Two important trends emerged in Canada’s housing market in April. First, the full impact of trade tensions on buyer sentiment may be nearing its peak and second, a price correction is taking place, particularly in the country’s most expensive markets.

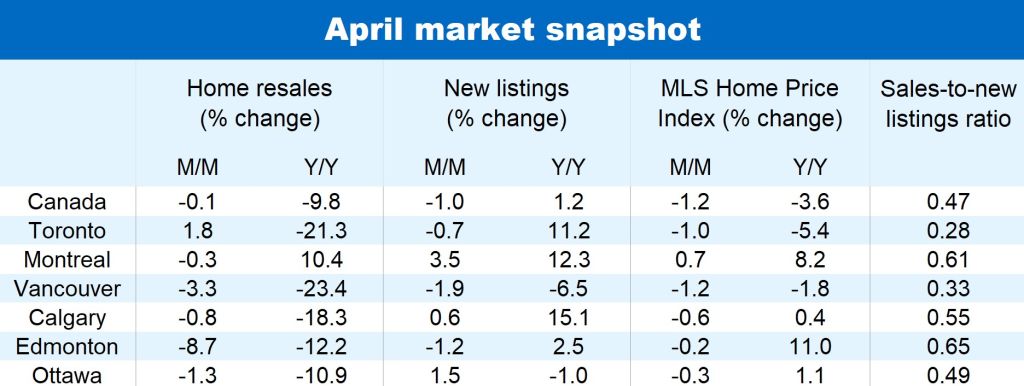

National home resales stabilized in April, down 0.1% from March following a sharp cumulative 19% decline over the previous four months. The U.S. administration’s decision to spare Canada from additional tariffs last month could boost confidence and attract buyers in coming months.

Meanwhile, downward pressure on home prices is intensifying, particularly in Southern Ontario and British Columbia. Softening supply-demand conditions have triggered a price correction that could persist. Canada’s composite MLS Home Price Index fell for a fifth consecutive month in April, down 1.2% from March and 3.6% year-over-year.

Material correction underway in Toronto area

Toronto’s composite MLS HPI has fallen 6.2% over five months including April’s 1% monthly decline. Larger corrections are evident across Southern Ontario: London (-7.7%), Kitchener-Waterloo (-7.6%), Niagara (-6.9%) and Hamilton (-6.5%). Every Ontario market recorded month-over-month price declines.

Similarly, B.C. is experiencing weakness with Vancouver and the Fraser Valley both seeing 2.8% composite price drops over four months.

Condos leading the price decline

The correction has been most pronounced in the condominium segment across major Southern Ontario and B.C. markets. Toronto’s condo MLS HPI is now down 7.3% annually, while Vancouver saw a 2% fall.

Rising inventories have shifted market dynamics decisively in buyers’ favor throughout Ontario and B.C., creating some of the most buyer-friendly conditions in decades.

Regional resilience elsewhere in Canada

Markets in Alberta, Saskatchewan, Manitoba, Quebec and Atlantic Canada remain comparatively tight with supply-demand fundamentals still supporting modest price growth.

Montreal has seen relative stability in resale activity with single-family home and condominium prices rising in April on a monthly and annual basis.

However, price appreciation will likely moderate across these regions as broader economic uncertainty continues to weigh on buyer sentiment.

Download the Report

Robert Hogue is the Assistant Chief Economist responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.