How the math is changing

To judge by Davos’s main promenade, globalization is alive and well. Yes, the U.S. took over a church and shop to celebrate America First. But there were far more storefronts promoting Brazil, Indonesia, the Philippines and Nigeria. India wrapped an entire hotel on the promenade, where thousands schlepped every morning from their crash pads to the Congress Centre, and back at night from dinners and nightcaps.

Is this a false spring, just like the mild week in Davos? Or the beginning of what Christine Lagarde called “Plan B” and a more diversified global economy?

The European Central Bank president told the closing session of the World Economic Forum that she “is not on the same page” as Mark Carney’s view of a global rupture—but does see an important diversification of trade underway.

According to the WEF’s own research, close to half of global growth over the next five years (2025-30) will come from Asia, with China accounting for 23% and India another 15%, while the U.S. will produce 11%. Combined, the G7 will account for only 18.5% of growth.

If it feels like a new age of diversification, one should never forget the gravitational pull of the two economic superpowers, which over the past decade (and longer) have consumed much of the world’s capital and trade. Case in point: China now accounts for about 40% of published studies on drug research, while Europe’s share has dropped from 20% to 12%. Guess where most of the world’s drugs will come from in the 2030s.

With so much in flux, who will dominate the world’s future trade zones? I came away from Davos thinking three forces will help shape the answer:

1. Balance-sheet strength. We may be on the verge of some heavy government (and perhaps private sector) borrowing to underwrite all that’s needed for diversification—from new supply chains to infrastructure. Points to the U.S. for owning the world’s reserve currency, but a range of middle powers—Germany and Canada, among them—can borrow plenty on their own.

2. Artificial Intelligence. It’s sucking up much of the world’s private capital, and will determine a lot of trade outcomes as it (along with robotics) transforms production. Yes, the U.S. and China dominate, but if AI becomes available to all, like the Internet, advantage will go to those with energy to power all those learning algorithms and the entrepreneurial brains to put the results to work. The eight biggest U.S. tech companies have $18 trillion of equity value to leverage—and a lot more domestic energy than China or Europe.

3. Demographics. It’s the sleeper trend, as the West (and Far East) tumble over demographic cliffs. Even in an age of AI, trade still relies on humans to help make and ship things and humans to buy those things. Africa’s population is on course to hit 2.5 billion by 2050, when it will be home to 25% of the world’s working age population.

Some shrewd advice I heard was for companies to think country, supplier and currency—and have an option for each. Call it a matrix of Plan Bs. Or what Carney termed “variable geometry.”

It’s the new math.

— John Stackhouse

The week that was

Bank of Canada Q4 survey shows Canadian businesses continue to be negatively impacted by trade tensions, but some are increasing non-U.S. exports

-

33% of Canadian firms reported they are strongly impacted by U.S. trade policies. A small but increasing share of businesses reported higher sales to non-US markets. Despite weaker sales to U.S. customers, most exporters to the U.S. have not diversified into other markets citing barriers like investment in specialized equipment, compliance with regulatory requirements, and transportation costs.

-

This signals, albeit modestly, that Canadian firms are willing to expand in other markets. However, immediate economic pressures are significantly constraining hiring, investment, and diversification efforts.

Canada agrees to new partnership with Qatar to cooperate on trade, investment, and defence

-

Canada and Qatar agreed to conclude FIPA negotiations, signed an MoU to establish a Joint Economic Committee (JEC), expand air services, and increase defence collaboration (including more exports from Canada’s defence sector).

-

This is the latest in a series of wins, following last week’s agreement with China, for the Canadian government’s diversification efforts. The value of merchandise trade between Canada and Qatar in 2024 was $325 million, leaving lots of room for growth.

European lawmakers delay Mercosur trade pact over legal concerns

-

EU ratification of this agreement, decades in the making, with South American economies has been postponed by lawmakers seeking an opinion from the European Court of Justice.

-

This is the latest hurdle in a protracted process, following pressure from European farmers, which could delay the trade pact by a further two years. However, German Chancellor Friedrich Merz called on the European Commission to provisionally apply the deal, which would create one of the world’s largest free-trade zones, covering over 700 million people, and ~20% of global GDP, in recognition of the current “geopolitical situation.”

First Chinese order of Canadian canola in months comes following trade mission

-

Prime Minister Mark Carney’s visit to Beijing has led to a Chinese importer buying 60,000 metric tons of Canadian canola, the first cargo order of its kind since China halted imports in October. This comes as China is expected to lower tariffs on Canadian canola to 15%. Canadian agriculture minister Heath MacDonald encouraged Chinese investment in Canada’s agri-food sector this week, highlighting the potential for collaboration in domestic value-added processing and research.

-

Saskatchewan, Canada’s biggest canola-producing province and the province with the highest year-over-year growth in wholesale trade, is especially well positioned to capitalize. Premier Scott Moe (who was on the trip to China) has emphasized the benefits for his province and Canada’s agricultural industry more broadly.

— Thomas Ashcroft

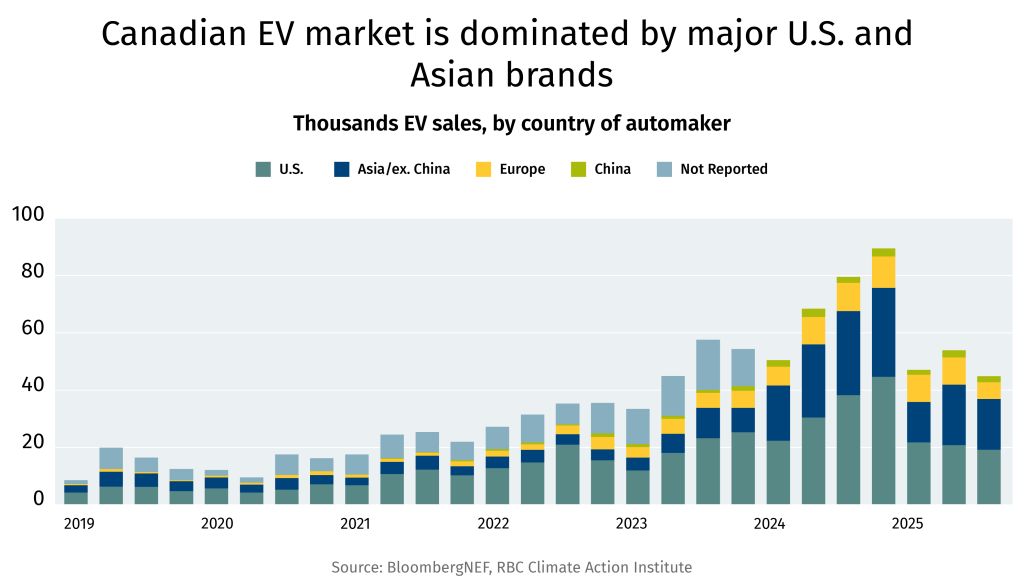

Canada plans to allow 49,000 made-in-China EVs at much lower tariffs in return for easing levies on Canadian agricultural products. Here is what you need to know about the deal and its implications:

-

About half of the vehicles imported from China are expected to cost less than $35,000 by 2030. Average EV purchase price in Canada in 2024-25 was around $67,000.

-

Canadian EV sales were projected to remain largely flat in 2026 following a 30% decline last year. To size up Chinese imports, 49,000 would represent a quarter of Canada’s annual EV market. Ontario Premier Doug Ford is worried it could impact sales—and jobs—from existing manufacturers.

-

Europe’s strategy could serve as an alternative roadmap for Canada on autos: The continent worked with Chinese carmakers to level the playing field, and set targeted tariffs aimed at offsetting the impact of subsidies. Even with that, however, Chinese brands have captured 10-15% of the EV segment in Europe.

-

The Canada-China thaw comes ahead of critical CUSMA renegotiations that could disrupt the 80% of Canadian exports that enter the U.S. market tariff-free. Could it further complicate U.S.-Canada negotiations?

— Farhad Panahov

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.