In this week’s edition: Four potential global trade scenarios, Canada’s agri-food rebound, and why copper is in the crosshairs

Trade war fallout

By Jordan Brennan, Head of Thought Leadership

What if the U.S. is no longer at the centre of the global trading system? That was one of the ideas explored at a Fields Institute-hosted roundtable I attended this week in Toronto.

The U.S. has wielded tremendous soft power through its custody of the global trading system for the better part of 80 years. That came to an end on April 2nd with President Trump’s ‘Liberation Day’ tariffs, according to one speaker. The speaker went on to claim that the end of American leadership would beget four possible scenarios:

-

World War Trade. This is a 1930s-style scenario where other countries follow the U.S. in ignoring WTO policies. Unless resolved in the coming weeks, Trump’s tariffs will likely provoke retaliatory tariffs from other countries in a tit-for-tat escalation. In one scenario, the trigger is Chinese retaliation against the anti-China provisions the U.S. is seeking from trading partners (e.g., the U.S.-U.K. deal attempts to lock China out of critical supply chains). This nightmarish scenario, thankfully, is the least likely.

-

Managed multi-lateral drift. This is the current base case. The world sees more protectionism from the U.S. and more liberalization everywhere else. The U.S. stands alone in violating the WTO rules, but everyone else plays nice.

-

Fighting trade blocs. Further geo-political fragmentation leads to the creation of adversarial trade blocs. Within the blocs, there is some measure of cooperation and openness. Between the blocs, we see WTO non-compliance. Three main blocs will form: a U.S.-centric bloc with Canada and Mexico, a pan-European bloc, and a China-led bloc. Japan is a wildcard.

-

Re-globalization without America. This is the most likely scenario. The U.S. will become a more closed economy, trading less with the world. Given that the U.S. only accounts for 15% of global trade, this is not fatal to the international trading system.

It’s not clear what these scenarios would mean for Canada. With more than 75% of our merchandise exports headed to our American neighbours, it is difficult to imagine a future in which the U.S. does not remain Canada’s largest and most important trading partner.

It is possible, strangely, that Canada’s position with the United States is strengthened on a relative basis, given that U.S. tariffs on Canada may end up being considerably lower than those on America’s EU and Asian trading partners. Canada could end up trading more with the United States, not less, despite the tariffs.

It’s also possible, again unexpectedly, that foreign direct investment in Canada is strengthened—think auto—as countries that were happy to pay the ~3% most favoured nation tariff rate now face a 25% tariff wall and will therefore look to pick up spare capacity within North America to work around that wall.

What’s clear is that Canada needs a strong ‘Plan B’ and ‘Plan C’ in the current negotiations with President Trump. Free trade with the U.S. is the preferred outcome, but Canada needs a menu of options if we cannot secure a satisfactory deal.

The week that was

-

Prime Minister Mark Carney acknowledged that a deal with the U.S. isn’t likely to result in the elimination of all tariffs.

-

Trump’s tariffs have raked in nearly US$50 billion for the U.S.—so far.

-

Mexican President Claudia Sheinbaum said she and Carney have spoken about Mexico and Canada increasing collaboration around trade.

-

A dozen EU nations are considering so-called anti-coercion instrument, that could include new taxes on big U.S. tech firms or investment restrictions, if a deal with the U.S. isn’t struck by Aug. 1.

Protein pop

Canada’s agri-food exports rebounded in May after plunging in April, with meat and seafood exports leading the way. New Statistics Canada merchandise trade data shows meat exports were up 13% in May—largely spurred by pork exports to Japan—while packaged seafood splashed up to 52.9% after a year-long decline.

Why that matters?

-

Commodities travel the path of least resistance, but adjustments can take time. Thanks to the CPTPP, Japan’s duty on Canadian fresh, chilled or frozen pork of 4.3% is gradually phasing out by April 2027, specifically for products that are “over-gate,” which is Japan’s minimum pricing system for all pork imports. Processed products like sausages that faced tariffs of up to 10% pre-CPTPP, are now fully phased out. Canadian prepared and preserved swine meat, including lunch meat, to the U.S. dropped from $4 million in January to $2.4 million in May, while the same category of exports to Japan rose from $3.2 million in January to $8 million in May.

-

Canada’s agri-food trade diversification efforts may not be that diversified, yet. The U.S. remains an important partner, especially for highly perishable products like greenhouse tomatoes. Yet, Canada’s agri-food exporters for many categories are on the move and looking to grow in markets where access is already strong, and logistics are in place, including Japan, Mexico, and South Korea. Further unlocks could be markets on the edges with high growth potential for Canada driven by expanded market access. For example, Columbia and Taiwan, both outside of Canada’s top 5 markets for beef and veal export, have grown in export value by 236% and 57%, respectively, between May 2024 and 2025.

Bottom line: With a tariff-free North America looking more unlikely, Canada continues to diversify its agri-food trading partners and appears to be focused on growing in existing tariff-free or low-tariff markets.

The big number

84

Percentage of Canadians who don’t expect the Trump administration to negotiate in good faith.

Copper in the crosshairs

Copper is now a target of the Trump Administration’s AI-centered energy and resource security agenda, where the commodity’s utility as an electrical conductor makes it a priority for the transformers, transmission lines, and battery technologies that will underpin the buildout of AI infrastructure. By the end of the month copper imports into the U.S. could face 50% tariffs, the latest metal to become front and centre in a realignment of resource supply chains.

-

The U.S. imported 42% of its refined copper on average in the past four years. But with 5% of global reserves, there is scope to expand domestic production.

-

Canada occupies a relatively small share of global copper refining, responsible for 1.2% of refinery production in 2024, and approximately 0.8% of reserves.

-

Canada is a major supplier of copper to the U.S. in the form of ore and concentrate, refined copper, copper scrap, and copper matte and precipitate, and exports to Asia and Europe. Canadian exports to the U.S. were worth $4.8 billion in 2023.

-

The effect of the copper tariffs will be felt less in some provinces. B.C., for instance, hosts Canada’s largest copper mines but doesn’t export significantly to the U.S. But others could be more susceptible. Quebec hosts a copper smelter and a refinery and accounted for 80% of copper exports to the U.S. in 2024, according to data from Innovation, Science, and Economic Development Canada.

-

Canadian mines produced 508,000 tonnes of copper in 2023, and the country counted 14 copper deposits among its top 100 mineral exploration projects in 2024. Expanding Canada’s reserve base and bringing more Canadian copper to market, whether at home or abroad, will be important for achieving our energy and AI ambitions.

Eye on Africa

Africa has long been a battleground for the China and the U.S. as they vie for economic and trade influence in the continent. The competition has only intensified as the two countries seek access to minerals, from gold to graphite. The U.S. is trying to break Chinese sway in the continent by brokering a peace between Rwanda and the Democratic Republic of Congo (DRC). Washington also recently wrapped up a U.S.-Africa Business Summit with US$2.5-billion investment commitment, that included US$1.5 billion towards a 1,150-kilometre transmission line from Angola to deliver 1.2 gigawatt electricity to power DRC mining sites. In return, the U.S. gets access to DRC’s natural resources that include two-thirds of global cobalt that power EV batteries. It’s also the largest supplier of tantalum–a critical metal used in capacitors–and the world’s second largest supplier of copper.

Africa could prove to be a new, thriving trading destination as Ottawa casts its export net wider. There are opportunities abound:

-

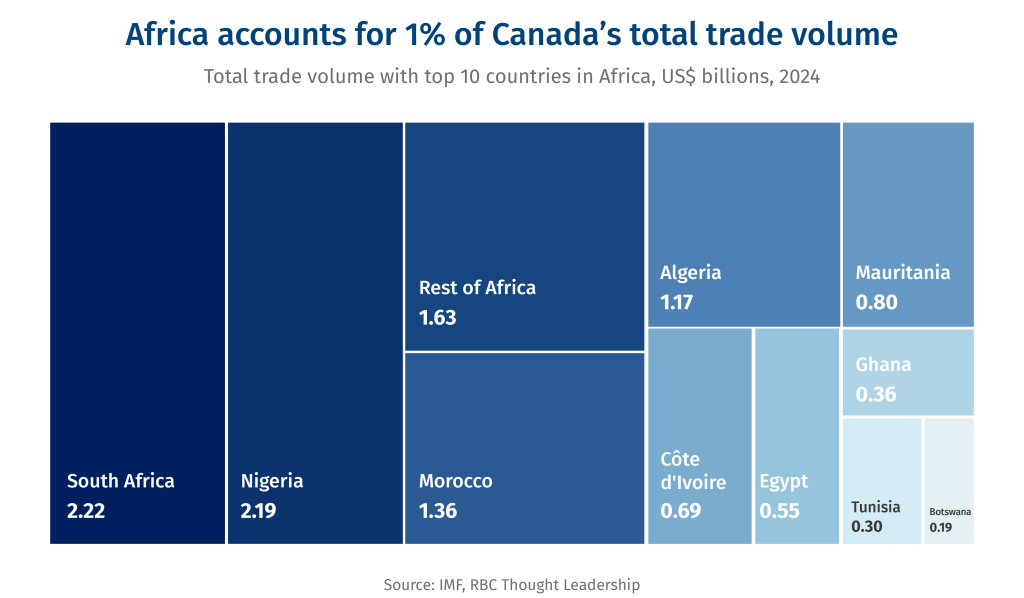

Canada-Africa trade has tripled over the past 25 years, but still accounts for a mere 1% of Canada’s total trade volume.

-

Canada could sell cleantech to a continent that remains heavily dependent on coal, especially in growing economies like South Africa. May be LNG, too.

-

Canada can also export mining equipment and clean extraction methods in resource-rich African nations.

-

Health-tech and pharma services could also boost digital health services, especially in the continent’s underserved regions. Edu-tech exports to a continent with the world’s youngest population could prove to be another winner.

-

Africa’s critical minerals supplies offer diverse range of inputs to EV battery supply chains, offering analternative to Chinese-controlled resources.

Final word

“We’ve been clear from the get-go that supply management is off the table.”

—François-Philippe Champagne, Canada’s Finance Minister, on the protections in place on dairy and agriculture not being part of the U.S/Canada negotiations.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.