Canada’s housing market showed further signs of recovery in June with home resales picking up for a third straight month on a monthly basis. But, prices remained lower overall with nationwide declines largely driven by softening in Ontario and British Columbia.

Regional disparities in market performance have come into sharper focus recently with some markets in the Prairies, Quebec and Atlantic Canada seeing tight supply-demand conditions, while others in Ontario and B.C. are challenged by high inventory levels, significant affordability issues and deteriorating job prospects.

Home resales recover broadly but prices keep falling

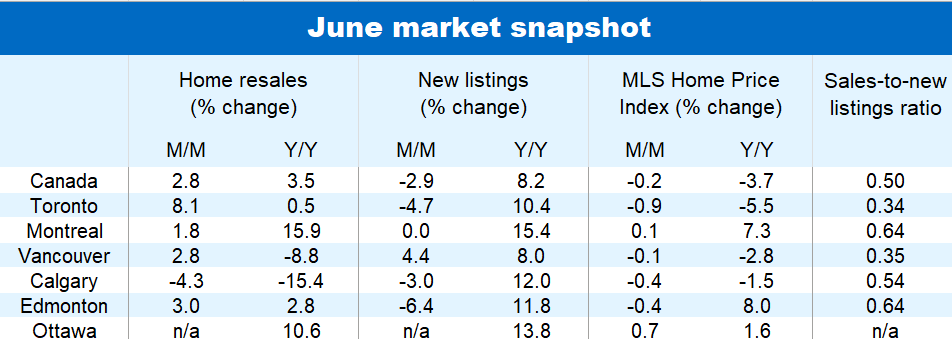

Nationally, home resales increased by 2.8% in June from May, and by 3.5% from a year ago.

This reversed part of the drop in activity from earlier in the year when the trade war hammered confidence. Gains in key markets included Toronto (up 8.1% from May), Vancouver (2.8%), Edmonton (3%) and Montreal (1.8%).

However, the recovery has yet to stem the decline in house prices across the country.

The national composite MLS Home Price Index (HPI) edged 0.2% lower in June from May—marking a seventh consecutive drop. It’s bringing some welcome affordability relief to prospective homebuyers who saw ownership costs spike during the pandemic.

Diverging regional trends

Price declines were mainly concentrated in Southern Ontario and B.C., where sellers fiercely competed amid a historically high number of homes for sale, while buyers faced stretched affordability conditions.

The MLS HPI fell again from May to June in Toronto (-0.9%), Guelph (-2.5%), Niagara region (-1.5%), London (-1.2%), Windsor (-0.8%), Cambridge (-0.4%), Fraser Valley (-1%) and Vancouver (-0.1%). These markets have seen some of the most significant weakening over the past year as supply-demand conditions shift heavily into the buyer’s favour.

Property values remain more resilient in the Prairies, Quebec, and Atlantic Canada. The MLS HPI still trends higher in Regina (up 7.9% from a year ago), Saskatoon (7.3%), Winnipeg (7.5%), Montreal (7.3%), Quebec City (16.4%), Fredericton (11.3%), Saint John (12.9%), Halifax (4%) and St. John’s (12.3%). Most of these markets also saw monthly gains in June.

The picture is rebalancing in Calgary and Edmonton. Homebuying leveled off this year—but is still at solid levels—and prices are easing amid growing supply.

Mixed outlook for Canada

Looking ahead, we expect the Canadian housing market to sustain its gradual resales recovery as confidence returns and interest rate cuts continue to have an impact. That said, we see little that would alter the diverging price trends in the near term.

High inventory, affordability issues and soft labour markets are likely to prolong weaker home prices in Ontario and B.C.

But, the persistence of tight supply-demand conditions is poised to drive further price gains in the Prairies, Quebec, and Atlantic Canada—albeit at a slower pace in some areas.

Download the Report

Robert Hogue is the Assistant Chief Economist responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.