In this week’s Edition: On the ground in Canada’s “Pinnacles of Progressiveness,” How Trump’s ‘big, beautiful bill’ could impact Canada, and what major projects might be on the government’s fast-track list

Noteworthy

By John Stackhouse

This past week, I was in Quebec and B.C. — Canada’s “Pinnacles of Progressiveness” — to gauge how the conversation is shifting around resource development, particularly oil and gas exports. Here are a few of my takeaways:

-

In Quebec, which has generally opposed fossil fuel pipelines and LNG, Premier Francois Legault is expressing more and more support for a national East-West pipeline.

-

A senior Quebec official told me that more public pronouncements in favour of gas may come in the weeks ahead.

-

B.C. is about to become a global LNG player, which is why Premier David Eby is headed to Japan and Malaysia in the first week of June.

-

I spent time with the province’s Energy and Climate Solutions Minister Adrian Dix who says B.C. will continue to expand its electricity to power more LNG plants.

-

The LNG industry believes as many as six more LNG plants could be built, which would meet about 20% of the world’s projected growth in demand.

-

But the clock is ticking. I keep hearing people say that Canada has about an18-month window to get these major projects going.

Week in numbers

1

Number of times the word ‘trade’ was mentioned in the joint statement made by the G7 finance and central bank chiefs following three days of meetings in Banff, Alberta this past week. There wasn’t a single mention of ‘tariffs’ in the statement.

400

Companies in the S&P 500 that mentioned ‘tariffs’ in Q1 earnings calls.

$1.5 billion

What Foxconn, Apple’s long-time supplier, is spending to build a production facility in southern India. Apple continues to shift production from China to India, which prompted Trump to end the week with a 25% tariff threat on iPhones not made in the U.S.

$3,500

One estimate on what an iPhone would cost consumers if it was made in the U.S. Another analyst landed on US$1,500, up about 25% from the current retail price.

View from Washington

Trump’s “One, Big Beautiful” Bill includes several policies affecting cross-border industries and supply chains that grew out of Canada-US trade talks under Biden.

-

LOSER: North American electric vehicles. Four years ago, Canada and Mexico successfully lobbied for an expansion of the Inflation Reduction Act’s EV tax credit to include North American products. The bill would end the US$7,500 credit (US$4,000 for used EVs), eliminating a major consumer incentive for a cross-border industry already grappling with tariff-related price increases. And the resulting consumer demand slowdown bodes poorly for Canadian EV supply chain projects.

-

WINNER: Continental defence spending. Canada has expressed interest in joining Trump’s “Golden Dome” missile defence program, which gets a US$25-billion injection if this bill passes. Canada could integrate the acquisition of U.S. defence products into a broader Canada-U.S. trade agreement. Trump is a proponent of using defence sales to rebalance U.S. trade relations and said this week that Canada will pay its “fair share” if it joins.

-

UNCLEAR: Canadian critical minerals. Critical minerals were a focal point of Canada-U.S. trade relations for several years; the countries even signed a Joint Action Plan on mineral supply chains in the final days of Trump 1.0. House Republicans have allocated an additional US$2.5 billion for critical minerals production. It’s too early to tell what impact that will have on Canadian critical minerals projects, which qualify for Pentagon funding through Title III of the Defense Production Act.

Major project list: What’s on the fast-track?

The upcoming discussions around a renewed economic and security agreement, and the broader imperative to diversify trade, cannot be advanced without expediting and realizing resource, energy and infrastructure projects.

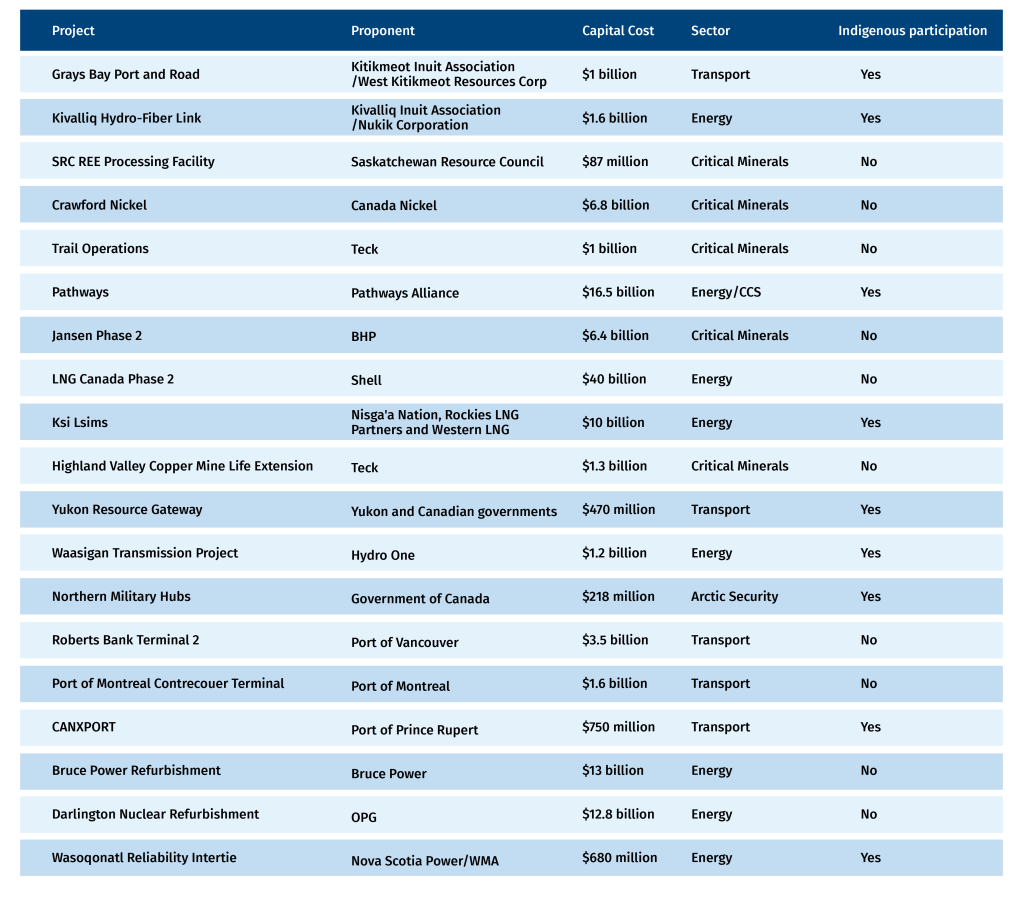

A big part of June’s First Ministers meeting in Saskatoon will be identifying nation-building projects the federal government has promised to fast-track in collaboration with provinces and Indigenous Nations. Besides regional and political considerations, a project list must cut across multiple sectors, contribute to important strategic objectives (including energy and Arctic security), and build Canada’s economic strength.

The 19 projects below help meet many of those objectives. They represent more than $120 billion in capital costs, covering major transportation, critical minerals, oil and gas, nuclear, carbon capture, utilization and storage (CCUS) and Arctic security infrastructure. They span the regulatory lifecycle-from pre-feasibility to under construction. Most if not all will require Indigenous partnerships. And they bolster Canada’s clean and conventional energy, trade diversification and Arctic security capabilities.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.