Why Trump’s ‘very severe’ fertilizer tariff threat is a big deal

By Lisa Ashton, Director of Agriculture Policy, RBC Thought Leadership

U.S. President Donald Trump’s US$12 billion aid package for American farmers struggling with rising input costs like fertilizer and seeds comes with a sting for Canada. Trump is considering “very severe” tariffs on Canadian fertilizer to “bolster” U.S. domestic fertilizer production.

This could prove to be an own goal for Washington. More tariffs on Canadian fertilizers are likely to raise prices for U.S. farmers in the short-term and could create volatility in securing long-term supply. The proposed move comes as the U.S. has few alternatives to Canadian fertilizer, while American farmers have limited leverage in the market and are price receivers. Here’s what is at stake for both the Canadian and U.S. agriculture sectors:

-

Canada accounts for 81% of U.S. potassium-based chemical fertilizer imports and tariffs would further raise costs along North America’s interconnected agri-food supply chain.1

-

The U.S. tried a version of this before: It imposed broad tariffs (25%) earlier this year on many Canadian imports, including potash and other fertilizers. After pushback from American farmers and industry groups, fertilizer tariffs were reduced to 10%.

-

Those moves proved to be a body blow as U.S. Import Price Index for chemical fertilizers rose from 164.5 in December 2024 to 186.5 in September 2025.2

-

The U.S. Prices Paid Index tracking costs paid by U.S. farmers rose to 149.9 in June 2025, up from 139.9 the year before. Over the same period, fertilizer costs were the primary driver for rising costs for U.S. crop farmers, up 11% in the index.3

-

-

Canada has the world’s largest potash reserves, with 1.1 billion tonnes of potash, which is 5x larger than U.S. reserves.4 Canada’s scale of potash mining by production volumes was 36x larger than the U.S. in 2024.5

-

Fertilizers account for roughly 30% to 45% of a U.S. farmer’s annual operating cost, depending on the crop.6 As farmers are vulnerable to volatility in input prices, they often can’t pass rising input costs onto consumers since many sell into commodity markets (i.e. corn, wheat, soybeans). That could challenge the U.S. administration’s efforts to reduce costs for farmers ahead of 2026 mid-terms with active tariffs on their inputs and threats of more.

The week that was

-

The U.S. could carve out separate deals with Canada and Mexico says U.S. Trade Representative Jamieson Greer. He said the Trump administration is leaving all options on the table when it comes to the Canada-U.S.-Mexico Agreement (CUSMA). Mark Carney was quick to dismiss the possibility of separate deals: “That’s not what they’re saying.”

-

Kirsten Hillman, Canada’s ambassador to the U.S. who played a key role in the CUSMA negotiations, announced that she will step down in the New Year. Hillman’s replacement has yet to be announced but reports surfaced that Mark Wiseman, former chief executive of the Canada Pension Plan Investment Board, is the front-runner.

-

Canada’s $153-million trade surplus in September blew past analysts’ expectations of a $4.5-billion deficit. Exports to the U.S. rose 4.6% (imports fell 1.7%). And exports to other parts of the world shot up 18.6%.

-

In the U.S. exports surged in September, resulting in the smallest trade deficit in 5 years.

-

And China’s trade surplus tops US$1 trillion for the first time. Despite trade tensions with the U.S., Beijing exported US$3.4 trillion worth of goods in the first 11 months of the year by finding, in part, new markets for its outbound shipments, including Africa (+26%), Southeast Asia (+14%) and Latin America (+7.1%).

Trump’s tariff toll

By Jordan Brennan, Managing Director, RBC Thought Leadership

President Trump has been making the point that tariffs carry with it short-term pain for long-term gain. The data confirms that he’s got the pain part right.

Inflation: Since Trump’s so-called ‘Liberation Day’ in April, producer prices in the U.S. have moved meaningfully higher. The knock-on-effect: consumer inflation has grown for five consecutive months and now stands at 3%—a level not seen since early 2024.

Consumer sentiment: According to the University of Michigan’s long-running survey of consumers, confidence is sitting at half-century lows. Four of the 10 worst monthly readings have come since Liberation Day.

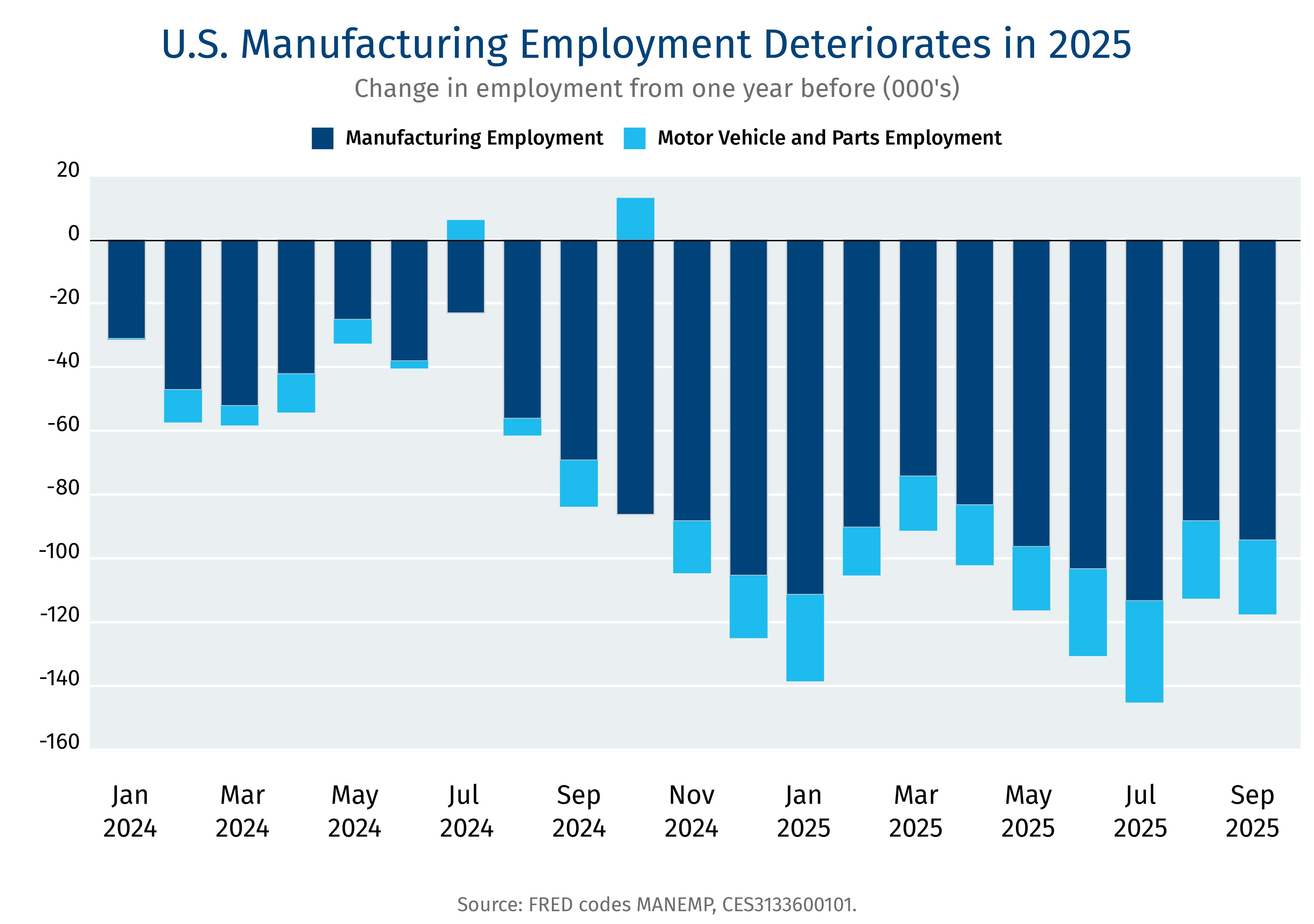

Manufacturing: Far from rebounding, manufacturing employment—including politically-sensitive auto jobs—has worsened since January. The U.S. has shed nearly 50,000 manufacturing jobs this year.

The rejoinder from the White House is inevitably that the tariff policy takes time and discomfort is transitional. But voters rarely reward distant promises over immediate pain. And Trump has already started to ease off, recently slashing tariffs on beef, coffee and assortment of other grocery-store items. Expect more selective tariff relief—targeted by region and by product—as the midterms draw closer.

UN Comtrade. Trade Data, 2025.

Federal Reserve Bank of St. Louis. Import Price Index (End Use): Chemicals – Fertilizers, 2025.

USDA National Agricultural Statistics Service. Agricultural Prices, 2025.

Potash facts. Natural Resources Canada, 2025.

U.S. Geological Survey. Mineral Commodity Summaries – Potash, January 2025

USDA Economic Research Service. Fertilizer prices stable at onset of 2025 planting season, below highs of 2021 and 2022, 2025.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.