Corporate responsibility

At RBC, we define corporate responsibility as operating with integrity at all times and sustaining our long-term viability while contributing to the present and future well-being of our stakeholders.

This means that we strive to take active responsibility for the daily choices that we face, especially in regard to ethical business practices, our economic impact, as well as our practices in the workplace, the environment and the community.

Sustainability reporting

Increasingly, companies are being asked to report on their social, environmental and ethical performance, which is sometimes called sustainability reporting. While there are many stakeholders asking for such information, there is little agreement about what and how much companies should disclose, as well as the appropriate manner of disclosure.

RBC has adopted a multi-pronged approach to sustainability reporting. We provide tailored reporting geared to various stakeholders, with an appropriate level of detail in each. Additional information can be found on our website at rbc.com/responsibility.

Corporate

responsibility

principles |

| Business practices |

| • |

Comply with laws and regulations |

| • |

Manage under strong governance |

| • |

Operate with ethical business practices |

| • |

Provide products and access to banking services responsibly |

| • |

Protect and educate consumers |

|

| Economic impact |

| • |

Provide strong returns to shareholders |

| • |

Pay fair share of taxes |

| • |

Support small business and community economic development |

| • |

Foster innovation and entrepreneurship |

| • |

Purchase goods and services responsibly |

|

| Workplace and employment |

| • |

Respect diversity |

| • |

Foster a culture of employee engagement |

| • |

Provide competitive compensation and total rewards |

| • |

Provide opportunities for training and development |

|

| Environment |

| • |

Lend responsibly |

| • |

Leverage “green” business opportunities |

| • |

Reduce operational footprint |

|

| Community |

| • |

Provide donations with a lasting social impact |

| • |

Sponsor key community initiatives |

| • |

Enable employees to contribute |

|

Ethical business practices

At RBC, one of our key values is to operate with trust through integrity in everything we do. We have enterprise-wide compliance policies and processes to support the assessment and management of risks, and have formal policies to address issues such as:

| • |

Economic sanctions |

| • |

Lending to political parties |

| • |

Financing military materiel |

| • |

Money laundering |

| • |

Terrorist financing |

| • |

Conflicts of interest including outside activities and external directorships of employees |

| • |

Insider trading, information barriers and employee trading |

| • |

Environmental risk |

| • |

Outsourcing risk |

| • |

Structured transactions and complex credits |

| • |

Auditor independence. |

Policies and controls are reviewed regularly to ensure continued effectiveness.

Code of Conduct

All RBC employees worldwide are governed by our Code of Conduct, which was established more than 20 years ago and is updated regularly. Our Code of Conduct e-learning program ensures all our employees (from the CEO down) know and understand the Code’s principles and compliance elements. This e-learning program includes both an online course and a test. All employees must complete the program and test within three months of joining RBC and at least once every two years thereafter.

Client due diligence (Know Your Client and Suitability)

RBC must perform due diligence on new and existing clients both to comply with applicable anti-money laundering, anti-terrorism and economic sanctions legislation and also so we can understand our clients’ needs in offering suitable products and services. To address the various anti-money laundering and anti-terrorism rules, RBC has implemented appropriate scrutiny and monitoring measures in line with regulatory requirements. This client due diligence helps us to monitor trade suitability within our securities businesses, and more broadly, helps us to ensure we are providing clients with an appropriate range of products and services.

Anti-money laundering policy

RBC is committed to preventing the use of its financial services for money laundering or terrorist financing purposes. Our Global Anti-Money Laundering Compliance Group is dedicated to the continuous development and maintenance of policies, guidelines, training and risk assessment tools and models to help our employees deal with ever-evolving money laundering and terrorism financing risks.

Anti-terrorism policy

RBC and our directors, officers and employees will not knowingly enter into transactions with, or provide or assist in providing, directly or indirectly, financial services to, or for the benefit of, states, entities, organizations and individuals targeted by applicable anti-terrorism measures. To effectively meet these requirements, automated systems scan client names against various terrorist and control lists daily, including scanning of payments against the Office of the Superintendent of Financial Institutions, the Office of Foreign Assets Control and other control lists, as per terrorist financing regulations.

Economic sanctions policy

RBC businesses, directors, officers and employees will not knowingly conduct business with states, entities, organizations and individuals targeted by the economic sanctions of the jurisdictions where they are located or where they operate, or those jurisdictions otherwise applicable to them.

Privacy and information security

The Internet and other information technologies have revolutionized the way we do business, enabling us to interact and do business with clients, employees, and other third parties from the convenience of the home or office. At the same time, it also brings legitimate concerns about privacy and security.

At RBC, we are dedicated to safeguarding the privacy and confidentiality of personal, business, financial, and other information. In fact, it is one of our highest priorities and remains a cornerstone of our commitment to our clients, employees, and other third parties. We have had a formal Privacy Code since 1991, overseen by our Chief Privacy Officer, and we use vigorous security safeguards and internal controls to ensure the privacy and security of information entrusted to us.

Fraud prevention

RBC places a high priority on protecting clients against potential losses from financial fraud. We work closely with other financial institutions, industry associations and law enforcement authorities globally to combat financial crime. We also have a website on fraud, credit and debit card safety for clients globally, and a publication, Straight Talk, about financial fraud, available through our branch network and online.

Voluntary codes of conduct

The Canadian banking industry has developed a number of voluntary commitments and codes to protect consumers to which RBC has committed. These are listed at rbc.com/voluntary-codes-public-commitments, including:

| • |

Canadian Code of Practice for Consumer Debit Card Services |

| • |

Canadian Bankers Association Code of Conduct for authorized insurance activities |

| • |

Model Code of Conduct for Bank Relations with Small- and Medium-Sized Businesses |

| • |

Principles of Consumer Protection for Electronic Commerce: A Canadian Framework |

| • |

Visa Zero Liability Policy |

| • |

Visa E-Promise. |

Crisis management

RBC’s Crisis Management teams, made up of senior executives across the organization, are responsible for the overall identification, isolation and management of major crises, and are activated when crises emerge that are both within and outside RBC’s control. We have enterprise-wide business continuity management processes and undergo periodic simulations and exercises to help prepare for possible crises, while testing our contingent strategies and tactics and the capabilities of crisis response teams.

For more information on RBC’s business integrity, visit rbc.com/responsibility/business

| RBC’s business continuity planning encompasses our response to a wide variety of disruption and crisis scenarios affecting the well-being of our employees, clients, business operations and our communities. |

The RBC Business Emergency Information Line is set up to advise our employees in the event of an RBC-wide crisis or external situation affecting our ability to access RBC offices or serve our clients. |

The RBC Reporting Hotline enables employees and third parties around the world to confidentially report questionable internal accounting or auditing matters directly to RBC’s Ombudsman. For more information, visit rbc.com/governance. |

|

Socially responsible investing

Investors who wish to express their values through ethical investments are increasingly turning to research firms for solid, third-party analysis of which companies have a positive or negative effect on society and the environment. RBC is included on a number of significant indices that recognize financial, social and environmental leaders. |

| Client care |

|

Responding to feedback

Clients surveyed (thousands)

|

| |

| RBC’s vision is “Always earning the right to be our clients’ first choice.” The entire company is focused on that vision, from soliciting and acting on client feedback to maintaining vigilant consumer protection measures to ensuring access to financial services. |

| |

| Every year, RBC businesses track client satisfaction and use feedback to make improvements. For instance, in 2006, in Canada, we: |

| • |

Enhanced our online investing site to help investors make more informed decisions |

| • |

Improved our Interactive Voice Response (IVR) for easier navigation, information and representative access |

| • |

Significantly reduced our personal account opening process time |

| • |

Launched a new unlimited transactions account for only $11.95 per month. |

| |

|

| In 2006, in the U.S., we: |

| • |

Introduced online cheque imaging |

| • |

Decreased loan turnaround time for small business clients. |

Fraud prevention

RBC has stringent security policies and practices, backed up by around-the-clock resources to prevent and detect potential fraud. In 2006, we introduced guarantees for online banking and self-directed brokerage clients, offering 100 per cent reimbursement for funds lost through unauthorized transactions in their accounts.

We have developed a number of fraud-education initiatives including up-to-date tips and alerts, brochures and client presentations. In 2006, we published a new Guide to Security and Privacy and undertook a client education campaign on fraud prevention and identity protection.

A resolve to make it right

Our formal process for handling client concerns is outlined on our website and in our Straight Talk brochures. Customers whose issues are unresolved following this process may appeal to RBC’s Office of the Ombudsman, which examines decisions made by RBC companies and reviews their compliance with proper business procedures. The Office ensures customers get a fair and impartial hearing and are treated with consideration and respect. We also respect the dignity and privacy of all parties involved in the proceedings.

Responsible development of products and services

RBC follows a defined, rigorous review process before launching any new product or significantly changing an existing one. We evaluate products for a range of risks and ensure they align with our Code of Conduct, with legislation, and with any voluntary consumer protection codes that we have signed. Approval levels within RBC correspond to the level of risk identified for a particular product or service.

A cornerstone of investor and client protection is the Know Your Client rule. Our employees are required to make all necessary efforts to understand their clients’ situation and financial and personal objectives before making recommendations.

RBC is also committed to providing banking access to a host of previously underserved groups through customized products and services. For information, see our Corporate Responsibility Report and Public Accountability Statement at rbc.com.

|

|

Economic impact |

|

|

|

|

|

|

|

|

|

| |

($ millions) |

|

2006 |

|

|

2005 |

|

|

2004 |

|

|

|

|

|

Employee compensation and benefits |

$ |

7,340 |

|

$ |

6,736 |

|

$ |

6,701 |

|

| |

Dividend payments to common and preferred shareholders |

|

1,907 |

|

|

1,554 |

|

|

1,334 |

|

| |

Income and other taxes (all jurisdictions) |

|

2,083 |

|

|

2,021 |

|

|

1,989 |

|

| |

Goods and services purchased from suppliers of all sizes |

|

3,900 |

|

|

3,700 |

|

|

3,700 |

|

| |

Community investments including donations, sponsorships |

|

83 |

|

|

65 |

|

|

59 |

|

|

|

|

|

| |

Based on continuing operations. |

|

|

|

|

|

|

|

|

|

Economic impact

Companies both large and small can help shape the economies of the communities and countries in which they do business, simply through their day-to-day business decisions and actions. At RBC, we have an economic impact as an employer and taxpayer through our activities as a financial services company and as a purchaser of goods and services.

Economic development

RBC invests in sustainable economic development, and we are committed to contributing to the success of people and businesses in the communities where we operate. We support:

| • |

Programs that address basic needs, such as food banks and shelters |

| • |

Economic growth in communities where we do business |

| • |

Initiatives that help build wealth and capacity in Aboriginal communities |

| • |

Resources to promote economic self-sufficiency |

| • |

Financial literacy programs. |

RBC also promotes economic growth through industry partnerships. For example, we are a member of the Canadian American Business Council, raising awareness of the value of the Canada-U.S. trade relationship and enhancing the overall competitiveness of North American economies.

Small business

Small business is an important engine driving economic growth. RBC is the marketplace leader in Canada with almost 600,000 small- and medium-sized enterprise clients, while RBC Centura serves almost 60,000 small business clients in the Southeast U.S.

Financing is essential for many small businesses to start, operate or grow, and RBC offers a host of credit solutions tailored to meet the needs of diverse businesses at various stages. We also strive to provide the best possible products, advice and expertise to help this sector prosper.

Innovation

RBC takes a leadership role in supporting innovation and the commercialization of research, and we support projects and organizations that promote learning, innovation and entrepreneurship, such as:

| • |

The Medical and Related Sciences (MaRS) project, facilitating research and development, and its commercialization |

| • |

The Canadian Institute for Advanced Research, helping fuel Canada’s knowledge base by bringing together the most distinguished thinkers from across Canada and around the world. |

We have made direct investments in a number of promising early-stage ventures across North America through RBC Technology Ventures and its partner funds. Our Strategic Technology Fund has brought investment dollars and our vast knowledge and expertise to budding technology companies in the financial services sector.

Purchasing

In 2006, we spent $3.9 billion on goods and services from international, national, regional and local suppliers of all sizes.

Our procurement group is responsible for sourcing products and services. Our procurement policies are inclusive and aim to promote sustainable business practices and economic development where possible and appropriate. In maintaining the highest standards, our purchasing policies are reviewed annually.

We promote fair purchasing practices and strive to support, whenever possible, the communities in which we operate. We are a founding member of the Canadian Aboriginal and Minority Supplier Council (CAMSC). RBC has been a member of the CAMSC’s U.S. affiliate, the National Minority Supplier Development Council, since 2002.

For more information on RBC’s economic impact, visit rbc.com/responsibility/economic

| Outside the workplace, RBC employees around the world participate in numerous community activities like the 2006 Juvenile Diabetes Research Foundation (JDRF) Ride for Diabetes Research. |

|

|

| |

Employment worldwide

(as at October 31, 2006) |

| |

|

Workplace

Attracting and retaining a talented and highly motivated workforce is a crucial part of our ongoing success. Consistently ranked as one of the top employers in Canada, we strive to strengthen our reputation as an employer in all countries in which we do business.

Understanding what employees value and need enables us to leverage a flexible and competitive Total Rewards program to support the mutual success of employees and RBC. This comprehensive approach includes compensation, benefits and a positive work environment, along with career and learning opportunities that reward people for skills and contribution. Flexibility within the work environment includes the opportunity for flexible working hours, modified work schedules and telework.

Employee savings and share ownership plans are part of the RBC Rewards program and promote a sense of ownership that helps align employee, investor and company objectives. The vast majority of employees are RBC shareholders through these programs.

Continuous employee growth and development helps ensure we meet current and future client needs. Employees have access to the training resources and opportunities they need to learn and grow as professionals, including global access to RBC Campus, our web-based learning platform, and Career Advisor, a comprehensive career management resource. Hiring practices focus on identifying and selecting talented people who share our passion for putting clients first.

Diversity is one of RBC’s core values and we have become a recognized leader in Canada for promoting diversity. Leveraging diversity for growth and innovation is both a sound business imperative and the right thing to do for our employees, clients and the communities we serve.

Keeping employees informed helps ensure alignment with company goals. RBC’s senior management team regularly meets with employees to discuss the company’s goals, strategies and progress. Employees have access to company information via intranet sites, electronic news magazines, e-mail bulletins, and other communication channels, and are encouraged to provide feedback and comments in a variety of ways.

Listening and responding to employee feedback is part of the RBC culture and we have conducted employee opinion surveys since 1981. High levels of employee engagement and a strong commitment to putting clients first are achieved through understanding employee views and taking action consistent with employee needs and RBC priorities.

For more information on RBC’s workplace, visit rbc.com/responsibility/workplace

| RBC is actively working to minimize our risks and pursue opportunities presented by environmental issues. |

|

|

Environment

RBC recognizes that our long-term economic success is dependent on a sound environment and healthy communities. That is why we strive to conduct our business and operational activities in a manner that minimizes environmental risk and recognizes environmental market opportunities for the benefit of our shareholders, clients and employees.

Environmental policy

RBC’s Corporate Environmental Policy was originally developed in 1991 and supplements the environmental section of our Code of Conduct. The Policy’s objective is to guide RBC’s business and operational activities in a manner that respects the principles of sustainable development. The Policy is currently under review and a revised version, addressing emerging environmental issues, will be released in 2007.

Responsible lending

RBC considers potential environmental and social consequences of our lending using our Credit and Project Finance Environmental Risk Management Policy suite. This collection of policies provides the basis upon which we review transactions for environmental issues. These policies require that, where warranted, transactions are reviewed by environmental specialists to proactively identify and manage our environmental risks.

In 2006, RBC recommitted to the revised Equator Principles, a set of voluntary guidelines developed in 2003 to address environmental and social risks associated with project finance. Since our original adoption of the Equator Principles in 2003, we have reviewed 14 projects which qualified for review under our Equator Principles policy.

Issues and stakeholder engagement

In 2006, we worked with external stakeholders to help identify issues relevant to our business activities and operations, including climate change, forestry, biodiversity and the rights of indigenous peoples. We believe that by engaging stakeholders, we deepen our understanding of these issues and are better able to achieve a sustainable balance between environmental stewardship and economic prosperity.

Performance and initiatives

We are actively working to minimize our risks and pursue opportunities presented by environmental issues. For example, RBC Technology Ventures is a lead investor in the GEF Clean Technology Fund, and we are committed to this through 2007. We are seeking opportunities to further expand our underwriting, arranging and advisory services for alternative energy financing.

We are also focusing on finding more ways to reduce our operational impacts through our SOFT (sourcing, operations, facilities and travel) Footprint program. We commit to reporting our ongoing progress on our Environment website on rbc.com in 2007.

For more information, see the Risk management section of the Management’s Discussion and Analysis and our 2006 Corporate Responsibility Report.

For more information on RBC’s business integrity, visit rbc.com/responsibility/environment

| In 2006, RBC provided more than $2 million in funding so that community-based organizations could offer after-school programs across Canada, such as this program held at the Braeburn Junior School in Toronto. |

|

|

Community

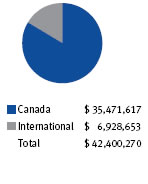

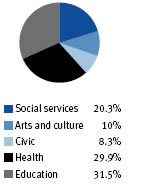

In 2006, RBC contributed more than $83 million to community causes worldwide through donations of more than $42 million and an additional $41 million in the sponsorship of community events and national organizations.

RBC believes in building prosperity by supporting a broad range of community causes. Our employees and pensioners also make an enormous contribution as volunteers, sharing their financial and business knowledge, time and enthusiasm with thousands of community groups worldwide.

Donations

Donations are a cornerstone of our community programs, with a tradition of philanthropy dating back to our roots. In fact, we have donations on record as far back as 1891. We are one of Canada’s largest corporate donors, and contribute to communities across North America and around the world. We are committed to making a lasting social impact through inspired, responsible giving and by building strong partnerships with the charitable sector. Our priority areas for funding include programs that:

| • |

Help keep kids in school |

| • |

Support emerging artists |

| • |

Encourage employee involvement |

| • |

Help seniors lead healthy and independent lives. |

Employee contributions

RBC’s Employee Volunteer Grants Program was launched in 1999 to support and encourage community involvement. Employees and pensioners who volunteer a minimum of 40 hours a year to a registered charity are eligible for a $500 grant to the organization in their honour.

Since 1999, RBC has made over 10,700 grants and donated more than $5.35 million to celebrate our employees’ volunteer efforts.

Sponsorships

Sponsorships are an integral part of RBC’s marketing and promotional activities, and are selected to promote our brand, image and reputation. Sponsorships often include an assortment of benefits such as consumer promotions, on-site and media brand and product exposure, as well as client hosting and staff volunteer opportunities.

Our community sponsorships are focused on:

| • |

Amateur sport: We support the development of amateur athletes by sponsoring grassroots events in local communities to national sport associations. We are the longest-standing supporter of Canada’s Olympic team, dating back to 1947, a premier national partner of the Vancouver 2010 Olympic and Paralympic Winter Games and a proud sponsor of the Canadian Olympic and Paralympic Teams through 2012. RBC also sponsors hockey, snowboarding, freestyle skiing, athletics and Special Olympics. |

| • |

Arts: We believe that healthy vibrant communities are a direct result of investing in creative vision and artistic talent. Our portfolio of interests in this area includes the RBC Canadian Painting Competition, celebrating Canadian visual artists early in their career. We also support community events such as art exhibitions, as well as theatre and orchestra performances. |

2006 Worldwide RBC donations

by geography

(C$) |

|

2006 RBC donations

in Canada by cause |

|

|

|

For more information on RBC’s business integrity, visit rbc.com/responsibility/community

|