Also in this week’s edition: How five tariff-exposed industries in Canada are faring

Alberta’s MoU adds to Washington’s heavy-oil dilemma

By Shaz Merwat, Energy Policy Lead

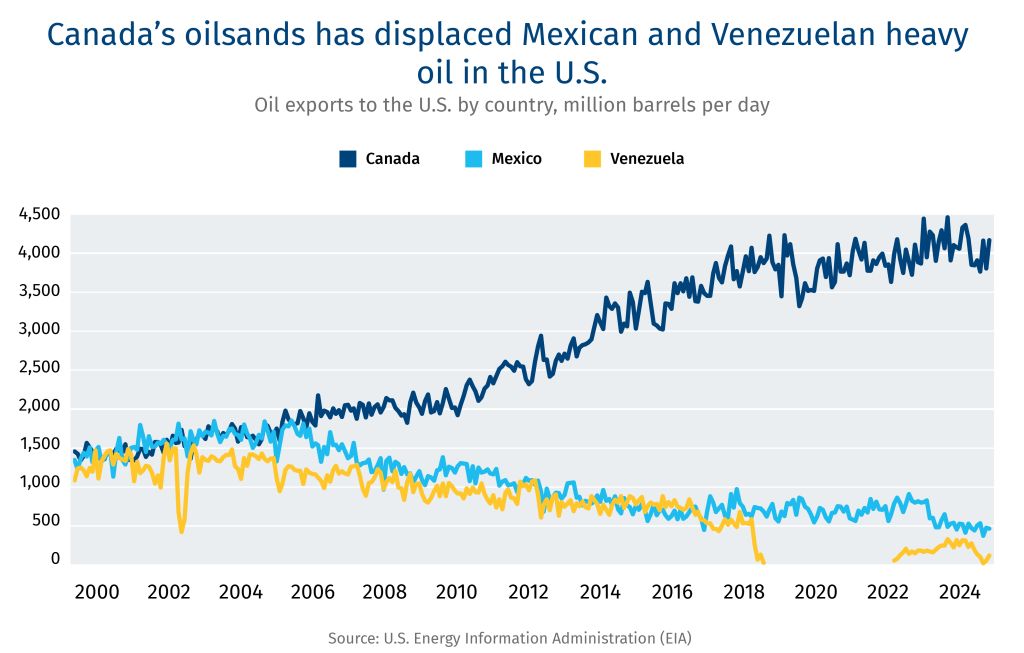

As U.S. President Donald Trump hosted Prime Minister Mark Carney and Mexico’s President Claudia Sheinbaum, energy issues loomed in the background amid U.S. concerns about structural deficits in heavy crude. Historically, Canadian barrels competed with Venezuelan heavy crude in key U.S. refining markets—primarily the U.S. Midwest and the Gulf Coast. While Venezuelan volumes have been largely absent for the past decade, shifting U.S. foreign-policy signals suggest that competition could re-emerge.

Why it matters — Trump cannot unwind two core U.S. dependencies

Despite efforts to reshape U.S. supply chains, Washington remains structurally dependent on two things it cannot easily substitute: Canadian heavy crude and Chinese rare earths. Heavy crude is foundational to U.S. refining capacity, and as it stands, the U.S. cannot easily replace Canadian supply: domestic production is overwhelmingly light, and heavy-crude alternatives from Mexico and Venezuela have structurally declined.

These twin constraints limit U.S. leverage and elevate the importance of stable, long-term supply partners. Alberta’s Memorandum of Understanding (MoU) arrives at a moment when U.S. policymakers must balance geopolitical objectives—such as renewed attention on Venezuela—with the reality that Canadian barrels remain irreplaceable in the refinery system.

By the numbers — the heavy-barrel shortfall

-

Mexico: U.S. bound heavy-crude exports have fallen from as high as ~1.7 mb/d in 2005-2006 to roughly ~0.40 mb/d today.

-

Venezuela: heavy-crude exports to the U.S. surpassed 1.5 mb/d in the early 2000s; today U.S. exports are ~0.1 mb/d.

-

Canada: The dominant exporter to the U.S., with around four million barrels of crude shipped south of the border daily. The Canada-Alberta MoU proposed 1 million bpd pipeline, plus 300,000–400,000 bpd from Trans Mountain together create a sizeable uplift in export capacity—primarily oriented toward Asia.

The bigger picture — if Venezuela returns, does Canada lose leverage?

A Venezuelan “return” would likely be slow, expensive and politically fragile. Refinery contracts, debt obligations and upstream infrastructure all require rebuilding. Even under a regime change, investors will demand decade-long stability before committing capital.

Mexico faces similar limits: Sheinbaum inherits state-owned Pemex’s declining production and mounting debt, meaning a rapid restoration of heavy-crude exports is unlikely.

This leaves Canada as the only credible, scalable source of heavy supply. The MoU’s accelerated timelines—carbon-pricing equivalency, methane rules and Pathways carbon capture, utilization and storage project—signal Ottawa and Edmonton are preparing for sustained output growth.

Bottom line — the MoU prepares Canada for a more competitive heavy-oil landscape

As Canada builds westward capacity through TMX and the proposed 1 million bpd pipeline, more barrels are positioned for Asia rather than the U.S. That shift inevitably forces U.S. policymakers to consider how they will secure heavy-crude supply in the coming decade—including whether to re-engage Venezuela in a more meaningful way.

For Canada, today, this is less of a challenge. The MoU ensures that, regardless of how U.S. policy evolves, producers have diversified market access and greater resilience. If Venezuelan volumes rise, Canada will have optionality; if they do not, Canada remains the primary supplier to U.S. refiners.

Either way, the middle of the next decade is shaping up to be a far more dynamic heavy-oil environment—and the MoU positions Canada to navigate it from a position of strength.

The week that was

-

Canada entered the trade war in better shape than previously thought. StatsCan revised GDP for each of the past three years up by about half a point.

-

The Canadian government served automaker Stellantis a notice of default for shifting production of the Jeep Compass from Brampton, Ont., to Illinois despite receiving hundreds of millions in incentives in recent years. “Stellantis is on the hook,” said Industry Minister Mélanie Joly. “Defending these jobs means defending Canada’s economic backbone.”

-

While speaking to business leaders in Ottawa, Japan’s Ambassador to Canada Kanji Yamanouchi noted the role energy could play in future Canada-Japan relations. “If we need energy from a county which is difficult to trust or the country which we can trust,” he said, “it’s much better for us to have trade with a country with trust.”

-

Despite $500 million in government loans, Algoma Steel is laying off 1,050 workers from its plant in Sault Ste. Marie, Ont., in the face of “extraordinary and external market forces.”

Look what’s trending

The RBC Economics team did a deep dive this week: ‘Tracking the impact of U.S. tariffs on five targeted Canadian industries.’

Overall, we track moderately lower manufacturing production and employment in most of the highly tariffed sectors in Canada. These trends have also been much less volatile than international trade flow, that were heavily distorted around when tariffs were implemented (as U.S. importers front-ran purchases to build pre-tariff inventories in Q1.)

Selling prices among Canadian manufacturers have generally held up, with foreign buyers paying the bulk of initial tariff costs, but have led to declining U.S. corporate profits this year. We haven’t seen systemically higher U.S. consumer prices but still expect those will show up more significantly in 2026.

Here’s a breakdown of how five key Canadian industries have fared in their production, employment and selling prices, amid rising U.S. tariffs.

Read the full report here.

Listen Up – Disruptors: The Canada Project

In a recent episode of Disruptors, John Stackhouse takes listeners to Quebec to meet former premier Jean Charest and Eric Desaulniers, founder & CEO of Nouveau Monde Graphite. Together, they explore how a new graphite mine at Matawinie and an integrated refining plant at Bécancour aim to connect the full chain from rock to anode material in one province—and what that could mean for Canada’s role as a trusted supplier of critical minerals to its G7 allies.

From China’s dominance in graphite refining to Quebec’s push for all‑electric mining fleets powered by hydro, this episode looks at how Canada can move from “quarry” to strategic partner in a re‑wired global economy.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.