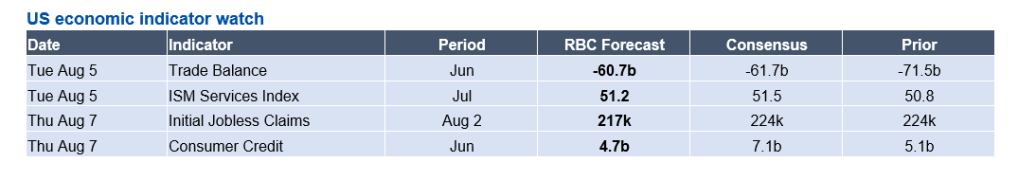

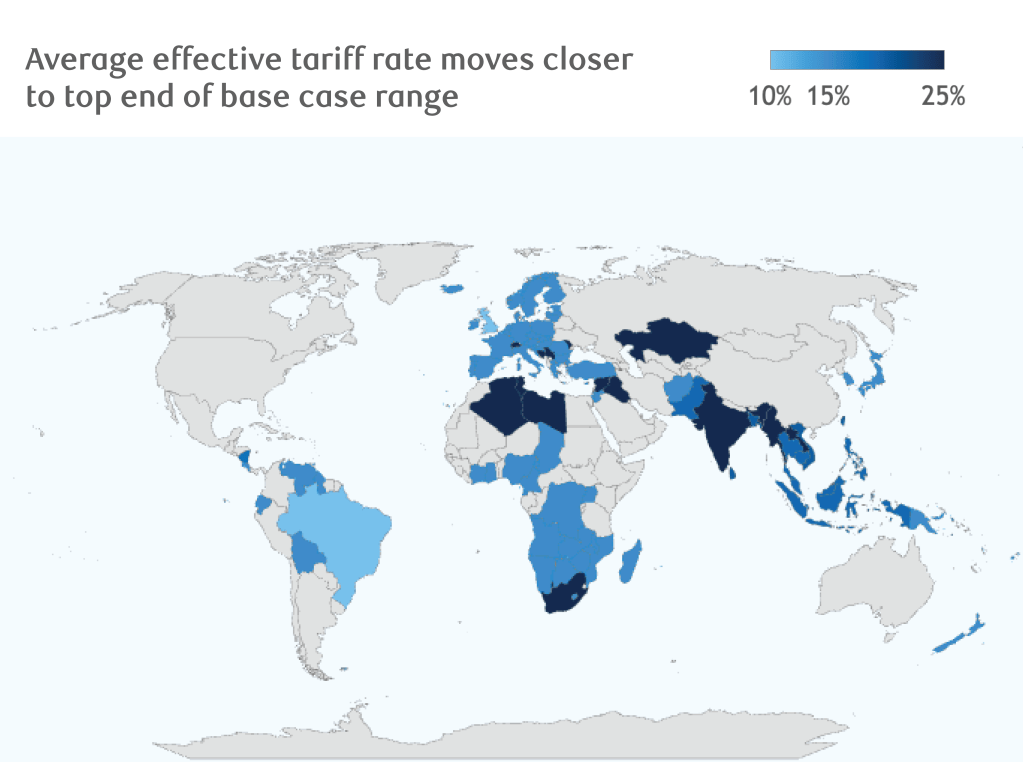

This upcoming week is a relatively light week on the data front, which will give markets and macro strategists space to digest the latest trade policy developments and this morning’s massive NFP revisions. Landing front-and-center on Tuesday is June’s trade balance, expected to narrow (slightly) to a deficit of 60.7 billion from 71.5 billion in May marking the continued reversal of the initial import surge as firms front-loaded ahead of tariffs. As per President Trump’s Executive Order signed on the eve of the August 1st tariff deadline, effective August 7th, overnight tariff hikes are set to push the average effective tariff rate closer to the top end of the 10-15% range that we have been assuming for our base case US outlook.

While Canada and Mexico face higher levies on goods which are not USMCA exempt (at 35% and 25% respective tariff rates), the vast majority of imports from these trading partners (who collectively account for ~28% of imports) are covered under USMCA. Still, 15% tariffs on EU imports and 30% on imports on China will inevitably exert upward pressure on consumer prices.

We view the established reciprocal rates coupled with product-specific targets largely as a continuation of the status quo – one that will put upward pressure on inflation and instigate a deterioration in the labor market. And this morning’s massive NFP revisions, concentrated in tariff-exposed sectors now flag that our ‘stagflation lite’ scenario is materializing as trade policy as the uncertainty it presents chokes hiring.

We expect to see a slightly weaker jobless claims print, however, though this is reflective of the continuation in the low-firing environment rather than an improvement in labor market conditions. While this morning’s leisure and hospitality hires were exceptionally weak and Q2 services GDP prints illustrated a weakening consumer barometer, ISM services has held up and is expected to continue to hold up, at least for now.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.