Easing uncertainty to get recovery back on track

Canada’s housing market has faced significant challenges this year. A trade war disrupted what had been an early recovery in demand for existing homes, driving transactions to cyclical lows this spring and pushing down property values, particularly in Ontario and British Columbia.

Our January outlook anticipated that interest rate cuts would spur activity and push prices slightly higher in 2025. However, market conditions have been weaker than expected.

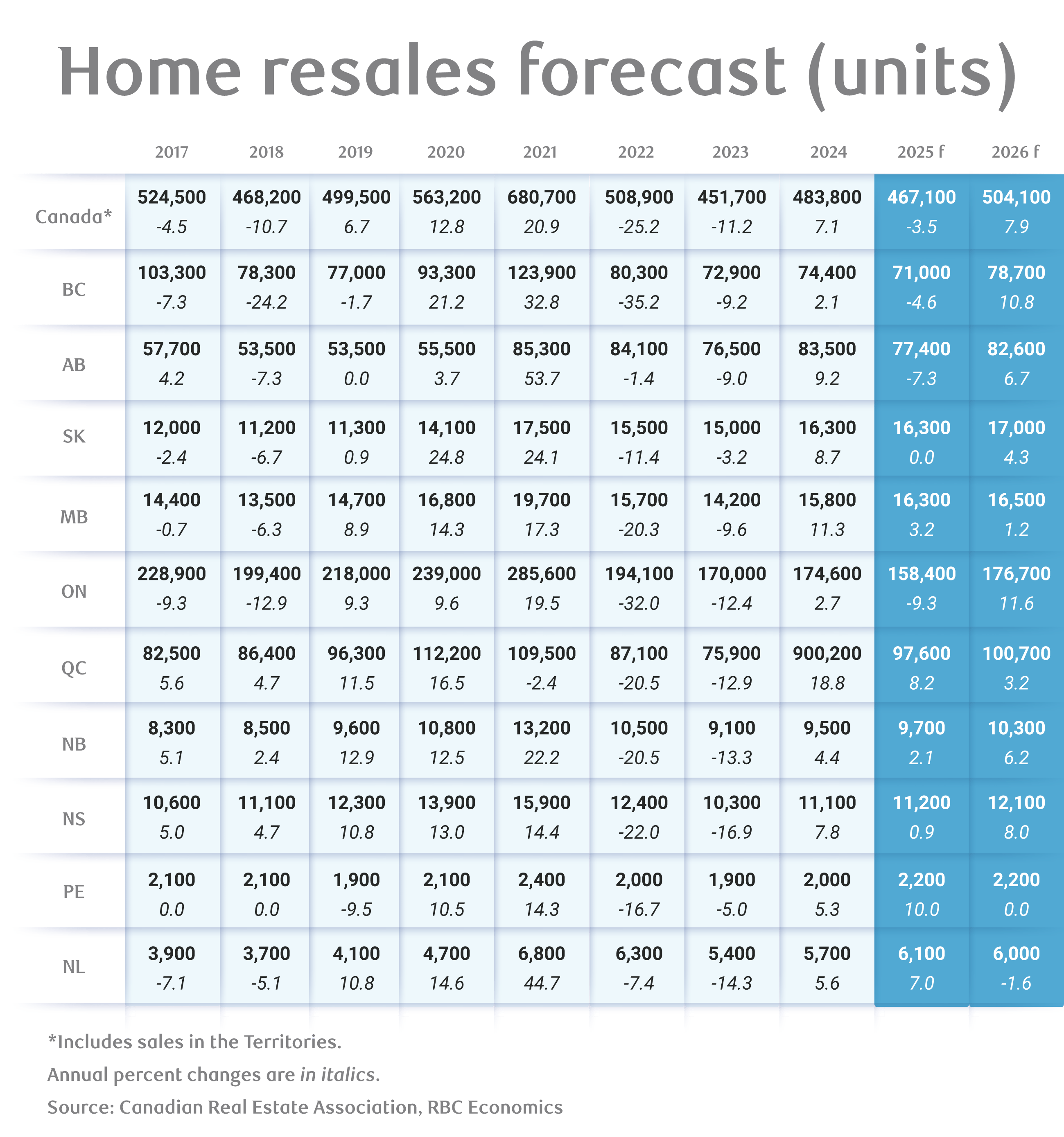

We now project home resales will decline 3.5% in Canada to 467,100 units this year with the first half seeing a 4.1% pullback, largely concentrated in Ontario and B.C.

Encouragingly, recent signs of an ongoing recovery have emerged. Prospective buyers are re-entering the market as economic fears ease and lower interest rates gain traction. We expect this gradual recovery to continue in the second half of 2025, setting the stage for stronger demand in 2026.

Firming demand in 2026 amid persistent challenges

We project a 7.9% rebound in home resales next year reaching 504,100 units—but still below the pre-pandemic five-year average of 511,000 units.

Several constraints will temper the recovery. A fragile labour market, reduced immigration targets, and affordability challenges will limit the pace of growth.

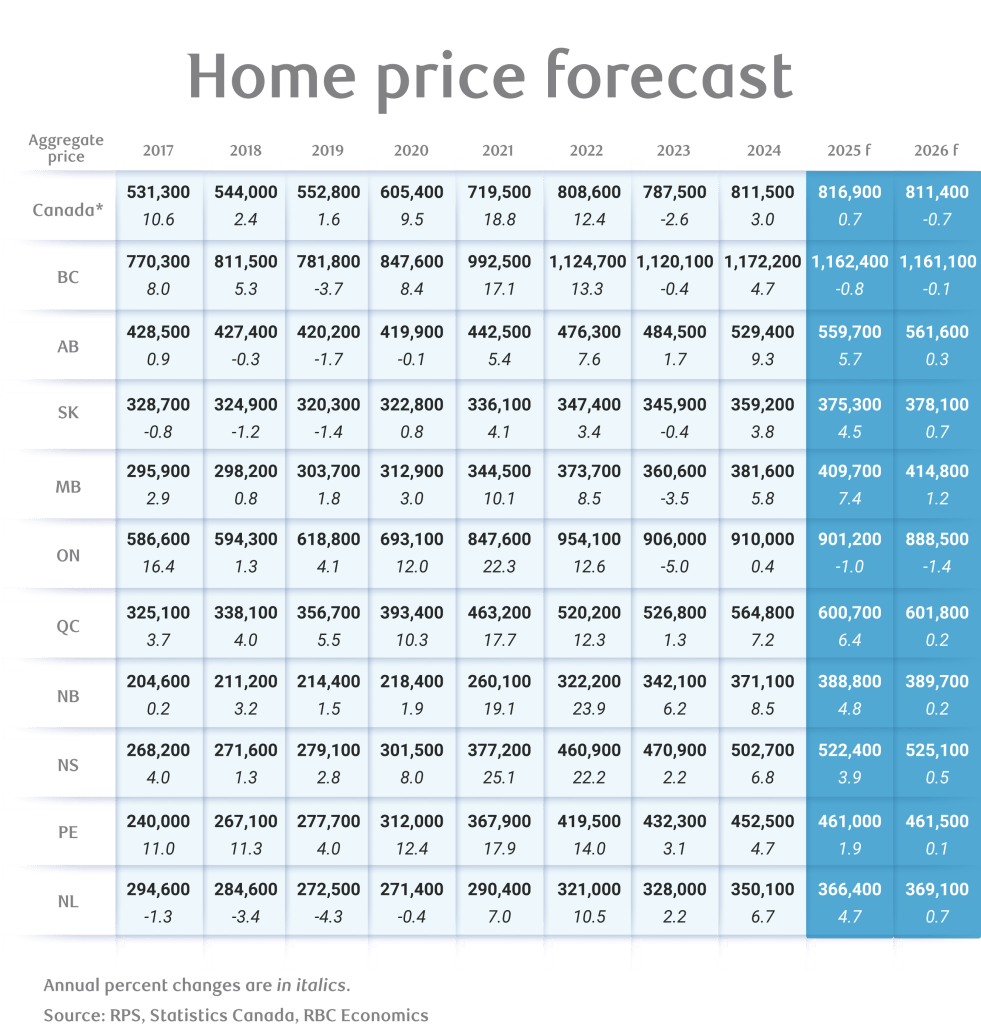

For pricing, supply-demand conditions have shifted in buyers’ favour, particularly in Ontario and B.C. where affordability issues are acute.

The national composite RPS Home Price Index is expected to rise by 0.7% in 2025, but this reflects gains made earlier in the year. We anticipate prices will decline in the latter half of 2025 and into 2026 with Ontario and B.C. experiencing the steepest drops due to high inventory levels and strong competition among sellers. Nationally, prices are expected to decline by 0.7% in 2026, reversing this year’s modest increase.

Regional divergences in home prices

Prices will vary significantly across the country. Balanced supply-demand conditions in the Prairies, Quebec, and parts of Atlantic Canada are expected to support modest price gains in 2025 and 2026.

In contrast, Ontario and B.C. will continue to face challenges with imbalances in condo markets in Toronto and Vancouver likely spilling into other segments.

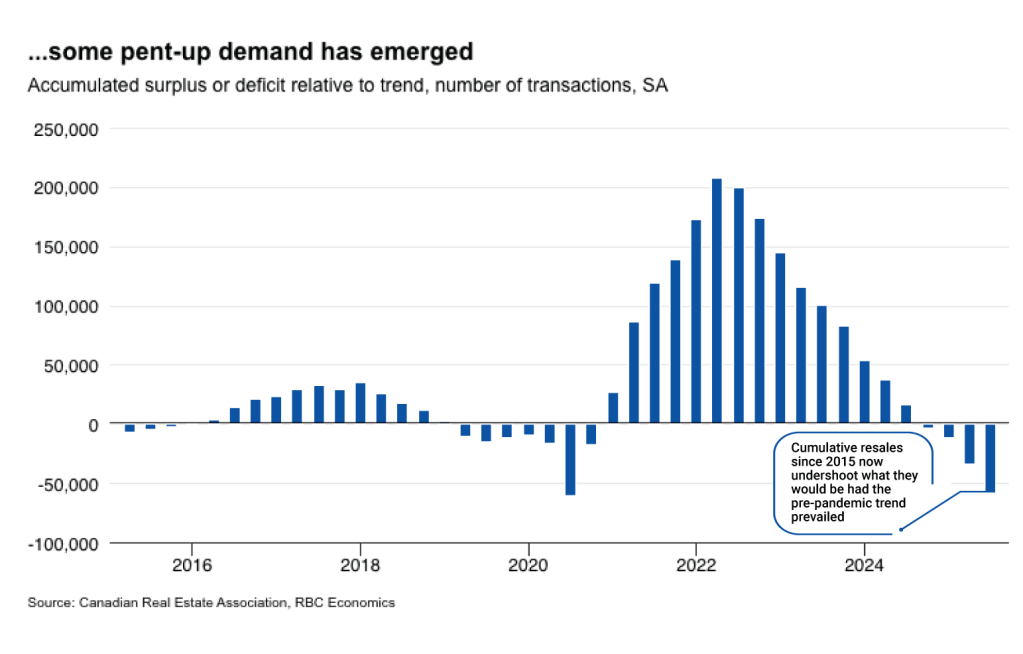

Payback for pandemic-driven activity

The pandemic’s impact on the housing market appears to have run its course. Exceptional circumstances—including rock bottom interest rates, government income support, and shifting housing needs—accelerated transactions that would have occurred later.

The subsequent market slump triggered by rate hikes in 2022 largely corrected this unsustainable surge.

We believe a growing number of Canadians are ready to re-enter the market under the right conditions such as improved affordability, stable interest rates, and better job prospects.

Brighter economic prospects to lift confidence

The unpredictability of the trade war has weighed on buyer confidence this year. However, recent developments suggest its impact will not be as widespread as initially feared, reducing some uncertainty.

We expect Canada’s economy to gain momentum in the second half of 2025 and accelerate further in 2026, gradually improving labour market conditions. The unemployment rate is projected to peak at 7.1% in late 2025 before easing next year.

Interest rate cuts supporting resales’ growth

The Bank of Canada’s rate cuts since June 2024 have yet to fully play out. Last fall’s market recovery was interrupted by the trade war, but we expect it will resume as lower borrowing costs trickle through the economy.

That said, additional stimulus from rate cuts is unlikely. Our forecast anticipates the BoC will hold its policy rate steady at 2.75% through 2026. Longer term rates have also started drifting slightly higher as bond markets price out further monetary easing.

Improved affordability to unlock pent-up demand

Declining ownership costs driven by lower rates and moderating prices in some regions have made homeownership the most affordable it’s been in three years. This trend is expected to continue, encouraging more buyers to act.

However, significant affordability challenges persist, particularly in high-priced markets like Ontario and B.C. Despite some relief, the share of household income required to cover ownership costs will remain well above pre-pandemic levels, limiting the pace of recovery.

Impact of immigration cuts on housing market

The federal government’s substantial cuts to immigration targets will slow population growth and household formation, primarily affecting rental demand. Newcomers, who typically rent for five to 10 years after arriving, will account for much of this decline.

This shift will also have knock-on effects in urban condo markets in Toronto and Vancouver where investor demand is expected to remain subdued. Other segments of the housing market will feel the demographic impact more gradually.

Higher inventory to sustain strong competition among sellers

A steady influx of sellers during the past three years combined with weaker transactions has pushed inventory in Ontario and B.C. to decade highs. Buyers now have more options and feel less urgency to act.

In contrast, inventory remains tight in the Prairies, Quebec, and Atlantic Canada, where listings are still below pre-pandemic levels. In Saskatchewan and Manitoba, inventory is continuing to decline.

We expect supply and demand to gradually rebalance as sales pick up. However, it will take time for the market in Ontario and B.C. to stabilize. Until then, strong competition among sellers will likely keep prices under pressure with declines continuing into early 2026 before steadying.

Robert Hogue is the Assistant Chief Economist responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.