In this week’s edition: Trump’s 35% tariff threat, Canada seeks partners across the Pacific, and the Canadian chocolatier that’s benefitting from the U.S. boycott.

High Noon in Canada

We seem to be in the Wild Wild West as Donald Trump’s latest 35% tariff threat against Canada disregards the July 21 deadline and disrupts the behind-closed-door negotiations underway.

The new deadline is August 1, by which date Canada has been asked to address several U.S. trade irritants, including supply management and the flow of fentanyl across the border. CUSMA-compliant goods crossing the border will “most likely” be exempt, said one U.S. official, in a volley of trade attacks on friends and foes alike that’s designed to confound and confuse—and lead to capitulation.

The latest threats from Washington have spurred the federal and provincial governments to look for new avenues of growth, seek new partners—east and west—, and rev up the dormant interprovincial trade engine.

Some Canadian policymakers were looking to do just that at the Calgary Stampede this week. The Greatest Outdoor Show on Earth, as it’s called, has become a blend of rodeo, carnival, and business fair, pulling in a million people a year.

Mark Carney and Pierre Poilievre were there, along with a gaggle of premiers and senior ministers. Ontario’s Doug Ford brought six cabinet members as he pushes ahead with his domestic trade agenda.

Here’s some of what’s at play as Canada looks for new trade streams:

-

A $100B energy package: Alberta and Ottawa are making progress on a big energy package that could include an oil pipeline to the West Coast, the Pathways project to capture carbon emissions, and room for expanded oil production. The Pipeline + Pathways package has a lot of political punch, but headline costs could be sobering. Add in the costs of expanding production, and the sticker could reach $100 billion. Now, that’s an investment over many years designed to deliver a multiple of that in economic growth and government revenue. But anything of that magnitude will require an explainer-in-chief.

-

New corridors: Pancake-flipping Ford and Alberta’s Danielle Smith also agreed to a feasibility study of new pipelines and rail lines between the two provinces, pledged to increase interprovincial trade of alcohol and vehicles, and push for nuclear energy development.

-

Pacific partners: International investors are very interested in Canada, as a relatively safe alternative to much of the world, including the U.S. But Japan and India wants to see action on regulatory reform, and more investment in export infrastructure. The biggest question is how quickly Canada can move on Indigenous consent for major projects.

-

Megaproject port side. ThePort of Vancouver is looking to boost its total capacity by 70% through the proposed Roberts Bank Terminal 2 Project. Canada’s main gateway has begun looking for a contractor to build the $3-billion project to boost trade with Asia.

A lot is at stake, and the country doesn’t have much time.

The week that was

-

A federal red-tap review is under way to weed out rules that impede internal trade and business investments. Cabinet ministers are also being asked to find ambitious spending cuts amid Ottawa-wide belt-tightening.

-

Canadian firms, such as Purdys Chocolatiers, are reporting brisk domestic business as the U.S. brand boycott persists in the country.

-

Global trade surged in the first half of 2025, but slowing global economic growth pose risks for trade in the latter half, the UN warns.

-

President Donald Trump’s trade threats and actions now extend to copper, pharmaceuticals and Brazil. Around 14 countries also received tariff missives with the President’s classic sign-off: “Thank you for your attention to this matter!”

-

A cavalcade of small U.S. businesses and interest groups are filing cases against Trump’s litany of tariffs imposed under the International Emergency Economic Powers Act.

From West to Rest: Can BRICS+ Redraw the Trade Map?

Multilateral cooperation is a delicate balancing act at the best of times. For half a century, the G7 skillfully juggled competing interests and represented the values of liberal openness, democratic governance, and pluralistic tolerance on the world stage. But with President Trump firing tariff missiles in all directions, including G7 partners, the BRICS+ bloc, seen as an emerging market counterweight to the G7, is quietly emerging as an attractive alternative for some nations.

The 11-nation group met in Rio de Janeiro last weekend. And while some have argued that the bloc lacks any basis for unity or cohesion apart from antipathy to the G7, the geo-economic coalition’s rising influence cannot be denied.

-

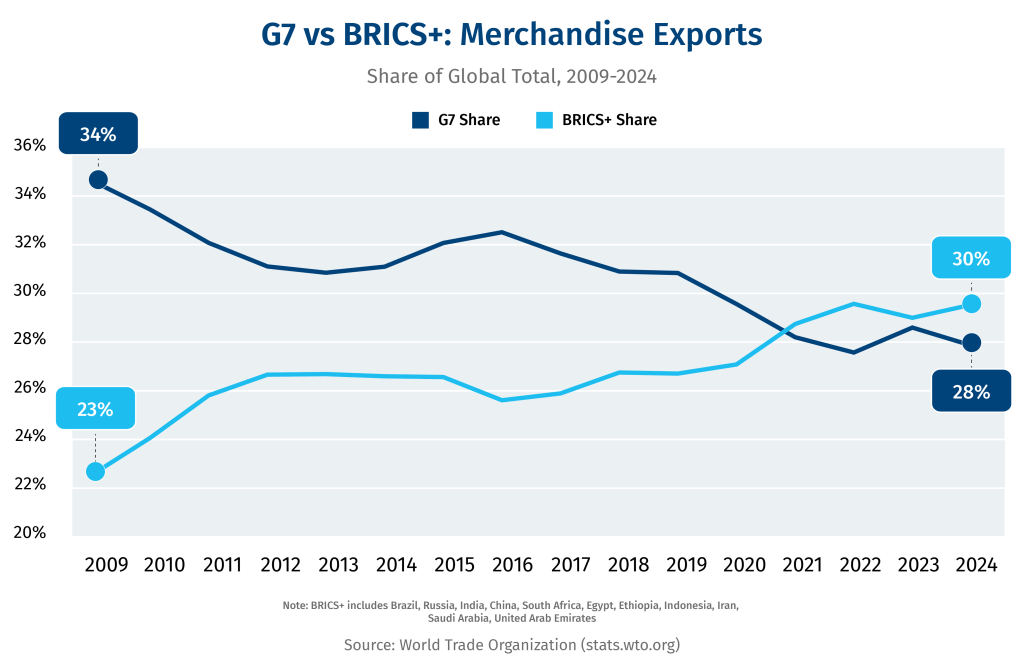

Formed in 2009, the bloc initially included Brazil, Russia, India and China, but now encompasses South Africa, Egypt, Ethiopia, Indonesia, Iran, and the UAE, with Saudi Arabia mulling over its membership. Together these countries account for more than a third of global GDP and nearly half of the world’s population. As a trading bloc, the BRICS+ eclipsed the G7 in merchandise exports in 2021, accounting for 30% of the global total.

-

Will Trump’s tariff war accelerate the G7’s relative decline? And will the BRICS+ be able to re-orient trade flows, proving to be a more influential voice for non-Western countries in multilateral governance? It’s too early to tell.

-

But the U.S. is already worried, with Trump threatening tariffs on countries aligning themselves with what he calls the bloc’s “Anti-American policies.”

-

Will Canada get swept up in the U.S.-BRICS cross-currents? Ottawa is already looking to reset ties with China and India—two founding members of BRICS. Foreign Affairs Minister Anita Anand, who is currently in Asia, says Canada is looking to wrap up free trade agreements with Southeast Asian nations—as soon as possible—, several of which are likely BRICS membership candidates.

-

As the Canadian government seeks relief from Trump’s tariff blitz, a longer-term trade strategy confronts the diminished status of G7 nations. How members of the BRICS+ fits into Canada’s trade future remains unknown, especially as Ottawa wants to avoid giving Washington any ammunition to blow up their fragile trade negotiations.

After decades of a unipolar world, the return of a multi-polar world is complicating Canada’s efforts to seek new trading partners.

The big number

11,000

The increase in the number of Canada’s trade-dependent manufacturing sector in June. Overall, the ecomony created 83,000 jobs, a figure that surprised analysts given the uncertainty around trade and investments.

The race North America can’t afford to lose

As the North American auto industry reels under the weight of U.S. tariffs, the real story on autos may not be in Washington, but in Shenzhen, where Chinese electric vehicle (EV) behemoth BYD’s headquarters are located.

Ford CEO Jim Farley has been the most vocal about the need to “humbly accept” Chinese leadership in EV technology. The executive even imported Chinese EVs recently to test their build quality. Canada and the U.S. remain the only two major nations with no consumer access to Chinese vehicles—the U.S. imposes an almost 150% duty on new Chinese EV imports and Canada has a 100% tax—but Chinese cars are widely expected to come to North American shores at some point.

The almost-overnight success of BYD, which has ramped up production to four million units in just four years, is notable. The automaker surpassed Tesla last year as the world’s largest EV seller. BYD’s patented Blade battery is considered to be among the world’s safest and most affordable, while its autonomous driving system is deemed to be as good as, if not better than, Tesla’s. Most stunning? BYD’s EVs come at bargain prices—on average US$20,000 (C$27,400), less than half the cost of a new North American vehicle.

Whatdoes China’s enhanced automotive industrial capacity portend for Canada’s auto industry, which has been under strain for the better part of two decades? Provincial and federal governments invested heavily in the EV value chain, but with stalling EV sales (9% of total sales in Q1, 2025, compared to 18% in Q4, 2024) and paused or postponed production facilities (Honda, BASF, Northvolt to name a few), the soundness of Canada’s EV bet is being questioned. Pressure on Ottawa from some automakers to scrap the EV mandate could be another body blow to the nascent industry.

One thing seems certain: Americans, Canadians and Mexicans fighting with each other over auto production will not catalyze innovation—it would only accelerate China’s global EV lead.

The Trade-Offs of Supply Management

Trade irritant, stable, costly, secure — these are just a few of the words currently being used to describe Canada’s supply management system, underscoring the renewed debate it’s attracting.

Supply management has faced scrutiny during nearly every major trade negotiation and economic downturn — and it’s poised to be a key discussion point in next year’s Canada-U.S.-Mexico Agreement (CUSMA) review.

The debate is no longer confined within agriculture’s siloed walls. Supply management touches many corners of Canada’s economy: from food prices and consumer choice to supply-chain jobs, trade diversification, and economic growth.

In RBC Thought Leadership’s latest report, Supply Management Explained, we take a closer look at the system’s benefits and drawbacks.

Read the full report here.

Final Word

“We’ll fight against it. Period.”— Canada’s Trade Minister Melanie Joly, responding to Donald Trump’s threat to impose 50% tariffs on imported copper.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.