Noteworthy

By Jordan Brennan, Head of RBC Thought Leadership

-

Mark Carney is going back to Washington next week. His agenda? Revive “security and economic” ties with the U.S., or at the very least bring some relief to Canada’s beleaguered steel, aluminum and auto sectors.

-

With security and economic front and centre, other likely topics at the Oval Office could include the Golden Dome missile shield program, something Donald Trump brought up as recently as this week, taking the opportunity to sting Ottawa with another “51st state” jibe. Could Carney push steel and aluminum’s importance as part of the defence collaboration with Washington?

-

Dominic LeBlanc, the minister responsible for trade with the U.S., sounded upbeat this week about making progress on some of our main pain points with the Trump administration.

-

The two partners also launched consultations last month on CUSMA ahead of the tripartite trade deal review. But what happens if the days of tariff-free access to the American market are permanently behind us?

-

It’s not far-fetched to suppose that Canada ends up with a U.K.-style deal, namely an across-the-board ‘market access’ tariff of 10%.

-

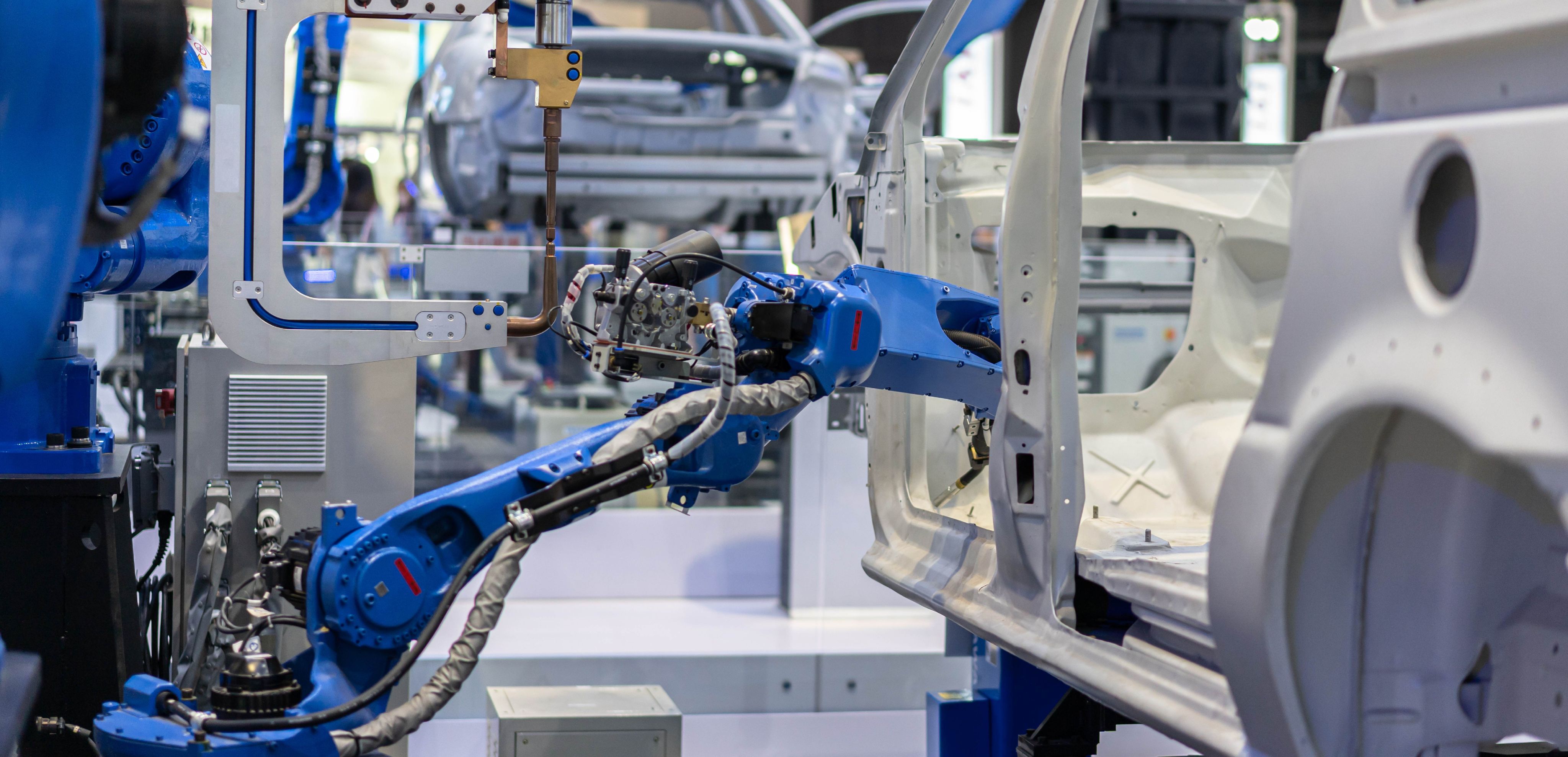

Trump slapped a 25% tariff on the non-U.S. content of automobile exports (the so-called ‘232’ or ‘national security’ tariffs) in March. Given that roughly 50% of the content of a Canadian-assembled vehicle comes from the U.S., Canadian autos have faced an effective tariff rate of about 12.5%. That’s close enough to the 10% market access tariff to warrant comparison.

-

Both sides are suffering: unemployment in Canada has ticked up since the trade war began, with the auto-producing municipality of Windsor suffering from the highest unemployment rate among Canada’s urban centres. South of the border, the manufacturing sector has shed 40k jobs over the past six months, with additional hits to primary and fabricated metal manufacturing.

The week that was

-

Canadian softwood lumber producers got hammered with an additional 10% tariff. The new levy will be added to the current 35.16% anti-dumping tariff that the U.S. imposed on lumber imports from Canada this year.

-

The European Union is expected to announce a 50% tariff on steel imports next week, aligning the bloc with similar U.S. and Canadian measures.

-

At the request of UK Prime Minister Keir Starmer, U.S. President Donald Trump is said to be considering easing the 10% tariff on imported Scotch whisky.

-

South Korea’s foreign ministry revealed that Seoul will likely announce a new security agreement with the U.S. before finalizing trade talks.

How to revive economic relations with India

An India-Canada reset is underway, writes John Stackhouse, and this time it will require a lot more than handshakes.

On trade, India has gone from Canada’s 16th largest partner in 2008 to 10th in 2015 to 7th last year.

The same can’t be said about Canada, which ranks only 30th for India. Bilateral trade reached $31 billion in 2024, including services, compared to $117 billion with China. The decline in international students—one of the largest sources of Indian revenue for Canada—will further slow that progress, as Canada’s perceived closed-door policy has tarnished our reputation across a generation of educated Indian youth.

That’s not the only reason Canada’s quest to restart trade negotiations may require patience. An increasingly confident India—and confident Modi—will not compromise easily, especially over issues like intellectual property rights, which India has long viewed as a form of Western colonialism.

Those differences aside, the two countries have unique and deep ties, largely through the Indo-Canadian population. Going forward, India will want a more mature relationship, based on interests, especially economic interests. Canada can pursue greater opportunities, too, from heavy oil and LNG to advanced manufacturing and space technologies.

A renewed relationship will require both countries to recognize what they bring to each other. It can also stress what they can achieve through alliances and multilateral groups.

Read the full column.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.