCE) will be telling the same story. That’s going to make a full-blown easing cycle more difficult but not impossible.

We saw a large dispersion in the 2026 dot plot – with significant uncertainty surrounding timing and magnitude of tariff passthrough to prices and the extent to which this weighs on growth. And while the weaker labor market data is currently giving the FOMC an opening to cut, we expect that justification will become more difficult in the months ahead.

About the Author

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.