In this edition: AI investments are partially masking the impact of the trade war on global growth – but Canada is missing out

Bad news keeps piling up for the auto industry

By Jordan Brennan, Head of RBC Thought Leadership

The U.S.-Canada auto story just took another hit – or two.

On the tails of the Stellantis decision to move production of its Jeep Compass from Brampton to Illinois, this past week’s news is compounding:

-

General Motors announced it will end production of its BrightDrop electric delivery vans at the CAMI plant in Ingersoll, affecting 1,000+ jobs.

-

Paccar is laying off 300 workers at its plant in Sainte-Thérèse, Quebec ahead of U.S. heavy-truck tariffs.

What’s going on? You could interpret these shifts as proof that Trump’s “re-patriation” strategy is working. But dig deeper: both plants were already facing weakness. CAMI had encountered soft demand for BrightDrop vans; Paccar is turbo-exposed to U.S. heavy-truck demand and tariff risk. Brampton had a litany of problems over the years, including softening EV sales.

Where does this leave Canada? Our auto industry sits between two storms:

-

China is going all in on EVs—nearly half of all new car sales last year were electric.

-

The U.S. and EU EV market are stalling or retrenching—EV penetration in Europe fell to ~21% in 2024 from ~22% the year before.

-

The U.S. sits at just 10%. And that was before Trump’s One Big Beautiful bill shredded EV incentives.

This makes Prime Minister Mark Carney’s pending climate strategy even more consequential. Canada has three broad options:

-

Align with the U.S.: back off EVs and count on gas guzzlers to propel the industry forward.

-

Follow China: invest aggressively in next-gen batteries and hope EVs are the future.

-

Carve a middle path: incentivize hybrid adoption while infrastructure and consumer preferences catch up.

The week that was

-

A 60-second ad, sponsored by the Ontario government and featuring former U.S. President Ronald Reagan disparaging the use of tariffs, prompted President Donald Trump to immediately cancel all trade talks with Canada. Premier Doug Ford’s government agreed to take the campaign off the air on Monday. But saying it wasn’t quick enough, Trump threatened an additional 10% tariff hike on Canadian goods.

-

Over the next 10 years, Prime Minister Mark Carney wants to double Canada’s exports to markets outside the U.S., boosting trade by $300 billion.

-

India invited Carney to New Delhi to meet with Prime Minister Narendra Modi. According to India’s new High Commissioner, a comprehensive free trade partnership between the two countries could result in $50-billion worth of trade annually, about double last year’s total.

-

An import ban on liquefied natural gas from Russia is part of a new package of sanctions agreed upon by the European Union countries..

-

President Trump will meet with his Chinese counterpart Xi Jinping next Thursday during the Asia-Pacific Economic Cooperation summit. This will mark the first meeting of the two since the U.S. President’s re-election.

Missing the AI Boom

By Farhad Panahov, Economist

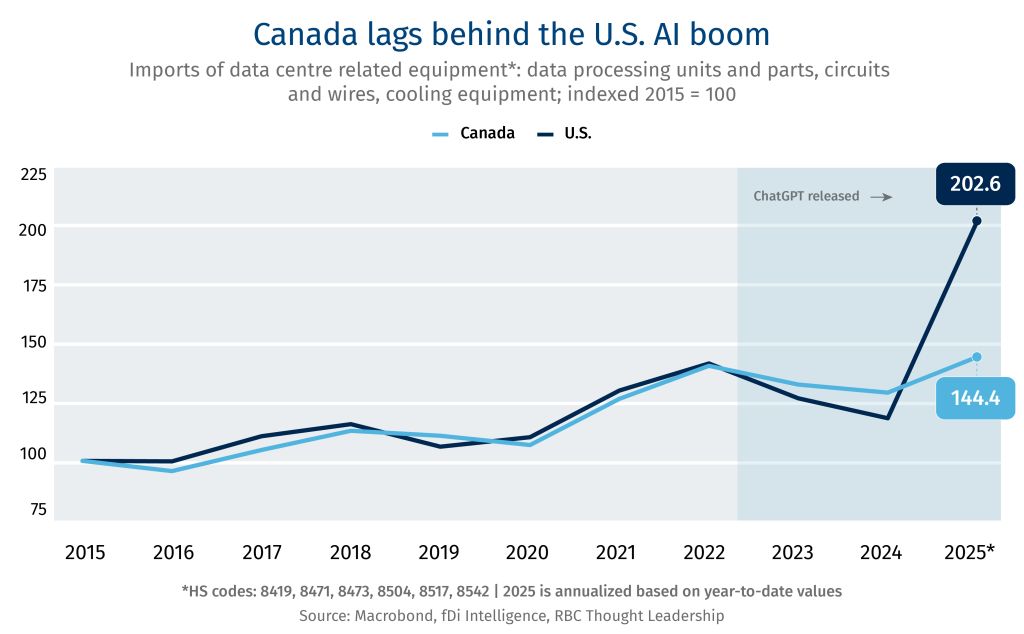

AI-related investments may have masked the impact of the U.S. trade war on global growth so far, the IMF notes in the latest World Economic Outlook. Since the release of ChatGPT in late 2022, U.S. firms have quadrupled data-centre construction spending to nearly US$40 billion. There are now 5,000 data centres dotted across the U.S. Imports of data centre related equipment is up 50% over the same period. Taiwan accounted for half of the growth when it comes to U.S. imports of digital processing units. Canada, as the chart below indicates, has remained on the sidelines of the AI boom despite a growing number of data centre applications. Demand for related equipment has shown only a small uptick in recent years.

Growing global

By Lisa Ashton, Director of Agriculture Policy

Canada’s agriculture equipment manufacturing industry is caught up in the U.S. tariff blitz.

The industry, which generates $7 billion in annual revenues (more than double from a decade ago), plays a critical role in North America’s food production, providing farmers with the equipment to plant seeds, harvest crops, feed animals, milk cows, and operate an efficient farm business.1

The U.S. market dominates exports, accounting for 82% in 2024, which has so far remained unchanged in 2025.2 But there’s a shift under way. The tariffs have benefitted the domestic industry in some cases by raising domestic demand of Canadian-made products and reducing some input prices, including Canadian steel.3 But the industry is also facing risks of rising costs to produce equipment that has parts from both sides of the border. Manufacturers are wadding through compliance complexity, with U.S. tariffs on some parts such as tractor brakes and Canada’s counter tariffs on parts such as tractor tires.4 For farmers, this means potentially higher input costs for new equipment and parts to repair their existing equipment—forcing decisions on investments that impact agricultural productivity. The shifts come as the industry has already seen a growing trade deficit since 2020, more than doubling in size in 2024.5

Manufacturers are setting their eyes on new growth markets, while maintaining relationships with their U.S. customers and supply chain. A renewed commitment in 2025 to the Canada and Mercosur free trade agreement negotiations offers promise for Canadian agricultural manufacturers to expand their presence in Argentina, Bolivia, Brazil, Paraguay and Uruguay, where agriculture production is expanding, and on-farm mechanization is exponentially improving.

Statistics Canada. Annual Survey of Manufactures and Logging, 2024.

Statistics Canada. Canadian International Merchandise Trade, 2025.

Statistics Canada. Industrial product price index, 2025.

Canada Tariff Finder, 2025.

Statistics Canada. Canadian International Merchandise Trade, 2025.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.